|

市场调查报告书

商品编码

1721494

高频宽记忆体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High Bandwidth Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

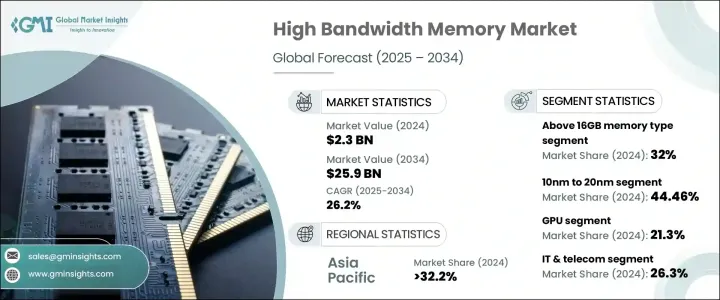

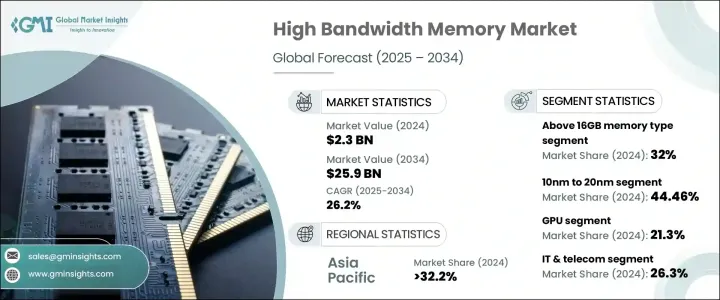

2024 年全球高频宽记忆体市场价值为 23 亿美元,预计到 2034 年将以 26.2% 的复合年增长率成长,达到 259 亿美元。全球向以数据为中心的技术的转变正在重塑记忆体解决方案的格局,高频宽记忆体正在成为更快资料处理和节能运算的关键推动因素。随着各行业的组织竞相采用下一代技术,对高速、低延迟记忆体的需求显着增加。

人工智慧 (AI)、机器学习 (ML)、进阶驾驶辅助系统 (ADAS) 和 5G 网路的影响力日益增强,持续推动对强大记忆体技术的需求。企业严重依赖 HBM 来支援巨量资料、高解析度成像、即时分析和深度学习工作负载。随着汽车、医疗保健、金融服务和媒体等领域的数位转型加速,HBM 解决方案正迅速成为开发更智慧、更快速、更互联的系统的基础。世界各地的公司纷纷投资尖端创新和扩大製造能力,以在这个快速发展的领域中保持竞争力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 259亿美元 |

| 复合年增长率 | 26.2% |

市场依技术节点细分为 10nm 以下、10nm 至 20nm 和 20nm 以上。 10nm 至 20nm 类别在 2024 年的价值为 10 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 26.7%。该节点已被证明非常适合需要平衡效能和成本效益的应用,例如汽车电子、物联网设备和中端消费产品。它的可扩展性,加上高产量生产和可靠的热管理,使其成为旨在优化性能而不增加製造成本的开发人员的首选。

根据应用,高频宽记忆体市场分为 GPU、CPU、FPGA、ASIC、AI、ML、HPC、网路和资料中心。受专业和沈浸式游戏生态系统需求飙升的推动,GPU 领域将在 2024 年占据 21.3% 的份额。随着超高清图形、即时渲染和扩展现实环境成为主流,图形处理单元正在整合 HBM3E 等先进的 HBM 技术,以满足不断增长的频宽需求。这种趋势在游戏和动画领域尤其突出,因为快速的刷新率和灵敏的用户体验至关重要。

2024 年,亚太地区以 32.2% 的市占率领先全球市场。同时,受云端和资料中心基础设施的数位现代化推动,同年美国高频宽记忆体市场价值达到 5.23 亿美元。该国拥有大量的资料中心,是 HBM 应用的主导力量,即时资料分析和边缘运算应用为加速部署铺平了道路。

全球高频宽记忆体市场的领导者包括 Cadence Design Systems, Inc.、Advanced Micro Devices, Inc. (AMD)、Broadcom Inc.、GlobalFoundries Inc.、IBM Corporation、Fujitsu Limited 和 Infineon Technologies AG。这些公司正在大力投资研发,以提高其 HBM 产品的速度、可扩展性和效率。人工智慧、游戏和半导体领域的战略联盟进一步支持了他们的全球扩张努力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商矩阵

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 产业衝击力

- 成长动力

- 数据密集型应用的扩展

- 高效能运算的成长

- 下一代平台集成

- 增强的游戏和图形需求

- 资料中心和云端服务的扩展

- 产业陷阱与挑战

- 生产成本高

- 技术整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 监管格局

第四章:市场估计与预测:按记忆体容量,2021 年至 2034 年

- 主要趋势

- 小于4GB

- 4GB 至 8GB

- 8GB 至 16GB

- 16GB以上

第五章:市场估计与预测:按技术节点,2021 年至 2034 年

- 主要趋势

- 10奈米以下

- 10奈米至20奈米

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 图形处理单元 (GPU)

- 中央处理器 (CPU)

- 现场可程式闸阵列(FPGA)

- 专用积体电路(ASIC)

- 人工智慧(AI)和机器学习(ML)

- 高效能运算 (HPC)

- 网路与资料中心

- 其他的

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- IT与电信

- 游戏和娱乐

- 医疗保健与生命科学

- 汽车

- 军事与国防

- 其他的

第八章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 日本

- 中国

- 印度

- 韩国

- 澳新银行

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 阿联酋

- 沙乌地阿拉伯

第九章:公司简介

- Advanced Micro Devices, Inc. (AMD)

- Broadcom Inc.

- Cadence Design Systems, Inc.

- Fujitsu Limited

- GlobalFoundries Inc.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Marvell Technology Group Ltd.

- Micron Technology, Inc.

- Nanya Technology Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Rambus Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Synopsys, Inc.

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Toshiba Corporation

The Global High Bandwidth Memory Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 26.2% to reach USD 25.9 billion by 2034. The global shift toward data-centric technologies is reshaping the landscape of memory solutions, with high bandwidth memory emerging as a critical enabler for faster data processing and energy-efficient computing. As organizations across various sectors race to adopt next-generation technologies, the demand for high-speed, low-latency memory has seen a notable surge.

The growing influence of artificial intelligence (AI), machine learning (ML), advanced driver-assistance systems (ADAS), and 5G networks continues to fuel demand for powerful memory technologies. Enterprises are leaning heavily on HBM to support big data, high-resolution imaging, real-time analytics, and deep learning workloads. With digital transformation accelerating in sectors like automotive, healthcare, financial services, and media, HBM solutions are rapidly becoming foundational to the development of smarter, faster, and more connected systems. Companies worldwide are responding by investing in cutting-edge innovations and expanding manufacturing capabilities to stay competitive in this rapidly evolving space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 26.2% |

The market is segmented by technology node into below 10nm, 10nm to 20nm, and above 20nm. The 10nm to 20nm category accounted for USD 1 billion in 2024 and is projected to grow at a CAGR of 26.7% between 2025 and 2034. This node has proven ideal for applications requiring balanced performance and cost-efficiency, such as automotive electronics, IoT devices, and mid-range consumer products. Its scalability, coupled with high-yield production and reliable thermal management, continues to make it a go-to option for developers aiming to optimize performance without inflating manufacturing costs.

Based on application, the high bandwidth memory market is categorized into GPUs, CPUs, FPGAs, ASICs, AI, ML, HPC, networking, and data centers. The GPU segment captured a 21.3% share in 2024, supported by soaring demand in professional and immersive gaming ecosystems. As ultra-high-definition graphics, real-time rendering, and extended reality environments become mainstream, graphics processing units are integrating advanced HBM technologies such as HBM3E to meet rising bandwidth needs. This trend is particularly prominent in the gaming and animation sectors, where rapid refresh rates and responsive user experiences are essential.

The Asia Pacific region led the global market with a 32.2% share in 2024. Meanwhile, the U.S. high bandwidth memory market was valued at USD 523 million in the same year, driven by the digital modernization of cloud and data center infrastructures. The country's vast number of data centers makes it a dominant force in HBM adoption, with real-time data analytics and edge computing applications paving the way for accelerated deployment.

Leading players in the global high bandwidth memory market include Cadence Design Systems, Inc., Advanced Micro Devices, Inc. (AMD), Broadcom Inc., GlobalFoundries Inc., IBM Corporation, Fujitsu Limited, and Infineon Technologies AG. These companies are investing heavily in R&D to boost the speed, scalability, and efficiency of their HBM offerings. Strategic alliances across AI, gaming, and semiconductor sectors further support their global expansion efforts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Expansion of Data-Intensive Applications

- 3.7.1.2 Growth of High-Performance Computing

- 3.7.1.3 Next-Generation Platform Integration

- 3.7.1.4 Enhanced gaming and graphics demand

- 3.7.1.5 Expansion of the data center and cloud services

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High Production Costs

- 3.7.2.2 Technical Integration Complexity

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Memory Capacity, 2021 – 2034 ($ Mn & Bn GB)

- 4.1 Key trends

- 4.2 Less than 4GB

- 4.3 4GB to 8GB

- 4.4 8GB to 16GB

- 4.5 Above 16GB

Chapter 5 Market Estimates and Forecast, By Technology Node, 2021 – 2034 (USD Mn & Bn GB)

- 5.1 Key trends

- 5.2 Below 10nm

- 5.3 10nm to 20nm

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn & Bn GB)

- 6.1 Key trends

- 6.2 Graphics Processing Units (GPUs)

- 6.3 Central Processing Units (CPUs)

- 6.4 Field-Programmable Gate Arrays (FPGAs)

- 6.5 Application-Specific Integrated Circuits (ASICs)

- 6.6 Artificial Intelligence (AI) and Machine Learning (ML)

- 6.7 High-Performance Computing (HPC)

- 6.8 Networking and Data centers

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & Bn GB)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Gaming & entertainment

- 7.4 Healthcare & life Sciences

- 7.5 Automotive

- 7.6 Military & defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & Bn GB)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 UAE

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Advanced Micro Devices, Inc. (AMD)

- 9.2 Broadcom Inc.

- 9.3 Cadence Design Systems, Inc.

- 9.4 Fujitsu Limited

- 9.5 GlobalFoundries Inc.

- 9.6 IBM Corporation

- 9.7 Infineon Technologies AG

- 9.8 Intel Corporation

- 9.9 Marvell Technology Group Ltd.

- 9.10 Micron Technology, Inc.

- 9.11 Nanya Technology Corporation

- 9.12 NVIDIA Corporation

- 9.13 Qualcomm Incorporated

- 9.14 Rambus Inc.

- 9.15 Samsung Electronics Co., Ltd.

- 9.16 SK Hynix Inc.

- 9.17 Synopsys, Inc.

- 9.18 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 9.19 Toshiba Corporation