|

市场调查报告书

商品编码

1683867

电动商用车电池组:市场占有率分析、产业趋势与统计、成长预测(2025-2029 年)Electric Commercial Vehicle Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

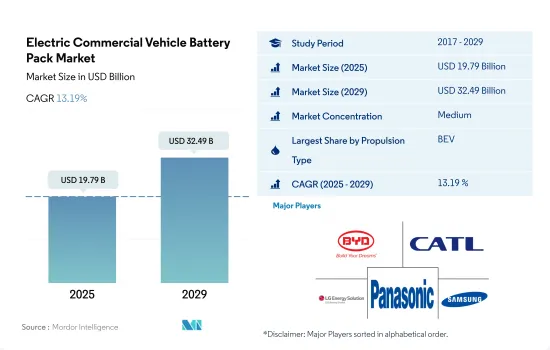

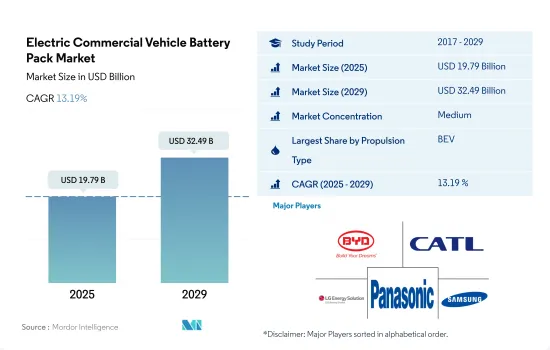

2025 年电动商用车电池组市场规模预估为 197.9 亿美元,预计到 2029 年将达到 324.9 亿美元,预测期内(2025-2029 年)的复合年增长率为 13.19%。

人们对小型电动送货车的兴趣日益浓厚,推动了电池产能的扩张

- 近年来,商用车越来越受欢迎,但它们也对污染和气候变迁产生了重大影响。因此,近年来,世界许多地方对电动商用车及其动力来源电池的需求不断增长。中国不仅是电池生产大国,也引领全球电动车热潮,2021年全电动卡车销量占90.24%。电动商用车需求的增加将推动电池产业的发展,导致全球对包括LFP和NMC在内的各种电动商用车电池组的需求在2021年比2017年增长34.38%。

- 全球对电动卡车的需求不断增加,影响了全球各种电池市场。 NMC、NCM 和 LFP 电池正在多个地区迅速扩张。多种电动商用车电池市场的 90% 以上都来自中国,中国是全球电动商用车和电池生产的领导者。因此,2022 年全球对所有类型商用车电池的需求与 2021 年相比成长了 32.11%。

- 考虑到由于电子商务、物流和基础设施用户等各个行业的成长而导致对电动车的需求不断增长,预计预测期内世界各国对 BEV 和 PHEV 等电动商用车的需求将显着增长。

受中国、日本和韩国的推动,亚太地区将主导电动商用车电池组市场

- 电动商用车电池组市场在各个地区呈现出蓬勃发展的动能。亚太地区的电池组市场正在经历显着的成长。中国、日本和韩国等国家电动车日益普及,推动了对电池组的需求。中国电动车市场的大幅成长,推动亚洲地区成为全球电动车电池组市场的领导者。

- 欧洲市场出现了巨大的成长。这是由于汽车电气化的大力推动、严格的排放法规和政府的支持政策。该地区已成为电动车生产的中心,导致对电池组的需求增加。对电池研发和充电基础设施建设的投资进一步推动了市场成长。过去几年,北美电池组市场稳定成长。推动这一成长的因素包括消费者对电动车的需求不断增加、政府鼓励和监管清洁能源的政策以及电池技术的进步。电池组製造产能和投资的增加反映了该地区对永续交通和能源储存解决方案的承诺。

- 电池组市场的成长归因于多种因素,例如对电动车的需求不断增加、政府的支持性政策、技术进步以及对永续能源储存解决方案的需求。随着世界各国逐步转向更清洁的交通和能源系统,市场可望持续成长和创新。

电动商用车电池组市场趋势

比亚迪和特斯拉引领电动车市场并塑造未来

- 2022年,比亚迪在电动车销量方面领先市场,占13.3%的份额。比亚迪的主导地位得益于几个因素。比亚迪专注于生产电动车及相关技术,是电动车产业的早期和主要参与者。作为一个较早进入该市场的品牌,比亚迪已经赢得了广大消费者的认可。比亚迪也积极进行全球扩张、建立伙伴关係以及投资研发,所有这些都有助于巩固主导地位。

- 特斯拉一直处于电动车创新的前沿,并在电动车的全球普及中发挥了关键作用。 2022 年,特斯拉是电动车产业的重要参与者,市场占有率为 12.2%。特斯拉强大的品牌形象、最尖端科技和广泛的超级充电网路为其成功做出了贡献。

- 在电动车市场的其他主要企业中,还有其他几家公司占有相当大的市场占有率。 BMW在汽车产业享有盛誉,并且正在不断扩大其市场占有率,同时也透过其子品牌 BMW i 致力于电动车的发展。同样,大众汽车在 2022 年的市场占有率为 3.9%,在「大众汽车集团」的保护下,正在积极投资电动车。这些公司与梅赛德斯·奔驰、起亚和现代等其他公司一起,利用现有的品牌知名度,推出引人注目的电动车车型,并投资于提高电动车续航里程和性能的技术,重新占领电动车行业。

特斯拉和比亚迪在 2022 年最畅销的电动车车型中占据主导地位

- 2022 年最畅销的电动车车型由两大原始OEM製造商主导:特斯拉和比亚迪。特斯拉以两款车型Model Y和Model 3分别占据第一和第三的位置,确立了市场强势地位。特斯拉的Model Y是最受欢迎的插电式电动车,2022年全球销量约77.13万辆。同年,特斯拉Model 3和Model Y的销量突破120万辆,成为特斯拉最畅销的车型,与前一年同期比较成长36.77%。最畅销的五款插电式电动车 (PEV) 车型中有两款是特斯拉品牌,但这家电池电动车製造商在 2022 年面临亚洲品牌的竞争。由于其丰富的插电式混合动力电动车车型阵容,总部位于中国的比亚迪将在 2022 年超越特斯拉成为最畅销的 PEV 品牌。紧接在特斯拉Model Y之后的是比亚迪宋Plus(BEV+PHEV),以477,090辆的销量位居第二。比亚迪在中国市场占有重要地位,以生产可靠、技术先进的电动车而闻名,这可能促成了宋 Plus 车型的强劲销售表现。

- VolkswagenID.4是唯一一款进入前十名的欧洲PEV(插电式电动车),并在最畅销的电动车车型中脱颖而出。 ID.4 在 2022 年的销量为 174,090 辆,彰显了大众汽车对电动车的承诺及其在电动车市场日益增长的影响力。

- 总体而言,特斯拉和比亚迪的这些顶级电动车车型,以及五菱宏光 MINI EV 和大众 ID.4 等其他知名竞争对手,都显示消费者对电动车的需求日益增长。

电动商用车电池组产业概况

电动商用车电池组市场格局适度整合,前五大企业占59.48%。该市场的主要企业为:比亚迪股份有限公司、宁德时代新能源科技股份有限公司(CATL)、LG 能源解决方案有限公司、松下控股股份有限公司和三星 SDI(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动商用车销售

- 电动商用车销量(OEM)

- 最畅销的电动车车型

- 具有首选电池化学成分的OEM

- 电池组价格

- 电池材料成本

- 每种电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 比利时

- 巴西

- 加拿大

- 中国

- 哥伦比亚

- 法国

- 德国

- 匈牙利

- 印度

- 印尼

- 日本

- 墨西哥

- 波兰

- 泰国

- 英国

- 美国

- 价值链与通路分析

第五章 市场区隔

- 体型

- 公车

- LCV

- M&HDT

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCA

- NCM

- NMC

- 其他的

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

- 地区

- 亚太地区

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 匈牙利

- 义大利

- 波兰

- 瑞典

- 英国

- 其他欧洲国家

- 中东和非洲

- 北美洲

- 按国家

- 加拿大

- 美国

- 南美洲

- 亚太地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- A123 Systems LLC

- BYD Company Ltd.

- China Aviation Battery Co. Ltd.(CALB)

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Farasis Energy(Ganzhou)Co. Ltd.

- Guoxuan High-tech Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Sunwoda Electric Vehicle Battery Co. Ltd.(Sunwoda)

- Tata Autocomp Systems Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.(Lishen Battery)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Electric Commercial Vehicle Battery Pack Market size is estimated at 19.79 billion USD in 2025, and is expected to reach 32.49 billion USD by 2029, growing at a CAGR of 13.19% during the forecast period (2025-2029).

The growing interest in light electric delivery vans is driving battery capacity expansion

- Commercial vehicles have been more popular in recent years but have also greatly contributed to pollution and climate change. Therefore, in recent years, there has been a rise in demand for electric commercial vehicles and the batteries that power them in numerous regions worldwide. China is not just a major producer of batteries but also a driving force behind the global boom in demand for electric vehicles, with 90.24% of all-electric trucks sold in 2021. The increasing demand for electric CVs has boosted the battery sector, resulting in a 34.38% increase in the global demand for electric CV battery packs of different kinds, including LFP and NMC, in 2021 compared to 2017.

- Demand for electric trucks has increased worldwide, impacting the market for various battery types in different parts of the world. NMC, NCM, and LFP batteries are rapidly expanding in several regions. Over 90% of the market for several types of electric CV batteries comes from China, a global leader in producing electric CVs and batteries. As a result, worldwide demand for commercial vehicle batteries of all varieties expanded by 32.11% in 2022 compared to 2021.

- Considering the growing demand for electric vehicles due to the rise in various industries, such as e-commerce, logistics, and infrastructure users, the demand for electric commercial vehicles, such as BEV and PHEV, is expected to show significant growth during the forecast period in various countries globally.

The APAC region takes the lead in the electric CV battery pack market, driven by adoption in China, Japan, and South Korea

- The electric CV battery pack market is experiencing dynamic growth across different regions. The APAC region has experienced remarkable growth in the battery pack market. The rising adoption of electric vehicles in countries like China, Japan, and South Korea has fueled the demand for battery packs. China's massive growth in the EV market has propelled the Asian region to the forefront of the global electric CV battery pack market.

- Europe witnessed a significant surge in the market. This can be attributed to the strong push toward the electrification of vehicles, stringent emission regulations, and supportive government policies. The region has become a hub for electric vehicle production, leading to increased demand for battery packs. Investments in battery research and development, coupled with the establishment of charging infrastructure, further drive the growth of the market. The battery pack market in North America has been steadily growing over the years. Factors driving this growth include rising consumer demand for electric vehicles, government incentives and regulations promoting clean energy, and advancements in battery technology. The increasing capacity and investments in battery pack manufacturing reflect the region's commitment to sustainable transportation and energy storage solutions.

- The growth of the battery pack market can be attributed to several factors, including the growing demand for electric vehicles, supportive government policies, technological advancements, and the need for sustainable energy storage solutions. As countries worldwide strive for cleaner transportation and energy systems, the market is poised for continued growth and innovation.

Electric Commercial Vehicle Battery Pack Market Trends

BYD AND TESLA ARE LEADING THE CHARGE IN THE EV MARKET AND SHAPING THE FUTURE

- In 2022, BYD was the market leader in electric vehicle sales and held a share of 13.3%. BYD's leading position can be attributed to several factors. It has been an early and prominent player in the EV industry, with a strong focus on producing electric vehicles and related technologies. The company's early entry into the market allowed it to establish a solid foundation and gain recognition among consumers. BYD has also been actively expanding its operations globally, forging partnerships, and investing in research and development, all of which contribute to its leading position.

- Tesla has been at the forefront of electric vehicle innovation and has played a crucial role in popularizing EVs worldwide. Tesla was a significant player in the EV industry in 2022, with a market share of 12.2%. Tesla's strong brand image, cutting-edge technology, and extensive Supercharger network have contributed to its success.

- Among the other players in the EV market, there are several notable companies that hold significant market shares. BMW's established reputation in the automotive industry, coupled with its commitment to electric mobility through its "BMW i" sub-brand, has contributed to its market presence. Similarly, Volkswagen, which held a market share of 3.9% in 2022, has been actively investing in electric mobility under its "Volkswagen Group" umbrella. These companies, along with others like Mercedes-Benz, Kia, and Hyundai, are recolonizing the EV industry by leveraging their existing brand recognition, introducing compelling electric vehicle models, and investing in technology to enhance the range and performance of their electric offerings.

TESLA AND BYD DOMINATED THE BEST-SELLING EV MODELS OF 2022

- The best-selling EV models in 2022 were dominated by two key OEMs: Tesla and BYD. Tesla held a strong market position with two of its models, the Model Y and Model 3, capturing the first and third spots, respectively. The Tesla Model Y was the most popular plug-in electric vehicle, with global unit sales of roughly 771,300 in 2022. That year, deliveries of Tesla's Model 3 and Model Y surpassed 1.2 million, a Y-o-Y increase of 36.77% for Tesla's best-selling models. While two of the five best-selling plug-in electric vehicle (PEV) models were Tesla-branded, the battery electric vehicle manufacturer faced competition from Asian brands in 2022. China-based BYD overtook Tesla as the best-selling PEV brand in 2022, relying on a large offering of plug-in hybrid electric models. Following closely behind the Tesla Model Y, the BYD Song Plus (BEV + PHEV) secured the second spot, with sales reaching 477,090 units. BYD's established presence in the Chinese market, along with its reputation for producing reliable and technologically advanced electric vehicles, likely contributed to the strong sales performance of the Song Plus models.

- The Volkswagen ID.4 stood out among the best-selling EV models as the only European PEV (Plug-in Electric Vehicle) in the top ten. With a sales volume of 174,090 units in 2022, the ID.4 demonstrated Volkswagen's commitment to electric mobility and its growing presence in the EV market.

- Overall, these top-performing EV models from Tesla and BYD, along with other notable contenders like the Wuling Hong Guang MINI EV and Volkswagen ID.4, demonstrate the increasing consumer demand for electric vehicles.

Electric Commercial Vehicle Battery Pack Industry Overview

The Electric Commercial Vehicle Battery Pack Market is moderately consolidated, with the top five companies occupying 59.48%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Panasonic Holdings Corporation and Samsung SDI Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Commercial Vehicle Sales

- 4.2 Electric Commercial Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Belgium

- 4.11.2 Brazil

- 4.11.3 Canada

- 4.11.4 China

- 4.11.5 Colombia

- 4.11.6 France

- 4.11.7 Germany

- 4.11.8 Hungary

- 4.11.9 India

- 4.11.10 Indonesia

- 4.11.11 Japan

- 4.11.12 Mexico

- 4.11.13 Poland

- 4.11.14 Thailand

- 4.11.15 UK

- 4.11.16 US

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

- 5.9 Region

- 5.9.1 Asia-Pacific

- 5.9.1.1 By Country

- 5.9.1.1.1 China

- 5.9.1.1.2 India

- 5.9.1.1.3 Japan

- 5.9.1.1.4 South Korea

- 5.9.1.1.5 Thailand

- 5.9.1.1.6 Rest-of-Asia-Pacific

- 5.9.2 Europe

- 5.9.2.1 By Country

- 5.9.2.1.1 France

- 5.9.2.1.2 Germany

- 5.9.2.1.3 Hungary

- 5.9.2.1.4 Italy

- 5.9.2.1.5 Poland

- 5.9.2.1.6 Sweden

- 5.9.2.1.7 UK

- 5.9.2.1.8 Rest-of-Europe

- 5.9.3 Middle East & Africa

- 5.9.4 North America

- 5.9.4.1 By Country

- 5.9.4.1.1 Canada

- 5.9.4.1.2 US

- 5.9.5 South America

- 5.9.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A123 Systems LLC

- 6.4.2 BYD Company Ltd.

- 6.4.3 China Aviation Battery Co. Ltd. (CALB)

- 6.4.4 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.5 EVE Energy Co. Ltd.

- 6.4.6 Farasis Energy (Ganzhou) Co. Ltd.

- 6.4.7 Guoxuan High-tech Co. Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 SK Innovation Co. Ltd.

- 6.4.12 Sunwoda Electric Vehicle Battery Co. Ltd. (Sunwoda)

- 6.4.13 Tata Autocomp Systems Ltd.

- 6.4.14 Tianjin Lishen Battery Joint-Stock Co., Ltd. (Lishen Battery)

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms