|

市场调查报告书

商品编码

1684114

北美电动车锂离子电池:市场占有率分析、产业趋势和成长预测(2025-2030 年)North America Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

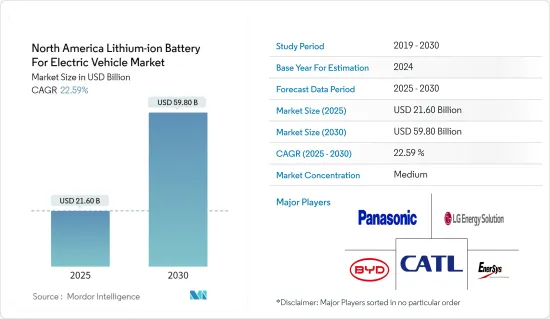

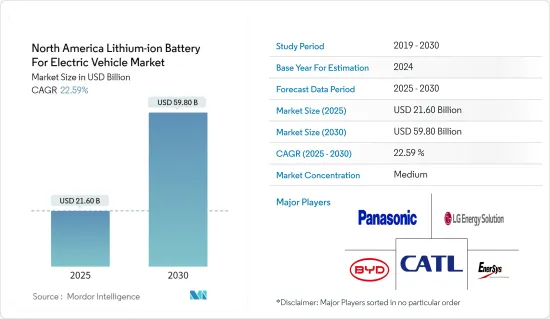

北美电动车锂离子电池市场规模预计在 2025 年为 216 亿美元,预计到 2030 年将达到 598 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.59%。

主要亮点

- 从中期来看,锂离子电池价格下降以及美国、加拿大和其他北美国家的电动车普及预计将推动市场成长。

- 另一方面,替代电池技术的兴起和原材料供需不匹配可能会影响预测期内的市场成长。

- 然而,北美国家电动车对固体锂离子电池的采用日益增多,预计将为市场成长机会。

- 由于政府的优惠政策和电动车的日益普及,美国预计将主导北美市场。

北美电动车锂离子电池市场趋势

电池电动车(BEV)领域预计将占据市场主导地位

- 电池电动车(BEV)通常也被称为配备马达的电动车。 BEV 是全电动汽车,不含内燃机 (ICE)、燃料箱或排气管,通常依靠电力驱动。车辆的能量来自于透过电网充电的电池组。 BEV 是零排放汽车,不会产生传统汽油动力汽车产生的有害废气排放或空气污染风险。

- 北美汽车需求不断增长、创新和先进技术的发展、消费者使用省油车意识的增强以及减少温室气体和排放气体意识的增强等因素正在推动该地区对电池式电动车(BEV) 的需求。

- BEV 是没有内燃机 (ICE)、燃料箱或排气管的电动车。推进完全依赖储存的电力。车辆的能量来自电池,由电网充电。 BEV 是零排放汽车,与传统的汽油动力汽车不同,它不会产生有害废气或空气污染。

- 根据国际能源总署(IEA)的数据,2023年美国电池电动车(BEV)销量将达到约110万辆,其次是加拿大,销量约13万辆。随着北美纯电动车销量的不断增加,对锂离子电池等电动车电池的需求也变得越来越重要。

- 2023年美国电动车销量将达到约160万辆,较2022年全国100万辆的销量成长60%。 2023年,美国占全球电动车新註册量的10%。考虑到《通货膨胀控制法案》(IRA)的潜在影响以及美国多个州实施加州《高级清洁汽车II》规则,到2030年,美国的电动车市场占有率可能会达到50%,与国家目标一致。此外,美国环保署即将提案的近期排放法规可能会进一步促进电动车市场占有率的扩大。

- 此外,私营部门的投资预计将推动加拿大电动车电池市场的发展。例如,2023年4月,大众汽车和加拿大政府承诺共同投资超过148亿美元,在安大略省建造电池製造工厂,即超级工厂。此外,加拿大政府宣布到2032年将投资约105亿美元用于製造业税额扣抵,以匹配美国《通货膨胀控制法案》(IRA)每千瓦时35美元的生产补贴。

- 因此,由于上述因素,预测期内北美电动车(EV)锂离子电池市场可能由 BEV 领域主导。

预计未来几年美国将主导市场

- 电动车(EV)因其环保特性和成本效益而越来越受欢迎。燃料成本上涨、人们对温室气体排放的认识不断提高以及独特的智慧功能等因素正在推动美国对电动车的需求。预计这将推动美国电动车电池市场的发展。

- 根据国际能源总署 (IEA) 的数据,美国电池式电动车(BEV) 销量将在 2023 年达到约 110 万辆,较 2022 年的约 80 万辆增长 37.5% 以上。随着 BEV 销售的持续成长,对电动车电池(例如锂离子电池)的需求变得越来越重要。

- 据美国能源效率和可再生能源办公室称,2023 年 1 月,美国政府正在考虑建立电动车电池工厂的计画。预计製造能力将从 2021 年的每年 55 吉瓦 (GWh/年) 增加到 2030 年的每年 1,000 GWh。大多数正在筹备的计划预计将在 2025 年至 2030 年之间开始生产。这显示未来几年美国电动车电池市场将强劲发展。

- 此外,2023年2月,美国电池回收及工程材料公司Ascend Elements宣布与本田汽车工业达成谅解备忘录,就稳定采购本田在北美的电动车再生锂离子电池材料展开合作。

- 随着上述发展,美国电动车的普及率正在上升,预计这将在预测期内推动北美电动车锂离子电池市场的发展。

北美电动车锂离子电池产业概况

北美电动车锂离子电池市场减少了一半。主要公司(排名不分先后)包括松下控股株式会社、比亚迪股份有限公司、Enersys、LG能源解决方案有限公司、宁德时代新能源科技股份有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2029 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 锂离子电池价格下跌

- 电动车日益普及

- 限制因素

- 原料供需不匹配

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 摩托车(电动自行车)

- 三轮车(电动人力车)

- 四轮车辆(乘用车、客车、轻型商用车、SUV等)

- 推进类型

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 混合动力电动车(HEV)

- 细胞类型

- 圆柱形

- 方块

- 小袋

- 地区

- 美国

- 加拿大

- 北美其他地区

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Contemporary Amperex Technology Co. Limited

- EnerSys

- E-One Moli Energy Corp.

- Hitachi Ltd

- Panasonic Holdings Corporation

- LG Energy Solutions Ltd

- VARTA AG

- List of Other Prominent Companies(Company Name, Headquarters, Relevant Products & Services, Contact Details, etc.)

- Market Ranking/Share(%)Analysis

第七章 市场机会与未来趋势

- 固体锂离子电池在电动车的应用

简介目录

Product Code: 50002583

The North America Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 21.60 billion in 2025, and is expected to reach USD 59.80 billion by 2030, at a CAGR of 22.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices and the growing adoption of electric vehicles in the United States, Canada, and other North American countries are expected to drive the growth of the market.

- On the other hand, emerging alternative battery technologies and the demand-supply mismatch of raw materials are likely to affect the market's growth during the forecast period.

- Nevertheless, the growing adoption of solid-state lithium-ion batteries for electric vehicles across North American countries is anticipated to provide opportunities for the market's growth.

- The United States is expected to dominate the North American market due to its favorable government policies and increasing utilization of electric vehicles.

North America Lithium-ion Battery for Electric Vehicle Market Trends

Battery Electric Vehicles (BEVs) Segment Expected to Dominate the Market

- Battery electric vehicles (BEVs) are also commonly referred to as electric vehicles with an electric motor. BEVs are fully electric vehicles that typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe and rely on electricity for propulsion. The vehicle's energy comes from the battery pack recharged from the grid. BEVs are zero-emission vehicles, and they do not generate harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- Factors like increasing demand for automotive vehicles across North America, growing innovation and advanced technologies, rising consumer awareness about the use of fuel-efficient cars, and growing awareness to reduce greenhouse gases and emissions are driving the demand for battery electric vehicles (BEV) across the region.

- BEVs are electric vehicles that do not have an internal combustion engine (ICE), fuel tank, or exhaust pipe. They rely solely on stored electricity for propulsion. The vehicle's energy comes from the battery, which is recharged from the grid. BEVs are zero-emissions vehicles that do not generate any harmful tailpipe emissions or air pollution hazards, unlike traditional gasoline-powered vehicles.

- According to the International Energy Agency (IEA), the US sales of battery electric vehicles (BEVs) stood at around 1.1 million units in 2023, followed by Canada's sales of about 0.13 million units. As the sales of BEVs continue to rise across North American countries, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- In the United States, around 1.6 million electric vehicles were sold in 2023, a 60% increase from the 1 million sold nationwide in 2022. The United States accounted for 10% of all new EV registrations worldwide in 2023. The potential impact of the Inflation Reduction Act (IRA) and the implementation of California's Advanced Clean Cars II rule by multiple US states could lead to the United States registering a significant market share of 50% for electric cars by 2030, aligning with the nation's target. Moreover, the anticipated implementation of the recently proposed emission standards introduced by the US Environmental Protection Agency is expected to contribute even more to the growing market share of electric vehicles.

- Moreover, private sector investments are expected to drive the Canadian electric vehicle batteries market. For instance, in April 2023, Volkswagen and the Government of Canada declared a joint investment of more than USD 14.8 billion to build a battery manufacturing unit or gigafactory in Ontario. Moreover, the Government of Canada announced an investment of approximately USD 10.05 billion in manufacturing tax credits through 2032 to match USD 35 per kilowatt hour in production subsidies provided by the US Inflation Reduction Act (IRA).

- Therefore, due to the abovementioned factors, the BEVs segment is likely to dominate the North American lithium-ion battery for electric vehicles (EV) market over the forecast period.

United States Projected to Dominate the Market Over the Coming Years

- Electric vehicles (EVs) have become popular owing to their eco-friendly nature and cost-effective benefits. Factors like rising fuel costs, increasing awareness about greenhouse gas emissions, and exclusive smart features have been boosting the demand for electric vehicles in the United States. This is expected to drive the electric vehicle batteries market in the United States.

- According to the International Energy Agency (IEA), the US sales of battery electric vehicles (BEVs) amounted to around 1.1 million units in 2023, an increase of over 37.5% from around 0.8 million units in 2022. As the sales of BEVs continue to rise, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- According to the Office of Energy Efficiency and Renewable Energy, in January 2023, the US government was considering plans for electric vehicle battery plants. The country is expected to witness a ramping up of manufacturing capacity from 55 gigawatts per year (GWh/year) in 2021 to 1,000 GWh/year by 2030. Also, most of the projects in the pipeline are anticipated to initiate production between the years 2025 and 2030. This indicates robust development of the US electric vehicle batteries market in the next couple of years.

- Moreover, in February 2023, Ascend Elements, a US-based battery recycling and engineered materials company, announced a basic agreement with Honda Motor Co. Ltd to collaborate on stable procurement of recycled lithium-ion battery materials for Honda's electric vehicles in North America, which is expected to reduce the carbon footprint of electric vehicles.

- In line with the abovementioned developments, the increasing usage of electric vehicles in the United States is expected to boost the North American lithium-ion battery for electric vehicles market during the forecast period.

North America Lithium-ion Battery for Electric Vehicle Industry Overview

The North American lithium-ion battery for electric vehicles market is semi-fragmented. Some of the major players (not in any particular order) include Panasonic Holdings Corporation, BYD Company Ltd, Enersys, LG Energy Solution Ltd, and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 Growing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Two-wheelers (E-bikes)

- 5.1.2 Three-wheelers (E-rickshaws)

- 5.1.3 Four-wheelers (Passenger Cars, Buses, Light Commercial Vehicles, SUVs, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicles (BEVs)

- 5.2.2 Plug-in Hybrid Electric Vehicles (PHEVs)

- 5.2.3 Hybrid Electric Vehicles (HEVs)

- 5.3 Cell Type

- 5.3.1 Cylindrical

- 5.3.2 Prismatic

- 5.3.3 Pouch

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 E-One Moli Energy Corp.

- 6.3.5 Hitachi Ltd

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 LG Energy Solutions Ltd

- 6.3.8 VARTA AG

- 6.4 List of Other Prominent Companies (Company Name, Headquarters, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-ion Batteries for Electric Vehicles

02-2729-4219

+886-2-2729-4219