|

市场调查报告书

商品编码

1910607

医药物流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

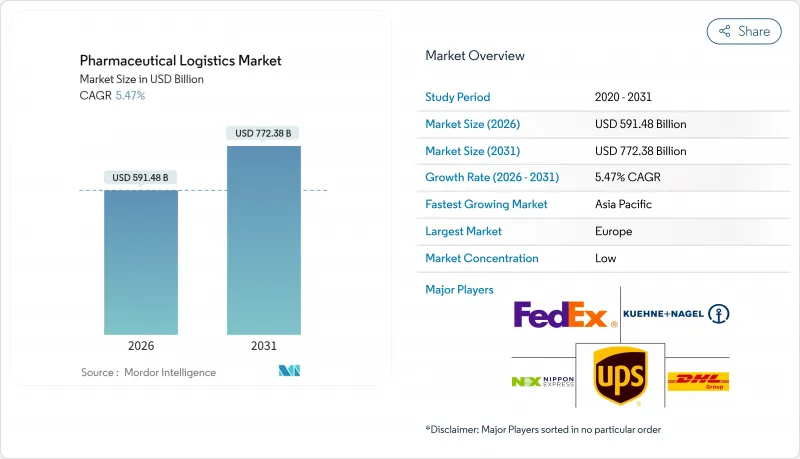

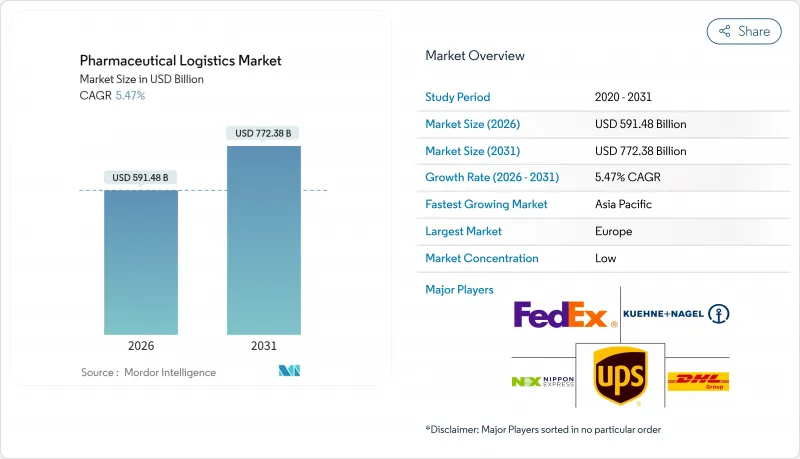

2025年,医药物流市场价值为5,608.1亿美元,预计从2026年的5,914.8亿美元成长到2031年的7,723.8亿美元,在预测期(2026-2031年)内,复合年增长率为5.47%。

强劲成长归功于生物製药的广泛应用、严格的序列化要求以及向直接面向患者的配送模式的转变,而这些都需要精准的配送能力。全球整合商的大量资本投入、网路药局的持续普及以及温控基础设施的扩展,不断加剧市场竞争,同时也扩大了对端到端合规供应链解决方案的潜在需求。随着相关人员采取措施防止温度偏差和假冒伪劣风险,技术应用,特别是物联网感测器、区块链溯源和人工智慧驱动的网路优化,正在加速发展。同时,为减少排放采取的永续性正在推动运输方式向多式联运和海运转变,为专业服务供应商创造了新的市场机会。儘管与低温运输能源成本和多司法管辖区合规性相关的价格压力仍然是不利因素,但它们也推动了对低碳包装、区域库存管理和替代燃料的投资,最终促进了医药物流市场的扩张。

全球医药物流市场趋势与洞察

网路药局的扩张

如今,近半数消费者更倾向于在线订购药品,这就要求物流公司建立送货上门的网络,以确保对温度敏感的药品能够保存在2°C至8°C的环境中。亚太地区的供应商正利用数位支付和远端医疗平台拓展常温和冷藏小包裹服务。同时,美国整合商正透过物联网赋能的包装解决方案提升最后一公里配送的透明度。监管机构也积极回应,将序列化和追踪细化到单品层级。合规门槛不断提高,而提供即时温度和位置数据的供应商也日益多元化。随着网路药局量的成长,微型仓配中心的网路改造正在缩短前置作业时间,提高病患的用药依从性,从而推动整个医药流市场需求的成长。

成药需求不断增加以及慢性病负担加重

成药受到的处理监管比处方药宽鬆,因此可以采取混合运输路线,从而降低综合经销商的仓储成本。然而,糖尿病和心血管疾病的日益普及导致药品需要持续补货,并增加了对时效性库存的产能需求。物流合作伙伴利用机器人拣货包装和智慧泡壳包装等自动化技术,将成药和慢性病药物整合到一个统一的物流流程中,以缩短停留时间。混合模式使医药物流市场能够提高资产利用率并保持盈利,同时也能提升对药局和诊所的服务品质。

温控运输成本高成本

低温运输故障每年造成製药企业约350亿美元的损失,其中包括废弃物处理、重新包装和运输罚款。使用相变材料的被动包装可以将保护期延长至96小时,但通常会使每个小包裹的成本增加一倍,这给资源匮乏的新兴市场专案带来了更大的压力。冗余的监控设备和合格人员的需求增加了营运成本,限制了製药物流市场中小型承运商的利润率。低碳冷媒和可重复使用的托特包等创新旨在降低运输成本,但由于初始投资成本高昂,其广泛应用仍受到限制。

细分市场分析

到2025年,运输环节将占总收入的51.40%,这显示实体运输是医药物流市场的支柱。公路货运负责区域间配送,尤其是在欧洲和北美之间;空运则支援长距离生物製药补给,并保证隔日送达。随着托运人寻求永续的运输方式,例如使用符合GDP标准的冷藏集装箱以减少排放,海运的重要性日益凸显。

附加价值服务正以4.42%的复合年增长率快速成长,涵盖贴标、二次包装、订单套件组装和序列化咨询等服务,从而减轻製造商的非核心营运负担。亚太地区的需求成长最为迅速,该地区的契约製造製造商正在寻找能够处理多语言法规印刷的单一来源合作伙伴。随着资料完整性法规的日益严格,经认证的重新贴标和防篡改包装正从可选附加服务转变为采购的必备条件,从而推动了医药物流市场利润率的提升。

区域分析

2025年,欧洲在全球收入份额中保持31.70%的领先地位,这得益于统一的GDP执行标准、密集的公路网络以及德国、瑞士和爱尔兰的大型製造群。对跨境铁路和航空走廊的投资正在推动模式转换,从而在不影响前置作业时间的前提下减少排放。欧洲医药物流市场规模的扩大也受惠于产能的持续成长,例如低温运输技术公司在荷兰新建的物流中心,这将加强区域相变材料(PCM)的生产并降低运输风险。

北美仍然是关键市场,这得益于其成熟的DSCSA序列化系统以及持续的疫情应对公共资金支持。 DHL已将其20亿欧元(20.8亿美元)计画的50%分配给其美国和加拿大的设施,引入太阳能仓库和液化天然气动力卡车,以在维持服务水准的同时减少排放。加之联邦快递斥资4.4亿美元扩建其医疗配销中心,该地区正不断重新定义资料可见性和永续性的最佳实践。

亚太地区预计将成为成长最快的地区,2026年至2031年的复合年增长率将达到5.02%,这主要得益于中国和印度产量的增长、保险覆盖范围的扩大以及网路药局的普及。各国政府都在鼓励低温运输升级,例如印度计画在2025年为符合GDP标准的仓储设施提供税收优惠。区域性物流公司正在中欧走廊沿线实施铁路-公路-海运-空运联运方案,以降低运输成本和排放气体。儘管中东和非洲的基础建设相对滞后,波湾合作理事会(GCC)的在地化计画正在刺激仓储投资,并确保医药物流市场的未来发展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 网路药局的扩张

- 成药需求不断增长,慢性病负担日益加重。

- 生技药品和疫苗低温运输需求加速成长

- 外包给第三方/第四方物流专家的业务迅速成长

- 一个必不可少的端对端物联网/区块链追踪系统

- 透过净零物流投资促进基础建设更新

- 市场限制

- 温控运输成本高成本

- 复杂多元的全球合规标准

- 先进相变封装材料短缺

- 新兴市场生技药品最后一公里配送瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情与地缘政治事件的影响

第五章 市场规模与成长预测

- 按服务类型

- 运输

- 公路货运

- 空运

- 海上运输

- 铁路货运

- 仓储和存储

- 附加价值服务及更多

- 运输

- 按操作模式

- 低温运输物流

- 非低温运输物流

- 依产品类型

- 处方药

- 非处方药

- 生物製药和生物相似药

- 疫苗和血液製品

- 临床试验材料

- 细胞和基因治疗

- 医疗设备和诊断设备

- 兽医学

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美洲

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 亚太其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deutsche Post DHL

- Kuehne+Nagel

- UPS

- FedEx

- Nippon Express

- World Courier

- SF Express

- CEVA Logistics

- DSV

- Kerry Logistics

- CH Robinson

- Lineage Logistics

- United States Cold Storage

- Americold Logistics

- Nichirei Logistics Group

- Kloosterboer

- NewCold Advanced Cold Logistics

- VersaCold Logistics Services

- Rhenus Logistics

- Cencora

第七章 市场机会与未来展望

The Pharmaceutical Logistics Market was valued at USD 560.81 billion in 2025 and estimated to grow from USD 591.48 billion in 2026 to reach USD 772.38 billion by 2031, at a CAGR of 5.47% during the forecast period (2026-2031).

Robust growth stems from biologics proliferation, rigorous serialization mandates, and the pivot toward direct-to-patient delivery models that require precision distribution capacities. Strong capital spending by global integrators, sustained e-pharmacy adoption, and expanding temperature-controlled infrastructure continue to intensify competition while enlarging addressable demand for end-to-end, compliant supply-chain solutions. Technology deployment-particularly IoT sensors, blockchain traceability, and AI-driven network optimization-has accelerated as stakeholders guard against temperature excursions and counterfeit risk. At the same time, sustainability commitments are redirecting capacity toward intermodal and ocean transportation to curb emissions, opening new service niches for specialty providers. Price pressures linked to cold-chain energy costs and multi-jurisdictional compliance remain headwinds, yet they also spur investment in low-carbon packaging, regionalized inventories, and alternative fuels that ultimately expand the pharmaceutical logistics market.

Global Pharmaceutical Logistics Market Trends and Insights

Expansion of Online Pharmacies

Nearly half of consumers now prefer ordering medicines online, compelling carriers to engineer door-step delivery networks that secure 2 °C-8 °C conditions for sensitive products. Providers in Asia-Pacific leverage digital payments and telehealth platforms to scale ambient and refrigerated parcel services, while U.S. integrators enhance last-mile visibility through IoT-enabled pack-out solutions. Regulators have responded by extending serialization and track-and-trace to the single-unit level, raising compliance hurdles but also differentiating operators that offer real-time temperature and location data. As e-pharmacy volumes climb, network redesign toward micro-fulfillment hubs tightens lead-times, improving medication adherence and fueling incremental demand across the pharmaceutical logistics market.

Rising OTC-Medicine Demand & Chronic-Disease Burden

OTC formulations carry less-stringent handling rules than prescription drugs, enabling blended transport lanes that cut storage costs for integrated distributors. However, the rising prevalence of diabetes and cardiovascular disease forces continual replenishment cycles that intensify throughput requirements for time-critical inventory. Logistics partners exploit automation, such as robotic pick-and-pack and smart blister packaging, to combine OTC and chronic-care medications within unified flows that reduce dwell time. Hybrid models improve asset utilization and sustain profitability within the pharmaceutical logistics market while enhancing service quality for pharmacies and clinics.

High Cost of Temperature-Controlled Distribution

Cold-chain failures cost drug makers an estimated USD 35 billion each year, reflecting write-offs, repackaging, and penalty shipments. Passive packaging with phase-change materials can extend protection to 96 hours but often doubles per-parcel expenses, placing strain on emerging-market programs where funding is scarce. The need for redundant monitoring equipment and qualified staff compounds overhead, limiting profit margins for smaller carriers within the pharmaceutical logistics market. Innovation in low-carbon refrigerants and reusable totes aims to reduce cost per shipment, yet wide deployment remains constrained by initial capital outlay.

Other drivers and restraints analyzed in the detailed report include:

- Acceleration of Biologics & Vaccine Cold-Chain Needs

- Outsourcing Surge to 3PL/4PL Specialists

- Complex & Divergent Global Compliance Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation generated 51.40% of 2025 revenue, illustrating that physical movement remains the backbone of the pharmaceutical logistics market. Road freight captures regional flows, particularly across Europe and North America, while air freight underpins long-haul biologics replenishment with next-day service guarantees. Ocean lanes gain relevance as shippers pursue sustainable options, leveraging GDP-compliant reefer containers to curb emissions.

Value-added services, growing at a 4.42% CAGR, include labeling, secondary packaging, order kitting, and serialization consulting that relieve manufacturers of non-core tasks. Demand rises fastest in Asia-Pacific, where contract manufacturers seek single-source partners to handle regulatory printing in multiple languages. As data integrity rules tighten, certified relabeling and tamper-evident pack-outs transform from optional extras into procurement prerequisites, driving incremental margin across the pharmaceutical logistics market.

The Pharmaceutical Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Storage, and Value-Added Services & Others), Mode of Operation (Cold-Chain Logistics and Non-Cold-Chain Logistics), Product Type (Prescription Drugs, OTC Drugs, Biologics & Biosimilars, and More), Geography (North America, South America, Europe, Asia-Pacific, and, More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 31.70% revenue share in 2025, underpinned by harmonized GDP enforcement, dense road networks, and large-scale manufacturing clusters in Germany, Switzerland, and Ireland. Investment in cross-border rail-air corridors supports modal shifts that lower emissions without compromising lead times. The pharmaceutical logistics market size in Europe benefits from continual capacity additions such as Cold Chain Technologies' new Netherlands hub, which augments regional PCM production and reduces transit risk.

North America remains a powerhouse thanks to DSCSA-driven serialization maturity and sustained public-sector funding for pandemic preparedness. DHL allocated 50% of its EUR 2 billion (USD 2.08 billion) plan to U.S. and Canadian facilities, integrating solar-powered warehouses and LNG trucks that curb emissions while preserving service standards. Combined with FedEx's USD 440 million expansion of healthcare distribution centers, the region continues to redefine best practices around data visibility and sustainability.

Asia-Pacific is expected to post the fastest growth at 5.02% CAGR from 2026 to 2031, buoyed by increased production out of China and India, widening insurance coverage, and e-pharmacy proliferation. Governments incentivize cold-chain upgrades, as evidenced by India's 2025 tax rebates on GDP-compliant warehousing equipment. Regional carriers deploy rail-truck sea-air solutions along the China-Europe corridor, trimming cost and cutting transit emissions. Middle East & Africa trail in infrastructure, yet Gulf Cooperation Council localization programs spur warehouse investment, securing future pharmaceutical logistics market expansion.

- Deutsche Post DHL

- Kuehne + Nagel

- UPS

- FedEx

- Nippon Express

- World Courier

- SF Express

- CEVA Logistics

- DSV

- Kerry Logistics

- C.H. Robinson

- Lineage Logistics

- United States Cold Storage

- Americold Logistics

- Nichirei Logistics Group

- Kloosterboer

- NewCold Advanced Cold Logistics

- VersaCold Logistics Services

- Rhenus Logistics

- Cencora

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of online pharmacies

- 4.2.2 Rising OTC-medicine demand & chronic-disease burden

- 4.2.3 Acceleration of biologics & vaccine cold-chain needs

- 4.2.4 Outsourcing surge to 3PL/4PL specialists

- 4.2.5 Mandatory end-to-end IoT / blockchain track-and-trace

- 4.2.6 Net-zero logistics investments driving infrastructure renewal

- 4.3 Market Restraints

- 4.3.1 High cost of temperature-controlled distribution

- 4.3.2 Complex & divergent global compliance standards

- 4.3.3 Shortage of advanced phase-change packaging materials

- 4.3.4 Last-mile biologic delivery bottlenecks in emerging markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of COVID-19 & Geo-Political Events

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road Freight

- 5.1.1.2 Air Freight

- 5.1.1.3 Sea Freight

- 5.1.1.4 Rail Freight

- 5.1.2 Warehousing & Storage

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Mode of Operation

- 5.2.1 Cold-Chain Logistics

- 5.2.2 Non-Cold-Chain Logistics

- 5.3 By Product Type

- 5.3.1 Prescription Drugs

- 5.3.2 OTC Drugs

- 5.3.3 Biologics & Biosimilars

- 5.3.4 Vaccines & Blood Products

- 5.3.5 Clinical Trail Materials

- 5.3.6 Cell & Gene Therapies

- 5.3.7 Medical Devices & Diagnostics

- 5.3.8 Veterinary Medicine

- 5.3.9 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Europe

- 5.4.4.1 United Kingdom

- 5.4.4.2 Germany

- 5.4.4.3 France

- 5.4.4.4 Spain

- 5.4.4.5 Italy

- 5.4.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.4.8 Rest of Europe

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Deutsche Post DHL

- 6.4.2 Kuehne + Nagel

- 6.4.3 UPS

- 6.4.4 FedEx

- 6.4.5 Nippon Express

- 6.4.6 World Courier

- 6.4.7 SF Express

- 6.4.8 CEVA Logistics

- 6.4.9 DSV

- 6.4.10 Kerry Logistics

- 6.4.11 C.H. Robinson

- 6.4.12 Lineage Logistics

- 6.4.13 United States Cold Storage

- 6.4.14 Americold Logistics

- 6.4.15 Nichirei Logistics Group

- 6.4.16 Kloosterboer

- 6.4.17 NewCold Advanced Cold Logistics

- 6.4.18 VersaCold Logistics Services

- 6.4.19 Rhenus Logistics

- 6.4.20 Cencora

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment