|

市场调查报告书

商品编码

1665047

电动车 EMC 电池滤波器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测EV EMC Battery Filter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

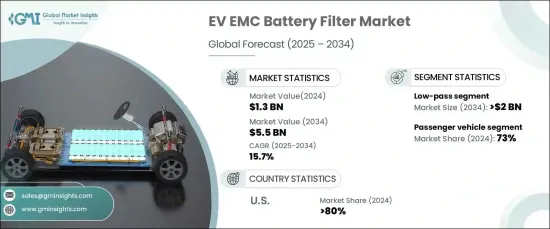

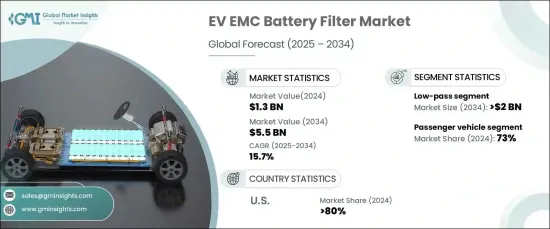

2024 年全球电动车 EMC 电池滤波器市场价值为 13 亿美元,预计在 2025 年至 2034 年期间经历显着增长,复合年增长率为 15.7%。随着对电动车的需求不断增长,对先进的电磁相容性 (EMC) 电池滤波器解决方案的需求也大幅增加。

安全问题和严格的汽车监管标准进一步推动了市场的发展。电动车中先进电子元件的整合度不断提高,因此符合 EMC 要求至关重要,以确保系统免受电磁干扰 (EMI)。国际电工委员会 (IEC) 和 ISO 等监管机构已经制定了严格的性能标准,以提高电动车系统的安全性和可靠性。这些监管要求正在推动 EMC 电池滤波器领域的创新和采用,从而促进强劲的市场前景。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 55亿美元 |

| 复合年增长率 | 15.7% |

市场按滤波器类型细分,包括低通、高通、带通和带阻滤波器。 2024 年,低通滤波器占据了 40% 的市场份额,预计到 2034 年将成长到 20 亿美元。随着电动车设计采用越来越复杂的电子设备(包括感测器、控制系统和通讯技术),对低通滤波器的需求持续上升。这些滤波器允许低频讯号通过,同时阻止破坏性的高频噪声,从而提高系统性能和可靠性。

按车型划分,乘用车在 2024 年占据市场主导地位,占 73% 的份额。电动车在个人交通领域的快速普及是由于人们环保意识的增强和排放法规的严格。随着消费者转向电动车,对 EMC 电池滤波器的需求正在增加,以确保乘用车的最佳性能和安全性。

在美国,电动车 EMC 电池滤波器市场在 2024 年占据了 80% 的区域份额。监管机构执行严格的排放和安全标准进一步推动了对先进 EMC 解决方案的需求,以确保电动车的合规性和无缝功能。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 组件提供者

- 生产

- 经销商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 成本分析

- 衝击力

- 成长动力

- 电动车需求不断成长

- 严格的 EMC 监管标准

- 电动车电池技术的进步

- 更加重视电源效率与降噪

- 产业陷阱与挑战

- 复杂的监理合规性

- 与现有电动车系统的整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按筛选条件,2021 - 2034 年

- 主要趋势

- 低通

- 高通

- 带通

- 带阻

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 动力系统 EMC 滤波

- 电池管理系统

- 充电基础设施

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 8 章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 铅酸电池

- 锂离子电池

- 镍氢电池

- 固态电池

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AstrodyneTDI

- AVX

- Bourns

- Cooper

- Delta

- Eaton

- Epcos

- InTiCa

- KEMET

- Littelfuse

- MAHLE

- Molex

- Mouse

- Murata

- NXP

- STMicroelectronics

- TDK

- TE Connectivity

- Vishay

- Wurth Elektronik

The Global EV EMC Battery Filter Market, valued at USD 1.3 billion in 2024, is projected to experience remarkable growth with a CAGR of 15.7% from 2025 to 2034. This surge is driven by the rising adoption of electric vehicles (EVs) worldwide, supported by stricter environmental policies and government incentives designed to accelerate EV usage. As the demand for EVs continues to grow, the need for advanced electromagnetic compatibility (EMC) battery filter solutions is expanding significantly.

Safety concerns and stringent automotive regulatory standards are further propelling the market. The increasing integration of advanced electronic components in EVs makes compliance with EMC requirements essential to ensure systems remain protected from electromagnetic interference (EMI). Regulatory bodies like the International Electrotechnical Commission (IEC) and ISO have established rigorous performance standards to enhance the safety and reliability of EV systems. These regulatory demands are driving innovation and adoption in the EMC battery filter sector, fostering a robust market outlook.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 15.7% |

The market is segmented by filter type, including low-pass, high-pass, band-pass, and band-stop filters. In 2024, low-pass filters held a dominant 40% market share and are anticipated to grow to USD 2 billion by 2034. Low-pass filters are critical in mitigating high-frequency EMI, which can disrupt sensitive EV components such as battery management systems and powertrains. As EV designs incorporate increasingly sophisticated electronics-spanning sensors, control systems, and communication technologies-the demand for low-pass filters continues to rise. These filters improve system performance and reliability by letting low-frequency signals to pass through while blocking disruptive high-frequency noise.

By vehicle type, passenger vehicles led the market in 2024, capturing a commanding 73% share. The rapid adoption of EVs in personal transportation is driven by heightened environmental awareness and stringent emissions regulations. As consumers transition to electric mobility, the demand for EMC battery filters to ensure optimal performance and safety in passenger vehicles is increasing.

In the United States, the EV EMC battery filter market accounted for 80% of the regional share in 2024. This growth is attributed to robust government support for EV adoption, including tax credits, subsidies, and investments in EV infrastructure development. Regulatory agencies enforcing strict emissions and safety standards further boost the demand for advanced EMC solutions, ensuring compliance and seamless functionality in electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacture

- 3.1.4 Distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for electric vehicles

- 3.9.1.2 Stringent regulatory standards for EMC

- 3.9.1.3 Advancements in EV battery technology

- 3.9.1.4 Increased focus on power efficiency and noise reduction

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Complex regulatory compliance

- 3.9.2.2 Integration challenges with existing EV systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Filter, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Low-pass

- 5.3 High-pass

- 5.4 Band-pass

- 5.5 Band-stop

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Powertrain EMC filtering

- 6.3 Battery management system

- 6.4 Charging infrastructure

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicle

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lead acid battery

- 8.3 Lithium-ion battery

- 8.4 Nickel metal hydride battery

- 8.5 Solid-state battery

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AstrodyneTDI

- 10.2 AVX

- 10.3 Bourns

- 10.4 Cooper

- 10.5 Delta

- 10.6 Eaton

- 10.7 Epcos

- 10.8 InTiCa

- 10.9 KEMET

- 10.10 Littelfuse

- 10.11 MAHLE

- 10.12 Molex

- 10.13 Mouse

- 10.14 Murata

- 10.15 NXP

- 10.16 STMicroelectronics

- 10.17 TDK

- 10.18 TE Connectivity

- 10.19 Vishay

- 10.20 Wurth Elektronik