|

市场调查报告书

商品编码

1665363

医药塑胶包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pharmaceutical Plastic Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

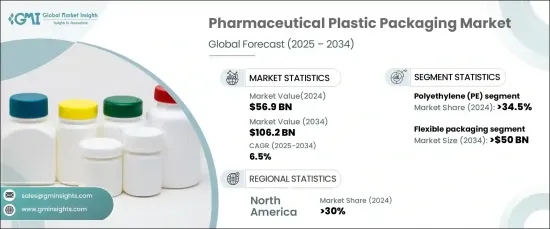

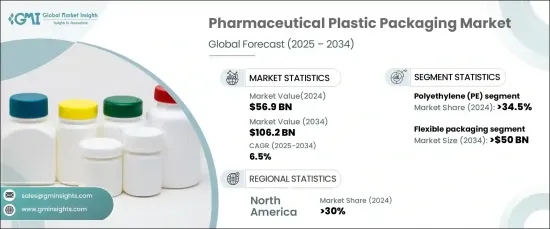

2024 年全球医药塑胶包装市场价值为 569 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.5%。在安全性、用户友善性和遵守监管要求的创新推动下,该行业正在经历重大变革。推动这一成长的关键趋势之一是对防篡改和儿童安全包装的需求不断增长。随着消费者安全成为重中之重,製造商越来越多地采用易碎瓶盖、防篡改密封和视觉指示器等先进功能,以加强保护并防止未经授权存取产品。

市场按材料类型分类,包括聚乙烯 (PE)、聚丙烯 (PP)、聚对苯二甲酸乙二酯 (PET)、聚氯乙烯 (PVC) 等。聚乙烯 (PE) 领域在 2024 年占据 34.5% 的主导市场份额。由于其具有防潮和防化学腐蚀性能,因此在储存和运输过程中保护敏感药物方面特别有效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 569亿美元 |

| 预测值 | 1062亿美元 |

| 复合年增长率 | 6.5% |

就包装类型而言,市场分为软包装和硬包装。软包装预计将以 7.5% 的复合年增长率成长,到 2034 年将达到 500 亿美元。软包装包括小袋、小包、泡罩包装和条状包装等产品,常用于包装药片、胶囊、粉末和液体等药品。这些包装解决方案提供出色的防潮、防氧、防光保护,有助于维持药品的完整性并延长其保质期。

2024 年,北美医药塑胶包装市场将占据 30% 的份额。製造商越来越多地采用环保材料,例如再生塑胶和可生物降解的材料,以实现环境目标。此外,还采用了二维码和 RFID 标籤等技术来增强产品的可追溯性、真实性和患者参与度,进一步推动市场向前发展。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 中断

- 未来展望

- 製造商

- 经销商

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 慢性病盛行率上升和人口老化

- 儿童安全、防篡改包装的采用日益广泛

- 远距医疗的成长推动了对安全送货上门包装的需求

- 单位剂量和多剂量包装形式的使用日益增多

- 生物製剂的快速扩张需要专门的包装

- 产业陷阱与挑战

- 平衡成本效益与高效能包装解决方案

- 回收多层和专用塑胶包装的挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯(PET)

- 聚氯乙烯(PVC)

- 其他的

第 6 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 瓶子

- 泡罩包装

- 注射器和药瓶

- 薄膜和包装

- 管

- 小袋和小包

- 其他的

第 7 章:市场估计与预测:依封装类型,2021-2034 年

- 主要趋势

- 软包装

- 硬包装

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 口服药物

- 注射药物

- 外用药物

- 其他的

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amcor

- APG Pharma

- Aptar

- Berry Global

- Bormioli

- CL Smith

- Comar

- Constantia

- Drug Plastics

- DWK

- Frapak

- Gerresheimer

- Klockner

- Medicopack

- Nelipak

- Origin Pharma

- Plascene

- Silgan

The Global Pharmaceutical Plastic Packaging Market, valued at USD 56.9 billion in 2024, is projected to grow at a CAGR of 6.5% between 2025-2034. The industry is undergoing significant changes, driven by innovations in safety, user-friendliness, and adherence to regulatory requirements. One of the key trends contributing to this growth is the rising demand for tamper-evident and child-resistant packaging. As consumer safety becomes a top priority, manufacturers are increasingly incorporating advanced features like breakable caps, tamper seals, and visual indicators to enhance protection and prevent unauthorized access to products.

The market is categorized by material types, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. The polyethylene (PE) segment holds a dominant market share of 34.5% in 2024. Polyethylene is widely favored for its versatility, durability, and affordability, making it ideal for manufacturing various pharmaceutical packaging solutions such as bottles, containers, and flexible packaging. Its resistance to moisture and chemicals makes it particularly effective at protecting sensitive medications during storage and transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.9 Billion |

| Forecast Value | $106.2 Billion |

| CAGR | 6.5% |

In terms of packaging types, the market is divided into flexible and rigid packaging. Flexible packaging is expected to grow at a CAGR of 7.5%, reaching USD 50 billion by 2034. This segment is rapidly gaining traction in the pharmaceutical packaging industry, offering key advantages like convenience, cost-effectiveness, and sustainability. Flexible packaging includes products like pouches, sachets, blister packs, and strip packs, which are commonly used for packaging pharmaceuticals such as tablets, capsules, powders, and liquids. These packaging solutions provide excellent protection against moisture, oxygen, and light, helping to preserve the integrity and extend the shelf life of pharmaceutical products.

North America pharmaceutical plastic packaging market held 30% in 2024. In the United States, the market is seeing rapid growth, driven by a focus on sustainability and the integration of smart technologies. Manufacturers are increasingly adopting eco-friendly materials, such as recycled plastics and biodegradable options, to meet environmental goals. Additionally, technologies like QR codes and RFID tags are being incorporated to enhance product traceability, authenticity, and patient engagement, further propelling the market forward.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising prevalence of chronic diseases and aging population

- 3.5.1.2 Growing adoption of child-resistant and tamper-evident packaging

- 3.5.1.3 Growth of telemedicine fueling need for secure home-delivery packaging

- 3.5.1.4 Rising use of unit dose and multi-dose packaging formats

- 3.5.1.5 Rapid expansion of biologics necessitating specialized packaging

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Balancing cost-efficiency with high-performance packaging solutions

- 3.5.2.2 Challenges in recycling multi-layer and specialized plastic packaging

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Polyvinyl Chloride (PVC)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Blister packs

- 6.4 Syringes and vials

- 6.5 Films and wraps

- 6.6 Tubes

- 6.7 Pouches and sachets

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Flexible packaging

- 7.3 Rigid packaging

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Oral drugs

- 8.3 Injectable drugs

- 8.4 Topical drugs

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 APG Pharma

- 10.3 Aptar

- 10.4 Berry Global

- 10.5 Bormioli

- 10.6 CL Smith

- 10.7 Comar

- 10.8 Constantia

- 10.9 Drug Plastics

- 10.10 DWK

- 10.11 Frapak

- 10.12 Gerresheimer

- 10.13 Klockner

- 10.14 Medicopack

- 10.15 Nelipak

- 10.16 Origin Pharma

- 10.17 Plascene

- 10.18 Silgan