|

市场调查报告书

商品编码

1871285

食品酵素市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Food Enzymes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

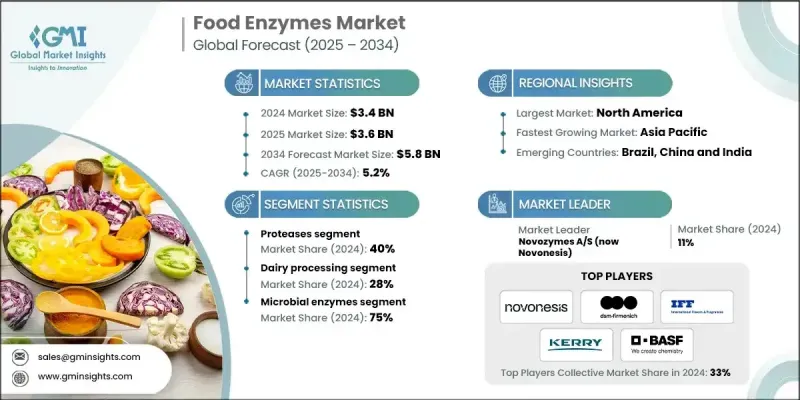

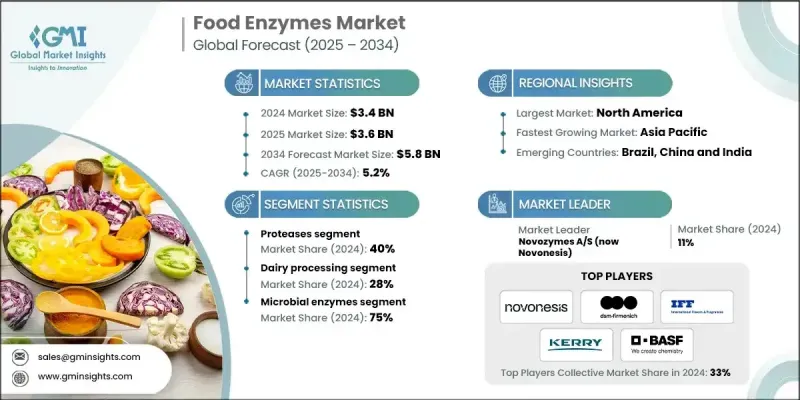

2024 年全球食品酵素市场价值为 34 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 58 亿美元。

在食品加工产业对酵素製剂解决方案需求不断增长的推动下,市场正稳步发展。酵素製剂能够提高生产效率、降低营运成本,并改善多种食品类别的产品品质。全球工业化食品製造规模的不断扩大进一步促进了这一增长,随着食品产量的增加,对加工助剂的需求自然也随之增长。此外,新兴地区对加工食品和方便食品日益增长的需求也为酵素製剂的应用开闢了新的途径。目前,酵素製剂技术的研发投入已达到历史新高,领先企业正投入大量资源进行创新。持续的研发投入确保了先进解决方案的不断涌现,从而维持了市场的长期成长,并展现出即使在经济波动中也能保持韧性的能力,这凸显了酶製剂在现代食品生产系统中的关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 58亿美元 |

| 复合年增长率 | 5.2% |

2024年,蛋白酶市场占有率达到40%,预计2034年将以4.9%的复合年增长率成长。其市场主导地位源自于其在肉类、乳製品、烘焙和酿造等加工过程中改善产品质地、消化率和整体品质的广泛应用。随着消费者对富含蛋白质和功能性食品的需求不断增长,蛋白酶的重要性也日益凸显。

2024年,乳製品加工产业占据28%的市场份额,预计2025年至2034年将以4.9%的复合年增长率成长。酵素在乳製品生产中发挥着至关重要的作用,包括乳酪製作和乳糖改性乳製品,以满足消费者对多样化营养选择日益增长的需求。先进的酵素系统能够改善风味、质地和延长保质期,其中蛋白酶和脂肪酶是生产高品质功能性乳製品的核心。

预计到2024年,北美食品酵素市场占有率将达到25%。该地区的成长得益于先进的食品加工基础设施、严格的监管框架以及消费者对酵素益处的认知不断提高。主要酵素生产商的存在,以及持续的创新和研发驱动的产品开发,进一步巩固了北美的领先地位。

全球食品酵素市场的主要参与者包括Novozenis(原Novozymes A/S)、帝斯曼-菲美意(DSM-Firmenich)、巴斯夫(BASF SE)、凯瑞集团(Kerry Group plc)、国际香料香精公司(IFF)、科汉森控股(Chr. Hansen Holzy/S)、先进酵素技术公司(IFF)、科汉森控股(Chr. Hansen Holzy/S)、先进酵素技术有限公司(ApzyS) Inc)、生物催化剂有限公司(Biocatalysts Ltd)、凯敏工业有限公司(Kemin Industries Inc)、联合英国食品公司(Associated British Foods plc)、酵素开发公司(Enzyme Development Corporation)、Maps Enzymes Ltd、Creative Enzymes、Prozomix Ltd、长濑化学株接合公司(NBioel)公司(NBiox Corporation)公司(Enconx)、Enconzy)。食品酵素市场的企业采取多种策略来巩固市场地位并扩大业务范围。他们大力投资研发,以开发具有更强功能、更高稳定性和更广泛应用的新型酵素。策略性併购和合作有助于拓展产品组合和区域市场渗透。此外,各公司也专注于製程优化、成本效益和技术整合,为工业食品加工商提供客製化解决方案。行销活动、与食品生产商的合作以及知识共享计划有助于建立品牌知名度和信任度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对清洁标籤产品的需求不断增长

- 不断提高的食品加工效率需求

- 健康意识日益增强

- 产业陷阱与挑战

- 监理合规的复杂性

- 高额研发投入需求

- 市场机会

- 植物性食品的新兴应用

- 生物技术创新管道

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 蛋白酶

- 凝乳酵素和凝乳酶

- 胃蛋白酶和胰蛋白酶

- 木瓜蛋白酶和凤梨蛋白酶

- 微生物蛋白酶

- 碳水化合物酶

- α-淀粉酶

- 葡糖淀粉酶和普鲁兰酶

- 纤维素酶和半纤维素酶

- 果胶酶和木聚醣酶

- 脂肪酶

- 动物脂肪酶

- 微生物脂肪酶

- 植物源性脂肪酶

- 植酸酶

- 微生物植酸酶

- 基因改造植酸酶

- 过氧化氢酶

- 牛肝过氧化氢酶

- 微生物过氧化氢酶

- 聚合酶和核酸酶

- DNA聚合酶

- RNA加工酶

- 其他

- 转谷氨酰胺酶

- 葡萄糖氧化酶

- 转化酶和乳糖酶

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 乳製品加工

- 乳酪生产与凝固

- 牛奶加工与改良

- 乳清加工和蛋白质回收

- 无乳糖产品开发

- 烘焙食品和糖果

- 麵团的改良和强化

- 抗老化及延长保质期

- 质地和体积改善

- 丙烯酰胺还原

- 动物饲料

- 植酸酶的应用

- 碳水化合物酶的应用

- 蛋白酶应用

- 多酵素复合物

- 饮料

- 果汁澄清与加工

- 酿造与发酵

- 葡萄酒生产与品质提升

- 运动饮料和功能饮料

- 加工食品

- 蛋白质改质与质构化

- 脂肪替代和减少

- 风味增强

- 营养强化

- 淀粉和甜味剂生产

- 葡萄糖浆生产

- 高果糖玉米糖浆(HFCS)

- 麦芽糊精和改性淀粉

- 特种甜味剂

第七章:市场估计与预测:依来源划分,2021-2034年

- 主要趋势

- 微生物酵素

- 细菌来源

- 真菌来源

- 酵母来源

- 转基因酶

- 重组凝乳酶

- 革兰氏阴性菌微生物酶

- 工程酶变体

- 植物源酵素

- 木瓜蛋白酶

- 凤梨蛋白酶

- 无花果中的无花果苷

- 动物源性酵素

- 胰臟

- 胃蛋白酶

- 动物凝乳酶

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Novozymes A/S (now Novonesis)

- DSM-firmenich

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group plc

- BASF SE

- Chr. Hansen Holding A/S

- Associated British Foods plc

- Advanced Enzyme Technologies Ltd

- Kemin Industries Inc

- Amano Enzyme Inc

- Biocatalysts Ltd

- Enzyme Development Corporation

- Maps Enzymes Ltd

- Creative Enzymes

- Prozomix Ltd

- Nagase ChemteX Corporation

- Enzyme Solutions Inc

- Biocon Ltd

The Global Food Enzymes Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.8 billion by 2034.

The market is steadily advancing, driven by the rising demand for enzyme-based solutions in the food processing industry. Enzymes enhance production efficiency, reduce operational costs, and improve product quality across multiple food categories. The growth is further supported by the expanding scale of industrial food manufacturing worldwide, where demand for processing aids naturally rises with higher food output. Additionally, the growing preference for processed and convenience foods in emerging regions creates fresh avenues for enzyme applications. Research and development investments in enzyme technologies are at an all-time high, with leading companies allocating substantial resources to innovation. Continuous R&D ensures the introduction of advanced solutions, sustaining long-term market growth and demonstrating resilience even through economic fluctuations, highlighting the essential role of enzymes in modern food production systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.2% |

The proteases segment held a 40% share in 2024 and is expected to grow at a CAGR of 4.9% by 2034. Their dominance stems from their versatile applications in enhancing texture, digestibility, and overall product quality in meat, dairy, baking, and brewing processes. Proteases continue to be vital as demand for protein-rich and functional foods expands.

The dairy processing segment held a 28% share in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Enzymes play a critical role in dairy production, including cheese-making and lactose-modified milk products, catering to the increasing consumer demand for diverse nutritional options. Advanced enzyme systems now improve flavor, texture, and shelf life, with proteases and lipases being central to producing high-quality, functional dairy products.

North America Food Enzymes Market held a 25% share in 2024. The region's growth is fueled by advanced food processing infrastructure, stringent regulatory frameworks, and consumer awareness about enzyme benefits. The presence of key enzyme manufacturers, coupled with ongoing innovation and R&D-driven product development, further strengthens North America's leadership position.

Leading players in the Global Food Enzymes Market include Novonesis (formerly Novozymes A/S), DSM-Firmenich, BASF SE, Kerry Group plc, International Flavors & Fragrances Inc. (IFF), Chr. Hansen Holding A/S, Advanced Enzyme Technologies Ltd, Amano Enzyme Inc, Biocatalysts Ltd, Kemin Industries Inc, Associated British Foods plc, Enzyme Development Corporation, Maps Enzymes Ltd, Creative Enzymes, Prozomix Ltd, Nagase ChemteX Corporation, Enzyme Solutions Inc, and Biocon Ltd. Companies in the Food Enzymes Market adopt a variety of strategies to strengthen market presence and expand their footprint. They invest heavily in research and development to create novel enzymes with enhanced functionality, improved stability, and broader application across food categories. Strategic mergers, acquisitions, and partnerships enable expansion of product portfolios and regional penetration. Firms also focus on process optimization, cost efficiency, and technology integration to provide tailored solutions for industrial food processors. Marketing initiatives, collaboration with food manufacturers, and knowledge-sharing programs help build brand recognition and trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Source

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for clean label products

- 3.2.1.2 Increasing food processing efficiency requirements

- 3.2.1.3 Rising health & wellness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory compliance complexity

- 3.2.2.2 High R&D investment requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in plant-based foods

- 3.2.3.2 Biotechnology innovation pipeline

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Proteases

- 5.2.1 Rennet & chymosin

- 5.2.2 Pepsin & trypsin

- 5.2.3 Papain & bromelain

- 5.2.4 Microbial proteases

- 5.3 Carbohydrases

- 5.3.1 Alpha-amylase

- 5.3.2 Glucoamylase & pullulanase

- 5.3.3 Cellulase & hemicellulase

- 5.3.4 Pectinase & xylanase

- 5.4 Lipases

- 5.4.1 Animal lipases

- 5.4.2 Microbial lipases

- 5.4.3 Plant-derived lipases

- 5.5 Phytases

- 5.5.1 Microbial Phytases

- 5.5.2 Genetically modified phytases

- 5.6 Catalases

- 5.6.1 Bovine liver catalase

- 5.6.2 Microbial catalases

- 5.7 Polymerases & Nucleases

- 5.7.1 DNA polymerases

- 5.7.2 RNA processing enzymes

- 5.8 Other

- 5.8.1 Transglutaminases

- 5.8.2 Glucose oxidase

- 5.8.3 Invertase & lactase

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy processing

- 6.2.1 Cheese production & coagulation

- 6.2.2 Milk processing & modification

- 6.2.3 Whey processing & protein recovery

- 6.2.4 Lactose-free product development

- 6.3 Bakery & confectionery

- 6.3.1 Dough conditioning & strengthening

- 6.3.2 Anti-staling & shelf-life extension

- 6.3.3 Texture & volume improvement

- 6.3.4 Acrylamide reduction

- 6.4 Animal feed

- 6.4.1 Phytase applications

- 6.4.2 Carbohydrase applications

- 6.4.3 Protease applications

- 6.4.4 Multi-enzyme complexes

- 6.5 Beverages

- 6.5.1 Juice clarification & processing

- 6.5.2 Brewing & fermentation

- 6.5.3 Wine production & quality enhancement

- 6.5.4 Sports & functional beverages

- 6.6 Processed foods

- 6.6.1 Protein modification & texturization

- 6.6.2 Fat replacement & reduction

- 6.6.3 Flavor enhancement

- 6.6.4 Nutritional fortification

- 6.7 Starch & sweetener production

- 6.7.1 Glucose syrup production

- 6.7.2 High fructose corn syrup (HFCS)

- 6.7.3 Maltodextrin & modified starches

- 6.7.4 Specialty sweeteners

Chapter 7 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Microbial enzymes

- 7.2.1 Bacterial sources

- 7.2.2 Fungal sources

- 7.2.3 Yeast sources

- 7.3 Genetically modified enzymes

- 7.3.1 Recombinant chymosin

- 7.3.2 Gm microbial enzymes

- 7.3.3 Engineered enzyme variants

- 7.4 Plant-derived enzymes

- 7.4.1 Papain from papaya

- 7.4.2 Bromelain from pineapple

- 7.4.3 Ficin from fig

- 7.5 Animal-derived enzymes

- 7.5.1 Pancreatin

- 7.5.2 Pepsin

- 7.5.3 Animal Rennet

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Novozymes A/S (now Novonesis)

- 9.2 DSM-firmenich

- 9.3 International Flavors & Fragrances Inc. (IFF)

- 9.4 Kerry Group plc

- 9.5 BASF SE

- 9.6 Chr. Hansen Holding A/S

- 9.7 Associated British Foods plc

- 9.8 Advanced Enzyme Technologies Ltd

- 9.9 Kemin Industries Inc

- 9.10 Amano Enzyme Inc

- 9.11 Biocatalysts Ltd

- 9.12 Enzyme Development Corporation

- 9.13 Maps Enzymes Ltd

- 9.14 Creative Enzymes

- 9.15 Prozomix Ltd

- 9.16 Nagase ChemteX Corporation

- 9.17 Enzyme Solutions Inc

- 9.18 Biocon Ltd