|

市场调查报告书

商品编码

1911810

欧洲咨询服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

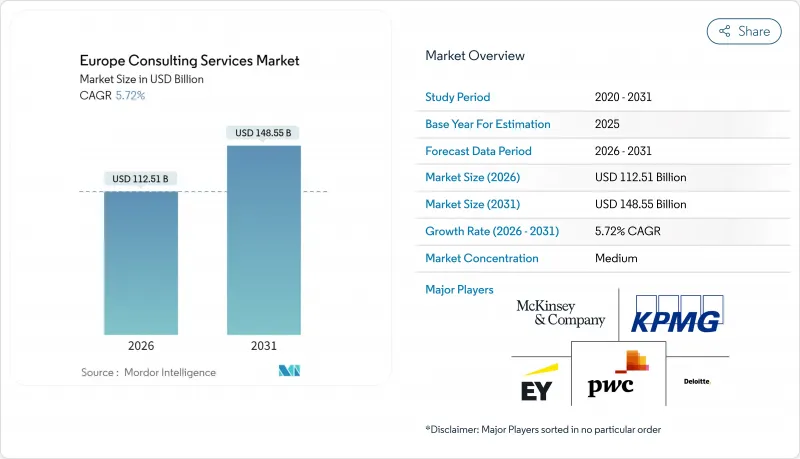

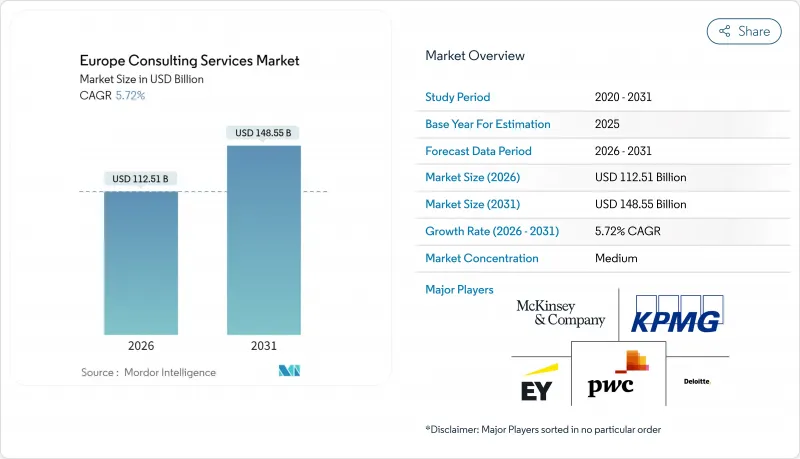

欧洲咨询服务市场预计将从 2025 年的 1,064.2 亿美元成长到 2026 年的 1,125.1 亿美元,预计到 2031 年将达到 1,485.5 亿美元,2026 年至 2031 年的复合年增长率为 5.72%。

这一稳步增长表明,专业服务公司已成功适应经济不确定性、数位转型以及日益严格的永续发展法规。欧盟委员会的「数位欧洲」计画将投入79亿欧元用于技术应用,不仅提振了市场需求,也使服务供应商能够拓展跨境业务。地缘政治供应链的紧张局势使得卓越营运计划始终是客户的优先事项,而主要企业对人工智慧的大规模投资正将新兴技术转化为常规咨询服务。欧盟復苏与韧性基金(RRF)的资金支持正在加速中小企业采用外部专业知识,扩大基本客群,并降低其对大型企业预算的依赖。随着四大会计师事务所投资超过40亿美元用于人工智慧能力建设,日益激烈的竞争正在重塑服务交付的经济格局,而中型企业则被迫专注于特定领域。

欧洲咨询服务市场趋势与洞察

跨境服务监理趋同

欧盟正在协调数位化法规,减少行政摩擦,使咨询公司能够以更少的合规性审查跨境复製解决方案。德国和法国将于2024年正式启动公共部门软体互通性的合作,这将使领先采用者有机会开发可重复使用的方案,从而缩短计划前置作业时间。中型服务提供者因无需在每个国家都配备完整的法律团队而获得了新的机会。虽然全面协调要到2027年才能实现,但现在投资于多语言监管专业知识的公司可能会在各国政府扩大联合服务范围时获得多年框架合约。

加速客户对人工智慧驱动的生产力咨询的需求

经营团队将人工智慧视为控製成本和促进成长的必然选择,这促成了大规模咨询交易的达成。光是德国的人工智慧市场就以每年15%的速度成长,到2030年可望为GDP贡献4,300亿欧元,进而推动人工智慧策略、资料工程和变革管理交易的激增。德勤的新平台Zora和安永的150个人工智慧代理商展示了大型公司如何将其智慧财产权产品化,并为客户带来25%至40%的生产力提升。随着基础自动化逐渐普及,规模较小的顾问公司如果不转向高度专业化的人工智慧应用,将面临利润率下降的风险。

高阶分析领域人才持续短缺

欧洲顾问公司正面临资料科学家招募难题。欧洲职业培训发展中心(CEDEFOP)发布的劳动力和技能短缺指数显示,到2035年,分析和人工智慧相关职位将面临严重的人才短缺。儘管技术岗位的就业人数创历史新高,但德国和法国政府仍报告人才持续短缺,迫使企业支付更高的薪资或将工作外包。人才短缺推高了计划成本,延长了交付週期,并降低了高阶分析工作的能力。规模较小的顾问公司受到的影响最大,因为它们无法与四大顾问公司相媲美,这加剧了市场整合的风险。

细分市场分析

营运咨询将占据最大的收入份额,到2025年将占欧洲咨询服务市场28.12%的份额,这主要得益于企业在当前地缘政治紧张局势下寻求供应链韧性和降低成本。精实生产、流程重组和营运资本优化仍然是欧洲咨询服务市场的重点,为专业人士提供了稳定的收入来源。同时,在人工智慧、云端迁移和永续发展仪錶板的驱动下,数位转型咨询正以7.49%的复合年增长率在所有细分市场中成长最快。

儘管策略、财务咨询和人力资源/变革管理仍发挥重要作用,但市场需求日益集中于整合技术、风险管理和人才发展的全面转型解决方案。由于网路威胁日益加剧和云端架构碎片化,技术咨询的重要性也日益凸显。随着企业将碳会计纳入工作流程,永续发展和ESG咨询正与核心业务需求相互融合。随着欧洲咨询服务市场从孤立的项目转向基于平台、以结果为导向的项目,能够根据产业专用的策略组建多学科团队的服务供应商将保持竞争优势。

资讯通信技术与媒体产业预计将占2025年总收入的29.56%,反映出该产业持续的技术更新週期和活跃的软体创新。该行业客户群持续试点生成式人工智慧、5G货币化和边缘运算计划,支撑了欧洲咨询服务市场的强劲需求。同时,受全通路投资加速、末端物流和数据驱动型商品行销的推动,消费品与零售业预计到2031年将维持7.41%的复合年增长率。

在金融服务领域,儘管面临股本监管和数位银行的竞争,咨询支出依然居高不下。製造业则专注于工业4.0蓝图和节能型工厂维修。在医疗保健领域,电子健康记录整合和基于云端的ERP迁移正在加速推进,Asklepios Kliniken的SAP S/4HANA实施就需要18个月的外部支援。在能源和公共产业,对电网数位化和氢能基础设施规划的需求,为专注于永续发展的顾问创造了独特的市场机会。

欧洲咨询服务市场按服务类型(营运咨询、策略咨询、财务顾问等)、客户行业(银行、金融服务和保险、製造/工业等)、公司规模(大型企业、中小企业)、交付模式(现场服务、远端/虚拟、混合模式)和国家/地区进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 跨境服务监理趋同

- 加速客户对人工智慧驱动的生产力咨询的需求

- 应对欧盟绿色交易和企业永续发展报告指令 (CSRD) 的压力

- 欧盟復苏基金津贴帮助中小企业提升数位成熟度

- 转向基于绩效的定价模式

- 由于供应链中的地缘政治风险,近岸外包成为可能

- 市场限制

- 高阶分析领域人才持续短缺

- 透过采购主导的谈判降低费用

- 利用 DIY 生成式 AI 工具包简化基础工作

- 大型整合商和顾问公司之间併购的监管审查

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按服务类型

- 营运咨询

- 策略咨询

- 财务咨询

- 技术咨询

- 人力资源与变革管理

- 永续发展与ESG咨询

- 数位转型咨询

- 按客户产业

- BFSI

- 製造业和工业

- 医疗保健和生命科学

- 能源与公共产业

- 资讯与通讯科技与媒体

- 消费品和零售

- 其他客户产业

- 按公司规模

- 大公司

- 中小企业

- 按交付模式

- 现场支援

- 远端/虚拟

- 混合模式

- 按国家/地区

- 英国

- 德国

- 法国

- 比荷卢经济联盟

- 义大利

- 北欧国家

- 西班牙

- 中欧和东欧(包括波兰)

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- KPMG International

- PricewaterhouseCoopers LLP

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture PLC

- Kearney

- Roland Berger

- Capgemini Invent

- BearingPoint

- Oliver Wyman

- LEK Consulting

- Alvarez & Marsal

- Grant Thornton International

- BDO Advisory

- PA Consulting Group

- IBM Consulting

- Infosys Consulting

- Atos Consulting

- Wipro Consulting Services

- NTT DATA Business Solutions

- CGI Inc.

- Tata Consultancy Services(TCS)Consulting

第七章 市场机会与未来趋势

- 评估差距和未满足的需求

The Europe Consulting Services Market is expected to grow from USD 106.42 billion in 2025 to USD 112.51 billion in 2026 and is forecast to reach USD 148.55 billion by 2031 at 5.72% CAGR over 2026-2031.

This steady climb underscores how professional services firms have adapted to economic uncertainty, digital-first mandates, and tightening sustainability rules. Demand strengthens as the European Commission's Digital Europe Programme channels EUR 7.9 billion toward technology adoption, allowing service providers to expand cross-border engagements. Geopolitical supply-chain stress keeps operational excellence projects at the top of client agendas, while heavy AI investment by leading firms converts emerging technology into day-to-day consulting deliverables. Funding from the EU Recovery and Resilience Facility (RRF) accelerates small-business adoption of external expertise, widening the customer base and reducing dependence on large-enterprise budgets. Competitive intensity rises as the Big Four plough more than USD 4 billion into AI capabilities, reshaping service delivery economics and pushing mid-tier players toward niche specialisms.

Europe Consulting Services Market Trends and Insights

Regulatory Convergence for Cross-Border Services

The European Union is reducing administrative friction by aligning digital regulations, letting consulting firms replicate solutions across borders with fewer compliance checks. Germany and France formalized cooperation on interoperable public-sector software in 2024, giving early movers a chance to develop reusable playbooks that cut project lead times. Mid-sized providers gain new reach because they no longer need full legal teams for each country. While complete harmonization will not occur until 2027, firms that invest now in multilingual regulatory expertise stand to win multiyear frameworks as governments scale joint services.

Accelerated Client Demand for AI-Enabled Productivity Consulting

C-suites view artificial intelligence as an essential lever for cost containment and growth, translating into sizeable advisory pipelines. Germany's AI market alone is growing 15% annually and could add EUR 430 billion to GDP by 2030, underpinning a surge in AI strategy, data engineering, and change-management engagements. Deloitte's new Zora platform and EY's fleet of 150 AI agents illustrate how the largest firms are productizing intellectual property to deliver 25-40% productivity gains for clients. Smaller consultancies must pivot to hyper-specialized AI applications or risk margin squeeze as basic automation becomes commoditized.

Persistent Talent Deficit in Advanced Analytics

European consultancies cannot hire data scientists fast enough. CEDEFOP's Labour and Skills Shortage Index flags analytics and AI roles as high-pressure occupations through 2035. German and French governments report persistent gaps despite record tech job creation, forcing firms to pay premiums or offshore work. Scarcity inflates project costs and slows delivery, reducing the addressable volume for advanced analytics engagements. Smaller providers feel the pinch hardest because they struggle to match Big Four compensation packages, thereby intensifying market consolidation risks.

Other drivers and restraints analyzed in the detailed report include:

- EU Green Deal and CSRD Compliance Pressures

- SME Digital-Maturity Funding via EU RRF Grants

- Fee-Compression from Procurement-Led Negotiations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Operations consulting generated the largest revenue slice, capturing 28.12% of the European consulting services market share in 2025 as companies sought supply-chain resilience and cost savings amid geopolitical strains. The European consulting services market continues to prioritise lean manufacturing, process re-engineering, and working-capital optimization, anchoring steady fee streams for specialists. In parallel, digital transformation consulting is growing at a 7.49% CAGR, the fastest among all segments, powered by AI, cloud migration, and sustainability dashboards.

Strategy, financial advisory, and HR/change management retain essential roles, yet demand increasingly converges around integrated transformation offerings blending technology, risk management, and workforce enablement. Technology advisory enjoys heightened relevance because cyber threats multiply and cloud architectures fragment. Sustainability and ESG consulting now overlap with core operational mandates as firms embed carbon accounting into process flows. Service providers that create multidisciplinary squads around sector-specific playbooks will defend relevance as the European consulting services market shifts from siloed engagements toward platform-based, outcome-linked programmes.

The ICT and Media sector contributed 29.56% of 2025 revenue, reflecting constant technology refresh cycles and heavy software innovation. This client group continues to pilot generative AI, 5G monetization, and edge computing projects, sustaining robust demand within the European consulting services market. Consumer and Retail, however, is registering a 7.41% CAGR to 2031 as omnichannel investment, last-mile logistics, and data-driven merchandising accelerate.

Financial services keep consulting spend elevated on account of capital adequacy regulations and digital banking competition, while manufacturing turns to Industry 4.0 roadmaps and energy-efficient plant retrofits. Healthcare clients ramp up electronic-medical-record consolidation and cloud-hosted ERP migrations such as Asklepios Kliniken's SAP S/4HANA rollout, which required 18 months of external support. Energy and Utilities look for grid digitization and hydrogen-ready infrastructure planning, creating niche opportunities for sustainability-focused advisers.

Europe Consulting Services Market is Segmented by Service Type (Operations Consulting, Strategy Consulting, Financial Advisory, and More), Client Industry (BFSI, Manufacturing and Industrials, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises), Delivery Model (On-Site Engagement, Remote/Virtual, and Hybrid Model), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- KPMG International

- PricewaterhouseCoopers LLP

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture PLC

- Kearney

- Roland Berger

- Capgemini Invent

- BearingPoint

- Oliver Wyman

- L.E.K. Consulting

- Alvarez & Marsal

- Grant Thornton International

- BDO Advisory

- PA Consulting Group

- IBM Consulting

- Infosys Consulting

- Atos Consulting

- Wipro Consulting Services

- NTT DATA Business Solutions

- CGI Inc.

- Tata Consultancy Services (TCS) Consulting

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory convergence for cross-border services

- 4.2.2 Accelerated client demand for AI-enabled productivity consulting

- 4.2.3 EU Green Deal and CSRD compliance pressures

- 4.2.4 SME digital-maturity funding via EU RRF grants

- 4.2.5 Shift to outcome-based pricing models

- 4.2.6 Near-shoring driven by geopolitical risk in supply chains

- 4.3 Market Restraints

- 4.3.1 Persistent talent deficit in advanced analytics

- 4.3.2 Fee-compression from procurement-led negotiations

- 4.3.3 Generative-AI DIY toolkits reducing entry-level work

- 4.3.4 Regulatory scrutiny on large integrator-consultant M&A

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Operations Consulting

- 5.1.2 Strategy Consulting

- 5.1.3 Financial Advisory

- 5.1.4 Technology Advisory

- 5.1.5 HR and Change Management

- 5.1.6 Sustainability and ESG Consulting

- 5.1.7 Digital Transformation Consulting

- 5.2 By Client Industry

- 5.2.1 BFSI

- 5.2.2 Manufacturing and Industrials

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Energy and Utilities

- 5.2.5 ICT and Media

- 5.2.6 Consumer and Retail

- 5.2.7 Other Client Industries

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Delivery Model

- 5.4.1 On-site Engagement

- 5.4.2 Remote/Virtual

- 5.4.3 Hybrid Model

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Benelux

- 5.5.5 Italy

- 5.5.6 Nordics

- 5.5.7 Spain

- 5.5.8 Central and Eastern Europe (incl. Poland)

- 5.5.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deloitte Touche Tohmatsu Limited

- 6.4.2 Ernst & Young Global Limited

- 6.4.3 KPMG International

- 6.4.4 PricewaterhouseCoopers LLP

- 6.4.5 McKinsey & Company

- 6.4.6 Boston Consulting Group

- 6.4.7 Bain & Company

- 6.4.8 Accenture PLC

- 6.4.9 Kearney

- 6.4.10 Roland Berger

- 6.4.11 Capgemini Invent

- 6.4.12 BearingPoint

- 6.4.13 Oliver Wyman

- 6.4.14 L.E.K. Consulting

- 6.4.15 Alvarez & Marsal

- 6.4.16 Grant Thornton International

- 6.4.17 BDO Advisory

- 6.4.18 PA Consulting Group

- 6.4.19 IBM Consulting

- 6.4.20 Infosys Consulting

- 6.4.21 Atos Consulting

- 6.4.22 Wipro Consulting Services

- 6.4.23 NTT DATA Business Solutions

- 6.4.24 CGI Inc.

- 6.4.25 Tata Consultancy Services (TCS) Consulting

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment