|

市场调查报告书

商品编码

1910826

欧洲施工机械市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Europe Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

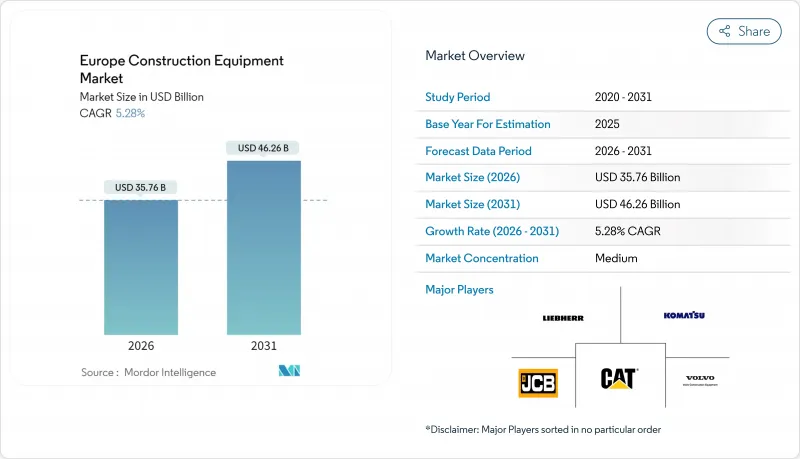

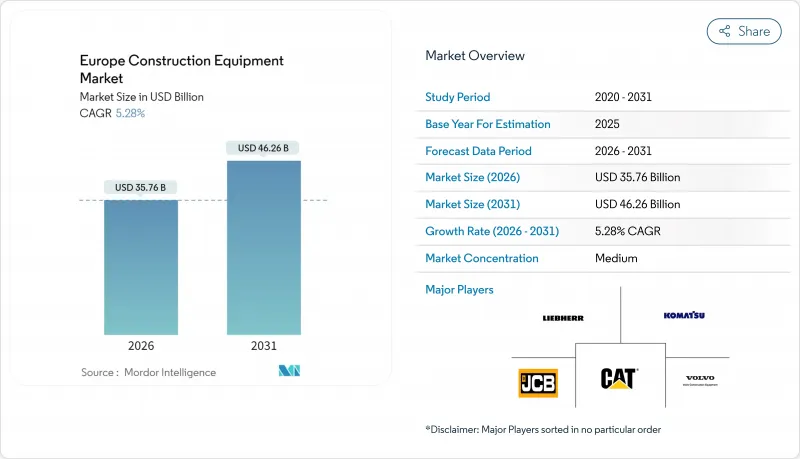

2025年欧洲施工机械市场价值为339.7亿美元,预计到2031年将达到462.6亿美元,高于2026年的357.6亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 5.28%。

与欧盟绿色交易相关的公共工程支出增加、欧洲央行2025年的降息週期以及第五阶段排放气体法规的持续实施,是影响需求的关键因素。儘管城市计划越来越倾向于使用纯电动车型,但柴油机械在重型基础设施建设中仍然不可或缺。中国原始设备製造商(OEM)正利用直接融资和本地支援中心来缩小与西方老牌企业的竞争差距。同时,租赁车队的过剩压低了平均售价,并加速了向以服务为中心的收入模式和基于订阅的远端资讯处理服务包的转型。

欧洲施工机械市场趋势与分析

与欧盟绿色交易相关的公共工程项目

成员国正以前所未有的力道向气候适应型基础设施投入资金,将采购週期从18-24个月缩短至最短12个月。德国的预算外资金预计在2024年略微减少后,于2025年略微增加建筑支出。支出增加将推高对可再生能源设施所需的挖土机、平地平土机和小型机械的需求。为了获得绿色交易的竞标,建筑商越来越倾向于选择符合第五阶段排放标准和电动车型,即使这意味着超过10%的价格溢价。因此,供应商面临维持更高库存缓衝的压力,以适应加快的计划进度。

随着欧洲央行降息週期的开始(2025-2026年),住宅将回升。

2025年第一季,住宅投资略有回升,这是自2022年以来的首次復苏。德国的核准房屋抵押贷款审批和建筑贷款需求尤其强劲,此前高利率时期积压的住宅需求得到了刺激。小型挖土机、小型装载机和加长型堆高机受益最大,因为都市区改造计划是新建住宅的主要类型。贷款条件的放宽也使得小规模承包商能够重返设备融资市场,从而扩大了入门动力机械的基本客群。

租赁车队供应过剩压低了新车的平均售价。

2021年至2022年间,车队规模的积极扩张导致租赁运转率年减,预计2024年将仅63.4%。租赁需求疲软迫使企业减少车队投资,造成通路库存过剩6至9个月。製造商正透过延长融资期限和提供服务抵扣来应对,但这些措施正在挤压利润空间并缩减创新预算。

细分市场分析

预计到2025年,挖土机将占据欧洲施工机械市场44.78%的份额,到2031年将以5.32%的复合年增长率成长,超过欧洲施工机械市场的整体成长速度。伸缩臂堆高机紧跟在后,增速显着提升,主要得益于仓库自动化计划对高空精准定位的需求。起重机销售量维持稳定,但受到低成本进口产品的利润压力;而平地平土机受惠于运输走廊的投资。

电气化正在重塑各细分领域的竞争格局。利勃海尔L 507 E轮式装载机运作长达16小时,其功能可与柴油动力机械媲美。装载机和后铲市场面临中国製造商的激烈价格竞争,而专用隧道钻掘机由于复杂的安全认证,准入门槛仍然很高。承包商越来越倾向于选择多功能附件,这些配件可以将挖土机改装成拆除、回收和整平工具,从而推高了单机平均售价,并将买家锁定在专有的液压介面上。

截至2025年,内燃机仍将占据欧洲施工机械市场80.66%的份额,其中纯电动工程机械的成长速度最快,复合年增长率为5.39%。在充电基础设施有限的地区,混合动力系统可以弥补这一不足,但对于高运转率的工地而言,纯电动工程机械由于其总体拥有成本优势显着。挪威和荷兰的地方政府已限制在公共工程项目中使用柴油设备,导致当地订单激增,超过了工厂的前置作业时间。

儘管电动机械的初始投资成本比柴油机械高出五分之一,但对于每年运作1500小时的建筑商而言,透过节省燃料和维护成本,不到四年即可收回额外的投资。氢燃料电池目前仍处于小众市场,但利勃海尔的氢燃料电池挖掘机试点计画已引发了人们对其在电力供应不稳定的偏远风电场应用的关注。製造商目前需要同时管理柴油和电动两种产品平台,这迫使他们必须增加研发预算并调整供应链。锂和稀土元素价格的波动使电池采购更加复杂,并推高了零件成本。这些限制因素导致欧洲施工机械市场的预测复合年增长率下降了0.5个百分点。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟绿色交易公共工程项目

- 随着欧洲央行降息週期的开始(2025-2026年),住宅将回升。

- 加速车队电气化进程,以满足第五/六阶段二氧化碳和氮氧化物排放法规的要求。

- 都市区改造区域对小型设备的需求不断增长

- OEM主导的订阅式车用资讯服务方案提升售后市场收入

- 仓库自动化领域对电池驱动加长型堆高机高机的需求激增

- 市场限制

- 租赁车队供应过剩压低了新车的平均售价。

- 缺乏合格的操作人员会延长计划工期。

- 锂和稀土元素价格的波动将影响电动车设备的物料清单成本。

- 中国进口商品CE标誌/型式认证审批延迟的情况仍在持续。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按机器类型

- 起重机

- 伸缩臂堆高机

- 挖土机

- 装载机和后铲

- 平土机机

- 其他的

- 透过电源

- 内燃机

- 杂交种

- 电池式电动车

- 氢燃料电池

- 按最终用户行业划分

- 基础设施和建筑

- 采矿和采石

- 石油和天然气

- 製造/仓储业

- 农业/林业

- 公共产业和可再生能源

- 透过使用

- 土木工程施工

- 起重和物料输送

- 挖掘和拆除

- 道路建设和铺路

- 隧道建设

- 回收和废弃物管理

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 比利时

- 波兰

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Caterpillar Inc.

- AB Volvo(Volvo CE)

- Liebherr Group

- CNH Industrial NV

- Komatsu Ltd.

- JCB Ltd.

- Hitachi Construction Machinery

- Deere & Company

- Sandvik AB

- Manitou Group

- Atlas Copco AB

- XCMG Europe

- Sany Europe GmbH

- Doosan Bobcat EMEA

- Wirtgen Group

- Kubota Corp.

- Terex Corp.

- Bomag GmbH

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

第七章 市场机会与未来展望

The Europe Construction Equipment Market was valued at USD 33.97 billion in 2025 and estimated to grow from USD 35.76 billion in 2026 to reach USD 46.26 billion by 2031, at a CAGR of 5.28% during the forecast period (2026-2031).

Rising public-works spending linked to the EU Green Deal, the European Central Bank's 2025 rate-cut cycle, and the ongoing rollout of Stage V emissions rules are the primary forces shaping demand. Equipment buyers are tilting toward battery-electric models for urban projects, while diesel machines remain essential on heavy infrastructure sites. Chinese original-equipment manufacturers (OEMs) are using direct financing and local support centers to narrow competitive gaps with incumbent Western brands. Simultaneously, rental-fleet oversupply is suppressing average selling prices, accelerating the pivot to service-centric revenue streams and subscription telematics bundles.

Europe Construction Equipment Market Trends and Insights

EU Green Deal-Linked Public-Works Pipeline

Member states are channeling unprecedented capital into climate-resilient infrastructure, compressing procurement cycles from 18-24 months to as few as 12 months. Germany's off-budget fund is already lifting real construction outlays by minimal in 2025 after a slight contraction in 2024. This spending wave boosts demand for excavators, motor graders, and compact machines needed for renewable-energy installations. Contractors increasingly favor Stage V-compliant or electric models, even when premiums exceed more than one-tenth, to secure eligibility for Green Deal tenders. Suppliers therefore face mounting pressure to maintain higher inventory buffers that match accelerated project timelines.

Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

Housing investment turned positive slightly in Q1 2025, the first upturn since 2022. Mortgage approvals and construction loan demand have strengthened, especially in Germany, where pent-up housing needs accumulated during the high-rate period. Compact excavators, mini loaders, and telehandlers benefit the most because urban infill projects dominate new housing activity. Easier credit is also pulling small contractors back into the equipment-financing market, widening the customer base for entry-level electric machines.

Rental-Fleet Oversupply Suppressing New-Unit ASPs

Aggressive fleet expansion during 2021-2022 left rental utilization at only 63.4% in 2024, pushing rental rates down on year over year. Sluggish rental growth has forced companies to cut fleet spending by minimal, creating channel inventory bulges of six to nine months. Manufacturers respond with longer financing terms and service credits, but these steps erode margins and slow innovation budgets.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- Growing Demand For Compact Equipment On Urban Infill Sites

- Scarcity of Certified Operators Inflating Project Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators captured 44.78% of the Europe construction equipment market share in 2025 and are projected to grow at a 5.32% CAGR to 2031, outpacing the overall Europe construction equipment market. Telescopic handlers follow closely in growth, fuelled by warehouse automation projects that demand precision placement at height. Cranes maintain steady volume but see margin pressure from lower-priced imports, while motor graders gain from transport-corridor spending.

Electrification reshapes competitive dynamics within each subcategory. Liebherr's L 507 E wheel loader delivers 16-hour run-time, showing functional parity with diesel units. Loader and backhoe segments face intense price competition from Chinese OEMs, whereas specialized tunneling equipment retains higher entry barriers thanks to complex safety certifications. Contractors increasingly prefer multi-functional attachments that turn excavators into demolition, recycling, or grading tools, boosting average selling price per unit and locking buyers into proprietary hydraulic interfaces.

Internal combustion engines still hold 80.66% of the Europe construction equipment market size in 2025, but battery-electric units are climbing fastest at a 5.39% CAGR. Hybrid drive-trains bridge constraints where charging infrastructure is lacking, yet total cost of ownership advantages favor full electrics on high-utilization sites. Provincial mandates in Norway and the Netherlands restrict diesel equipment on public projects, triggering regional spikes in electric orders that outstrip factory lead times.

Capital costs for electric machines are one-fifth higher, but contractors running 1,500 hours annually recoup premiums in under four years through fuel and maintenance savings. Hydrogen fuel cells remain niche, but Liebherr's pilot hydrogen excavator has sparked interest for use in remote wind farms where grid supply is thin. Manufacturers must now manage dual product platforms-diesel and electric-stretching R&D budgets and supply chains. Battery sourcing is complicated by lithium and rare-earth price swings that raise bills of material, a restraint subtracting 0.5 percentage points from Europe construction equipment market CAGR projections.

The Europe Construction Equipment Market Report is Segmented by Machinery Type (Cranes, Telescopic Handler, and More), Power Source (Internal-Combustion, Hybrid, and More), End-User Industry (Infrastructure & Construction, Mining & Quarrying, and More), Application (Earthmoving, Lifting & Material Handling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- AB Volvo (Volvo CE)

- Liebherr Group

- CNH Industrial N.V.

- Komatsu Ltd.

- JCB Ltd.

- Hitachi Construction Machinery

- Deere & Company

- Sandvik AB

- Manitou Group

- Atlas Copco AB

- XCMG Europe

- Sany Europe GmbH

- Doosan Bobcat EMEA

- Wirtgen Group

- Kubota Corp.

- Terex Corp.

- Bomag GmbH

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green Deal-Linked Public-Works Pipeline

- 4.2.2 Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

- 4.2.3 Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- 4.2.4 Growing Demand For Compact Equipment On Urban Infill Sites

- 4.2.5 OEM-Led Subscription & Telematics Bundles Boosting Aftermarket Revenue

- 4.2.6 Surge In Battery-Electric Telehandlers For Warehouse-Automation Build-Outs

- 4.3 Market Restraints

- 4.3.1 Rental-Fleet Oversupply Suppressing New-Unit Asps

- 4.3.2 Scarcity Of Certified Operators Inflating Project Timelines

- 4.3.3 Lithium & Rare-Earth Price Volatility Hitting Ev-Equipment Bom Costs

- 4.3.4 Persistent Ce-Mark/Homologation Delays For Chinese Imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handler

- 5.1.3 Excavator

- 5.1.4 Loader and Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Others

- 5.2 By Power Source

- 5.2.1 Internal-Combustion

- 5.2.2 Hybrid

- 5.2.3 Battery-Electric

- 5.2.4 Hydrogen Fuel-Cell

- 5.3 By End-user Industry

- 5.3.1 Infrastructure & Construction

- 5.3.2 Mining & Quarrying

- 5.3.3 Oil & Gas

- 5.3.4 Manufacturing & Warehousing

- 5.3.5 Agriculture & Forestry

- 5.3.6 Utilities & Renewable Energy

- 5.4 By Application

- 5.4.1 Earthmoving

- 5.4.2 Lifting & Material Handling

- 5.4.3 Excavation & Demolition

- 5.4.4 Road Building & Paving

- 5.4.5 Tunnelling

- 5.4.6 Recycling & Waste Management

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Netherlands

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 AB Volvo (Volvo CE)

- 6.4.3 Liebherr Group

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Komatsu Ltd.

- 6.4.6 JCB Ltd.

- 6.4.7 Hitachi Construction Machinery

- 6.4.8 Deere & Company

- 6.4.9 Sandvik AB

- 6.4.10 Manitou Group

- 6.4.11 Atlas Copco AB

- 6.4.12 XCMG Europe

- 6.4.13 Sany Europe GmbH

- 6.4.14 Doosan Bobcat EMEA

- 6.4.15 Wirtgen Group

- 6.4.16 Kubota Corp.

- 6.4.17 Terex Corp.

- 6.4.18 Bomag GmbH

- 6.4.19 Wacker Neuson SE

- 6.4.20 Hyundai Construction Equipment Europe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment