|

市场调查报告书

商品编码

1716470

替代蛋白质市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Alternative Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

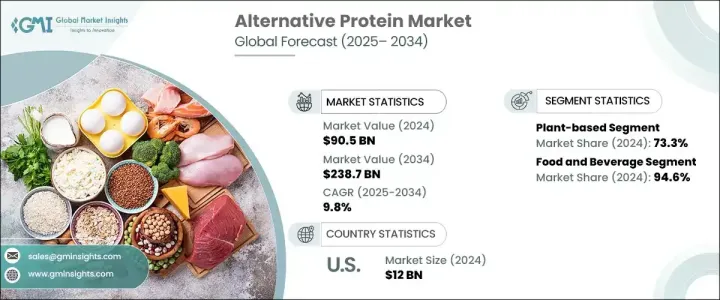

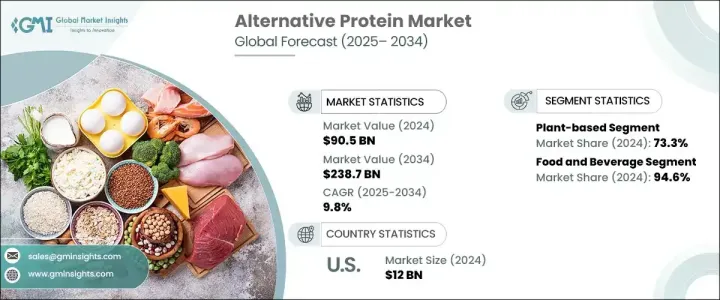

2024 年全球替代蛋白质市场规模达 905 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.8%。随着人们寻求可持续且营养的替代品,消费者对更健康、富含蛋白质的食品的偏好日益增加,推动了这一显着增长。随着人们对环境永续性、动物福利和个人健康意识的增强,消费者开始倾向于植物性、昆虫性以及培养细胞蛋白质。这些替代品提供了符合不断变化的消费者价值观的环保解决方案。此外,国家支持更健康、更永续的食品系统政策进一步推动了向替代蛋白质的转变,为市场扩张创造了有利的环境。

主要食品产业参与者正大力投资研发,推出满足不同饮食偏好和生活方式选择的创新蛋白质产品。食品科技公司和知名食品品牌之间日益增长的合作正在推动替代蛋白质的商业化,使其更容易获得并吸引更广泛的消费者群体。此外,食品加工技术的不断进步正在改善替代蛋白质产品的口感、质地和营养成分,从而促进更高的采用率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 905亿美元 |

| 预测值 | 2387亿美元 |

| 复合年增长率 | 9.8% |

2024 年,植物蛋白占据了市场主导地位,占有 73.3% 的份额,这得益于其广泛的可用性、成熟的供应链以及纯素食和弹性素食消费者不断增长的需求。随着越来越多的人养成以植物为基础的饮食习惯,製造商纷纷推出各种创新的纯素蛋白产品来满足日益增长的需求。虽然植物蛋白继续占据主导地位,但其他来源的蛋白,包括昆虫蛋白、微生物蛋白和培养细胞蛋白,正在稳定成长。这些替代蛋白质类别仍然较小,但随着技术进步改善其生产流程并降低成本,逐渐占领市场份额。

食品和饮料领域在2024年贡献了94.6%的市场份额,成为替代蛋白质产业中最大的应用领域。随着消费者越来越多地寻求符合道德和永续的食品来源,製造商正在扩大其产品组合以包括各种替代蛋白质产品。这些蛋白质被融入各种各样的产品中,包括肉类替代品、不含乳製品的饮料和植物性零食。此外,它们还可以满足特殊饮食的营养需求,例如运动营养、医疗食品和饮食限制个人的产品。人们越来越重视永续性和道德采购,导致多个消费者群体越来越多地采用替代蛋白质,为产品多样化创造了新的机会。

在政府倡议、技术创新和蓬勃发展的食品产业的推动下,美国替代蛋白质市场将在 2024 年创造 120 亿美元的收入。随着越来越多的美国消费者开始注重健康和环境可持续的饮食,对替代蛋白质产品的需求持续增长。社群媒体、目标广告以及对植物营养的认识不断提高,正在影响消费者的购买决策,并帮助替代蛋白质在零售和食品服务领域获得关注。植物性和培养蛋白质的日益普及正在鼓励零售商扩大其产品范围,确保消费者能够轻鬆获得各种可持续的蛋白质选择。因此,替代蛋白质正在成为美国家庭的主食,促进美国市场的快速成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 富含蛋白质的家禽饲料容易消化,不含抗营养因子(ANFS)

- 该地区牛肉出口的增加将促进产业成长

- 工业化畜牧业生产的成长将推动动物饲料蛋白质的需求

- 高蛋白健康产品的需求不断增长

- 政府采取措施促进藻类产品生产,支持藻类蛋白质市场成长

- 食用昆虫在食品中的应用日益广泛,以支持昆虫蛋白质市场的成长

- 提高对纯素饮食的认识

- 产业陷阱与挑战

- 食用昆虫在食品工业的应用缺乏明确的监管,限制了以昆虫为基础的蛋白质的成长

- 与不同替代蛋白质(例如植物性蛋白质和昆虫性蛋白质)相关的过敏

- 严格遵守饲料法规

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按来源,2021-2034 年

- 主要趋势

- 植物基

- 大豆分离蛋白

- 大豆浓缩蛋白

- 发酵大豆蛋白

- 浮萍蛋白

- 其他的

- 基于昆虫

- 基于微生物

- 细菌

- 酵母菌

- 藻类

- 真菌

- 其他的

- 其他的

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 肉类似物

- 麵包店

- 乳製品替代品

- 谷物和零食

- 饮料

- 其他的

- 动物饲料

- 家禽

- 肉鸡

- 层

- 土耳其

- 猪

- 起动机

- 种植者

- 母猪

- 牛

- 乳製品

- 小牛

- 水产养殖

- 鲑鱼

- 鳟鱼

- 虾

- 鲤鱼

- 宠物食品

- 马

- 其他的

- 家禽

第七章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- AB Mauri

- AMCO Proteins

- Angel Yeast

- Archer Daniel Midland Company

- Axiom Foods

- Calysta Inc.

- Cargill Incorporation

- Darling Ingredients

- Hamlet Protein

- Ingredion

- Innovafeed

- Lallemand Inc

- Royal DSM NV

- Ynsect

The Global Alternative Protein Market generated USD 90.5 billion in 2024 and is projected to grow at a CAGR of 9.8% between 2025 and 2034. This remarkable growth is fueled by an increasing consumer preference for healthier, protein-rich foods as individuals seek sustainable and nutritious alternatives. As awareness around environmental sustainability, animal welfare, and personal health gains momentum, consumers are gravitating toward plant-based, insect-based, and cultured cell proteins. These alternatives offer eco-friendly solutions that align with evolving consumer values. In addition, national policies supporting healthier and more sustainable food systems are further propelling this shift toward alternative proteins, creating a favorable environment for market expansion.

Major food industry players are investing heavily in research and development to introduce innovative protein products catering to diverse dietary preferences and lifestyle choices. Growing collaborations between food tech companies and established food brands are driving the commercialization of alternative proteins, making them more accessible and appealing to a broader consumer base. Additionally, ongoing advancements in food processing technologies are improving the taste, texture, and nutritional profile of alternative protein products, encouraging higher adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.5 Billion |

| Forecast Value | $238.7 Billion |

| CAGR | 9.8% |

Plant-based proteins dominated the market in 2024, holding a 73.3% share due to their wide availability, established supply chains, and rising demand among vegan and flexitarian consumers. As more people embrace plant-based eating habits, manufacturers are responding by introducing a diverse range of innovative vegan protein products to meet this growing demand. While plant-based proteins continue to lead the segment, other sources, including insect-based, microbial-based, and cultured cell proteins, are steadily gaining momentum. These alternative protein categories remain smaller but are gradually capturing market share as technological advancements improve their production processes and reduce costs.

The food and beverage segment contributed 94.6% of the market share in 2024, making it the largest application segment within the alternative protein industry. As consumers increasingly seek ethical and sustainable food sources, manufacturers are expanding their portfolios to include various alternative protein products. These proteins are being integrated into a wide range of offerings, including meat substitutes, dairy-free beverages, and plant-based snacks. Additionally, they are being tailored to meet the nutritional needs of specialty diets, such as sports nutrition, medical foods, and products for individuals with dietary restrictions. The growing emphasis on sustainability and ethical sourcing has led to increased adoption of alternative proteins across multiple consumer segments, creating new opportunities for product diversification.

The U.S. alternative protein market generated USD 12 billion in 2024, driven by government initiatives, technological innovations, and a robust food industry. As more consumers in the U.S. embrace health-conscious and environmentally sustainable diets, the demand for alternative protein products continues to grow. Social media, targeted advertising, and heightened awareness around plant-based nutrition are influencing consumer purchasing decisions and helping alternative proteins gain traction in the retail and food service sectors. The increasing popularity of plant-based and cultured protein options is encouraging retailers to expand their offerings, ensuring that consumers have easy access to a variety of sustainable protein choices. As a result, alternative proteins are becoming a staple in American households, contributing to the rapid growth of the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Protein rich diets for poultry are highly digestible and devoid of containing less anti-nutritional factors (ANFS)

- 3.6.1.2 Rising beef exports from the region will foster industry growth

- 3.6.1.3 Growing industrial livestock production will drive animal feed protein demand

- 3.6.1.4 Rising demand for healthy products with high protein content

- 3.6.1.5 Government initiatives to boost algae products production, supporting the algae-based protein market growth

- 3.6.1.6 Rising adoption of edible insects in food application to support the insect-based protein market growth

- 3.6.1.7 Increasing awareness towards vegan diet

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Edible insects have a lack of regulatory clarity in the food industry applications restricting the insect-based protein growth

- 3.6.2.2 Allergies associated with different alternative proteins such as plant-based and insect-based

- 3.6.2.3 Stringent feed regulatory compliances

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021–2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based

- 5.2.1 Soy protein isolates

- 5.2.2 Soy protein concentrates

- 5.2.3 Fermented soy protein

- 5.2.4 Duckweed protein

- 5.2.5 Others

- 5.3 Insect-based

- 5.4 Microbial-based

- 5.4.1 Bacteria

- 5.4.2 Yeast

- 5.4.3 Algae

- 5.4.4 Fungi

- 5.4.5 Others

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.2.1 Meat analogs

- 6.2.2 Bakery

- 6.2.3 Dairy alternatives

- 6.2.4 Cereals & snacks

- 6.2.5 Beverages

- 6.2.6 Others

- 6.3 Animal feed

- 6.3.1 Poultry

- 6.3.1.1 Broiler

- 6.3.1.2 Layer

- 6.3.1.3 Turkey

- 6.3.2 Swine

- 6.3.2.1 Starter

- 6.3.2.2 Grower

- 6.3.2.3 Sow

- 6.3.3 Cattle

- 6.3.3.1 Dairy

- 6.3.3.2 Calf

- 6.3.4 Aquaculture

- 6.3.4.1 Salmon

- 6.3.4.2 Trout

- 6.3.4.3 Shrimps

- 6.3.4.4 Carp

- 6.3.5 Pet food

- 6.3.6 Equine

- 6.3.7 Others

- 6.3.1 Poultry

Chapter 7 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AB Mauri

- 8.2 AMCO Proteins

- 8.3 Angel Yeast

- 8.4 Archer Daniel Midland Company

- 8.5 Axiom Foods

- 8.6 Calysta Inc.

- 8.7 Cargill Incorporation

- 8.8 Darling Ingredients

- 8.9 Hamlet Protein

- 8.10 Ingredion

- 8.11 Innovafeed

- 8.12 Lallemand Inc

- 8.13 Royal DSM NV

- 8.14 Ynsect