|

市场调查报告书

商品编码

1270831

通讯业者的5G代价 - 2022年债务增加,较低利润:COVID以后,投资剧增,部分通讯业者陷入困境- 随着利率上升和新收入未能出现,需要管理债务增加Telcos Pay 5G Price - Higher Debt, Lower Margins in 2022: Investments Have Surged Since COVID, Putting Some Telcos in Tough Spot - Need to Manage Higher Debt as Interest Rates Rise and New Revenues Fail to Appear |

|||||||

价格

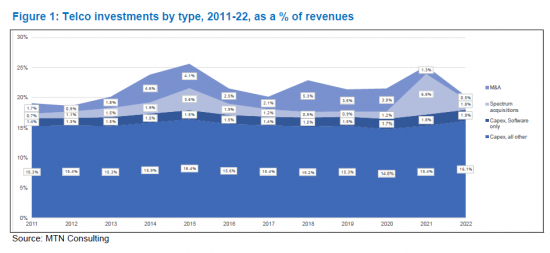

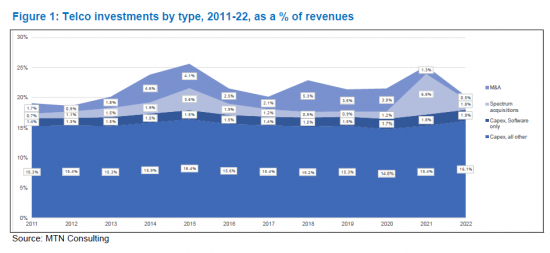

2022年第四季的通讯业者的负债总额为1兆1,400亿美金,17%明年还款到期。销售额中软体设备投资占的比例,2022年成为1.9%,从2021年的1.8%稍微上升。收购的支出2022年成为销售额的0.5%,是2012年以后最低的数值。

视觉

本报告提供通讯业者为焦点,彙整到目前为止的设备投资趋势,2022年第四季的负债,今后预测等相关资料。

目录

- 摘要

- 通讯业者过去2年,在设备投资,频带,M&A花费了高额的费用

- 2022年第四季的电信业者负债总额是1兆1,400亿美元,17%到明年还款到期

- 净负债2022年减少了,不过,EBITDA比率与2015~19年相符

- 许多各个的通讯业者的债务等级限制支出

- 利益,负债,支出预测的影响

- 附录

Product Code: GNI-03052023-1

This brief report presents data aimed at shedding light on the following question: can telcos afford to pay for their future investment needs? The report considers debt, cash, and margin metrics, for the industry overall and for specific key players. It also speculates how 2022 trends may impact 2023 and beyond, in a rising interest rate climate. A number of large telcos have high debt, low margins, and/or weak top line growth, and may have to curtail spending in 2023-4 in order to cope with this reality.

VISUALS

Key findings include:

- Total telco debt in 4Q22 was $1.14 trillion, 17% due in next year

- Software capex as a % of revenues was 1.9% in 2022, up a bit from 1.8% in 2021.

- Spending on acquisitions amounted to 0.5% of revenues in 2022, the lowest figure since 2012.

- At the industry level, the ratio of net debt to EBITDA in 2022 was 1.9, a bit up from 2021 but down from 2020.

- A number of large telcos face short-term debt levels over 30% of total debt

- Average margins for the industry in 2022 disappointed: free cash flow margin for the telco industry in 2022 was 11.4%, down from 12.6% in 2021; EBITDA margin was 33.7% (2021: 34.0%), and EBIT margin was 14.4% (2021: 14.9%).

Companies mentioned:

|

|

Table of Contents

- Summary

- Telcos have spent big on capex, spectrum and M&A in last 2 years

- Total telco debt in 4Q22 was $1.14 trillion, 17% due in next year

- Net debt declined in 2022 but ratio to EBITDA in line with 2015-19

- Many individual telcos have debt levels which will constrain their spending

- Margins, debt, and implications for spending outlook

- Appendix

List of Figures

- Figure 1: Telco investments by type, 2011-22, as a % of revenues

- Figure 2: Telco sector total debt in US$B, and short-term debt as % total

- Figure 3: Components of telco sector total debt at year-end 2022 (US$B)*

- Figure 4: Telco industry net debt ($M) and net debt to EBITDA ratio, 2011-22

- Figure 5: Telcos with net debt to EBITDA ratios above 3 (YE2022)**

02-2729-4219

+886-2-2729-4219