|

市场调查报告书

商品编码

1911714

欧洲化肥市场:市场占有率分析、产业趋势、统计数据和成长预测(2026-2031 年)Europe Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

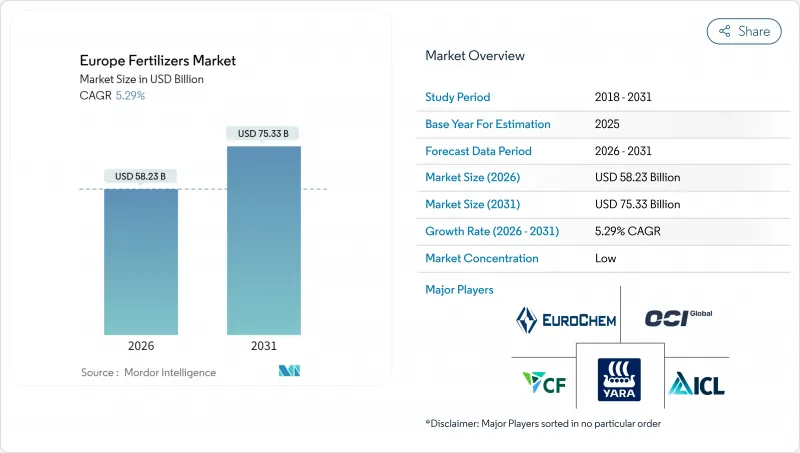

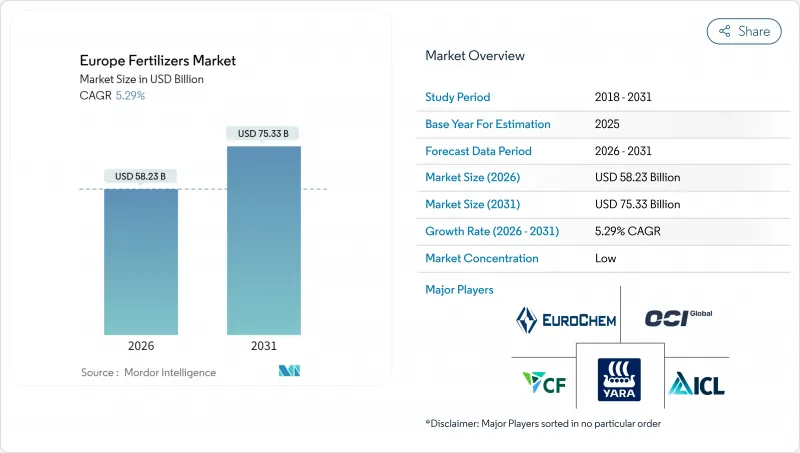

欧洲化肥市场预计将从 2025 年的 553 亿美元成长到 2026 年的 582.3 亿美元,预计到 2031 年将达到 753.3 亿美元,2026 年至 2031 年的复合年增长率为 5.29%。

强劲的需求主要归功于欧盟通用农业政策(CAP)的生态方案、碳边境调节机制(CBAM)以及对绿色氨计划的投资,这些倡议正在重塑氮肥供应结构。缓释肥和水溶性肥料的加速普及、可再生能源生产投资的增加以及2024年价格飙升后粮食种植面积的恢復,都将进一步推动市场成长。儘管天然气价格波动给生产商带来了成本压力,但他们正透过垂直整合和可再生原料策略来应对。欧洲化肥市场呈现分散且集中的格局,前五大公司仅占市场份额的一小部分。

欧洲化肥市场趋势与洞察

通用生态计划促进均衡施肥

欧盟透过其通用农业政策(CAP)生态计划,每年拨款310亿欧元(约335亿美元),鼓励采用能最大限度减少氮磷流失的养分规划。这些奖励促进了稳定氮肥、缓释包膜和精准施肥工具的推广应用,符合环境目标。法国和德国的大型粮食生产商正在对其设备进行现代化改造,以满足监管标准,这推动了硝化抑製剂和脲酶抑製剂的销售。化肥生产商正在将农艺服务与其产品结合,透过合规支援来增加产品价值。该计画的绩效支付机制缩短了精密农业设备的投资回收期,并加速了设备的更新换代。数据驱动的施肥规划也提高了产量稳定性,进一步推动了这些技术的推广应用。

精密农业中特种肥料使用量的快速成长

哥白尼卫星计画提供的高解析度影像和农场感测器实现了变数施肥,从而最大限度地提高了养分利用效率。在数据驱动的管理下,缓释、液态和水溶性肥料的表现优于传统产品。荷兰温室种植者使用肥料管理系统每小时调整养分混合比例,而北欧谷物种植者则使用包膜尿素来同步氮素释放和植物吸收。区域混合设施根据当地的微量元素缺乏情况来定製肥料配方,以提高肥料的有效性。种植者提供基于订阅的决策支援平台,将肥料转化为一系列农艺解决方案。由于减少损失可以抵消更高的产品成本,因此可以接受更高的价格,从而为特种肥料的成长创造良性循环。

更严格限制硝酸盐和氨的排放

在荷兰,牧场氮肥施用量限制为每公顷140公斤,耕地氮肥施用量限制为每公顷170公斤,比先前的标准减少了约30%。丹麦针对不同类型的土壤设定了氮肥施用配额,超出配额者将被处以每公顷10,800美元的巨额罚款。为此,农民们正在减少散装尿素的购买量,并增加稳定型颗粒混合肥料的使用。在过渡期内,由于种植者需要重新评估施肥计划并推迟购买,短期需求将会放缓。条施正在取代传统的撒施方式,总用量呈现下降趋势。化肥生产商被迫转向更有效率的产品线并提供监管咨询服务,虽然增加了成本,但也创造了高价销售机会。

细分市场分析

到2025年,简单肥料将占欧洲肥料市场份额的76.85%,同时也是成长最快的细分市场,预测期内复合年增长率将达到5.58%。在这一类别中,氮肥是小麦、玉米和油菜籽的主要营养来源。复合肥料的欧洲市场规模正在成长,因为德国和法国的大型农场更青睐省时省力、操作简便的复合肥料。土壤检测中常见的锌和硼缺乏现象,导致专用微量元素混合肥料的价格上涨。市场参与企业正在投资建造区域性混合中心,以调整养分比例并提高交付速度,从而支持复合肥料市场缓慢但稳定的成长。

随着排放法规日益严格,对养分利用效率的要求也越来越高,低挥发性的硝酸铵在排放法规较严格的地区市场份额不断扩大。尿素在价格敏感的东欧地区仍占主导地位。由于缺硫会限制氮的吸收,人们对硫等次要大量营养元素的兴趣日益浓厚。供应商正将次要营养元素添加到复合肥料(NPK复合肥料)中,以抵御特种肥料生产商的竞争。整体而言,该细分市场的成长轨迹与均衡营养策略和精准施肥技术的推广应用相一致。

到2025年,传统配方肥料将占欧洲肥料市场86.25%的份额,而特种配方肥料预计将以5.72%的复合年增长率(CAGR)实现最快增长,直至2031年。缓释包膜肥料市场正在蓬勃发展,聚合物包膜尿素在西班牙温室番茄生产中实现了10%的增产。水溶性肥料在荷兰温室中广泛应用,透过滴灌系统提供养分,实现高密度种植。液体肥料支持可变速率的空中和拖拉机施肥,可根据感测器数据进行即时调整。草坪管理领域对缓效肥料的需求日益增长,因为公共绿地管理需要减少施肥频率。

由于价格优势和现有设备的普及,传统颗粒肥仍然是大面积田间作物的首选。然而,日益严格的养分使用限制正推动着人们转向使用能够减少损失并符合法规的特殊配方产品。创新者正致力于研发可生物降解的包覆和双重养分释放机制,以拓展市场。注重环境、社会和治理(ESG)的食品品牌青睐使用高效养分种植的农产品,影响整个供应链的投入选择。持续的研发投入也印证了该领域作为欧洲化肥市场创新驱动力的重要地位。

欧洲肥料市场报告按类型(复合肥与单质肥)、形态(常规肥与特殊肥)、施用方法(灌溉施肥、叶面喷布、土壤施用)、作物类型(田间作物、园艺作物、草坪及观赏植物)和地区(法国、德国、义大利、荷兰等)进行细分。报告以价值(美元)和数量(公吨)为单位提供市场规模和预测数据。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

- 调查方法

第二章 报告

第三章执行摘要和主要发现

第四章 主要产业趋势

- 主要农作物种植面积

- 田间作物

- 园艺作物

- 平均施肥量

- 微量营养素

- 田间作物

- 园艺作物

- 宏量营养素

- 田间作物

- 园艺作物

- 次发性大量营养素

- 田间作物

- 园艺作物

- 微量营养素

- 具有灌溉设施的农田

- 法规结构

- 价值炼和通路分析

- 市场驱动因素

- 通用环境措施促进平衡施肥

- 精密农业中特种肥料使用量的快速成长

- 2024年价格上涨后粮食面积的恢復

- 透过绿色氨投资减少供应链排放

- 透过碳边境调节机制(CBAM)实现营养物质生产的驯化

- 斯堪的纳维亚半岛可控环境农业的兴起

- 市场限制

- 收紧硝酸盐和氨排放限制

- 天然气价格波动会推高生产成本。

- 生物刺激剂替代品的快速普及

- 东欧的物流和製裁中断

第五章 市场规模及成长预测(价值及数量)

- 类型

- 合成的

- 单一成分肥料

- 微量营养素

- 硼

- 铜

- 铁

- 锰

- 钼

- 锌

- 其他的

- 氮基

- 硝酸铵

- 无水氨

- 尿素

- 其他的

- 磷酸盐

- DAP

- MAP

- SSP

- TSP

- 其他的

- 钾

- MoP

- SoP

- 其他的

- 次发性大量营养素

- 钙

- 镁

- 硫

- 微量营养素

- 形式

- 传统的

- 特殊肥料

- 控释肥料(CRF)

- 液体肥料

- 缓效性肥料(SRF)

- 水溶性

- 应用方法

- 施肥和灌溉

- 叶面喷布

- 土壤

- 作物类型

- 田间作物

- 园艺作物

- 草坪和观赏植物

- 地区

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲地区

第六章 竞争情势

- 关键策略倡议

- 市占率分析

- 公司概况

- 公司简介

- Yara International ASA

- OCI Global NV

- EuroChem Group

- ICL Group

- CF Industries Holdings, Inc.

- Grupa Azoty SA

- Haifa Group

- YILDIRIM Group

- Sociedad Quimica y Minera de Chile SA

- Achema AB(Achemos Grupe)

- PhosAgro PJSC

- Fertiberia, SA(Triton)

- K+S Aktiengesellschaft

- Uralchem JSC

- Timac Agro(Groupe Roullier)

第七章:CEO们需要思考的关键策略问题

The Europe fertilizers market is expected to grow from USD 55.3 billion in 2025 to USD 58.23 billion in 2026 and is forecast to reach USD 75.33 billion by 2031 at 5.29% CAGR over 2026-2031.

Robust demand stems from the European Union's Common Agricultural Policy eco-schemes, the Carbon Border Adjustment Mechanism, and investments in announced green-ammonia projects that will reconfigure nitrogen supply. Accelerated adoption of controlled-release and water-soluble products, growing investments in renewable energy-powered production, and the rebound in cereal acreage after the 2024 price rally further support growth. Producers face cost-side headwinds from natural-gas price volatility but are responding through vertical integration and renewable feedstock strategies. The Europe fertilizers market displays a fragmented concentration, with the top five firms controlling a minor share of the market size.

Europe Fertilizers Market Trends and Insights

EU CAP eco-schemes boosting balanced fertilization

The European Union allocates EUR 31 billion (USD 33.5 billion) each year through Common Agricultural Policy eco-schemes that reward nutrient plans minimizing nitrogen and phosphorus losses . These incentives encourage stabilized nitrogen, controlled-release coatings, and precision-application tools that align with environmental objectives. Large cereal growers in France and Germany are modernizing equipment to meet scheme criteria, driving sales of nitrification and urease inhibitors. Fertilizer firms bundle agronomy services with their products to capture value from compliance support. The program's performance-based payments reduce payback time on precision machinery, accelerating upgrades. Data-driven application planning also enhances yield consistency, reinforcing adoption momentum.

Surge in specialty fertilizer adoption for precision farming

High-resolution imagery from the Copernicus satellite program and on-farm sensors enable variable-rate applications that maximize nutrient efficiency . Controlled-release, liquid, and water-soluble formulations outperform conventional products under these data-driven regimes. Dutch greenhouse operators use fertigation dashboards that adjust nutrient mixes hourly, while Nordic cereal growers deploy coated urea to synchronize nitrogen release with crop uptake. Regional blending facilities tailor micronutrient profiles to local deficiencies, boosting efficacy. Producers offer subscription-based decision-support platforms, turning fertilizers into bundled agronomic solutions. Premium pricing is accepted because reduced losses offset higher product costs, creating a virtuous cycle for specialty growth.

Tightened nitrate and ammonia emission caps

The Netherlands caps nitrogen applications at 140 kg per hectare for grassland and 170 kg per hectare for arable crops, a cut of nearly 30% from historical norms. Denmark imposes soil-type quotas with stiff fines reaching USD 10,800 per hectare for exceedance. Farmers respond by reducing bulk urea purchases and increasing stabilized granular blends. The transition period dampens near-term demand because growers delay buying while recalibrating nutrient plans. Conventional broadcast practices face replacement by banded placement, lowering total volumes. Fertilizer companies must pivot to enhanced-efficiency lines and provide compliance advisory services, incurring additional costs yet opening premium sales.

Other drivers and restraints analyzed in the detailed report include:

- Rebound in cereal acreage after 2024 price rally

- CBAM-driven reshoring of nutrient production

- Natural-gas price volatility inflating production costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Straight fertilizers captured 76.85% of the Europe fertilizers market share in 2025, which is also the fastest-growing segment with a CAGR of 5.58% during the forecast period. Within this category, nitrogenous products are the primary nutrient input for wheat, corn, and rapeseed. The Europe fertilizers market size for complex fertilizers is growing because labor savings and single-pass convenience resonate with large German and French farms. Specialty micronutrient blends command premiums as soil tests reveal widespread zinc and boron deficiencies. Market participants invest in regional blending hubs to tailor nutrient ratios and improve delivery speed, supporting a modest but steady expansion of complex formulations.

With enhanced emission rules pushing for nutrient-use efficiency, ammonium nitrate is gaining share in emission-sensitive zones due to its lower volatilization potential. Urea remains dominant in Eastern Europe, where price sensitivity prevails. Secondary macronutrients such as sulfur experience heightened interest because sulfur deficits limit nitrogen uptake. Suppliers bundle secondary nutrients into NPK compounds to protect their share against specialty entrants. Overall, the segment's growth trajectory aligns with the broader adoption of balanced nutrition strategies and precision application technologies.

Conventional formulations accounted for 86.25% of the Europe fertilizers market size in 2025, and specialty formulations are forecast to grow at the fastest 5.72% CAGR through 2031. The Europe fertilizers market size for controlled-release coatings is expanding as polymer-coated urea demonstrates 10% yield gains in greenhouse tomatoes across Spain. Water-soluble grades serve high-density Dutch greenhouses that feed nutrients via drip systems. Liquid formulations support variable-rate aerial and tractor applications, allowing on-the-go adjustments based on sensor data. Slow-release products thrive in turf management where public green standards favor fewer applications.

Conventional granules still dominate bulk field crops because of price advantage and embedded equipment fleets. Tightening nutrient thresholds pushes growers toward specialty formulations that reduce losses and meet compliance targets. Innovators focus on biodegradable coatings and dual-nutrient release mechanisms to broaden appeal. ESG-conscious food brands prefer produce cultivated with enhanced-efficiency nutrients, influencing input choices across supply chains. Sustained R&D investment underlines the segment's role as the innovation engine of the Europe fertilizers market.

The Europe Fertilizers Market Report is Segmented by Type (Complex and Straight), by Form (Conventional and Specialty), Application Mode (Fertigation, Foliar, and Soil), Crop Type (Field Crops, Horticultural Crops, and Turf and Ornamental), and Geography (France, Germany, Italy, Netherlands, and More). The Report Offers the Market Size and Forecasts in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Yara International ASA

- OCI Global N.V.

- EuroChem Group

- ICL Group

- CF Industries Holdings, Inc.

- Grupa Azoty S.A.

- Haifa Group

- YILDIRIM Group

- Sociedad Quimica y Minera de Chile S.A.

- Achema AB (Achemos Grupe)

- PhosAgro PJSC

- Fertiberia, S.A. (Triton)

- K+S Aktiengesellschaft

- Uralchem JSC

- Timac Agro (Groupe Roullier)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Acreage of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped for Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain and Distribution Channel Analysis

- 4.6 Market Drivers

- 4.6.1 EU CAP eco-schemes boosting balanced fertilization

- 4.6.2 Surge in specialty fertilizer adoption for precision farming

- 4.6.3 Rebound in cereal acreage after 2024 price rally

- 4.6.4 Green-ammonia investments cutting supply-chain emissions

- 4.6.5 CBAM-driven reshoring of nutrient production

- 4.6.6 Rise of controlled-environment farms in Northern Europe

- 4.7 Market Restraints

- 4.7.1 Tightened nitrate and ammonia emission caps

- 4.7.2 Natural-gas price volatility inflating production costs

- 4.7.3 Rapid uptake of biostimulant substitutes

- 4.7.4 East-Europe logistics and sanction disruptions

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Ammonium Nitrate

- 5.1.2.2.2 Anhydrous Ammonia

- 5.1.2.2.3 Urea

- 5.1.2.2.4 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 SSP

- 5.1.2.3.4 TSP

- 5.1.2.3.5 Others

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.4.3 Others

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.1.2.1 Micronutrients

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Specialty

- 5.2.2.1 Controlled-Release Fertilizer (CRF)

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 Slow-Release Fertilizer (SRF)

- 5.2.2.4 Water-Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf and Ornamental

- 5.5 Geography

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 Netherlands

- 5.5.5 Russia

- 5.5.6 Spain

- 5.5.7 Ukraine

- 5.5.8 United Kingdom

- 5.5.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yara International ASA

- 6.4.2 OCI Global N.V.

- 6.4.3 EuroChem Group

- 6.4.4 ICL Group

- 6.4.5 CF Industries Holdings, Inc.

- 6.4.6 Grupa Azoty S.A.

- 6.4.7 Haifa Group

- 6.4.8 YILDIRIM Group

- 6.4.9 Sociedad Quimica y Minera de Chile S.A.

- 6.4.10 Achema AB (Achemos Grupe)

- 6.4.11 PhosAgro PJSC

- 6.4.12 Fertiberia, S.A. (Triton)

- 6.4.13 K+S Aktiengesellschaft

- 6.4.14 Uralchem JSC

- 6.4.15 Timac Agro (Groupe Roullier)