|

市场调查报告书

商品编码

1871180

汽车资料记录与分析硬体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Data Logging and Analytics Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

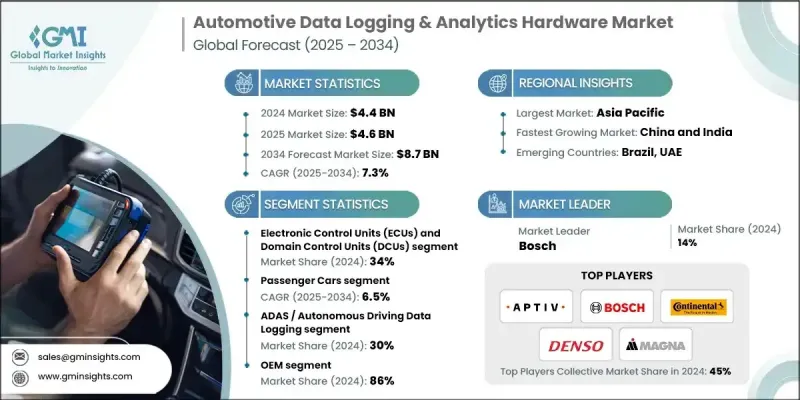

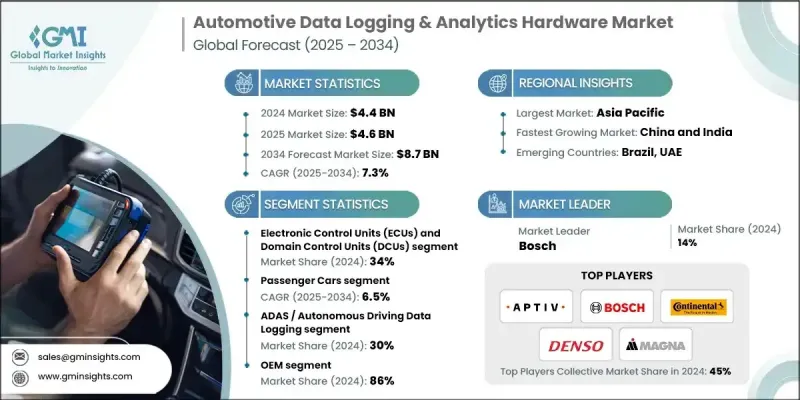

2024 年全球汽车数据记录与分析硬体市场价值为 44 亿美元,预计到 2034 年将以 7.3% 的复合年增长率成长至 87 亿美元。

汽车产业正经历一场由车辆电气化、自动化和互联出行驱动的根本变革。这项变革的核心在于对资料记录和分析硬体日益增长的依赖,这对于提升性能、确保合规性和提高车辆安全至关重要。世界各国政府正在实施更严格的法规,要求车辆配备资料记录系统,以确保透明度和可追溯性。向软体定义车辆 (SDV) 的转型正在重塑对能够处理空中升级、生命週期管理和即时遥测的硬体的需求。遵守全球安全和网路安全标准,例如联合国欧洲经济委员会 (UNECE) 的 R155 和 R156 法规,正迫使汽车製造商采用安全、高效能的资料记录平台。人工智慧和边缘运算在现代车辆中的快速应用,使得感测器产生的资料能够更快地进行本地处理。如今,先进的资料记录系统预计每天能够捕获 TB 级的信息,同时保持超过 1.2 GB/s 的网路吞吐量,并在 30 多个通道之间实现精确同步,这进一步巩固了它们在汽车生态系统中的关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 7.3% |

到2024年,电子控制单元(ECU)和域控制单元(DCU)市占率将达到34%。汽车设计正日益从分散式ECU转向集中式域架构,以实现资料记录功能的高阶整合。这些系统需要管理多种通讯协定、确保资料安全并快速处理资讯。全球标准下网路安全框架的采用,正在推动配备安全硬体模组、防篡改日誌记录和认证系统启动的ECU的部署,以确保资料完整性。

到2024年,ADAS(进阶驾驶辅助系统)和自动驾驶数据记录领域将占据30%的市场。下一代车辆中先进感测器和即时计算技术的日益集成,正在加速对复杂资料记录解决方案的需求。自动驾驶和半自动驾驶技术的不断发展,需要同时对雷达、光达和摄影机系统进行高速、多通道资料收集。这有助于对自动驾驶演算法进行精确分析和验证,从而支持车辆安全和自动驾驶领域的持续创新。

2024年,中国汽车数据记录与分析硬体市场占据了显着份额,这得益于其庞大的汽车生产基地和对智慧互联的高度重视。政府主导的智慧网联汽车技术推广措施强化了即时车辆资料撷取和集中管理的标准。国家智慧汽车发展策略下的各项政策加速了先进数据记录硬体的部署,确保了车队的安全合规性、自动化和资料可追溯性。

引领全球汽车数据记录与分析硬体市场的关键企业包括大陆集团、电装、采埃孚、安波福、现代摩比斯、李尔、博世、麦格纳、法雷奥和Vector Informatik。这些领导企业正致力于创新、合作和产品多元化,以巩固其市场地位。许多企业正在投资开发高速、人工智慧赋能的硬体解决方案,以管理自动驾驶和连网车辆产生的复杂资料流。与汽车製造商和技术提供商的策略合作正在推动即时分析、网路安全和边缘处理领域的进步。此外,各企业也正在增强研发能力,以设计模组化、可扩展的硬件,从而与不断发展的软体定义车辆架构相容。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- ADAS和自动驾驶系统的应用日益普及

- 电动车(EV)和电池管理系统的扩展

- 车队数位化和预测性维护的日益普及

- 软体定义车辆 (SDV) 的采用

- 产业陷阱与挑战

- 先进日誌记录硬体成本高昂

- 硬体-软体整合的复杂性

- 市场机会

- 连网汽车基础设施的扩展

- 售后改装解决方案的成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利分析

- 永续性和环境方面

- 碳足迹评估

- 循环经济一体化

- 电子垃圾管理要求

- 绿色製造倡议

- 用例和应用

- 最佳情况

- 价格分析及趋势

- 历史价格演变(2019-2024)

- 零件价格通膨的影响

- 半导体短缺对成本的影响

- 批量定价策略

- 区域价格差异

- 未来价格预测(2025-2034 年)

- 全球贸易分析

- 进出口量及价值分析

- 主要出口国

- 主要进口市场

- 贸易流模式及依存关係

- 关税影响分析

- 供应链中断的影响

- 原料及成分分析

- 半导体材料要求

- 稀土元素依赖性

- 塑胶和金属外壳材料

- 电池和电源管理组件

- 材料价格波动的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 电子控制单元(ECU)和域控制单元(DCU)

- 车载资讯控制单元 (TCU) 和连接硬体

- 感测器介面和数据采集硬体

- 网关和网路硬体

- 其他的

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- ADAS/自动驾驶资料记录

- 车队管理和远端资讯处理

- 电动车电池管理

- 软体定义车辆 (SDV) 支持

- 其他的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Aptiv

- Bosch

- Continental

- Denso

- Harman International (Samsung)

- Lear

- Magna

- Panasonic Automotive Systems

- Valeo

- ZF Friedrichshafen

- 区域玩家

- Geotab

- Vector Informatik

- Verizon Connect

- Webfleet Solutions

- 技术专家和新兴企业

- Intrepid Control Systems

- IPETRONIK

- National Instruments

- Samsara

- Spireon

- Trimble

- Asian Market Leaders

- BYD Electronic

- Huawei Technologies

- Hyundai Mobis

- LG Electronics

- Pioneer

- Fleet Management Specialists

- Azuga

- Fleet Complete

- Omnitracs

The Global Automotive Data Logging & Analytics Hardware Market was valued at USD 4.4 Billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 8.7 Billion by 2034.

The automotive industry is undergoing a fundamental transformation driven by vehicle electrification, automation, and connected mobility. At the core of this evolution lies the increasing reliance on data logging and analytics hardware, which is essential for enhancing performance, ensuring compliance, and improving vehicle safety. Governments worldwide are enforcing stricter regulations that require data logging systems in vehicles to ensure transparency and traceability. The transition toward software-defined vehicles (SDVs) is reshaping the demand for hardware capable of handling over-the-air updates, lifecycle management, and real-time telemetry. Compliance with global safety and cybersecurity standards, such as UNECE Regulations R155 and R156, is compelling automakers to adopt secure, high-performance data recording platforms. The rapid adoption of AI and edge computing in modern vehicles allows for faster local processing of sensor-generated data. Advanced data logging systems are now expected to capture terabytes of information daily while maintaining network throughput exceeding 1.2 GB/s and precise synchronization across more than 30 channels, reinforcing their critical role in the automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.3% |

The Electronic Control Units (ECUs) and Domain Control Units (DCUs) segment held a share of 34% in 2024. Automotive design is increasingly shifting from distributed ECUs to centralized domain architectures that enable advanced integration of data logging features. These systems are required to manage multiple communication protocols, ensure data protection, and process information rapidly. The adoption of cybersecurity frameworks under global standards is encouraging the implementation of ECUs equipped with secure hardware modules, tamper-resistant logging, and authenticated system booting to ensure data integrity.

The ADAS and Autonomous Driving Data Logging segment accounted for a 30% share in 2024. The growing integration of advanced sensors and real-time computing in next-generation vehicles is accelerating demand for sophisticated data logging solutions. The continuous evolution of autonomous and semi-autonomous technologies necessitates high-speed, multi-channel data capture across radar, LiDAR, and camera systems simultaneously. This enables accurate analysis and validation of automated driving algorithms, supporting ongoing innovation in vehicle safety and autonomy.

China Automotive Data Logging & Analytics Hardware Market generated a significant share in 2024, owing to its extensive automotive production base and strong emphasis on intelligent connectivity. Government-led initiatives promoting intelligent and connected vehicle technologies have reinforced standards for real-time vehicle data collection and centralized management. Policies under the national intelligent vehicle development strategy accelerate the deployment of advanced logging hardware, ensuring safety compliance, automation, and data traceability across fleets.

Key companies shaping the Global Automotive Data Logging & Analytics Hardware Market include Continental, Denso, ZF Friedrichshafen, Aptiv, Hyundai Mobis, Lear, Bosch, Magna, Valeo, and Vector Informatik. Leading companies in the Automotive Data Logging & Analytics Hardware Market are focusing on innovation, partnerships, and product diversification to strengthen their market position. Many are investing in developing high-speed, AI-enabled hardware solutions capable of managing complex data streams generated by autonomous and connected vehicles. Strategic collaborations with automakers and technology providers are fostering advancements in real-time analytics, cybersecurity, and edge processing. Companies are also enhancing their R&D capabilities to design modular, scalable hardware compatible with evolving software-defined vehicle architectures.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of ADAS and autonomous driving systems

- 3.2.1.2 Expansion of electric vehicles (EVs) and battery management systems

- 3.2.1.3 Growing fleet digitization and predictive maintenance

- 3.2.1.4 Software-defined vehicle (SDV) adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced logging hardware

- 3.2.2.2 Complexity in hardware-software integration

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of connected vehicle infrastructure

- 3.2.3.2 Growth of aftermarket retrofit solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Carbon footprint assessment

- 3.9.2 Circular economy integration

- 3.9.3 E-Waste management requirements

- 3.9.4 Green manufacturing initiatives

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Pricing analysis & trends

- 3.12.1 Historical price evolution (2019-2024)

- 3.12.2 Component price inflation impact

- 3.12.3 Semiconductor shortage cost impact

- 3.12.4 Volume pricing strategies

- 3.12.5 Regional price variations

- 3.12.6 Future price projections (2025-2034)

- 3.13 Global trade analysis

- 3.13.1 Import/Export volume & value analysis

- 3.13.2 Major exporting countries

- 3.13.3 Major importing markets

- 3.13.4 Trade flow patterns & dependencies

- 3.13.5 Tariff impact analysis

- 3.13.6 Supply chain disruption effects

- 3.14 Raw Material & component analysis

- 3.14.1 Semiconductor material requirements

- 3.14.2 Rare earth elements dependency

- 3.14.3 Plastic & metal housing materials

- 3.14.4 Battery & power management components

- 3.14.5 Material price volatility impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Electronic Control Units (ECUs) and Domain Control Units (DCUs)

- 5.3 Telematics Control Units (TCUs) and Connectivity Hardware

- 5.4 Sensor Interface and Data Acquisition Hardware

- 5.5 Gateway and network hardware

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger Cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ADAS / Autonomous Driving Data Logging

- 7.3 Fleet management and telematics

- 7.4 EV battery management

- 7.5 Software-Defined Vehicle (SDV) Support

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Harman International (Samsung)

- 10.1.6 Lear

- 10.1.7 Magna

- 10.1.8 Panasonic Automotive Systems

- 10.1.9 Valeo

- 10.1.10 ZF Friedrichshafen

- 10.2 Regional Players

- 10.2.1 Geotab

- 10.2.2 Vector Informatik

- 10.2.3 Verizon Connect

- 10.2.4 Webfleet Solutions

- 10.3 Technology Specialists & Emerging Players

- 10.3.1 Intrepid Control Systems

- 10.3.2 IPETRONIK

- 10.3.3 National Instruments

- 10.3.4 Samsara

- 10.3.5 Spireon

- 10.3.6 Trimble

- 10.4 Asian Market Leaders

- 10.4.1 BYD Electronic

- 10.4.2 Huawei Technologies

- 10.4.3 Hyundai Mobis

- 10.4.4 LG Electronics

- 10.4.5 Pioneer

- 10.5 Fleet Management Specialists

- 10.5.1 Azuga

- 10.5.2 Fleet Complete

- 10.5.3 Omnitracs