|

市场调查报告书

商品编码

1910655

中东汽车租赁市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Middle East Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

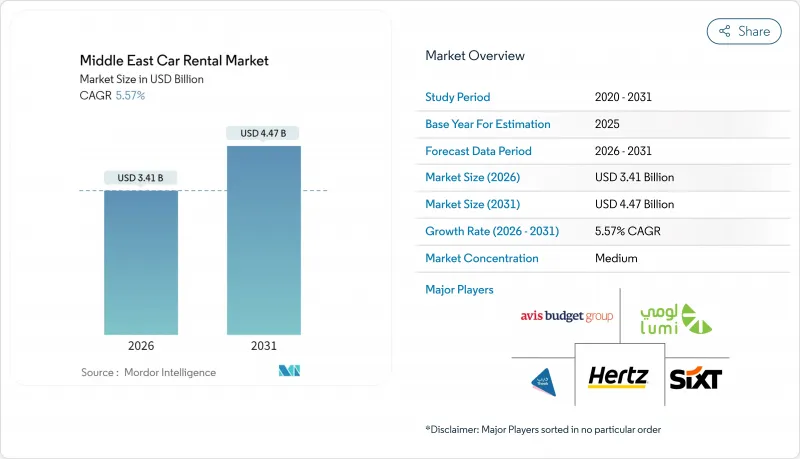

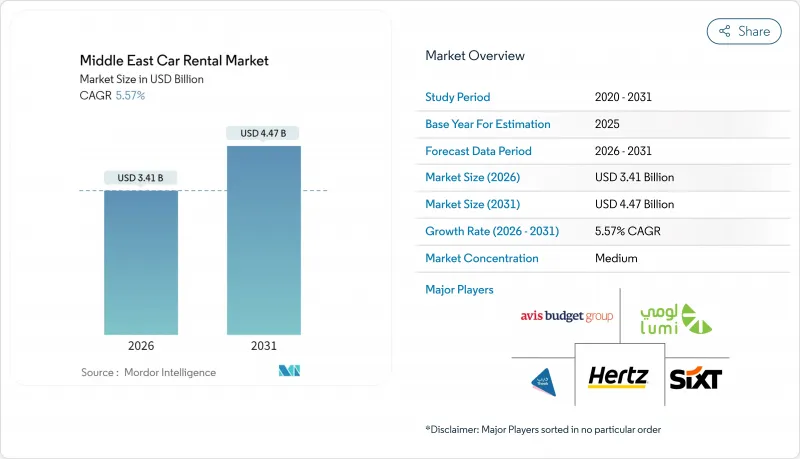

预计到 2026 年,中东汽车租赁市场价值将达到 34.1 亿美元。

这代表着从 2025 年的 32.3 亿美元成长到 2031 年的 44.7 亿美元,2026 年至 2031 年的年复合成长率(CAGR)为 5.57%。

入境旅游的成长、对高端出行方式的需求以及数位技术的广泛应用正在推动市场扩张。预计2024年国际旅客造访量将比疫情前水准增加32%,达到9,500万人次,将持续带动租车需求。目前,基于应用程式的预订量已占总交易量的约三分之二,其中豪华车和电动车细分市场成长最为迅速。沙乌地阿拉伯的「2030愿景」和2030年世博会等政府主导的大型企划正在推动出行走廊的扩张,促进车辆升级,并在机场之外开发新的收入来源。相对分散的市场格局,加上大规模创业融资,预计将进一步推动产业整合。

中东汽车租赁市场趋势与洞察

海湾合作委员会走廊旅游业復苏

2024年,海湾合作委员会(GCC)国家的旅游业显着復苏。沙乌地阿拉伯的游客人数激增69%,旅游收入达606亿美元。旅游业为阿联酋的国内生产毛额(GDP)贡献了599亿美元,相当于该国经济规模的11.7%。卡达在2025年上半年迎来了100万名游客的显着成长。同时,科威特正大力投资以旅游为中心的基础建设,从而推动了对更多车辆的需求。这种跨境交通流动将要求营运商在不同辖区之间进行策略性车队调配,建立稳健的走廊式服务策略,并适应不同的法规结构——所有这些都必须充分利用不断增长的客流量。

快速转向应用程式预订

智慧型手机的高普及率和数位支付的成熟度使得行动预订量超过了线下交易量,降低了分销成本,并使企业能够直接获取客户资料。在阿联酋,近乎普及的5G网路覆盖范围和消费者对非接触式服务的偏好正在加速这一趋势,而沙乌地阿拉伯的年轻人口也在推动行动装置使用量的成长。嵌入式身份验证和无钥匙进入提升了便利性,而预测分析则优化了车辆轮换。拥有自主应用程式的企业可以避免第三方费用,提高利润率,并透过忠诚度工具确保客户的终身价值。

共乘压力

在大都会圈,叫车服务的扩张正逐步取代传统的短程城市出行,而这些出行方式以往主要由私人租车主导。然而,对于多日观光旅行、家庭旅行和城际旅行而言,租车仍然具有强大的吸引力,并维持着稳固的需求基础。为了因应这种变化,营运商正在拓展服务范围,并专注于推出能够提升租车体验的加值服务。他们也将必要的导航工具与叫车平台整合,打造无缝接轨的多式联运出行方案。透过策略性地将租车服务定位在长途旅行和高价值用途,他们有效地减少了客户流失到叫车平台的趋势,并在日益便捷的出行方式中确保了私家车的持续吸引力。

细分市场分析

预计到2025年,线上预订将占中东汽车租赁市场62.12%的份额,预测期内复合年增长率(CAGR)为6.74%。线下柜檯仍主要服务于机场和饭店的散客,但面临高昂的营运成本。行动优先的介面支援即时升级、添加选项和积分奖励,从而缩短预订前置作业时间并提高车辆利用率。从长远来看,全通路策略将成为主流,实体门市将专注于客户支援和车辆交付,而数位管道将承担销售、支付和提升销售功能。

竞争主要集中在专有应用程式与市场聚合平台之间。整合了即时车辆库存管理、数位身份验证和无钥匙取车等功能的营运商正在缩短交易时间。阿联酋智慧型手机的普及加速了行动支付的普及,而拥有广泛4G网路的沙乌地阿拉伯也紧随其后。科威特和阿曼目前仍依赖线下预订,但随着消费者期望的改变,它们也稳步采用行动解决方案。

预计到2025年,休閒和旅游租赁将占中东汽车租赁市场收入的95.10%,并在2031年之前以7.22%的复合年增长率增长。杜拜、杜哈、利雅德和Muscat凭藉着大型活动和宽鬆的签证政策,保持着对游客的吸引力。然而,企业需求正在推动收入来源多元化,跨国公司纷纷在沙乌地阿拉伯和阿联酋设立区域总部。

全年持续的会议和计划主导差旅正在缓解假日高峰期带来的季节性风险。同时服务游客和企业高管的公司正在优化车队配置,在旅游旺季使用经济型轿车,在淡季则将豪华轿车分配给企业客户。这种双市场策略有助于稳定现金流并提高整体运转率。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 海湾合作委员会走廊旅游业復苏

- 向基于应用程式的预订方式的快速转变

- 大型活动和基础设施计划(2030愿景、2030年世博会)

- 企业行动订阅采用情况

- 政府对电动车租赁的激励措施

- 整合出行超级应用的兴起

- 市场限制

- 取代叫车的压力

- 与劳动力本土化相关的合规成本

- 电动车租赁保险供给能力短缺

- 进口依赖型车辆供应瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望(车载资讯系统、OTA、电动车)

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过预约方式

- 在线的

- 离线

- 透过使用

- 休閒/旅游

- 日常使用/商务

- 按车辆类型

- 经济

- 奢华与高端

- 按最终用户类型

- 自驾

- 专车接送

- 按服务类型

- 机场内部

- 机场外/区域内

- 透过推进力

- 内燃机(ICE)

- 电动和混合动力汽车

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 科威特

- 卡达

- 其他中东国家

第六章 竞争情势

- 市场集中度

- 策略趋势(併购、 首次股票公开发行、车队电气化)

- 市占率分析

- 公司简介

- Avis Budget Group

- Hertz Corporation

- Enterprise Holdings Inc.

- Sixt SE

- Europcar Mobility Group

- Lumi Rental Company

- Theeb Rent A Car

- Yelo

- Fast Rent A Car

- Al Talaa International Transportation Co(Hanco)

- Telgani Company

第七章 市场机会与未来展望

The Middle East car rental market size in 2026 is estimated at USD 3.41 billion, growing from 2025 value of USD 3.23 billion with 2031 projections showing USD 4.47 billion, growing at 5.57% CAGR over 2026-2031.

Rising inbound tourism, premium-oriented mobility demand, and broad digital adoption underpin the expansion. International arrivals surpassed pre-pandemic levels by 32% in 2024, translating into 95 million visitors and sustained rental demand . App-based reservations already account for close to two-thirds of total transactions, while luxury and electric fleet niches record the fastest volume gains. Government-backed megaprojects such as Saudi Arabia's Vision 2030 and Expo 2030 are widening mobility corridors, encouraging fleet upgrades, and opening new off-airport revenue pools. Moderate market fragmentation, coupled with sizable venture funding, signals further consolidation.

Middle East Car Rental Market Trends and Insights

Tourism Rebound Across GCC Corridors

GCC destinations recorded a pronounced tourism recovery in 2024, led by Saudi Arabia's 69% surge in arrivals and tourism receipts of USD 60.6 billion. The United Arab Emirates contributed USD 59.9 billion to GDP from travel and tourism, equivalent to 11.7% of the economy . In the first half of 2025, Qatar welcomed a significant influx of one million visitors. Meanwhile, Kuwait is making substantial investments in visitor-centric infrastructure, indicating a rising demand for additional fleets. These cross-border movements require operators to strategically reposition vehicles across jurisdictions, establish robust corridor-based service strategies, and adapt to varying regulatory frameworks, all while leveraging the growing utilization rates.

Rapid Shift to App-Based Bookings

High smartphone penetration and digital payments maturity enable mobile reservations to eclipse counter transactions, trimming distribution overheads and granting operators direct access to customer data. In the UAE, near-ubiquitous 5G coverage and consumer preference for contactless services accelerate the trend, while Saudi Arabia's youthful demographic amplifies mobile adoption. Embedded identity verification and keyless entry elevate user convenience, and predictive analytics refine fleet rotation. Firms that own proprietary apps bypass third-party commissions, enhance margins, and lock in lifetime customer value through loyalty tools.

Ride-Hailing Substitution Pressure

The expansion of ride-hailing services in bustling metropolitan areas increasingly captures short city trips that once favored self-drive rentals. However, for multi-day tourism, family vacations, and intercity commutes, the allure of rental cars remains strong, sustaining a solid base of demand. In response to this shifting landscape, operators are ramping up their offerings, highlighting premium service tiers that elevate the rental experience. They're also bundling essential navigation tools and forging partnerships with e-hail platforms to create seamless blended mobility passes. By strategically positioning rentals for longer journeys and higher-value usage, they effectively minimize the loss of customers to on-demand rides, ensuring that the charm of a personal vehicle endures amidst the rising tide of convenience.

Other drivers and restraints analyzed in the detailed report include:

- Mega-Events and Infrastructure Projects (Vision 2030, Expo 2030)

- Corporate Mobility-Subscription Adoption

- Labor-Nationalization Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online reservations represented 62.12% of the Middle East car rental market size in 2025 and are projected to climb at a 6.74% CAGR during the forecast period. Offline counters still capture walk-in tourists at airports and hotels, but suffer higher overheads. Mobile-first interfaces support instant upgrades, add-ons, and loyalty redemption, shrinking booking lead times and lifting utilization. In the longer run, omnichannel strategies will persist, with physical outlets pivoting toward customer support and vehicle handover while digital funnels handle sales, payments, and upselling.

Competition centers on proprietary apps versus marketplace aggregators. Operators that integrate real-time vehicle availability, digital KYC, and keyless pick-ups are lowering transaction times. The UAE's smartphone penetration accelerates uptake, and Saudi Arabia follows closely, aided by widespread 4G coverage. Kuwait and Oman remain more reliant on desk bookings but are steadily onboarding mobile solutions as consumer expectations shift.

Leisure and tourism rentals supplied 95.10% of the Middle East car rental market revenue in 2025, advancing at a forecast 7.22% CAGR through 2031. Mega-events and relaxed visa regimes sustain destination appeal across Dubai, Doha, Riyadh, and Muscat. Nevertheless, corporate demand is diversifying revenue streams as multinationals locate regional headquarters in Saudi Arabia and the United Arab Emirates.

Seasonality risk tied to holiday peaks is being diluted by year-round conferences and project-driven travel. Firms adept at serving both tourists and executives optimize fleet mix, rotating economy cars during peak visitor influx and allocating premium sedans for business accounts in shoulder months. This dual-market posture stabilizes cash flow and raises overall utilization.

The Middle East Car Rental Market is Segmented by Booking Type (Online and Offline), Application (Leisure/Tourism, Daily Utility/Business), Vehicle Type (Economy, Luxury and Premium), End-User Type (Self-Driven and Chauffeur), Service Model (On-Airport, and Off-airport/Local), Propulsion (Internal-Combustion ICE, Electric and Hybrid), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Avis Budget Group

- Hertz Corporation

- Enterprise Holdings Inc.

- Sixt SE

- Europcar Mobility Group

- Lumi Rental Company

- Theeb Rent A Car

- Yelo

- Fast Rent A Car

- Al Talaa International Transportation Co (Hanco)

- Telgani Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism Rebound Across GCC Corridors

- 4.2.2 Rapid Shift to App-Based Bookings

- 4.2.3 Mega-Events and Infrastructure Projects (Vision 2030, Expo 2030)

- 4.2.4 Corporate Mobility-Subscription Adoption

- 4.2.5 Government EV-Rental Incentives

- 4.2.6 Emergence of Integrated Mobility Super-Apps

- 4.3 Market Restraints

- 4.3.1 Ride-Hailing Substitution Pressure

- 4.3.2 Labor-Nationalization Compliance Costs

- 4.3.3 Thin EV-Rental Insurance Capacity

- 4.3.4 Import-Driven Vehicle Supply Bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Telematics, OTA, EV)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Booking Type

- 5.1.1 Online

- 5.1.2 Offline

- 5.2 By Application

- 5.2.1 Leisure / Tourism

- 5.2.2 Daily Utility / Business

- 5.3 By Vehicle Type

- 5.3.1 Economy

- 5.3.2 Luxury and Premium

- 5.4 By End-User Type

- 5.4.1 Self-driven

- 5.4.2 Chauffeur

- 5.5 By Service Model

- 5.5.1 On-airport

- 5.5.2 Off-airport / Local

- 5.6 By Propulsion

- 5.6.1 Internal-Combustion (ICE)

- 5.6.2 Electric and Hybrid

- 5.7 By Country

- 5.7.1 Saudi Arabia

- 5.7.2 United Arab Emirates

- 5.7.3 Kuwait

- 5.7.4 Qatar

- 5.7.5 Rest of Middle East Countries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, IPOs, Fleet Electrification)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Avis Budget Group

- 6.4.2 Hertz Corporation

- 6.4.3 Enterprise Holdings Inc.

- 6.4.4 Sixt SE

- 6.4.5 Europcar Mobility Group

- 6.4.6 Lumi Rental Company

- 6.4.7 Theeb Rent A Car

- 6.4.8 Yelo

- 6.4.9 Fast Rent A Car

- 6.4.10 Al Talaa International Transportation Co (Hanco)

- 6.4.11 Telgani Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment