|

市场调查报告书

商品编码

1529552

3D IC 市场:按最终用途部门、按基板类型、按製造製程、按产品、按地区 - 2020-2027 年市场规模、份额、前景、机会分析3D ICs Market, By End-Use Sectors, by Substrate Type, by Fabrication Process, by Product and by Region - Size, Share, Outlook, and Opportunity Analysis, 2020 - 2027 |

||||||

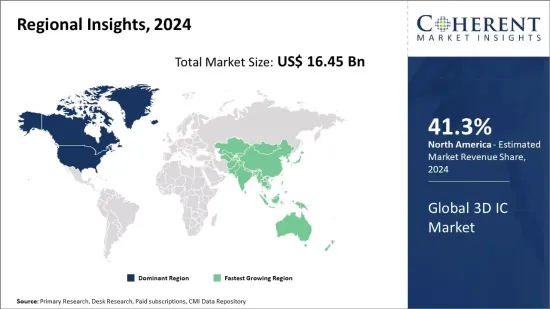

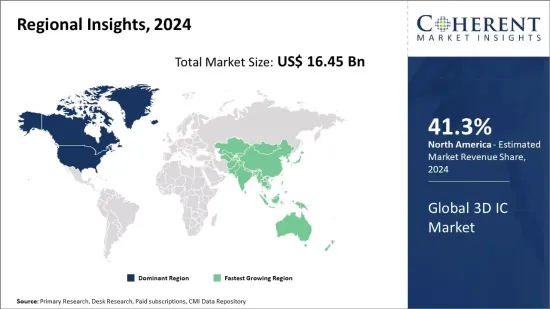

预计2024年全球3D IC市场规模为164.5亿美元,2031年将达602.3亿美元,2024年至2031年复合年增长率为20.4%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2024年市场规模 | 164.5亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024年至2031年 |

| 预测 2024-2031 年复合年增长率: | 20.40% | 2031年价值预测 | 602.3亿美元 |

随着对更紧凑和高性能电子设备的需求不断增加,全球 3D IC 市场正在经历强劲成长。 3D IC,也称为3D积体电路,是指堆迭两个或多个IC晶片并透过硅通孔(TSV)垂直连接以缩短互连长度并提高讯号传播速度的一种垂直组装。透过将许多组件整合到较小的占地面积中,可以使设备变得更小。 3D IC 技术透过堆迭晶粒并将其整合到单一封装中来最大限度地提高晶片密度,从而有助于降低晶片成本。记忆体、图形、处理器和无线电子装置等各种组件可以放置在一个模组中。与 3D IC 相关的高频宽和低功耗特性正在推动各种应用的需求,包括家用电子电器、医疗设备和汽车产业。

市场动态:

全球 3D IC 市场受到对高性能可携式电子产品日益增长的需求的推动。对在紧凑外形规格中增加功能的设备的需求正在推动对 3D IC 的需求。然而,与製造 3D IC 相关的高製造成本是其广泛使用的问题。设计和製造过程的复杂性增加了製造成本。商机在于 3D IC 在自动驾驶汽车、扩增实境和虚拟实境设备中的新应用。使用 3D IC 技术整合逻辑晶片、记忆体和感测器组件有助于实现汽车中的高级驾驶辅助、导航和资讯娱乐服务。 3D IC 支援更高的频宽和更低的功耗,有助于在具有图形和处理密集要求的电池供电设备中采用。

本研究的主要特点

- 该报告对全球3D IC市场进行了详细分析,并列出了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

- 它还揭示了各个细分市场的潜在商机,并说明了该市场有吸引力的投资提案矩阵。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的重要见解。

- 它根据公司亮点、产品系列、主要亮点、财务业绩和策略等参数,对全球 3D IC 市场的主要企业进行了介绍。

- 该报告的见解使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

- 本研究报告针对该产业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

- 相关人员可以透过用于分析全球 3D IC 市场的各种策略矩阵来促进决策。

目录

第一章 研究目的与前提

- 研究目的

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 抑制因素

- 市场机会

- 监管场景

- 产业动态

- 併购

- 新系统的推出/核准

第四章 COVID-19大流行对3D IC市场的影响

- 按地区分類的短期和长期影响

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第五章 全球 3D IC 市场:依最终用途部门划分,2017-2027 年

- 家电

- 资讯和通讯技术

- 交通运输(汽车和航太)

- 军队

- 其他(生物医学应用/研发)

第六章 全球 3D IC 市场:依基板类型划分,2017-2027 年

- 绝缘体上硅 (SOI)

- 体硅

第七章 全球 3D IC 市场:依製造流程划分,2017-2027 年

- 结晶结晶

- 晶圆键合技术

- 硅外延生长

- 固相结晶

第8章全球3D IC市场:依产品分类,2017-2027

- MEMS 和感测器

- 射频系列

- 光电与成像

- 记忆体(3D 堆迭)

- 逻辑(3D SIP/SOC)

- HB LED

第9章全球3D IC市场:依地区划分,2017-2027

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第10章竞争格局

- 公司简介

- Taiwan Semiconductor Manufacturing Company, Ltd

- MonolithIC 3D Inc.

- XILINX, Inc.

- Elpida Memory, Inc.

- (Micron Technology, Inc.)

- The 3M Company,

- Ziptronix, Inc.

- STATS ChipPAC Ltd.

- United Microelectronics Corporation

- Tezzaron Semiconductor Corporation

第11章 章节

- 参考

- 调查方法

The global 3D ICs market is estimated to be valued at US$ 16.45 Bn in 2024 and is expected to reach US$ 60.23 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 20.4% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 16.45 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2024 to 2031 CAGR: | 20.40% | 2031 Value Projection: | US$ 60.23 Bn |

The global 3D ICs market is witnessing robust growth with the rising demand for more compact and high-performance electronic devices. 3D ICs, also known as three-dimensional integrated circuits, refers to the vertical assembly of two or more IC chips stacked and connected vertically via through-silicon vias (TSVs) to reduce wire length and improve the signal propagation speeds. It enables device miniaturization by integrating more components in a small footprint. 3D ICs technology helps maximize chip density by stacking silicon dies and integrating them into one package which helps reduce the chip cost. It allows the placement of different components such as memory, graphics, processors, and radio electronics in one module. The higher bandwidth and low power consumption features associated with 3D ICs are fueling their demand for various applications across consumer electronics, medical devices, and automotive industries.

Market Dynamics:

The global 3D ICs market is driven by the increasing demand for high performance portable consumer electronics. The demand for devices with improved functionality in a compact form factor is propelling the need for 3D ICs. However, the high manufacturing cost associated with 3D ICs fabrication poses a challenge for widespread adoption. The complexity in the design and manufacturing process increases production costs. Opportunities lies in the emerging applications of 3D ICs in autonomous vehicles, augmented and virtual reality devices. The integration of logic chips, memory, and sensor components using 3D ICs technology can help enable advanced driver assistance, navigation, and infotainment services in vehicles. 3D ICs supports higher bandwidth and low-power consumption which will drive their adoption in battery-operated devices with graphics and processing-intensive requirements. efforts to lower manufacturing costs through new materials and design techniques will further help address barriers.

Key Features of the Study:

- This report provides in-depth analysis of the global 3D ICs market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global 3D ICs market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Amkor Technology, ASE Group, BeSang Inc., IBM Corporation, Intel Corporation, Jiangsu Changjiang Electronics Technology Co., Ltd., Micron Technology Inc., MonolithIC 3D ICs Inc., Samsung Electronics Co. Ltd., STATS ChipPAC Ltd., STMicroelectronics N.V., Taiwan Semiconductor Manufacturing Company, Tezzaron Semiconductor, Toshiba Corporation, United Microelectronics Corporation, and Xilinx Inc.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global 3D ICs market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global 3D ICs market

Detailed Segmentation:

- By Product Type

- LED

- Memories

- MEMS

- Sensor

- Logic

- Others

- By Substrate Type

- Silicon on Insulator (SOI)

- Bulk Silicon

- By Application

- Information and Communication Technology

- Military

- Consumer Electronics

- Others

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Key Players Insights

- Amkor Technology

- ASE Group

- BeSang Inc.

- IBM Corporation

- Intel Corporation

- Jiangsu Changjiang Electronics Technology Co., Ltd.

- Micron Technology Inc.

- MonolithIC 3D ICs Inc.

- Samsung Electronics Co. Ltd.

- STATS ChipPAC Ltd.

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company

- Tezzaron Semiconductor

- Toshiba Corporation

- United Microelectronics Corporation

- Xilinx Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By End-Use Sectors

- Market Snippet, By Substrate Type

- Market Snippet, By Fabrication Process

- Market Snippet, By Process

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launch/Approval

4. Impact of COVID-19 Pandemic on 3D ICs Market

- Short Term and Long Term Impact, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

5. Global 3D ICs Market, By End- Use Sectors, 2017-2027 (US$ Billion)

- Introduction

- Market Share Analysis, 2019 and 2027 (%)

- Segment Trends

- Consumer electronics

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Information and communication technology

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Transport (automotive and aerospace)

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Military

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Others (Biomedical applications and R&D)

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

6. Global 3D ICs Market, By Substrate Type, 2017-2027 (US$ Billion)

- Introduction

- Market Share Analysis, 2019 and 2027 (%)

- Segment Trends

- Silicon on insulator (SOI)

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Bulk silicon

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

7. Global 3D ICs Market, By Fabrication Process, 2017-2027 (US$ Billion)

- Introduction

- Market Share Analysis, 2019 and 2027 (%)

- Segment Trends

- Beam re-crystallization

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Wafer bonding

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Silicon epitaxial growth

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Solid phase crystallization

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

8. Global 3D ICs Market, By Process, 2017-2027 (US$ Billion)

- Introduction

- Market Share Analysis, 2019 and 2027 (%)

- Segment Trends

- MEMS and Sensor

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- RF SiP

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Optoelectronics and imaging

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Memories (3D Stacks)

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- Logic (3D Sip/Soc)

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

- HB LED

- Introduction

- Market Size and Forecast, 2020-2027, (US$ Billion)

9. Global 3D ICs Market, By Region, 2017-2027 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2019 and 2027 (%)

- North America

- Regional Trends

- Market Size and Forecast, By End-Use Sectors, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Substrate Type, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Fabrication Process, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Process, 2020-2027 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2027 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By End-Use Sectors, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Substrate Type, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Fabrication Process, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Process, 2020-2027 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2027 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Regional Trends

- Market Size and Forecast, By End-Use Sectors, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Substrate Type, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Fabrication Process, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Process, 2020-2027 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2027 (%)

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By End-Use Sectors, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Substrate Type, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Fabrication Process, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Process, 2020-2027 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2027 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By End-Use Sectors, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Substrate Type, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Fabrication Process, 2020-2027 (US$ Billion)

- Market Size and Forecast, By Process, 2020-2027 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2027 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

10. Competitive Landscape

- Company Profiles

- Taiwan Semiconductor Manufacturing Company, Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- MonolithIC 3D Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- XILINX, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Elpida Memory, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- (Micron Technology, Inc.)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- The 3M Company,

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Ziptronix, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- STATS ChipPAC Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- United Microelectronics Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Tezzaron Semiconductor Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Taiwan Semiconductor Manufacturing Company, Ltd

11. Section

- References

- Research Methodology

- About Us and Sales Contact