|

市场调查报告书

商品编码

1683875

印度电动车电池组:市场占有率分析、行业趋势和统计、成长预测(2025-2029 年)India EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

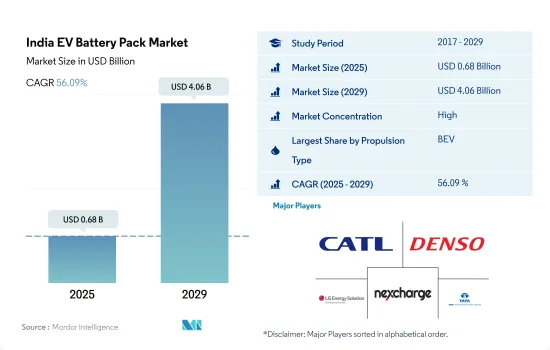

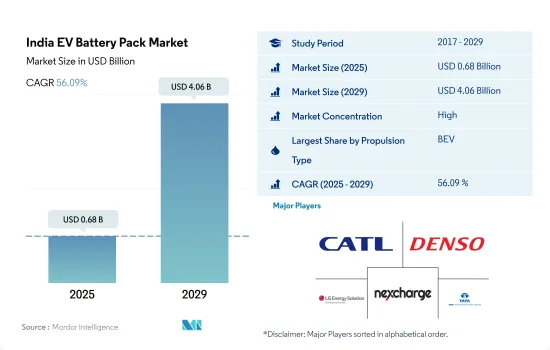

预计 2025 年印度电动车电池组市场规模为 6.8 亿美元,到 2029 年将达到 40.6 亿美元,预测期内(2025-2029 年)的复合年增长率为 56.09%。

政府政策、环保意识和相对于插电式混合动力汽车的成本优势预计将推动印度电动车电池产业的发展。

- 电动车已成为汽车产业不可或缺的一部分,目标是提高能源效率并减少污染物和其他温室气体的排放。政府严格的排放法规、对电动车的认识、电动车相对于传统汽车的优势以及政府补贴进一步鼓励客户投资电动车。因此,印度对各种类型电池的锂离子电池的需求也在增加,包括电池式电动车和插电式混合动力电动车。

- 由于电动车选项越来越多,与插电式混合动力车电池式电动车电动车的需求更高。因此,与插电式电动车相比,纯电动车对更大电池的需求更高。插电式混合动力技术价格昂贵,并不是每个国民都能轻易负担。因此,印度纯电动车使用的锂离子电池正在成长。

- 随着对锂离子电池的需求不断增长,对电池电动车的需求也在增长。然而,各公司都在发布插电式混合动力领域的新产品。 2023年1月,在车展上,名爵发表了插电式混合动力车型eHS。预计2024年至2029年间新产品的推出将推动印度电动车和电池产业的发展。

印度电动车电池组市场的趋势

塔塔车主导印度电动车市场

- 印度的电动车市场正处于起步阶段。市场高度整合,主要由五大公司推动,到 2022 年,这五大公司将总合占据 95% 以上的市场份额。这些公司包括丰田集团、MG、比亚迪印度、塔塔汽车和现代汽车。塔塔汽车是印度最大的电动车零售商,占电动车销售量的 65% 左右。作为国内製造商,我们享有消费者的信任与信心。我们也专注于定价策略,并以与印度其他品牌相比有竞争力的价格提供我们的产品。

- 丰田集团的市场占有率约为22%,是印度第二大电动车销售商。该公司为不断增长的汽车行业提供价格实惠、先进的电动紧凑型 SUV。其品牌形象和在印度市场的广泛影响力正在帮助该公司在印度实现成长。爵位以7.27%的市场占有率位居电动车销量第三位。透过提供技术先进的产品,我们正在扩大在印度市场的份额。

- 现代汽车在印度电动车销售排名第四。过去几年,韩国品牌越来越受到印度消费者的青睐,逐渐在印度电动车产业中占有一席之地。比亚迪在印度电动车市场排名第五,市场占有率约1.1%。在印度销售电动车的其他公司包括 Mahindra、Kia、BMW、Mercedes 和 Olectra。

塔塔汽车占印度电动车销量的 60% 以上,推动对电池组的需求

- 印度电动车市场尚处于早期阶段,电动车的需求正在逐步成长。印度消费者正在寻找经济实惠的选择,各种印度品牌透过提供优质的电动紧凑型 SUV 选择来满足这一需求。因此,印度对紧凑型 SUV 的需求正在增长。近年来,印度对电动紧凑型 SUV 的需求不断增长。

- 由于人们越来越喜欢运动型和冒险型车辆,紧凑型 SUV 在印度的销售量正在蓬勃发展。作为印度续航里程和动力最强劲的经济型全电动紧凑型 SUV 之一,Tata Nexon EV 在 2022 年实现了显着的销售成长。由于丰田公司可靠的品牌形象,印度人们对丰田等各种品牌表现出兴趣。该公司是一个畅销品牌,2022 年其紧凑型 SUV Urban Cruiser High-Rider 销量强劲。

- ZS EV 也是 MG 2022 年印度电动车市场最畅销的车款之一,提供续航里程超过 250 公里的全电动动力传动系统和许多其他吸引人的功能。印度电动车市场还拥有来自各个国际品牌的电动 SUV 和轿车。一种常见的汽车是现代科纳 (Hyundai Kona),其在 2022 年的销售量强劲。其他在印度电动车市场受客户欢迎的车款包括Volvo XC 40 Recharge 和塔塔 Tigor EV。

印度电动汽车电池组产业概况

印度电动车电池组市场相当集中,前五大公司占据了 98.33% 的市场。市场的主要企业是:宁德时代新能源科技(CATL)、电装株式会社、LG 能源解决方案有限公司、Nexcharge 和塔塔汽车系统有限公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动汽车销售

- 电动车销量(按OEM)

- 最畅销的电动车车型

- 具有首选电池化学成分的OEM

- 电池组价格

- 电池材料成本

- 每种电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 印度

- 价值链与通路分析

第五章 市场区隔

- 体型

- 公车

- LCV

- M&HDT

- 搭乘用车

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCM

- NMC

- 其他的

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- Amara Raja Batteries Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Denso Corporation

- Exicom Tele-Systems Ltd.

- Exide Industries Ltd.

- LG Energy Solution Ltd.

- Manikaran Power Ltd.

- Nexcharge

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- Tata Autocomp Systems Ltd.

- TOSHIBA Corp.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001527

The India EV Battery Pack Market size is estimated at 0.68 billion USD in 2025, and is expected to reach 4.06 billion USD by 2029, growing at a CAGR of 56.09% during the forecast period (2025-2029).

Government policies, environmental awareness, and cost advantages over plug-in hybrids are expected to boost the electric vehicle battery industry in India

- Electric vehicles have become an essential part of the automotive industry, as they aim to improve energy efficiency and decrease emissions of pollutants and other greenhouse gases. Stringent emission norms by the government, awareness regarding electric vehicles, the benefits of EVs over conventional vehicles, and government subsidies further encourage customers to invest in electric vehicles. As a result, the demand for lithium-ion batteries is also increasing for various types of batteries, such as battery electric vehicles and plug-in hybrid electric vehicles in India.

- The demand for battery electric vehicles is higher compared to plug-in hybrid electric vehicles due to more options available for electric vehicles. As a result, the demand for large batteries used in pure electric vehicles is high compared to those used in plug-in electric vehicles. Plug-in hybrid technology is costly and is not easily affordable for everyone in the country. As a result, lithium-ion batteries used in pure electric vehicles have grown in India.

- The rising demand for battery electric vehicles is also growing, along with the need for lithium-ion batteries. However, various companies are launching new products in the plug-in hybrid category. In January 2023, at the auto expo, MG unveiled its plug-in hybrid electric car, eHS, which will be launched in India in the near future. Launching new products is expected to boost the electric vehicle and battery industry in India between 2024 and 2029.

India EV Battery Pack Market Trends

THE INDIAN ELECTRIC VEHICLE MARKET IS DOMINATED BY TATA MOTORS

- The Indian electric vehicle market is at an initial stage. The market is highly consolidated and largely driven by five major companies, which together held more than 95% of the market in 2022. These companies include Toyota Group, MG, BYD India, Tata Motors, and Hyundai. Tata Motors is the largest seller of electric vehicles in India, accounting for around 65% of the share in EV sales. As a domestic manufacturer, the company enjoys the trust and reliability of consumers. It extensively focuses on its pricing strategy and offers products with competitive pricing compared to other brands in India.

- Toyota Group holds a market share of around 22%, making it the second-largest seller of electric vehicles across India. The company offers advanced electric compact SUVs with affordable pricing in the growing automotive industry. Its brand image and vast presence in the Indian market have aided the growth of the company in the country. MG holds the third-highest market share of 7.27% in electric vehicle sales. The company is growing its share in the Indian market by offering technologically advanced products.

- Hyundai Motors has attained fourth place in EV sales across India. The South Korean brand has had a strong hold on Indian customers over the past few years and is also growing its share in the Indian electric vehicle industry gradually. The fifth-largest player operating in the Indian EV market is BYD, with a market share of around 1.1%. Some of the other players selling EVS in India include Mahindra, Kia, BMW, Mercedes, and Olectra.

TATA MOTORS ACCOUNTS FOR OVER 60% OF EV SALES IN INDIA, DRIVING BATTERY PACK DEMAND

- The Indian electric vehicle market is still in a developing phase, and the demand for electric vehicles is growing gradually in the country. Consumers in India are looking for economical options, and various brands in India are seeking to cater to this demand by offering good options for electric compact SUVs. As a result, the demand for compact SUVs is growing in the country. India has also witnessed an increasing demand for electric compact SUVs in recent years.

- The country has witnessed good sales of compact SUVs as people are gradually expressing a preference for sporty and adventurous rides, and India currently has limited options for electric sedans or hatchbacks. Tata Nexon EV recorded significant sales growth in 2022 as one of the most affordable full electric compact SUVs in India with good range and good power. People in India are showing interest in various brands such as Toyota, owing to the company's highly reliable brand image. The company is a bestselling brand and witnessed good sales of its compact SUV, Urban Cruiser Hyryder, in 2022.

- ZS EV was also one of the bestsellers from MG in the Indian EV market in 2022, with a full-electric powertrain with a range of 250+ km and many other attractive features. The Indian EV market also features a variety of electric SUVs and sedans from various international brands. One of the common cars is the Hyundai Kona, which registered good sales in 2022. Other cars in the Indian EV market that are popular with customers include Volvo XC 40 Recharge and Tata Tigor EV.

India EV Battery Pack Industry Overview

The India EV Battery Pack Market is fairly consolidated, with the top five companies occupying 98.33%. The major players in this market are Contemporary Amperex Technology Co. Ltd. (CATL), Denso Corporation, LG Energy Solution Ltd., Nexcharge and Tata Autocomp Systems Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 India

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCM

- 5.3.3 NMC

- 5.3.4 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Amara Raja Batteries Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 Denso Corporation

- 6.4.4 Exicom Tele-Systems Ltd.

- 6.4.5 Exide Industries Ltd.

- 6.4.6 LG Energy Solution Ltd.

- 6.4.7 Manikaran Power Ltd.

- 6.4.8 Nexcharge

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 Tata Autocomp Systems Ltd.

- 6.4.12 TOSHIBA Corp.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219