|

市场调查报告书

商品编码

1684010

东协电动车电池组:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

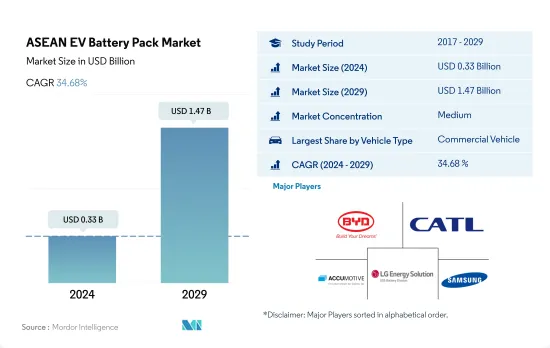

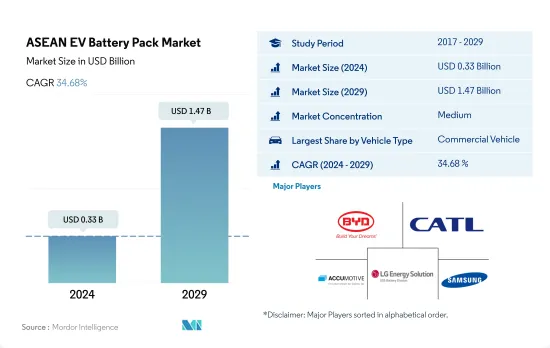

预计 2024 年东协电动车电池组市场规模为 3.3 亿美元,到 2029 年将达到 14.7 亿美元,预测期内(2024-2029 年)的复合年增长率为 34.68%。

东协电动车电池组市场概况

- 为亚太电池组市场的成长和发展做出贡献的是东南亚国协。各种政府倡议、丰富的资源以及对电动车日益增长的兴趣使这些国家成为电池组製造商、供应商和投资者的活跃市场。

- 在政府大力推动电动车生产和出口的推动下,泰国在电池组市场取得了长足进步。该国拥有诱人的投资激励措施、熟练的劳动力和成熟的汽车工业。泰国位于东协地区的战略位置,作为电池组製造地正受到日本国内外的关注。泰国致力于成为电动车领域的地区领导者,这为电池组市场的成长提供了充足的机会。

- 受电动车产业蓬勃发展和锂离子电池关键成分镍矿蕴藏量丰富的推动,印尼正逐渐成为电池组市场的重要参与者。在政府支持政策和致力于成为全球电动车和电池市场主要企业的背景下,印尼的电池组市场前景看好。马来西亚、新加坡、越南和菲律宾等国家也对电动车和可再生能源表现出日益浓厚的兴趣。这些国家实施了支持性政策、奖励和基础设施建设,以鼓励电动车的普及,从而推动了对电池组的需求。东协地区消费市场的成长,加上向清洁能源解决方案的转变,为电池组产业的扩张提供了有利的环境。

东协电动车电池组市场趋势

东协地区有多家电动车製造商,但五菱、特斯拉和比亚迪是2022年电池组需求的主要来源。

- 过去几年,东协多个国家对电动车的需求激增。购买电动车的兴趣因地区和国家而异。然而,在东协地区,SUV是最受欢迎的电动车。作为轿车实用且宽敞的替代品,SUV 越来越受欢迎,这推动了东协地区对电动 SUV 的需求。

- 近年来,东协消费者对小型运动型多用途车(SUV)的需求急剧增加。特斯拉 Model Y 凭藉其全电动动力传动系统、五星级 NCAP 安全认证、七人座能力和长续航里程,被多个东协主要国家列为首选。比亚迪宋DM插电式混合动力车款凭藉着低廉的价格、高燃油效率等优势,受到了东协国家消费者的青睐。

- Model 3 是特斯拉 2022 年在东南亚国协最畅销的车款之一。这是因为它配备了全电动引擎和一些吸引买家的功能。东协电动车市场还拥有来自各种外国品牌的电动 SUV 和轿车。 Nissan Rix Haval H6 是一款热门车型,2022 年销量良好。在东协电动车市场上竞争的其他车型包括Innova和现代 Ioniq。

东协电动车电池组产业概况

东协电动车电池组市场适度整合,前五大公司占53.19%的市场。市场的主要企业有:比亚迪股份有限公司、宁德时代新能源科技有限公司(CATL)、德国ACCUmotive GmbH & Co. KG、LG Energy Solution Ltd.和三星SDI。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动汽车销售

- 电动车销量(按OEM)

- 最畅销的电动车车型

- 具有优选电池化学成分的OEM

- 电池组价格

- 电池材料成本

- 每种电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 体型

- 公车

- LCV

- M&HDT

- 搭乘用车

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCA

- NCM

- NMC

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 包包

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

- 国家

- 泰国

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Denso Corporation

- Deutsche ACCUmotive GmbH & Co. KG

- Do-Fluoride(Jiaozuo)New Energy Technology

- Guoxuan High-tech Co. Ltd.

- LG Energy Solution Ltd.

- Ningde E-CON Power System Co. Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The ASEAN EV Battery Pack Market size is estimated at 0.33 billion USD in 2024, and is expected to reach 1.47 billion USD by 2029, growing at a CAGR of 34.68% during the forecast period (2024-2029).

An overview of the ASEAN electric vehicle battery pack market

- The ASEAN countries collectively contribute to the growth and development of the battery pack market in the Asia-Pacific region. With various government initiatives, abundant resources, and an increasing focus on electric mobility, these countries create a dynamic market for battery pack manufacturers, suppliers, and investors.

- Thailand is making significant strides in the battery pack market, driven by the government's push for electric vehicle production and export. The country offers attractive investment incentives, skilled labor, and a well-established automotive industry. With its strategic location in the ASEAN region, Thailand serves as a manufacturing hub for battery packs, attracting domestic and international players. Thailand's commitment to becoming a regional leader in electric mobility presents ample opportunities for the growth of the battery pack market.

- Indonesia is emerging as a significant player in the battery pack market, driven by its growing electric vehicle industry and ample reserves of nickel, a crucial component in lithium-ion batteries. With supportive government policies and a focus on becoming a major player in the global electric vehicle and battery market, Indonesia holds promising prospects for the battery pack market. Countries like Malaysia, Singapore, Vietnam, and the Philippines are also witnessing increasing interest in electric vehicles and renewable energy sources. These countries have implemented supportive policies, incentives, and infrastructure development to promote the adoption of electric vehicles, which drives the demand for battery packs. The ASEAN region's growing consumer market, combined with a shift toward clean energy solutions, presents a favorable landscape for the expansion of the battery pack industry.

ASEAN EV Battery Pack Market Trends

The ASEAN region has several EV manufacturers, but Wuling, Tesla, and BYD were the primary demand generators for battery packs in 2022

- In several ASEAN countries, the demand for electric cars has risen sharply during the last few years. The interest in purchasing EVs varies by location and country. However, in the ASEAN region, SUVs are the most popular EVs. The rising popularity of SUVs as a practical and spacious alternative to sedans is driving the demand for electric SUVs throughout the ASEAN region.

- The demand for compact sport utility vehicles (SUVs) among ASEAN customers has increased dramatically in recent years. Several key ASEAN countries have made the Tesla Model Y one of their top picks due to the vehicle's all-electric powertrain, 5-star NCAP safety certification, room for up to 7 people, long range, and other attributes. The BYD Song DM's plug-in hybrid engine has been well-accepted by consumers in numerous ASEAN nations as well, owing to the vehicle's low price and high fuel economy.

- The Model 3 was one of Tesla's best-selling cars in ASEAN countries in 2022. This is because it has a fully electric engine and several features that make it appealing to buyers. There are also electric SUVs and sedans from different foreign brands in the ASEAN EV market. The Haval H6, Nissan Licks, is a popular car that sold well in 2022. Other cars in the ASEAN EV market that are in competition include the Toyota Innova and Hyundai Ionic.

ASEAN EV Battery Pack Industry Overview

The ASEAN EV Battery Pack Market is moderately consolidated, with the top five companies occupying 53.19%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), Deutsche ACCUmotive GmbH & Co. KG, LG Energy Solution Ltd. and Samsung SDI Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-Selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

- 5.9 Country

- 5.9.1 Thailand

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 Denso Corporation

- 6.4.4 Deutsche ACCUmotive GmbH & Co. KG

- 6.4.5 Do-Fluoride (Jiaozuo) New Energy Technology

- 6.4.6 Guoxuan High-tech Co. Ltd.

- 6.4.7 LG Energy Solution Ltd.

- 6.4.8 Ningde E-CON Power System Co. Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 SK Innovation Co. Ltd.

- 6.4.12 SVOLT Energy Technology Co. Ltd. (SVOLT)

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms