|

市场调查报告书

商品编码

1910507

聊天机器人:市占率分析、产业趋势与统计、成长预测(2026-2031)Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

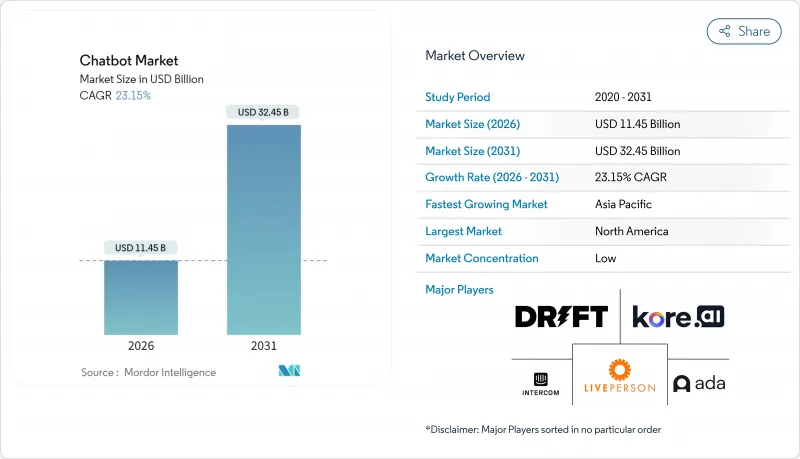

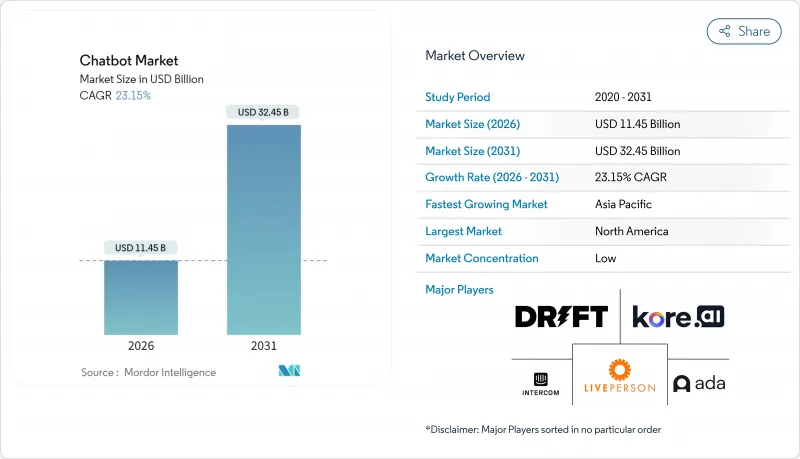

预计聊天机器人市场将从 2025 年的 93 亿美元成长到 2026 年的 114.5 亿美元,到 2031 年达到 324.5 亿美元,2026 年至 2031 年的复合年增长率为 23.15%。

这种持续扩张是由即时通讯应用的普及、大规模语言模型性能的快速提升以及传统客服中心运营成本压力不断增加所驱动的。客户体验领导者现在优先考虑自主、始终在线的管道,这些管道能够降低服务成本,同时透过语音、文字和多模态介面保持类人互动。平台供应商正在积极回应,整合搜寻增强型生成技术、多语言模型和特定领域代理,以缩短开发週期并普及部署。随着企业对可衡量投资回报率的需求日益增长,供应商正专注于基于运作的定价、主动合规工具以及垂直整合的知识包,以加快受监管行业实现价值的速度。日益激烈的竞争正促使全球超大规模资料中心业者、独立专家和客户体验外包商透过收购、伙伴关係和策略性资本注入来整合自身能力。

全球聊天机器人市场趋势与洞察

通讯应用用户群快速成长

WhatsApp 目前拥有 30 亿用户,每天支援 1.75 亿次商务对话,为聊天机器人市场提供了一个庞大且现成的发行管道。企业已开设 7.64 亿个 WhatsApp Business 帐户,其开启率高达 98%,远高于电子邮件的 20%,并显着降低了获客成本。这个庞大的通讯生态系统涵盖全球超过 2 亿家企业,形成了强大的网路效应,提高了零售、银行和医疗保健等产业聊天机器人的投资报酬率。企业正在利用富媒体模板,将互动从行销提示转化为完整的交易流程,而无需用户下载应用程式。随着用户熟悉程度的提高,基于讯息的互动方式正逐渐成为服务咨询、订单追踪和通路内支付的预设介面。

大规模语言建模(NLP)取得突破

GPT-4.5 和即将推出的 GPT-5 模型的出现,使得聊天机器人能够以接近人类的流畅度处理复杂的多轮对话。摩根士丹利等公司正在部署 GPT-4 进行内部知识搜寻,从而缩短顾问的搜寻时间并提高合规信心。供应商正在整合搜寻扩展生成功能,使机器人能够在保持对话流畅性的同时检索即时数据,从而解决传统知识缺口带来的挑战。 Yellow.ai 建立了一个多语言学习模型 (LLM) 管道,每年可处理超过 160 亿次对话,并透过为每个查询选择专门的模型来优化成本和准确性。这些创新降低了对训练资料的需求,使没有大规模标註资料集的中小型企业也能使用先进的互动式人工智慧。

整合复杂性和遗留资料孤岛

拥有数十年历史系统的公司在将聊天机器人连接到大型主机、CRM 和 ERP 系统时,会面临数月的进度延误。 47% 的公司正在建立内部生成式人工智慧来管理资料管道,这反映出他们对整合方面的担忧。中介软体编配、即时同步和严格的安全审查会增加计划预算并延迟全面部署,尤其是在资料碎片化严重的通讯业。因此,数位原民获得了上市时间优势,迫使现有企业投资于 API 现代化改造。

细分市场分析

到2025年,平台软体产品将占据聊天机器人市场64.12%的份额,凸显其作为底层基础设施的重要地位。同时,服务领域到2031年将以24.12%的复合年增长率成长,超过整体市场成长率。随着互动式人工智慧日趋复杂,企业对咨询、整合和优化方面的专业知识的需求也日益增长。 Yellow.ai透过提供涵盖策略制定、客製化模型调优和持续管治的全生命週期支持,推动了对服务的需求。对于客户而言,专业的合作伙伴可以解决整合难题并确保合规性,将供应商的专业知识转化为切实可见的业务成果,从而证明其高价的合理性。

实施咨询通常与包含运作保证、再培训和季度绩效评估的託管服务等级协定 (SLA) 捆绑在一起。这种转变正在将收入结构转向持续服务合同,从而稳定供应商的现金流。随着人工智慧工具的成熟,差异化因素将从底层技术转向以结果为导向的合作,这将使拥有深厚垂直行业专业知识和强大合作伙伴生态系统的供应商更受青睐。聊天机器人市场将持续进行平台整合,同时服务细分市场也将持续成长,占据越来越大的市场份额。

到2025年,客户支援将占据聊天机器人市场份额的41.82%,反映出其咨询量庞大且投资报酬率显着。同时,人力资源和招募领域的应用将以24.86%的复合年增长率(CAGR)实现最快成长,直至2031年。借助聊天机器人处理候选人初步筛检、面试安排和政策咨询等工作,人力资源部门可以将精力集中在更高价值的活动上。企业报告称,他们已实现了90%重复性咨询的自动化,并缩短了招募时间,从而显着提高了生产力。

销售和行销机器人透过持续的个人化对话来培养潜在客户,IT 服务台人员可以重设密码或诊断硬体问题,而新兴的内部知识助理则可以聚合结构化和非结构化内容,从而缩短搜寻週期。这些不断扩展的功能展现了互动式人工智慧的多功能性,并巩固了其作为核心自动化基础而非小众辅助工具的地位。

区域分析

到2025年,北美将占据聊天机器人市场38.72%的份额,这主要得益于低层级管理(LLM)技术的早期应用以及高昂的人事费用推动了自动化投资回报率的提升。美国金融机构和零售商正在部署先进的语音和视觉代理,而加拿大企业则利用GPT-4进行内部知识搜寻。成熟的数位基础设施和活跃的创业投资资金支持着持续的实验,并透过近岸服务中心将技术推广到拉丁美洲。

亚太地区将呈现最快的成长速度,到2031年复合年增长率将达到24.71%,这主要得益于政府对人工智慧投资的支持以及行动商务的兴起。中国正在人工智慧计划上投资21亿美元,印度的聊天机器人市场正以每年25%的速度成长,而新加坡则被定位为人工智慧管治的试验场。智慧型手机的高普及率和超级应用生态系统正在产生大量的对话流量,加速人工智慧在银行、旅游和公共服务领域的应用。本地供应商正在开发针对不同地区方言客製化的多语言聊天机器人,以促进包容性的数位存取。

在欧洲,欧盟人工智慧立法的框架下,创新与严格合规之间正取得平衡。德国、法国和英国正将聊天机器人融入製造业、医疗保健和公共管理领域,并将年度合规预算纳入总体拥有成本 (TCO) 的计算中。标准化的管治框架加强了跨国合作,并确立了事实上的全球标准。在南美、中东和非洲等新兴地区,云端运算成本的下降和宽频的普及正在推动电信、能源和交通运输等产业的应用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 通讯应用用户群快速成长

- 大规模语言模型(LLM):自然语言处理(NLP)领域的技术进步

- 全天候客户支援成本压力

- 数位顾客体验策略中对自助服务的呼声日益高涨

- 语音优先与多模态机器人

- 利用LLM实现内部知识自动化

- 市场限制

- 整合复杂性和遗留资料孤岛

- 隐私/监管合规问题

- 幻觉带来的品牌风险

- 缺乏垂直训练资料集

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按组件

- 平台/软体

- 服务

- 透过使用

- 客户支援

- 销售与行销

- 人力资源/招聘

- IT服务管理

- 其他的

- 透过部署模式

- 云

- 本地部署

- 按组织规模

- 小型企业

- 大公司

- 按最终用户行业划分

- 零售与电子商务

- BFSI

- 卫生保健

- 旅游与饭店

- 电讯和资讯技术

- 政府和公共部门

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- LivePerson, Inc.

- Kore.ai, Inc.

- Ada Support Inc.

- Intercom, Inc.

- Drift.com, Inc.

- Yellow.ai Pvt. Ltd.

- Cognigy GmbH

- Freshworks Inc.

- Gupshup Technology India Pvt. Ltd.

- Boost.ai AS

- Rasa Technologies GmbH

- SnatchBot SA

- Tidio Poland Sp. z oo

- Chatfuel, Inc.

- Aivo Technologies, Inc.

- Inbenta Holdings, Inc.

- Senseforth.ai Labs Pvt. Ltd.

- BotsCrew, Inc.

- Quiq, Inc.

- LiveChat Software SA

- Zendesk, Inc.

- Artificial Solutions International AB

第七章 市场机会与未来展望

The Chatbot market is expected to grow from USD 9.30 billion in 2025 to USD 11.45 billion in 2026 and is forecast to reach USD 32.45 billion by 2031 at 23.15% CAGR over 2026-2031.

This sustained expansion is propelled by ubiquitous messaging-app reach, rapid advances in large-language-model performance, and mounting cost pressures on traditional contact-center operations. Customer experience leaders now prioritize autonomous, always-on channels that lower service costs while sustaining human-like interactions across voice, text, and multimodal interfaces. Platform vendors respond by embedding retrieval-augmented generation, multilingual models, and fine-tuned domain agents that reduce development cycles and democratize deployment. As enterprises seek measurable ROI, vendors emphasize outcome-linked pricing, proactive compliance tooling, and verticalized knowledge packs that accelerate time-to-value in regulated industries. Competitive intensity is rising as global hyperscalers, independent specialists, and CX outsourcers consolidate capabilities through acquisitions, partnerships, and strategic capital infusions.

Global Chatbot Market Trends and Insights

Explosion of Messaging-App User Base

WhatsApp now serves 3 billion users and supports 175 million daily business conversations, giving the Chatbot market an immense, ready-made distribution channel. Businesses have opened 764 million WhatsApp Business accounts that achieve 98% open rates versus 20% for email, dramatically lowering acquisition costs. The broader messaging ecosystem engages more than 200 million businesses worldwide, creating strong network effects that improve bot ROI across retail, banking, and healthcare. Firms leverage rich-media templates that shift interactions from marketing prompts to full-funnel transactions without requiring app downloads. As user familiarity rises, message-based journeys become the default interface for service queries, order tracking, and in-channel payments.

Breakthroughs in Large-Language-Model NLP

The launch of GPT-4.5 and expected GPT-5 models enabled chatbots to manage complex multi-turn dialogues with near-human fluency. Enterprises such as Morgan Stanley showcased GPT-4 for internal knowledge retrieval, reducing advisor search time and boosting compliance confidence. Vendors embed retrieval-augmented generation so bots pull real-time data yet maintain conversation flow, addressing historical knowledge-cutoff limits. Yellow.ai orchestrates multi-LLM pipelines over 16 billion annual conversations, selecting specialized models per query to optimize cost and accuracy. These innovations cut training-data demands and open advanced conversational AI to SMEs lacking large labeled datasets.

Integration Complexity and Legacy Data Silos

Enterprises with decades-old systems face month-long timeline overruns when wiring chatbots into mainframes, CRMs, and ERPs. Forty-seven percent of firms build generative AI in-house to control data pipelines, reflecting integration anxiety. Middleware orchestration, real-time synchronization, and stringent security vetting inflate project budgets and delay full rollout, especially in banking and telecom, where data fragmentation is acute. As a result, greenfield digital-native firms gain time-to-market advantage, pressing incumbents to invest in API modernization.

Other drivers and restraints analyzed in the detailed report include:

- 24/7 Customer-Support Cost Pressure

- Self-Service Mandates in Digital CX Strategies

- Privacy/Regulatory Compliance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform and software offerings retained a 64.12% share of the Chatbot market in 2025, underscoring their role as foundational infrastructure. Services, however, outpace overall growth at a 24.12% CAGR through 2031. Enterprises increasingly seek advisory, integration, and optimization expertise as conversational AI complexity rises. Yellow.ai packages full-lifecycle support covering strategy, custom model tuning, and ongoing governance, driving services demand. For clients, expert partners mitigate integration pain points and ensure compliance, turning vendor know-how into tangible business outcomes that justify premium fees.

Implementation consulting is often bundled with managed-service SLAs that guarantee uptime, retraining, and quarterly performance reviews. This shift nudges revenue mix toward recurring service contracts, smoothing vendor cash flows. As AI tooling matures, differentiation hinges less on base technology and more on outcome-driven engagement, favoring providers with deep vertical playbooks and robust partner ecosystems. The Chatbot market expects continued platform consolidation alongside a flourishing services layer that captures expanding wallet share.

Customer support commanded 41.82% of the Chatbot market share in 2025, reflecting high ticket volumes and proven ROI. HR and recruiting use cases, however, register the quickest rise with a 24.86% CAGR through 2031. Bots prescreen candidates, schedule interviews, and answer policy questions, freeing HR teams for high-touch activities. Enterprises report 90% automation of repetitive inquiries and accelerated time-to-hire, translating into measurable productivity gains.

Sales and marketing bots nurture leads via personalized drip conversations, while IT service-desk agents reset passwords and diagnose hardware issues. Emerging internal knowledge assistants aggregate structured and unstructured content, cutting search cycles. This functional diversification underscores conversational AI's versatility and cements its status as a core automation pillar rather than a niche support add-on.

The Chatbot Market Report is Segmented by Component (Platform/Software and Services), Application (Customer Support, Sales and Marketing, and More), Deployment Mode (Cloud and On-Premise), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Retail and ECommerce, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.72% to the Chatbot market size in 2025, anchored by early LLM adoption and high labor costs that sharpen automation payback. U.S. financial institutions and retailers implement advanced voice-plus-vision agents, and Canadian enterprises tap GPT-4 for internal knowledge retrieval. Mature digital infrastructure and vibrant venture funding support continuous experimentation that spills over into Latin America through nearshore service hubs.

Asia-Pacific posts the fastest 24.71% CAGR through 2031 as governments back AI investments and mobile commerce proliferates. China poured USD 2.1 billion into AI projects, India's chatbot segment grows 25% annually, and Singapore positions itself as an AI governance testbed. High smartphone penetration and super-app ecosystems generate massive conversational traffic, accelerating adoption in banking, travel, and public services. Local vendors tailor multilingual bots to regional dialects, fostering inclusive digital access.

Europe advances under the shadow of the EU AI Act, balancing innovation with rigorous compliance. Germany, France, and the U.K. integrate chatbots into manufacturing, healthcare, and public administration, with annual compliance budgets absorbed into total cost of ownership calculations. Standardized governance frameworks enhance cross-border collaborations and set de-facto global norms. Emerging regions, South America, the Middle East, and Africa benefit from falling cloud costs and expanding broadband, unlocking greenfield deployments across telecom, energy, and transport.

- LivePerson, Inc.

- Kore.ai, Inc.

- Ada Support Inc.

- Intercom, Inc.

- Drift.com, Inc.

- Yellow.ai Pvt. Ltd.

- Cognigy GmbH

- Freshworks Inc.

- Gupshup Technology India Pvt. Ltd.

- Boost.ai AS

- Rasa Technologies GmbH

- SnatchBot SA

- Tidio Poland Sp. z o.o.

- Chatfuel, Inc.

- Aivo Technologies, Inc.

- Inbenta Holdings, Inc.

- Senseforth.ai Labs Pvt. Ltd.

- BotsCrew, Inc.

- Quiq, Inc.

- LiveChat Software S.A.

- Zendesk, Inc.

- Artificial Solutions International AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of messaging-app user base

- 4.2.2 Breakthroughs in large-language-model (LLM) NLP

- 4.2.3 24/7 customer-support cost pressure

- 4.2.4 Self-service mandates in digital CX strategies

- 4.2.5 Voice-first and multimodal bot convergence

- 4.2.6 LLM-powered internal knowledge automation

- 4.3 Market Restraints

- 4.3.1 Integration complexity and legacy data silos

- 4.3.2 Privacy/regulatory compliance concerns

- 4.3.3 Hallucination-driven brand-risk

- 4.3.4 Scarcity of vertical-grade training datasets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Platform/Software

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Customer Support

- 5.2.2 Sales and Marketing

- 5.2.3 HR and Recruiting

- 5.2.4 IT Service Management

- 5.2.5 Others

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Retail and eCommerce

- 5.5.2 BFSI

- 5.5.3 Healthcare

- 5.5.4 Travel and Hospitality

- 5.5.5 Telecom and IT

- 5.5.6 Government and Public Sector

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LivePerson, Inc.

- 6.4.2 Kore.ai, Inc.

- 6.4.3 Ada Support Inc.

- 6.4.4 Intercom, Inc.

- 6.4.5 Drift.com, Inc.

- 6.4.6 Yellow.ai Pvt. Ltd.

- 6.4.7 Cognigy GmbH

- 6.4.8 Freshworks Inc.

- 6.4.9 Gupshup Technology India Pvt. Ltd.

- 6.4.10 Boost.ai AS

- 6.4.11 Rasa Technologies GmbH

- 6.4.12 SnatchBot SA

- 6.4.13 Tidio Poland Sp. z o.o.

- 6.4.14 Chatfuel, Inc.

- 6.4.15 Aivo Technologies, Inc.

- 6.4.16 Inbenta Holdings, Inc.

- 6.4.17 Senseforth.ai Labs Pvt. Ltd.

- 6.4.18 BotsCrew, Inc.

- 6.4.19 Quiq, Inc.

- 6.4.20 LiveChat Software S.A.

- 6.4.21 Zendesk, Inc.

- 6.4.22 Artificial Solutions International AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment