|

市场调查报告书

商品编码

1685093

办公室锅炉市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Office Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

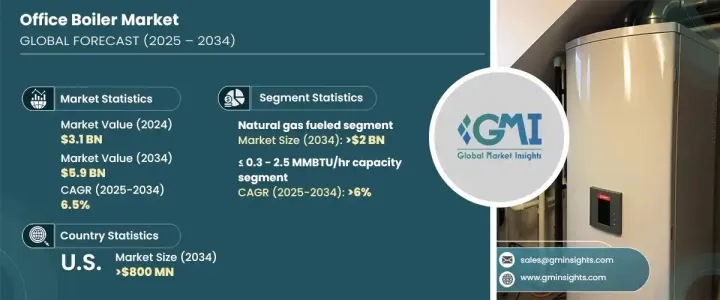

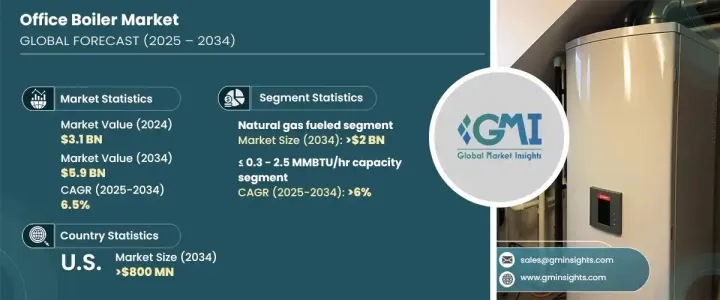

2024 年全球办公锅炉市场规模达 31 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.5%。商业建筑对高效空间供暖解决方案的需求不断增长,再加上严格的绿色建筑要求,将继续推动市场扩张。人们对能源效率和减少碳足迹的认识不断提高,导致了向永续供热技术的重大转变,进一步推动了产业成长。整个商业领域的公司都在积极投资高效能锅炉系统,以遵守不断变化的能源法规并提高营运成本的节省。

商用锅炉产业正在经历快速转型,世界各国政府都在实施更严格的政策来抑制温室气体排放。多锅炉组的采用正在获得发展势头,以提高效率和可靠性并降低安装成本。绿色建筑计画正在重塑产业格局,企业优先考虑环保供热技术以满足监管标准和企业永续发展目标。降低碳排放和提高能源效率的推动已经将现代办公锅炉定位为下一代建筑基础设施的重要组成部分。随着企业寻求对过时的暖气系统进行现代化改造,对先进、高性能锅炉的需求持续激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 31亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 6.5% |

办公室锅炉市场中的天然气燃料部分预计到 2034 年将创收 20 亿美元。政府支持低排放燃料的优惠政策和丰富的天然气供应正在加速这一领域的成长。公司正积极以符合能源效率和永续发展目标的现代化解决方案取代老旧、低效的暖气系统。此外,锅炉设计技术的进步提高了热效率,使天然气锅炉成为办公空间的首选。向更清洁能源的转变凸显了商业供暖行业的持续转型,企业优先考虑具有成本效益且环保的供暖解决方案。

随着紧凑型节能加热系统的普及,预计到 2034 年,<= 0.3 - 2.5 MMBTU/小时容量部分的复合年增长率将达到 6%。这些锅炉在确保办公环境中可靠的暖气性能的同时,也节省了维护和运作方面的大量成本。从化石燃料转向脱碳替代能源的转变,加上对清洁能源技术的持续投资,正在推动这一领域的发展。此外,服务业的快速成长和商业建筑专案投资的增加,推动了全球各市场对办公锅炉的持续需求。

受监管政策、经济激励措施和鼓励采用高效供暖系统的环境倡议的推动,美国办公室锅炉市场预计到 2034 年将创收 8 亿美元。旨在减少对化石燃料依赖的更严格的政府法规在塑造产业格局方面发挥关键作用。随着能源标准的发展,美国各地的企业都在积极投资先进的锅炉系统,以优化能源消耗并符合永续发展基准。有利的政策措施、技术进步以及对绿色建筑计划的认识不断提高,将使美国办公锅炉市场在未来十年实现大幅增长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按燃料,2021 – 2034 年

- 主要趋势

- 天然气

- 油

- 煤炭

- 电的

- 其他的

第六章:市场规模及预测:依产能,2021 – 2034 年

- 主要趋势

- ≤ 0.3 - 2.5 百万英热单位/小时

- > 2.5 - 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

第 7 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 热水

- 蒸气

第 8 章:< 市场规模与预测:按技术,2021 – 2034 年

- 主要趋势

- 冷凝

- 无凝结

第 9 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第十章:公司简介

- AO Smith

- Ariston Holding

- Babcock & Wilcox

- Bosch Industriekessel

- Bradford White Corporation

- BURNHAM COMMERCIAL BOILERS

- Clayton Industries

- Cleaver-Brooks

- Energy Kinetics

- FERROLI

- FONDITAL

- Fulton

- Hurst Boiler & Welding

- Miura America

- PARKER BOILER

- Precision Boilers

- Vaillant Group

- VIESSMANN

- Weil-McLain

- WOLF

The Global Office Boiler Market reached USD 3.1 billion in 2024 and is set to experience a CAGR of 6.5% between 2025 and 2034. Rising demand for efficient space heating solutions in commercial buildings, coupled with stringent green building mandates, continues to drive market expansion. Increasing awareness regarding energy efficiency and carbon footprint reduction has led to a significant shift toward sustainable heating technologies, further fueling industry growth. Companies across the commercial sector are actively investing in high-efficiency boiler systems to comply with evolving energy regulations and enhance operational cost savings.

The commercial boiler industry is undergoing rapid transformation, with governments worldwide implementing stricter policies to curb greenhouse gas emissions. The adoption of multiple boiler units is gaining momentum, offering enhanced efficiency, reliability, and reduced installation costs. Green building initiatives are reshaping the industry landscape, with businesses prioritizing eco-friendly heating technologies to meet regulatory standards and corporate sustainability goals. The push for lower carbon emissions and improved energy efficiency has positioned modern office boilers as an essential component of next-generation building infrastructure. As businesses seek to modernize outdated heating systems, the demand for advanced, high-performance boilers continues to surge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 6.5% |

The natural gas-fueled segment in the office boiler market is projected to generate USD 2 billion by 2034. Favorable government policies supporting low-emission fuels and abundant natural gas availability are accelerating this segment's growth. Companies are actively replacing older, inefficient heating systems with modernized solutions that align with energy efficiency and sustainability goals. Additionally, technological advancements in boiler design have led to improved thermal efficiency, making natural gas-fueled boilers a preferred choice for office spaces. The shift toward cleaner energy sources underscores the ongoing transformation of the commercial heating industry, with businesses prioritizing cost-effective and environmentally friendly heating solutions.

The <= 0.3 - 2.5 MMBTU/hr capacity segment is expected to expand at a CAGR of 6% through 2034, driven by the increasing adoption of compact and energy-efficient heating systems. These boilers offer significant cost savings in terms of maintenance and operation while ensuring reliable heating performance in office environments. The transition from fossil fuels to decarbonized alternatives, combined with ongoing investments in clean energy technology, is propelling this segment forward. Furthermore, the rapid growth of the service sector and rising investments in commercial construction projects are contributing to the sustained demand for office boilers in various global markets.

The U.S. office boiler market is forecasted to generate USD 800 million by 2034, driven by regulatory policies, economic incentives, and environmental initiatives encouraging the adoption of high-efficiency heating systems. Stricter government regulations aimed at reducing reliance on fossil fuels are playing a pivotal role in shaping the industry landscape. As energy standards evolve, businesses across the United States are proactively investing in advanced boiler systems to optimize energy consumption and align with sustainability benchmarks. The combination of favorable policy measures, technological advancements, and increasing awareness of green building initiatives is positioning the U.S. office boiler market for substantial growth over the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Hot water

- 7.3 Steam

Chapter 8 < Market Size and Forecast, By Technology, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Condensing

- 8.3 Non-condensing

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 A.O. Smith

- 10.2 Ariston Holding

- 10.3 Babcock & Wilcox

- 10.4 Bosch Industriekessel

- 10.5 Bradford White Corporation

- 10.6 BURNHAM COMMERCIAL BOILERS

- 10.7 Clayton Industries

- 10.8 Cleaver-Brooks

- 10.9 Energy Kinetics

- 10.10 FERROLI

- 10.11 FONDITAL

- 10.12 Fulton

- 10.13 Hurst Boiler & Welding

- 10.14 Miura America

- 10.15 PARKER BOILER

- 10.16 Precision Boilers

- 10.17 Vaillant Group

- 10.18 VIESSMANN

- 10.19 Weil-McLain

- 10.20 WOLF