|

市场调查报告书

商品编码

1698554

益智玩具市场机会、成长动力、产业趋势分析及2025-2034年预测Educational Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

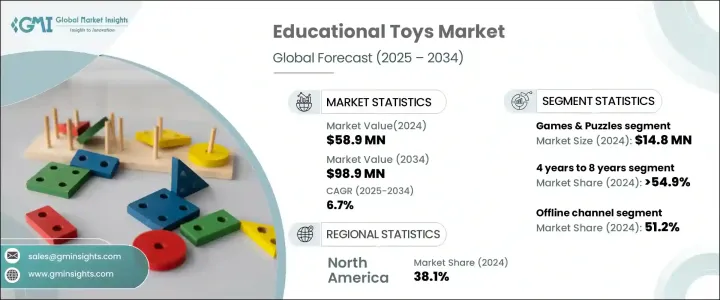

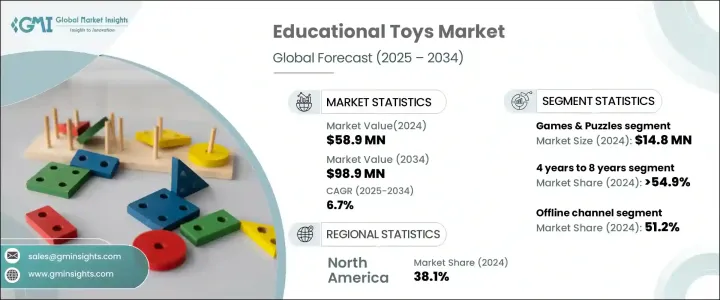

2024 年全球益智玩具市场价值为 5,890 万美元,预计 2025 年至 2034 年期间的复合年增长率为 6.7%。推动这一市场发展的因素包括消费者对益智玩具发展益处的认识不断提高,以及对 STEM 为重点产品的需求不断增长。家长和教育工作者都认识到互动游戏在培养认知、社交和运动技能方面的作用,因此对学习型玩具的偏好日益增加。

消费者越来越关注玩具所使用的材料,尤其是当幼儿倾向于透过触觉和味觉来探索周围环境时。接触邻苯二甲酸盐、铅和 BPA 等有害化学物质引发了人们的担忧,促使人们转向无毒替代品,如木製玩具、不含 BPA 的塑胶和蒙特梭利玩具。随着全球安全法规日益严格,製造商纷纷推出符合严格环境和健康标准的产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5890万美元 |

| 预测值 | 9890万美元 |

| 复合年增长率 | 6.7% |

教育类和 STEM 类玩具的日益普及正在显着影响市场趋势。研究表明,大多数学龄前儿童喜欢玩那些鼓励技能培养活动的玩具。兴趣的激增反映了人们越来越倾向于旨在提高解决问题、创造力和批判性思考能力的产品。在产品类别中,游戏和拼图在 2024 年创造了 1,480 万美元的收入,预计未来几年的复合年增长率为 7.4%。消费者的偏好也在不断变化,越来越倾向于可持续和环保的益智玩具。日益增长的环境问题促使企业采用负责任的采购、可回收材料和更环保的製造流程。

按年龄细分,4 至 8 岁的儿童占据最大的市场份额,到 2024 年将达到 54.9%。预计到 2034 年,这一细分市场将以 6.9% 的复合年增长率扩张。在这个发展阶段,儿童的认知和运动功能会快速成长,因此益智玩具特别有益。家长和教育工作者正在投资支持读写能力、运算能力和分析思考基础技能的玩具,以强化早期学习体验。

市场也按分销管道细分,到 2024 年,线下零售将占销售额的 51.2%。许多父母喜欢在店内购物,因为他们可以在购买前评估玩具的品质和安全性。零售商提供专家指导,帮助顾客选择适合年龄的教育产品。然而,由于家庭购物的便利性、更广泛的产品范围以及方便的价格比较,网上销售正在迅速增长。

从地理位置来看,北美是教育玩具市场的领导者,占 38.1% 的份额,2024 年的收入为 2,240 万美元。该地区的高可支配收入和对早期儿童教育的重视推动了学习型玩具的大量支出。强大的零售基础设施确保了可近性,而政府对教育项目的持续投资进一步促进了市场扩张。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 玩具中的科技融合

- 无害材料的需求增加

- STEM玩具日益受到关注

- 产业陷阱与挑战

- 仿冒品

- 无品牌产品日益盛行

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品类型,2021 - 2034 年(百万美元)

- 主要趋势

- 艺术与工艺

- 游戏和谜题

- 运动技能

- 音乐玩具

- STEM玩具

- 角色扮演

- 其他的

第六章:市场估计与预测:按年龄段,2021 - 2034 年(百万美元)

- 主要趋势

- 4岁至8岁

- 最多 4 年

- 8岁以上

第七章:市场估计与预测:按价格,2021 - 2034 年(百万美元)

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年(百万美元)

- 主要趋势

- 离线

- 在线的

第九章:市场估计与预测:按地区,2021 - 2034 年(百万美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Bandai Namco Holdings Inc.

- Clementoni SpA

- Fisher-Price, Inc.

- Gigo Toys

- Hape International AG

- Hasbro, Inc.

- K'NEX Brands

- LeapFrog Enterprises, Inc.

- LEGO Group

- Mattel, Inc.

- Melissa & Doug, LLC

- Ravensburger AG

- Spin Master Corp.

- VTech Holdings Limited

- WowWee Group Limited

The Global Educational Toys Market was valued at USD 58.9 million in 2024 and is projected to expand at a CAGR of 6.7% from 2025 to 2034. This market is driven by increasing consumer awareness of the developmental benefits of educational toys and the rising demand for STEM-focused products. Parents and educators recognize the role of interactive play in fostering cognitive, social, and motor skills, leading to a growing preference for learning-oriented toys.

Consumers are becoming more conscious of the materials used in toys, especially as young children tend to explore their surroundings through touch and taste. Exposure to harmful chemicals such as phthalates, lead, and BPA has raised concerns, prompting a shift towards non-toxic alternatives like wooden toys, BPA-free plastic, and Montessori-based options. With safety regulations tightening globally, manufacturers are responding by introducing products that meet strict environmental and health standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.9 Million |

| Forecast Value | $98.9 Million |

| CAGR | 6.7% |

The rising popularity of educational and STEM-focused toys is significantly influencing market trends. Studies indicate that a majority of preschool-age children engage with toys that encourage skill-building activities. This surge in interest reflects a broader shift towards products designed to enhance problem-solving, creativity, and critical thinking abilities. Among product categories, games and puzzles generated USD 14.8 million in revenue in 2024 and are forecasted to expand at a CAGR of 7.4% in the coming years. Consumer preferences are also evolving, with an increasing inclination toward sustainable and eco-friendly educational toys. Growing environmental concerns are pushing companies to adopt responsible sourcing, recyclable materials, and greener manufacturing processes.

Age-based segmentation highlights that children aged 4 to 8 years represent the largest share of the market, accounting for 54.9% in 2024. This segment is projected to expand at a 6.9% CAGR through 2034. At this developmental stage, children experience rapid growth in cognitive and motor functions, making educational toys particularly beneficial. Parents and educators are investing in toys that support foundational skills in literacy, numeracy, and analytical thinking, reinforcing early learning experiences.

The market is also segmented by distribution channels, with offline retail accounting for 51.2% of sales in 2024. Many parents prefer in-store shopping, where they can assess the quality and safety of toys before making a purchase. Retailers provide expert guidance to help customers choose age-appropriate educational products. However, online sales are rapidly increasing, driven by the convenience of home shopping, access to a wider product range, and easy price comparisons.

Geographically, North America leads the educational toys market, holding a 38.1% share and generating USD 22.4 million in revenue in 2024. The region's high disposable income and emphasis on early childhood education drive significant spending on learning-based toys. A strong retail infrastructure ensures accessibility, while ongoing government investments in educational programs further boost market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Integration of technology in toys

- 3.10.1.2 Increase in demand for non-harmful materials

- 3.10.1.3 Growing focus on STEM Toys

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Counterfeit products

- 3.10.2.2 Rising prevalence of unbranded products

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Arts & craft

- 5.3 Games & Puzzles

- 5.4 Motor Skills

- 5.5 Musical Toys

- 5.6 STEM Toys

- 5.7 Role play

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 4 years to 8 years

- 6.3 Up to 4 years

- 6.4 Above 8 years

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bandai Namco Holdings Inc.

- 10.2 Clementoni S.p.A.

- 10.3 Fisher-Price, Inc.

- 10.4 Gigo Toys

- 10.5 Hape International AG

- 10.6 Hasbro, Inc.

- 10.7 K’NEX Brands

- 10.8 LeapFrog Enterprises, Inc.

- 10.9 LEGO Group

- 10.10 Mattel, Inc.

- 10.11 Melissa & Doug, LLC

- 10.12 Ravensburger AG

- 10.13 Spin Master Corp.

- 10.14 VTech Holdings Limited

- 10.15 WowWee Group Limited