|

市场调查报告书

商品编码

1871138

超音波食品加工技术市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Ultrasonic Food Processing Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

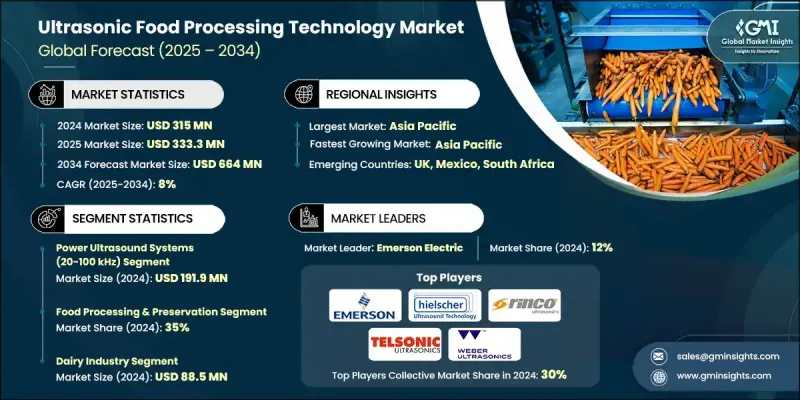

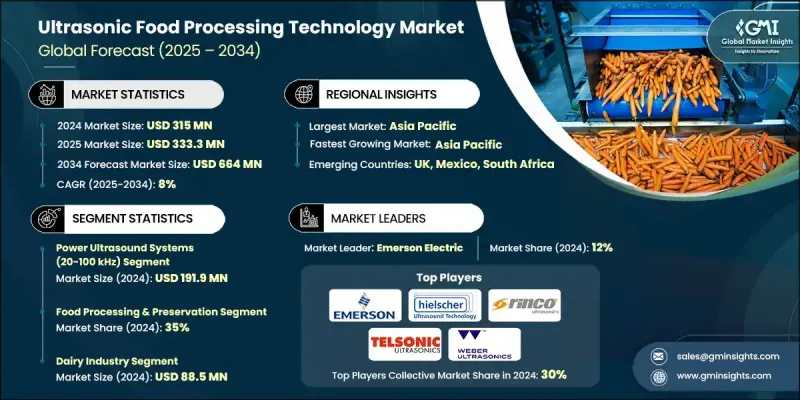

2024 年全球超音波食品加工技术市场价值为 3.15 亿美元,预计到 2034 年将以 8% 的复合年增长率增长至 6.64 亿美元。

随着消费者在不牺牲品质的前提下,更加重视食品安全、营养和保质期,非热加工方法的日益普及正在重塑食品製造的趋势。超音波加工、高压处理和脉衝电场等技术因其能够在满足监管安全标准的同时保持食品的感官和营养特性而得到更广泛的认可。随着消费者对食品污染的担忧日益加剧,以及对可追溯和卫生加工食品的需求不断增长,製造商正在投资开发符合严格全球安全准则的创新加工系统。为了应对不断变化的出口标准和消费者期望,生产商越来越多地采用超音波技术来提高生产效率并确保合规性。这些系统有助于满足产业对清洁标籤产品、更高加工效率和永续生产实践日益增长的需求。将超音波设备整合到更广泛的食品技术生态系统中,也正在简化生产线的运营,尤其是在拥有先进食品製造基础设施的地区。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.15亿美元 |

| 预测值 | 6.64亿美元 |

| 复合年增长率 | 8% |

2024年,工作频率在20-100 kHz范围内的功率超音波系统市场规模达到1.919亿美元。这些系统在乳化、均质和萃取等传质操作中发挥着至关重要的作用。超音波系统利用空化效应,促进有价值的生物活性化合物、营养成分和风味物质的释放,使其在植物和动物性原料的加工中高效发挥作用。尤其在生产高产乳化产品方面,超音波系统的优势更为显着,因为此类产品的一致性和品质至关重要。

2024年,食品加工和保藏领域占35%的市场。随着製造商优先采用能够保持食品营养完整性和理想感官特性的技术,该领域正在快速成长。随着消费者需求转向最少加工、功能性丰富的食品,超音波处理、冷冻干燥和真空包装等方法正日益普及。这些技术有助于延长保存期限,同时保留原料的功能价值。

2024年,美国超音波食品加工技术市场占75.6%的市场份额,市场规模达8,380万美元。这一领先地位源自于美国对食品创新、数位转型以及遵守食品安全法规的高度重视。随着北美地区不断采用自动化和数位追踪解决方案,大型和中型食品生产企业对先进加工技术的需求日益增长。该地区对清洁标籤产品开发和延长保质期的关注,正促使製造商转向非热加工方法以增强竞争力。

全球超音波食品加工技术市场的主要参与者包括Dukane、Telsonic、FoodTools、Cavitus、Emerson Electric、Herrmann Ultrasonics、Weber Ultrasonics、Hielscher Ultrasonics、AERZEN、Marchant Schmidt、Ultrasonic Power、MS Ultrasonic Technology Group、Innovative Ultrasonics、RerialO ULSSON、SSONS、VN週,Ojexsonics、RerialO ULSchanges。为了巩固其在超音波食品加工技术市场的地位,领导企业正致力于开发针对不同食品类别的特定应用超音波系统。许多企业正在拓展全球分销网络,增加製造商数量,并与原始设备製造商 (OEM) 和食品製造商建立战略合作伙伴关係,同时投资于自动化集成,以实现工厂的无缝运作。此外,企业也着重提升空化控制和功率效率,以最大限度地提高产量和一致性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对非热加工的需求不断增长

- 食品安全与卫生要求

- 植物性及功能性食品的成长

- 产业陷阱与挑战

- 高昂的初始投资成本

- 可扩展性问题

- 机会

- 与自动化和智慧製造的集成

- 拓展至植物性与功能性食品领域

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依技术类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依技术类型划分,2021-2034年

- 主要趋势

- 功率超音波系统(20-100 kHz)

- 声化学系统(100 kHz-1 MHz)

- 诊断超音波系统(1-10 MHz)

- 混合超音波系统

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 食品加工与保藏

- 萃取与分离

- 均质化和乳化

- 切割和密封

- 清洁与消毒

- 品质控制与分析

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 乳製品业

- 肉类和海鲜加工

- 饮料业

- 烘焙食品和糖果

- 包装产业

- 食品配料和添加剂

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Cavitus

- Dukane

- Emerson Electric

- FoodTools

- Herrmann Ultrasonics

- Hielscher Ultrasonics

- Innovative Ultrasonics

- Marchant Schmidt

- MS Ultrasonic Technology Group

- RINCO ULTRASONICS

- Sonics & Materials

- Sonimat

- Telsonic

- Ultrasonic Power

- Weber Ultrasonics

The Global Ultrasonic Food Processing Technology Market was valued at USD 315 million in 2024 and is estimated to grow at a CAGR of 8% to reach USD 664 million by 2034.

The growing popularity of non-thermal processing methods is reshaping food manufacturing trends, as consumers prioritize food safety, nutrition, and shelf life without compromising on quality. Technologies such as ultrasonic processing, high-pressure treatment, and pulsed electric fields are becoming more widely accepted due to their ability to maintain sensory and nutritional properties while meeting regulatory safety standards. With rising consumer concerns over contamination and the demand for traceable and hygienically processed food, manufacturers are investing in innovative processing systems that meet strict global safety guidelines. In response to evolving export standards and consumer expectations, producers are increasingly turning to ultrasonic technology to improve productivity and ensure compliance. These systems help meet the industry's growing need for clean-label products, enhanced processing efficiency, and sustainable production practices. The integration of ultrasonic equipment into broader food tech ecosystems is also streamlining operations across production lines, especially in regions with advanced food manufacturing infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $315 Million |

| Forecast Value | $664 Million |

| CAGR | 8% |

The power ultrasound systems operating within the 20-100 kHz range segment generated USD 191.9 million in 2024. These systems play a critical role in boosting mass transfer operations such as emulsification, homogenization, and extraction. By leveraging cavitation effects, ultrasonic systems facilitate the release of valuable bioactive compounds, nutrients, and flavors, making them highly effective in processing plant- and animal-based materials. Their benefits are especially notable in producing high-yield emulsified products, where consistency and quality are key.

The food processing and preservation segment held 35% share in 2024. This segment is expanding rapidly as manufacturers prioritize techniques that preserve nutritional integrity and maintain desirable sensory attributes in food products. As consumer demand shifts toward minimally processed, functionally rich foods, methods like ultrasonic treatment, freeze-drying, and vacuum packaging are gaining ground. These techniques are instrumental in extending shelf life while retaining the functional value of ingredients.

U.S. Ultrasonic Food Processing Technology Market held 75.6% share and generated USD 83.8 million in 2024. This leadership position stems from a strong emphasis on food innovation, digital transformation, and compliance with food safety mandates. As North America continues to embrace automation and digitized tracking solutions, demand for advanced processing technologies is rising across both large-scale and mid-tier food production facilities. The region's focus on clean-label product development and longer shelf stability is pushing manufacturers toward non-thermal methods for enhanced competitiveness.

Key players operating in the Global Ultrasonic Food Processing Technology Market include Dukane, Telsonic, FoodTools, Cavitus, Emerson Electric, Herrmann Ultrasonics, Weber Ultrasonics, Hielscher Ultrasonics, AERZEN, Marchant Schmidt, Ultrasonic Power, MS Ultrasonic Technology Group, Innovative Ultrasonics, RINCO ULTRASONICS, Sonimat, and Sonics & Materials. To strengthen their position in the Ultrasonic Food Processing Technology Market, leading companies are focusing on developing application-specific ultrasonic systems tailored to different food product categories. Many are expanding global distribution networks, net manufacturers and strategic partnerships with OEMs and food manufacturers and investing in automation integration for seamless plant operations. Emphasis is also placed on advancing cavitation control and power efficiency to maximize yield and consistency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-thermal processing

- 3.2.1.2 Food safety & hygiene requirements

- 3.2.1.3 Growth in plant-based & functional foods

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Scalability issues

- 3.2.3 Opportunities

- 3.2.3.1 Integration with automation & smart manufacturing

- 3.2.3.2 Expansion into plant-based and functional foods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Power ultrasound systems (20-100 khz)

- 5.3 Sonochemistry systems (100 khz-1 mhz)

- 5.4 Diagnostic ultrasound systems (1-10 mhz)

- 5.5 Hybrid ultrasonic systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Food processing & preservation

- 6.3 Extraction & separation

- 6.4 Homogenization & emulsification

- 6.5 Cutting & sealing

- 6.6 Cleaning & sanitization

- 6.7 Quality control & analysis

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Dairy industry

- 7.3 Meat & seafood processing

- 7.4 Beverage industry

- 7.5 Bakery & confectionery

- 7.6 Packaging industry

- 7.7 Food ingredients & additives

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cavitus

- 9.2 Dukane

- 9.3 Emerson Electric

- 9.4 FoodTools

- 9.5 Herrmann Ultrasonics

- 9.6 Hielscher Ultrasonics

- 9.7 Innovative Ultrasonics

- 9.8 Marchant Schmidt

- 9.9 MS Ultrasonic Technology Group

- 9.10 RINCO ULTRASONICS

- 9.11 Sonics & Materials

- 9.12 Sonimat

- 9.13 Telsonic

- 9.14 Ultrasonic Power

- 9.15 Weber Ultrasonics