|

市场调查报告书

商品编码

1910542

电子书:市占率分析、产业趋势与统计、成长预测(2026-2031)E-book - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

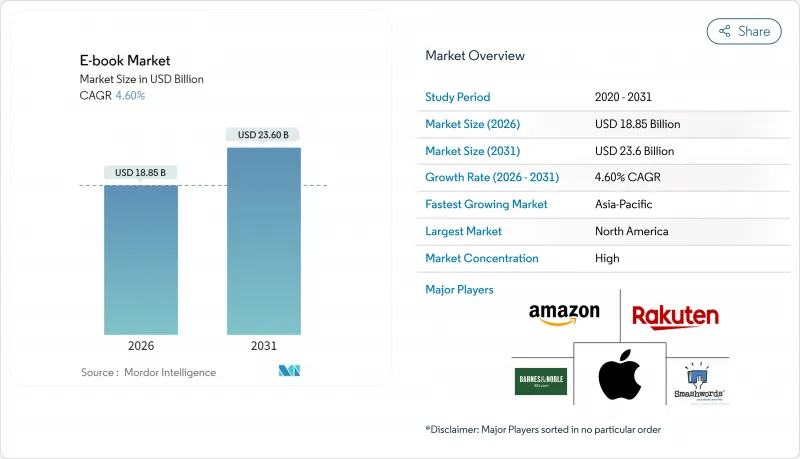

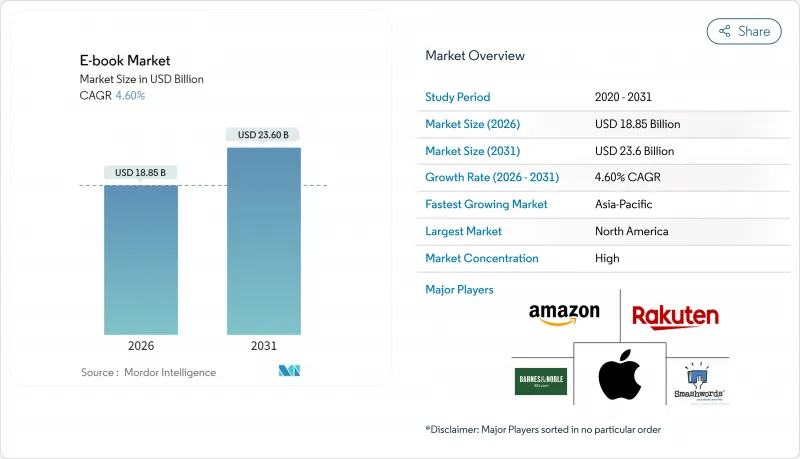

预计电子书市场将从 2025 年的 180.2 亿美元成长到 2026 年的 188.5 亿美元,到 2031 年达到 236 亿美元,2026 年至 2031 年的复合年增长率为 4.6%。

订阅主导的经营模式、机构授权的兴起以及行动优先的阅读习惯是塑造电子书市场的三大强大力量。收入的可预测性支撑着出版商对平台专属体验的投资,例如互动式教科书和连载网路漫画。智慧型手机的普及推动了微交易和社交发现功能的尝试,从而加深了读者的参与。同时,基于区块链的版权管理正在简化作者的报酬结构,并缓解长期存在的数位版税纠纷。市场竞争强度适中。虽然亚马逊的 Kindle 生态系统仍然是基础平台,但亚太地区涌现的区域性颠覆者和以图书馆为中心的供应商正在削弱其垄断地位。

全球电子书市场趋势与洞察

行动装置的日益普及

智慧型手机的兴起已将数位阅读的核心从专用电子阅读器转移到始终连网的装置。出版商正利用这一趋势,发布短小精悍的内容,优化垂直滚动体验,并融入游戏化元素,以鼓励用户每天持续阅读。显示器製造商正在改进防眩光OLED萤幕和自适应更新率,以减少长时间阅读造成的眼部疲劳。人工智慧驱动的建议引擎的兴起进一步提升了应用程式内内容发现的个人化程度,提高了阅读完成率和平均每次阅读时长。在设备更新换代週期较短的亚太地区,阅读应用程式如今已预先安装在高阶设备上,为使用者进入电子书市场提供了预设入口。

不断扩展的全球互联网连接

新一代宽频部署和对5G回程传输的投资正在扩大先前受频宽成本限制的市场的覆盖范围。根据GSMA的「数位国家」框架,亚太地区的18个国家政府已将普及网路连接作为经济竞争力的基础。更快、更便宜的连接使出版商能够嵌入高解析度图片、音频片段和短影片,而无需忍受漫长的加载时间。与区域频宽品质挂钩的动态定价也变得越来越普遍。网路速度较慢的读者可以选择价格更低的低比特率套餐,在满足网路基础设施实际情况的同时,保持了可访问性。连接性的提升也消除了云端同步的障碍,确保在多个装置上无缝追踪阅读进度。

电子经销商和作者的隐私和版权问题

围绕数位版权管理和数据使用的复杂问题正威胁着分销生态系统的分裂。欧洲监管机构正对难以维护合规基础设施的小规模出版商处以GDPR罚款,罚款金额可能占其年度数位收入的10%以上。围绕数位借阅法规的诉讼凸显了合理使用界限方面持续存在的模糊性,这延缓了机构的采购决策,并抑制了图书馆通路电子书市场近期的成长。作者们越来越质疑人工智慧公司是否在未经许可的情况下抓取其全文,这促使约翰霍普金斯大学出版社等早期采用者创建了清晰的人工智慧授权框架,以确保模型训练获得补偿。具有前瞻性的出版商正在探索利用区块链技术记录内容交易时间戳,透过记录每次访问的时间、地点和方式,提高透明度和审核。

细分市场分析

订阅服务将继续推动电子书市场的扩张,预计到2025年将占总收入的55.72%。数据丰富的环境使得新系列书籍的演算法推荐成为可能,确保新书能精准触达目标读者群。机构授权(主要来自图书馆和企业培训入口网站)正以5.05%的复合年增长率快速增长,主要得益于较高的用户单价。儘管机构授权用户数量低于消费者订阅用户,但这一成长趋势仍显着提升了电子书市场规模。在学术收费和专业参考书等需要永久存取权限的领域,付费下载模式仍将继续存在;而在註重成本的地区,诸如广告位变现和社交共用后解锁章节等免费增值模式正变得越来越受欢迎。

出版商正围绕着「内容即服务」建立工作流程,透过即时校对和添加多媒体内容来更新其数位书目。这种延长的生命週期有助于平滑收入确认,并增强书目持久性。在平台方面,管理定期订阅解约率正逐渐成为一门科学。预测分析能够识别易流失的读者,并在流失风险高峰到来之前推播精心策划的通知和忠诚度奖励。整合的支付系统简化了方案变更流程,鼓励常用使用者升级到包含有声书和图文内容的付费方案。这些倡议形成了一个良性循环,逐年提升用户参与度,并扩大定期订阅电子书的市场份额。

区域分析

预计到2025年,北美将维持39.45%的市场份额,这主要得益于当地电子阅读器的使用习惯、较高的宽频普及率以及密集的图书馆和学术机构生态系统。各大平台正在投资开发人工智慧阅读助手,提供章节摘要和即时翻译等功能,以提升时间紧迫的专业的阅读体验。儘管目前针对平台垄断的监管调查尚未带来结构性解决方案,但有望遏制平台的收购策略,并促使现有平台专注于以客户为中心的功能增强,而非一味囤积内容。

亚太地区将成为成长最快的地区,到2031年将以4.72%的复合年增长率成长,这主要得益于智慧型手机的普及和灵活的行动支付系统。自2020年以来,日本的数位漫画收入翻了一番,而韩国的网路漫画则透过不断创造IP价值(例如改编成电视剧和游戏),吸引消费者回归原创作品。据GSMA称,新加坡、韩国和澳洲已实现近乎全面的5G网路覆盖,为频宽密集型互动电子书创造了有利条件。东南亚的Start-Ups正在尝试分段定价,以几美分的价格出售单一章节,透过提高电子书的可负担性来增强其市场竞争力。

在机构数位化指令和跨境内容监管的推动下,欧洲正经历稳定成长。 GDPR合规虽然需要成本高昂的一般资料保护规则处理保障措施,但正在建立消费者信任并提高订阅转换率。多语言支援的需求促使出版商加快对人工智慧翻译流程的投资,以缩短在地化时间。德国和荷兰的区块链试点计画正在实现透明的版税分配,旨在将支付週期从数月缩短至数天。同时,英国正利用其强大的独立出版业,尝试将按需印刷客製印刷服务整合到直接面向读者的销售捆绑包中,以解决英国脱欧后复杂的许可问题。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 行动装置的普及率不断提高

- 不断扩展的全球互联网连接

- 数位教育和数位学习的发展

- 订阅式阅读平台的日益普及

- 基于区块链的版权管理和微支付

- 将出版商的 D2C 店面与 CRM 数据集成

- 市场限制

- 电子经销商与作者之间的隐私与版权问题

- 新兴市场对纸本书的偏好依然强劲。

- 电子阅读器生态系之间的互通性有限

- 为减少因数位疲劳而导致的萤幕使用时间而采取的措施

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按收入模式

- 定期订阅(无限阅读)

- 按次收费下载

- 免费增值/广告模式

- 机构许可

- 按类型

- 小说

- 非虚构类

- 教育与学术

- 漫画和图像小说

- 专业/技术领域

- 最终用户

- 个人消费者

- 成人

- 适用于儿童和青少年

- 按机构

- 小学、国中和高中

- 高等教育

- 企业/专业培训

- 公共图书馆

- 个人消费者

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 印尼

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon.com, Inc.

- Rakuten Kobo Inc.

- Apple Inc.

- Barnes and Noble, LLC

- Smashwords, Inc.

- Blurb, Inc.

- DIY Media Group, Inc.

- Lulu Press, Inc.

- Macmillan Publishers Ltd

- Scribd, Inc.

- Google LLC

- Hachette Livre SA

- HarperCollins Publishers LLC

- Penguin Random House LLC

- Draft2Digital, LLC

- OverDrive, Inc.

- Storytel AB

- Wattpad Corp.

- Inkitt GmbH

- John Wiley and Sons, Inc.

- Pearson plc

- Cengage Learning, Inc.

第七章 市场机会与未来展望

The e-book market is expected to grow from USD 18.02 billion in 2025 to USD 18.85 billion in 2026 and is forecast to reach USD 23.6 billion by 2031 at 4.6% CAGR over 2026-2031.

Subscription-led business models, institutional licensing momentum, and mobile-first reading habits are the three most powerful forces shaping the e-book market. Revenue predictability underpins publisher investment in platform-native experiences such as interactive textbooks and webtoon serialization. Smartphone ubiquity drives microtransaction experimentation and social discovery features that deepen reader engagement. Meanwhile, blockchain-enabled rights management is beginning to streamline author compensation, mitigating long-running disputes over digital royalties. Competitive intensity is moderate: Amazon's Kindle ecosystem remains the anchor platform, but regional disruptors from Asia Pacific and library-centric vendors are eroding any path toward monopoly dominance.

Global E-book Market Trends and Insights

Increasing Penetration of Mobile Devices

Smartphone saturation has shifted the center of gravity for digital reading away from dedicated e-readers and toward always-connected handsets. Publishers capitalize on this reality by releasing bite-sized content episodes, optimizing for vertical scrolling, and layering in gamified achievements that reinforce daily reading streaks. Display manufacturers are refining glare-free OLED screens and adaptive refresh rates that reduce eye strain during extended reading sessions. The rise of AI-driven recommendation engines further personalizes in-app discovery, boosting completion rates and average reading time per session. In Asia Pacific, where handset upgrades occur on rapid cycles, premium devices now ship with pre-installed reading apps that create a default pathway into the e-book market.

Expanding Global Internet Connectivity

Next-generation broadband rollouts and 5G backhaul investments expand addressable audiences in markets historically constrained by bandwidth cost. GSMA's Digital Nations framework shows 18 Asia Pacific governments prioritizing ubiquitous coverage as a pillar of economic competitiveness. Faster, cheaper connections enable publishers to embed high-resolution artwork, audio snippets, and short-form video without incurring intolerable load times. Dynamic pricing tied to regional bandwidth quality is also gaining traction: readers on slower networks can opt for lower-bitrate packages at reduced prices, preserving accessibility while respecting infrastructure realities. Enhanced connectivity likewise removes frictions for cloud synchronization, ensuring seamless progress tracking across multiple devices.

Privacy and Copyright Issues Among E-sellers and Authors

Complexities around digital rights management and data usage threaten to fragment distribution ecosystems. European regulators enforce GDPR penalties that can absorb more than 10% of annual digital revenue for small presses struggling to maintain compliant infrastructure. Controlled digital lending lawsuits underscore lingering ambiguity over fair-use boundaries, delaying institutional purchasing decisions and depressing near-term e-book market growth in library channels. Authors increasingly question whether AI companies scrape full texts without consent, prompting early adopters like Johns Hopkins University Press to craft explicit AI licensing frameworks that guarantee compensation for model training. Forward-looking publishers explore blockchain timestamping of content transactions to record when, where, and how each copy is accessed, enhancing transparency and auditability.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Digital Education and E-learning

- Rising Adoption of Subscription-Based Reading Platforms

- Persistent Preference for Print Books in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Subscription services commanded 55.72% of 2025 revenue and remain the engine behind the e-book market expansion. Their data-rich environments inform algorithmic commissioning of new series, ensuring that titles debut with pre-qualified audiences. Institutional licensing, chiefly libraries and corporate training portals, shows the sharpest momentum, growing at 5.05% CAGR on a base of high per-user spending. That uptrend contributes meaningfully to the e-book market size even though its user count trails consumer subscriptions. Pay-per-download persists for academic monographs and professional references where perpetual access is mandatory, while freemium models gain traction in cost-sensitive territories by monetizing advertising inventory or unlocking chapters after social sharing actions.

Publishers are engineering workflows around "content-as-a-service," refreshing digital backlists with real-time errata fixes and multimedia add-ons. This lifecycle extension smooths revenue recognition and strengthens catalog durability. For platforms, subscription churn management has become a science: predictive analytics flag disengaging readers so that curated push notifications or loyalty rewards arrive before cancellation risk peaks. Integrated payment rails simplify tier upgrades, nudging heavy readers toward premium plans that bundle audiobooks or graphic content. These measures reinforce a virtuous loop wherein higher engagement elevates the e-book market share of subscription formats year over year.

The E-Book Market Report is Segmented by Revenue Model (Subscription, Pay-Per-Download, Freemium/Ad-supported, and Institutional Licensing), Genre (Fiction, Non-Fiction, Education and Academic, Comics and Graphic Novels, and Professional and Technical), End-User (Individual Consumers, and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained its 39.45% share in 2025 owing to entrenched e-reader habits, high broadband penetration, and a dense ecosystem of library and academic buyers. Leading platforms invest in AI-generated reading companions that summarize chapters and translate passages on the fly, raising engagement among time-pressed professionals. Regulatory inquiries into platform exclusivity have not yet produced structural remedies, but they do temper acquisition strategies, pushing incumbents to focus on customer-centric feature upgrades rather than aggressive content hoarding.

Asia Pacific charts the fastest regional expansion at a 4.72% CAGR through 2031, propelled by smartphone ubiquity and flexible mobile payment systems. Japanese digital manga revenue has doubled since 2020, while Korean webtoons add recurring IP value thanks to drama and gaming adaptations that rebound consumers back into source titles. GSMA notes that Singapore, South Korea, and Australia achieve near-total 5G coverage, creating fertile ground for bandwidth-heavy interactive books. South-East Asian start-ups experiment with sachet-pricing, selling single chapters for cents, thereby broadening affordability and bolstering the e-book market.

Europe grows steadily on the back of institutional digitization mandates and cross-border content regulation. GDPR compliance engenders consumer trust, elevating subscription conversion rates though it imposes costly data-handling safeguards. Multilingual requirements spur publishers to invest in AI-translation pipelines that reduce localization timelines. Blockchain pilots in Germany and the Netherlands test transparent royalty disbursement, aiming to shorten payment cycles from months to days. In parallel, the UK navigates post-Brexit licensing complexities, leveraging its robust independent press scene to experiment with direct-to-reader bundles that integrate print-on-demand add-ons.

- Amazon.com, Inc.

- Rakuten Kobo Inc.

- Apple Inc.

- Barnes and Noble, LLC

- Smashwords, Inc.

- Blurb, Inc.

- DIY Media Group, Inc.

- Lulu Press, Inc.

- Macmillan Publishers Ltd

- Scribd, Inc.

- Google LLC

- Hachette Livre SA

- HarperCollins Publishers LLC

- Penguin Random House LLC

- Draft2Digital, LLC

- OverDrive, Inc.

- Storytel AB

- Wattpad Corp.

- Inkitt GmbH

- John Wiley and Sons, Inc.

- Pearson plc

- Cengage Learning, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing penetration of mobile devices

- 4.2.2 Expanding global internet connectivity

- 4.2.3 Growth of digital education and e-learning

- 4.2.4 Rising adoption of subscription-based reading platforms

- 4.2.5 Blockchain-enabled rights management and micropayments

- 4.2.6 Publisher D2C storefront integration with CRM data

- 4.3 Market Restraints

- 4.3.1 Privacy and copyright issues among e-sellers and authors

- 4.3.2 Persistent preference for print books in emerging markets

- 4.3.3 Interoperability limitations across e-reader ecosystems

- 4.3.4 Digital fatigue driving screen-time reduction initiatives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Revenue Model

- 5.1.1 Subscription (all-you-can-read)

- 5.1.2 Pay-per-download

- 5.1.3 Freemium / Ad-supported

- 5.1.4 Institutional licensing

- 5.2 By Genre

- 5.2.1 Fiction

- 5.2.2 Non-fiction

- 5.2.3 Education and Academic

- 5.2.4 Comics and Graphic Novels

- 5.2.5 Professional and Technical

- 5.3 By End-user

- 5.3.1 Individual Consumers

- 5.3.1.1 Adults

- 5.3.1.2 Children and Young Adults

- 5.3.2 Institutional

- 5.3.2.1 K-12 Schools

- 5.3.2.2 Higher Education

- 5.3.2.3 Corporate / Professional Training

- 5.3.2.4 Public Libraries

- 5.3.1 Individual Consumers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Indonesia

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amazon.com, Inc.

- 6.4.2 Rakuten Kobo Inc.

- 6.4.3 Apple Inc.

- 6.4.4 Barnes and Noble, LLC

- 6.4.5 Smashwords, Inc.

- 6.4.6 Blurb, Inc.

- 6.4.7 DIY Media Group, Inc.

- 6.4.8 Lulu Press, Inc.

- 6.4.9 Macmillan Publishers Ltd

- 6.4.10 Scribd, Inc.

- 6.4.11 Google LLC

- 6.4.12 Hachette Livre SA

- 6.4.13 HarperCollins Publishers LLC

- 6.4.14 Penguin Random House LLC

- 6.4.15 Draft2Digital, LLC

- 6.4.16 OverDrive, Inc.

- 6.4.17 Storytel AB

- 6.4.18 Wattpad Corp.

- 6.4.19 Inkitt GmbH

- 6.4.20 John Wiley and Sons, Inc.

- 6.4.21 Pearson plc

- 6.4.22 Cengage Learning, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment