|

市场调查报告书

商品编码

1665326

婴幼儿玩具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Baby and Toddler Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

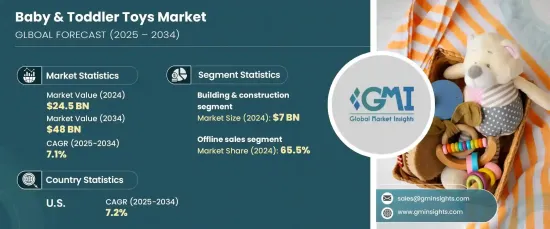

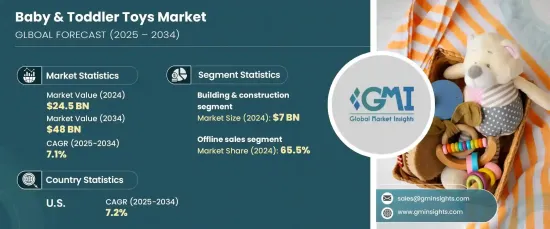

2024 年全球婴幼儿玩具市场价值为 245 亿美元,预计 2025 年至 2034 年期间将以 7.1% 的复合年增长率稳步增长。拼图、形状分类器和感官玩具等益智玩具之所以如此受欢迎,是因为它们能够促进解决问题、创造力和运动技能。这种将趣味与学习融为一体的玩具转变正在塑造消费者的购买习惯。

医疗保健专家和教育专家强调选择适合儿童年龄的玩具对于儿童成长的重要性,这导致对互动产品的需求增加。纹理游戏垫和乐器等感官玩具可满足婴儿的发展需求,其受欢迎程度持续上升。此外,政府支持早期儿童教育的计画在提高人们对儿童有趣且安全的玩具的价值的认识方面发挥了重要作用。这种知情育儿趋势持续为婴儿和幼儿玩具市场创造良好的成长机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 245亿美元 |

| 预测值 | 480亿美元 |

| 复合年增长率 | 7.1% |

依产品类型,市场分为不同的市场区隔,包括动作人物、玩偶、益智玩具、积木、拼图、户外玩具、电子玩具等。 2024 年,建筑玩具领域占据了最大的市场份额,为总市场价值贡献了约 70 亿美元。这些玩具由于其兼具娱乐性和教育性,仍然占据着市场的重要部分。许多製造商已将 STEM 学习元素融入这些产品中,并且越来越倾向于将实体玩具与数位功能相结合,以增强游戏体验。

从分销管道来看,市场分为线上销售和线下销售。 2024 年,线下销售约占总市场份额的 65.5%,预计复合年增长率为 7.2%。由于人们更喜欢亲自购物,离线购物仍然很重要,家长可以亲自检查玩具的安全性、品质和功能。零售店,包括玩具店、百货公司和超市,为父母提供了亲自评估产品、向店员寻求建议以及从节假日或生日等季节性购物活动中获益的机会。因此,这些实体店继续在市场上发挥关键作用。

在北美,美国占约 45 亿美元的市场份额,预计复合年增长率为 7.2%。美国是全球市场的主要参与者,其消费支出很高,越来越重视益智玩具。安全和发展利益是美国父母的首要考虑因素,这进一步刺激了对互动式和基于 STEM 的产品的需求。虽然知名品牌占据市场主导地位,但随着越来越多的消费者开始注重环保,环保玩具选择也越来越受欢迎。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 提高对儿童早期发展的认识

- 可支配所得和父母支出增加

- 拓展电子商务通路

- 产业陷阱与挑战

- 安全问题和严格规定

- 竞争加剧,市场饱和

- 成长动力

- 成长潜力分析

- 消费者购买行为分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 动作人物和玩具套装

- 洋娃娃和绒毛玩具

- 建筑和施工玩具

- 益智玩具

- 棋盘游戏和拼图

- 户外运动玩具

- 电子玩具

- 其他(玩耍和装扮玩具等)

第 6 章:市场估计与预测:按材料,2021 – 2034 年

- 主要趋势

- 塑胶

- 木头

- 织物

- 金属

- 其他(竹子等)

第七章:市场估计与预测:依年龄组,2021 – 2034 年

- 主要趋势

- 婴儿(0-2 岁)

- 幼儿(2-4 岁)

- 学龄前(4-6岁)

第 8 章:市场估计与预测:按性别,2021 年至 2034 年

- 主要趋势

- 男生

- 女孩

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 离线

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Artsana SpA

- Brands in Motion Inc.

- Fat Brain Toys LLC

- Geobra Brandstätter Stiftung & Co. KG

- Hape Holding AG

- Hasbro Inc.

- Juratoys SAS

- Learning Resources LLC

- LEGO A/S

- Mattel Inc.

- Melissa & Doug LLC

- Ravensburger AG

- Spin Master Corporation

- TOMY Company Ltd.

- VTech Holdings Limited

The Global Baby And Toddler Toys Market, valued at USD 24.5 billion in 2024, is projected to experience steady growth at a CAGR of 7.1% from 2025 to 2034. There is a growing awareness among parents and caregivers about the impact of play on early child development, which is driving the demand for these toys. Educational toys, such as puzzles, shape sorters, and sensory toys, have gained popularity because they promote problem-solving, creativity, and motor skills. This shift towards toys that combine fun with learning is shaping consumer purchasing habits.

Healthcare experts and educational specialists stress the importance of choosing age-appropriate toys for child development, leading to an increase in demand for interactive products. Sensory toys, like textured play mats and musical instruments, cater to the developmental needs of infants, and their popularity continues to rise. Moreover, government programs supporting early childhood education have played a role in boosting awareness about the value of engaging and safe toys for young children. This trend of informed parenting continues to create promising growth opportunities in the baby and toddler toy market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.5 Billion |

| Forecast Value | $48 Billion |

| CAGR | 7.1% |

The market is divided into various segments based on product types, including action figures, dolls, educational toys, building blocks, puzzles, outdoor toys, and electronic toys, among others. In 2024, the building and construction toy segment held the largest share of the market, contributing approximately USD 7 billion to the total market value. These toys remain a significant part of the market due to their ability to offer both entertainment and educational benefits. Many manufacturers have incorporated STEM learning elements into these products, and there is a growing trend toward combining physical toys with digital features, which enhances the play experience.

When it comes to distribution channels, the market is divided into online and offline sales. In 2024, offline sales made up around 65.5% of the total market share and are expected to grow at a CAGR of 7.2%. The offline segment remains important due to the preference for in-person shopping, where parents can physically inspect toys for safety, quality, and functionality. Retail stores, including toy shops, department stores, and supermarkets, offer parents the opportunity to evaluate products firsthand, seek advice from staff, and benefit from seasonal shopping events like holidays or birthdays. As a result, these physical stores continue to play a key role in the market.

In North America, the U.S. accounts for about USD 4.5 billion of the market share, with a projected CAGR of 7.2%. The U.S. is a major player in the global market, with high consumer spending and a growing focus on educational toys. Safety and developmental benefits are top priorities for American parents, further fueling demand for interactive and STEM-based products. While established brands dominate the market, eco-friendly toy options are gaining traction as more consumers become environmentally conscious.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of early childhood development

- 3.6.1.2 Rising disposable income and parental spending

- 3.6.1.3 Expansion of e-commerce channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Safety concerns and stringent regulations

- 3.6.2.2 Rising competition and market saturation

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Action figures and playsets

- 5.3 Dolls and stuffed toys

- 5.4 Building and construction toys

- 5.5 Educational toys

- 5.6 Board games and puzzles

- 5.7 Outdoor sports toys

- 5.8 Electronic toys

- 5.9 Others (play and dress-up toys, etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Wood

- 6.4 Fabric

- 6.5 Metal

- 6.6 Others (bamboo, etc.)

Chapter 7 Market Estimates & Forecast, By Age Group, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Infants (0-2 years)

- 7.3 Toddlers (2-4 years)

- 7.4 Preschool (4-6 years)

Chapter 8 Market Estimates & Forecast, By Gender, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Boy

- 8.3 Girl

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Artsana S.p.A.

- 11.2 Brands in Motion Inc.

- 11.3 Fat Brain Toys LLC

- 11.4 Geobra Brandstätter Stiftung & Co. KG

- 11.5 Hape Holding AG

- 11.6 Hasbro Inc.

- 11.7 Juratoys SAS

- 11.8 Learning Resources LLC

- 11.9 LEGO A/S

- 11.10 Mattel Inc.

- 11.11 Melissa & Doug LLC

- 11.12 Ravensburger AG

- 11.13 Spin Master Corporation

- 11.14 TOMY Company Ltd.

- 11.15 VTech Holdings Limited