|

市场调查报告书

商品编码

1716556

婴儿车及婴儿车市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Baby Stroller and Pram Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

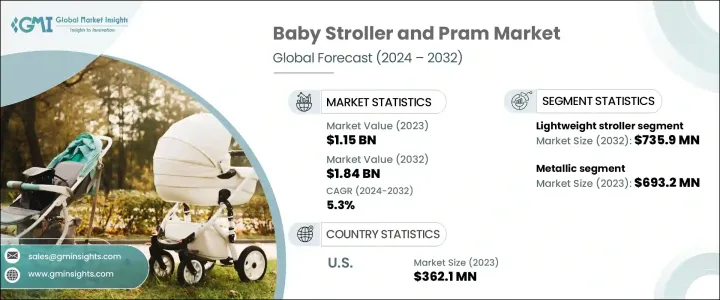

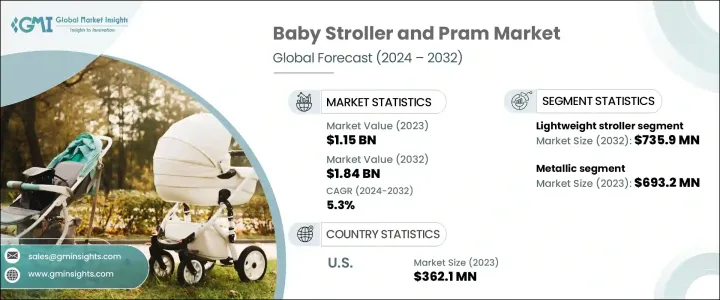

2023 年全球婴儿车和婴儿车市场规模达到 11.5 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 5.3%。这一增长受到快速城市化、生活方式转变以及对便利性婴儿护理产品日益增长的需求的推动。随着越来越多的家庭迁往城市地区,对紧凑、移动式婴儿护理解决方案的需求大幅增加。现代父母,尤其是大都市的父母,非常重视功能性和舒适性,婴儿车和婴儿车成为他们日常生活中不可或缺的物品。核心家庭和双收入家庭的增加趋势进一步提高了消费能力,鼓励父母选择高端、功能丰富的婴儿车。

随着对儿童安全和舒适度的关注度日益增加,父母愿意投资于具有耐用性、安全性和易用性的产品。父母对美观与实用相结合的产品的偏好正在不断变化,这正在重塑婴儿车和婴儿车市场。此外,方便旅行的可折迭设计、多功能婴儿车以及智慧煞车系统等技术整合功能等创新正在改变消费者的选择,使市场高度活跃和竞争激烈。人们对婴儿安全标准的认识不断提高,以及对奢侈婴儿产品的日益增长的倾向,促使製造商推出具有先进人体工学和安全功能的婴儿车。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 11.5亿美元 |

| 预测值 | 18.4亿美元 |

| 复合年增长率 | 5.3% |

婴儿推车和婴儿车市场根据框架材料分为金属和非金属两种。 2023 年金属板块估值为 6.932 亿美元,预计预测期内复合年增长率为 5.4%。越来越多的父母选择金属婴儿车,这种婴儿车主要由铝和不銹钢等优质金属製成,因为它们结构坚固、长期可靠。这些材质具有优异的强度,确保婴儿车即使频繁使用也能保持结构稳固,进而提高婴儿的安全性和舒适度。随着越来越多的父母在选择婴儿车时注重耐用性和坚固性,对金属框架的需求日益增长,使其成为高端婴儿用品的首选。

市场还根据产品类型细分为全尺寸婴儿车、轻便婴儿车、慢跑婴儿车、双人婴儿车、旅行系统、车架婴儿车等。轻型婴儿车占据了市场主导地位,2023 年估值为 4.613 亿美元,预计到 2032 年将达到 7.359 亿美元。轻便婴儿车的日益普及源于其便携性、紧凑性和易于操作性,非常适合日程繁忙的城市父母。这些婴儿车设计为易于折迭和方便携带,已成为城市生活和旅行的必需品,特别是在拥挤的空间中,笨重的婴儿车会带来挑战。

2023 年,美国婴儿车和婴儿车市场规模达 3.621 亿美元,预计 2024 年至 2032 年期间的复合年增长率将达到 5.5%。美国凭藉着更高的消费者消费能力、城市生活趋势以及对优质、安全认证婴儿产品的强烈偏好,在全球处于领先地位。在先进零售通路的支持下,电动和高科技婴儿车的日益普及进一步促进了市场的成长。父母对儿童安全法规的日益关注,促使人们采用配备增强安全性和人体工学功能的婴儿车,从而推动了全国范围内的持续需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 都市化进程加快,可支配所得增加

- 婴儿安全和舒适度意识不断增强

- 电子商务和数位行销策略的扩展

- 产业陷阱与挑战

- 高端婴儿车价格高昂

- 严格的安全法规和合规挑战

- 成长动力

- 技术与创新格局

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

- 消费者行为分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 年至 2032 年

- 主要趋势

- 轻便婴儿车

- 全尺寸婴儿车

- 慢跑婴儿车

- 旅行系统

- 双人婴儿车

- 框架式婴儿车

- 其他的

第六章:市场估计与预测:按车架材料,2021 年至 2032 年

- 主要趋势

- 金属

- 非金属

第七章:市场估计与预测:依年龄段,2021 年至 2032 年

- 主要趋势

- 0-6个月

- 6-12个月

- 12-36个月

- 36个月以上

第八章:市场估计与预测:以价格,2021 年至 2032 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:按配销通路,2021 年至 2032 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Britax

- Bugaboo

- Chicco

- Dorel

- Evenflo

- Goodbaby

- Graco

- Joie

- Joovy

- Maclaren

- Mamas & Papas

- Maxi-Cosi

- Peg Perego

- Silver Cross

- UPPAbaby

The Global Baby Stroller and Pram Market reached USD 1.15 billion in 2023 and is projected to grow at a CAGR of 5.3% between 2024 and 2032. This growth is fueled by rapid urbanization, shifting lifestyles, and rising demand for convenience-driven baby care products. As more families move to urban areas, the need for compact, mobile solutions for infant care has significantly surged. Modern parents, especially those in metropolitan cities, are prioritizing functionality and comfort, making strollers and prams indispensable in their daily routines. The increasing trend of nuclear families and dual-income households has further boosted spending capacity, encouraging parents to opt for premium and feature-rich baby strollers.

With growing concerns around child safety and comfort, parents are willing to invest in products that promise durability, safety, and ease of use. The evolving parental preferences for products that blend aesthetics with practicality are reshaping the baby stroller and pram market. Additionally, innovations such as travel-friendly foldable designs, multi-functional strollers, and tech-integrated features like smart braking systems are transforming consumer choices, making the market highly dynamic and competitive. Rising awareness of infant safety standards and a growing inclination toward luxury baby products are pushing manufacturers to introduce strollers with advanced ergonomics and safety features.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $1.15 Billion |

| Forecast Value | $1.84 Billion |

| CAGR | 5.3% |

The baby stroller and pram market is segmented based on frame material into metallic and non-metallic options. The metallic segment garnered a valuation of USD 693.2 million in 2023 and is expected to register a CAGR of 5.4% during the forecast period. Parents are increasingly choosing metallic strollers, primarily crafted from high-quality metals such as aluminum and stainless steel, due to their robust construction and long-term reliability. These materials offer superior strength, ensuring that the stroller remains structurally sound even with frequent use, thereby enhancing infant safety and comfort. As more parents focus on longevity and sturdiness when selecting strollers, the demand for metallic frames is gaining momentum, making them a preferred choice for high-end baby gear.

The market is also segmented by product type into full-size strollers, lightweight strollers, jogging strollers, double strollers, travel systems, frame strollers, and others. The lightweight stroller segment dominated the market, with a valuation of USD 461.3 million in 2023, and is estimated to reach USD 735.9 million by 2032. The soaring popularity of lightweight strollers stems from their portability, compactness, and ease of maneuverability, which perfectly cater to urban parents managing busy schedules. Designed to fold easily and carry conveniently, these strollers have become essential for city living and travel, especially in crowded spaces where bulkier strollers pose challenges.

The U.S. baby stroller and pram market generated USD 362.1 million in 2023 and is forecasted to grow at a CAGR of 5.5% between 2024 and 2032. The U.S. leads globally due to higher consumer spending power, urban living trends, and a strong preference for premium, safety-certified baby products. The increasing availability of motorized and high-tech strollers, supported by advanced retail channels, is further amplifying market growth. Heightened parental focus on child safety regulations is encouraging the adoption of strollers equipped with enhanced safety and ergonomic features, driving continued demand across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising urbanization and increasing disposable income

- 3.2.1.2 Growing awareness of infant safety and comfort

- 3.2.1.3 Expansion of e-commerce and digital marketing strategies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of premium and advanced strollers

- 3.2.2.2 Stringent safety regulations and compliance challenges

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Consumer behavior analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2032, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Lightweight strollers

- 5.3 Full-size strollers

- 5.4 Jogging strollers

- 5.5 Travel systems

- 5.6 Double strollers

- 5.7 Frame strollers

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Frame Material, 2021 – 2032, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Metallic

- 6.3 Nonmetallic

Chapter 7 Market Estimates & Forecast, By Age Group, 2021 – 2032, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 0-6 months

- 7.3 6-12 months

- 7.4 12-36 months

- 7.5 Above 36 months

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2032, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2032, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce websites

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2032, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Britax

- 11.2 Bugaboo

- 11.3 Chicco

- 11.4 Dorel

- 11.5 Evenflo

- 11.6 Goodbaby

- 11.7 Graco

- 11.8 Joie

- 11.9 Joovy

- 11.10 Maclaren

- 11.11 Mamas & Papas

- 11.12 Maxi-Cosi

- 11.13 Peg Perego

- 11.14 Silver Cross

- 11.15 UPPAbaby