|

市场调查报告书

商品编码

1871212

汽车网路安全半导体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Cybersecurity Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

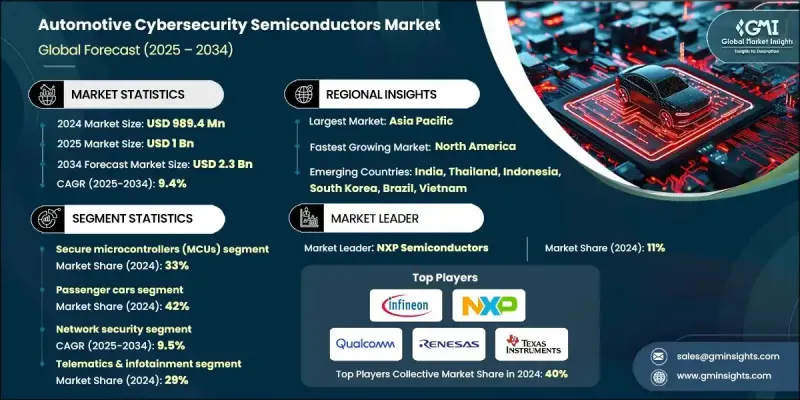

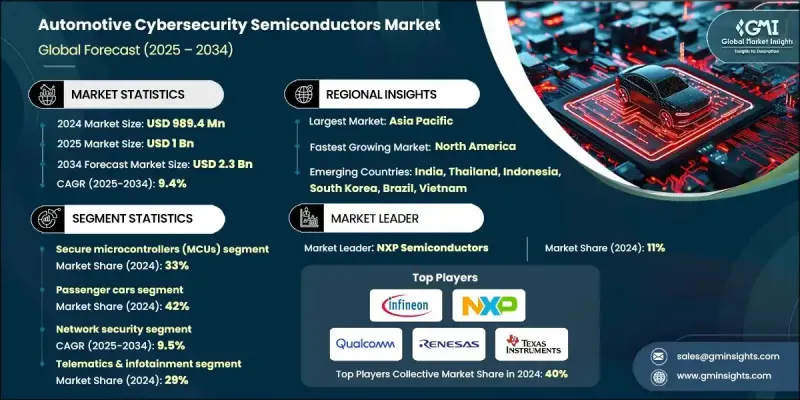

2024年全球汽车网路安全半导体市场规模为9.894亿美元,预计将以9.4%的复合年增长率成长,到2025年达到23亿美元。

2034年。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.894亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 9.4% |

随着汽车日益软体化和互联化,对内建安全功能的半导体的需求也随之增长。这些晶片对于保护汽车系统免受网路威胁至关重要,尤其是在汽车製造商转型为电气化和软体定义架构之际。先进驾驶辅助系统的日益普及以及自动驾驶技术的兴起,正在加速安全硬体组件的整合。汽车製造商正在嵌入安全网路元件、支援加密的处理器和可信任平台,以确保安全通讯、空中升级和即时入侵侦测。这些改进措施符合不断发展的监管框架,有助于遵守国际网路安全标准,同时加强车辆资料保护和系统完整性。

随着混合动力和电动车的兴起,对支援安全电池监控、充电和动力控制系统的安全型半导体的需求日益增长。下一代汽车需要高度可扩展且智慧的积体电路,以在资讯娱乐、诊断和远端软体管理功能方面提供无缝的安全保障。晶片製造商正在投资人工智慧赋能的网路威胁侦测技术,并提升半导体产品的耐热性和耐用性,以满足汽车级可靠性要求。供应商正在扩展产品组合,以满足乘用车和商用车应用的需求,同时专注于模组化、能源优化和合规性,从而为整个行业创造价值。

2024年,安全微控制器(MCU)市占率达到33%,预计2025年至2034年间将以9.5%的复合年增长率成长。这些MCU透过整合安全启动、身份验证和加密功能,为通讯介面、控制单元和车辆电子设备提供必要的硬体级保护。随着互联、电动化和自动驾驶汽车平台的兴起,安全MCU的需求正在迅速增长。围绕汽车网路安全的监管要求正促使原始设备製造商(OEM)和供应商采用防篡改和加密功能的组件,使安全MCU成为现代汽车架构的基础。

2024年乘用车市占率达42%,预计到2034年将以9.8%的复合年增长率成长。互联汽车和软体定义汽车的日益普及促使汽车製造商在资讯娱乐系统、高级驾驶辅助系统(ADAS)和车联网(V2O)通讯中部署先进的基于半导体的安全保护系统。安全启动功能、硬体加密和嵌入式入侵侦测系统正整合到电子控制单元(ECU)中,以保护车辆网路。随着个人车辆采用更复杂的数位平台,对车载网路安全的需求也不断增长。

预计到2024年,亚太地区汽车网路安全半导体市场将占42%的份额,其中中国市场规模将达到1.761亿美元。强劲的数位化趋势、ADAS功能的快速部署以及电动车产量的不断增长正在推动该地区市场的成长。由于高额的研发投入、在地化的半导体製造以及OEM厂商与网路安全技术供应商之间更紧密的合作,亚太地区正经历着显着的进步。中国市场的成长尤其强劲,这得益于其有利的政策框架以及互联和自动驾驶出行生态系统中安全通讯模组的日益普及。

汽车网路安全半导体市场的主要公司包括三星电子、微芯科技、恩智浦半导体、英飞凌科技、德州仪器、义法半导体、瑞萨电子、大陆集团、高通科技和安森美半导体。这些公司优先发展基于硬体的安全功能,例如安全启动机制、即时入侵侦测和加密模组。对人工智慧驱动的威胁侦测引擎的战略投资正在增强晶片架构的韧性。领先企业正在调整其产品组合,使其符合全球网路安全合规标准,并为乘用车和商用车开发可扩展的平台。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 车辆互联性和数位化程度不断提高

- 自动驾驶和ADAS技术的扩展

- 采用软体定义及集中式车辆架构

- 电动车和混合动力车(EV 和 HEV)的成长

- 网路威胁的频率和复杂性日益增加

- 产业陷阱与挑战

- 跨多个ECU和域的网路安全整合具有高度复杂性

- 全球网路安全法规不断演变且日益分散。

- 市场机会

- 与连网和自动驾驶汽车平台集成

- 电动车和混合动力车(EV 和 HEV)的普及率不断提高

- 人工智慧驱动和抗量子安全技术的进步

- 对安全无线 (OTA) 更新和云端连线的需求不断增长

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 定价分析与成本结构动态

- 历史价格趋势分析(2021-2024)

- 按组件分類的成本明细

- 製造成本结构分析

- 研发投资对定价的影响

- 基于销售量的定价策略

- 区域价格差异及影响因素

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 宏观经济动态影响分析

- 全球半导体短缺的影响(2021-2024 年)

- 通货膨胀和原材料成本压力

- 地缘政治贸易紧张局势与供应链中断

- 汇率波动对全球定价的影响

- 经济衰退对汽车需求的影响

- 利率变动与资本投资决策

- 微观经济动态及产业特定因素

- 汽车产量波动

- 不同OEM的技术采用率差异

- 竞争性定价压力分析

- 客户议价能力与采购策略

- 供应商集中度与市场力量动态

- 产品生命週期与技术更新周期

- 威胁情势及产业应对分析

- 新兴网路安全威胁载体

- 国家级和高阶持续性威胁

- 供应链攻击漏洞

- 零日漏洞利用风险及缓解策略

- 量子运算威胁时间线

- 产业合作防务计划

- 公司策略因应与适应策略

- 垂直整合与合作策略

- 地理多元化和近岸外包趋势

- 技术组合扩展策略

- 监理合规投资策略

- 人才招募与留任挑战

- 客户关係与锁定策略

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体安全模组(HSM)

- 安全微控制器(MCU)

- 可信任平台模组(TPM)

- 加密处理器/协处理器

- 网路安全晶片

- 可信执行环境(TEE)

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车

- 中型商用车

- 重型商用车辆

- 电动车

- 自动驾驶汽车

第七章:市场估计与预测:依证券类型划分,2021-2034年

- 主要趋势

- 网路安全

- 应用程式安全

- 云端安全

- 端点安全

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 车载资讯系统和资讯娱乐系统

- ADAS与自动驾驶系统

- 动力总成和电动车系统

- 车联网(V2X)

- 网关和区域控制器

- 空中下载 (OTA) 更新

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 葡萄牙

- 克罗埃西亚

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十章:公司简介

- Contract Manufacturers

- GlobalFoundries

- Samsung Electronics

- Taiwan Semiconductor Manufacturing Company (TSMC)

- United Microelectronics

- Integrated Device Manufacturers

- Analog Devices

- Continental

- Infineon Technologies

- Microchip Technology

- NXP Semiconductors

- ON Semiconductor

- Renesas Electronics

- STMicroelectronics

- Texas Instruments

- Fabless Semiconductor Companies

- Broadcom

- Marvell Technology

- Qualcomm Technologies

- IP Providers

- ARM Holdings

- Cadence Design Systems

- Imagination Technologies

- Synopsys

The Global Automotive Cybersecurity Semiconductors Market was valued at USD 989.4 million in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 2.3 Billion by

2034.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $989.4 Million |

| Forecast Value | $2.3 Billion |

| CAGR | 9.4% |

As vehicles become increasingly software-driven and connected, the demand for semiconductors with built-in security features is rising. These chips are essential for protecting automotive systems against cyber threats as automakers transition to electrified and software-defined architectures. The growing presence of advanced driver assistance systems and the shift toward autonomous mobility are accelerating the integration of secure hardware components. Automakers are embedding secure network elements, encryption-enabled processors, and trusted platforms to ensure secure communications, over-the-air updates, and real-time intrusion detection. These enhancements align with evolving regulatory frameworks, supporting compliance with international cybersecurity standards while strengthening vehicle data protection and system integrity.

With the rise in hybrid and electric mobility, there is a growing demand for safety-focused semiconductors that support secure battery monitoring, charging, and propulsion control systems. Next-generation vehicles require highly scalable and intelligent integrated circuits that offer seamless security across infotainment, diagnostics, and remote software management functions. Chipmakers are investing in AI-enabled cyber threat detection and improving the thermal endurance and ruggedness of semiconductor products to meet automotive-grade reliability. Vendors are expanding portfolios to address both passenger and commercial vehicle applications while also focusing on modularity, energy optimization, and compliance to drive value across the industry.

The secure microcontrollers (MCUs) segment held a 33% share in 2024 and is expected to grow at a 9.5% CAGR between 2025 and 2034. These MCUs provide essential hardware-based protections for communication interfaces, control units, and vehicle electronics by integrating secure boot, authentication, and encryption capabilities. With the rise in connected, electrified, and automated vehicle platforms, demand for secure MCUs is scaling rapidly. Regulatory mandates around automotive cybersecurity are compelling OEMs and suppliers to adopt tamper-resistant and cryptography-enabled components, making secure MCUs foundational to modern vehicle architectures.

The passenger cars segment held a 42% share in 2024 and is forecasted to grow at a CAGR of 9.8% through 2034. The growing shift toward connected and software-defined vehicles is prompting automakers to deploy advanced semiconductor-based protection systems across infotainment, ADAS, and vehicle-to-everything communications. Secure boot functions, hardware-based encryption, and embedded intrusion detection systems are being integrated into electronic control units to safeguard vehicle networks. As personal vehicles adopt more sophisticated digital platforms, the need for onboard cybersecurity continues to increase.

Asia Pacific Automotive Cybersecurity Semiconductors Market held a 42% share in 2024, with China generating USD 176.1 million. Strong digitalization trends, rapid deployment of ADAS features, and increasing EV production are propelling regional growth. Asia Pacific is witnessing significant advancements due to high R&D spending, localized semiconductor manufacturing, and stronger alliances between OEMs and cybersecurity technology providers. China's growth is particularly robust, backed by supportive policy frameworks and increasing adoption of secure communication modules across connected and autonomous mobility ecosystems.

Major companies in the Automotive Cybersecurity Semiconductors Market include Samsung Electronics, Microchip Technology, NXP Semiconductors, Infineon Technologies, Texas Instruments, STMicroelectronics, Renesas Electronics, Continental, Qualcomm Technologies, and ON Semiconductor. Companies operating in the automotive cybersecurity semiconductors sector are prioritizing innovation in hardware-based security features such as secure boot mechanisms, real-time intrusion detection, and cryptographic modules. Strategic investments in AI-driven threat detection engines are enhancing the resilience of chip architectures. Leading firms are aligning their portfolios with global cybersecurity compliance standards and developing scalable platforms for both passenger and commercial vehicles.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicles

- 2.2.4 Security

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising connectivity and digitalization of vehicles

- 3.2.1.3 Expansion of autonomous and ADAS technologies

- 3.2.1.4 Adoption of software-defined and centralized vehicle architecture

- 3.2.1.5 Growth in electric and connected vehicles (EVs and HEVs)

- 3.2.1.6 Increasing frequency and sophistication of cyber threats

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High complexity of cybersecurity integration across multiple ECUs and domains

- 3.2.2.2 Evolving and fragmented global cybersecurity regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with connected and autonomous vehicle platforms

- 3.2.3.2 Growing adoption of electric and hybrid vehicles (EVs & HEVs)

- 3.2.3.3 Advancements in AI-driven and quantum-resistant security technologies

- 3.2.3.4 Rising demand for secure over-the-air (OTA) updates and cloud connectivity

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis & cost structure dynamics

- 3.8.1 Historical price trend analysis (2021-2024)

- 3.8.2 Cost breakdown by component

- 3.8.3 Manufacturing cost structure analysis

- 3.8.4 R&D investment impact on pricing

- 3.8.5 Volume-based pricing strategies

- 3.9 Regional Price Variations & Influencing Factors

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Macro-economic dynamics impact analysis

- 3.12.1 Global semiconductor shortage impact (2021-2024)

- 3.12.2 Inflation & raw material cost pressures

- 3.12.3 Geopolitical trade tensions & supply chain disruptions

- 3.12.4 Currency fluctuation impact on global pricing

- 3.12.5 Economic recession impact on automotive demand

- 3.12.6 Interest rate changes & capital investment decisions

- 3.13 Micro-economic dynamics & industry-specific factors

- 3.13.1 Automotive production volume fluctuations

- 3.13.2 Technology adoption rate variations by OEM

- 3.13.3 Competitive pricing pressure analysis

- 3.13.4 Customer bargaining power & procurement strategies

- 3.13.5 Supplier concentration & market power dynamics

- 3.13.6 Product lifecycle & technology refresh cycles

- 3.14 Threat landscape & industry response analysis

- 3.14.1 Emerging cybersecurity threat vectors

- 3.14.2 Nation-state & advanced persistent threats

- 3.14.3 Supply chain attack vulnerabilities

- 3.14.4 Zero-day exploit risks & mitigation strategies

- 3.14.5 Quantum computing threat timeline

- 3.14.6 Industry collaborative defense initiatives

- 3.15 Company strategic response & adaptation strategies

- 3.15.1 Vertical integration vs partnership strategies

- 3.15.2 Geographic diversification & nearshoring trends

- 3.15.3 Technology portfolio expansion strategies

- 3.15.4 Regulatory compliance investment strategies

- 3.15.5 Talent acquisition & retention challenges

- 3.15.6 Customer relationship & lock-in strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hardware security modules (HSMs)

- 5.3 Secure microcontrollers (MCUs)

- 5.4 Trusted platform modules (TPMs)

- 5.5 Crypto processors / co-processors

- 5.6 Network security chips

- 5.7 Trusted execution environments (TEE)

Chapter 6 Market Estimates & Forecast, By Vehicles, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

- 6.4 Electric vehicles

- 6.5 Autonomous vehicles

Chapter 7 Market Estimates & Forecast, By Security, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Network security

- 7.3 Application security

- 7.4 Cloud security

- 7.5 Endpoint security

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Telematics & infotainment

- 8.3 ADAS & autonomous systems

- 8.4 Powertrain & EV systems

- 8.5 Vehicle-to-everything (V2X)

- 8.6 Gateway & zonal controllers

- 8.7 Over-the-Air (OTA) updates

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Contract Manufacturers

- 10.1.1 GlobalFoundries

- 10.1.2 Samsung Electronics

- 10.1.3 Taiwan Semiconductor Manufacturing Company (TSMC)

- 10.1.4 United Microelectronics

- 10.2 Integrated Device Manufacturers

- 10.2.1 Analog Devices

- 10.2.2 Continental

- 10.2.3 Infineon Technologies

- 10.2.4 Microchip Technology

- 10.2.5 NXP Semiconductors

- 10.2.6 ON Semiconductor

- 10.2.7 Renesas Electronics

- 10.2.8 STMicroelectronics

- 10.2.9 Texas Instruments

- 10.3 Fabless Semiconductor Companies

- 10.3.1 Broadcom

- 10.3.2 Marvell Technology

- 10.3.3 Qualcomm Technologies

- 10.4 IP Providers

- 10.4.1 ARM Holdings

- 10.4.2 Cadence Design Systems

- 10.4.3 Imagination Technologies

- 10.4.4 Synopsys