|

市场调查报告书

商品编码

1885877

电动车功率半导体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Power Semiconductors for EVs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

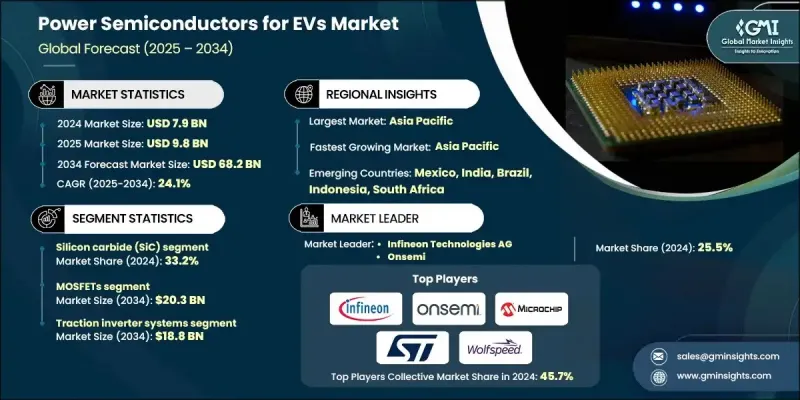

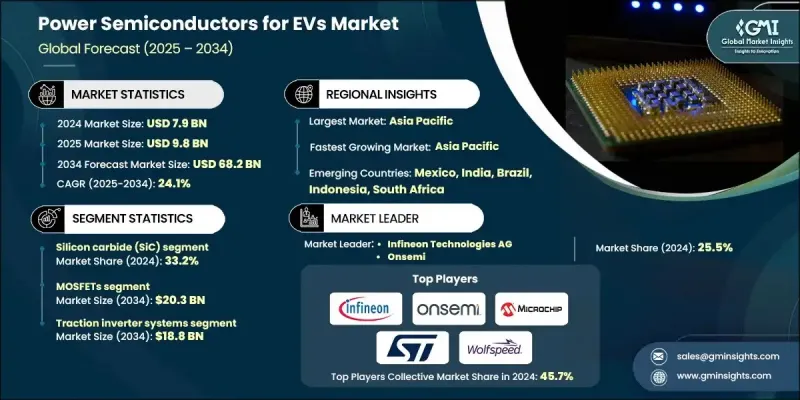

2024 年全球电动车功率半导体市场价值为 79 亿美元,预计到 2034 年将以 24.1% 的复合年增长率成长至 682 亿美元。

电动车的快速普及推动了对先进电力电子装置的巨大需求,这些装置能够支援电池系统、高速充电并优化车辆性能。 2025年第一季全球电动车销量年增35%,这反映了电气化进程的强劲势头,并凸显了功率半导体在确保高效功率转换、降低热损耗和提高系统可靠性方面的关键作用。随着电动车平台的不断发展,製造商需要能够承受高温、支援快速充电并在严苛条件下保持稳定效率的组件。这种转变持续影响着半导体生态系中的投资、技术路线图和产品升级。汽车品牌和半导体开发商之间的合作正在加速下一代材料的部署,同时建立更强大的供应链框架,以满足全球电动车产业日益增长的产量和性能需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 682亿美元 |

| 复合年增长率 | 24.1% |

预计到2024年,碳化硅(SiC)装置市场占有率将达到33.2%,主要得益于其优异的开关性能、耐热性和充电性能,SiC装置正日益受到青睐。为了提高能源效率并延长车辆续航里程,原始设备製造商(OEM)正越来越多地将SiC MOSFET整合到牵引逆变器和快速充电架构中。製造商们持续扩大SiC晶圆产能,推动垂直整合,并研发符合不同电动车平台性能要求的客製化模组。

预计到2034年,MOSFET市场规模将达到203亿美元,主要得益于车用充电器、辅助电路和DC-DC转换器等应用领域的强劲需求。生产商正致力于提升MOSFET的额定电压和热稳定性,以满足现代电动车设计中日益增长的电力负载和更高的功率密度。

2024年,美国电动车功率半导体市场规模预计将达19亿美元。近期一系列资金支持倡议,包括联邦政府对功率模组研发的支持,凸显了美国为加强充电基础建设而持续进行的努力。这种环境鼓励半导体供应商优先发展高性能碳化硅(SiC)和氮化镓(GaN)技术,并与国内汽车公司紧密合作,以应对快速充电需求和高压系统挑战。

电动车功率半导体市场的主要参与者包括英飞凌科技公司、罗姆株式会社、安森美半导体、三菱电机株式会社、瑞萨电子株式会社、微芯科技公司、义法半导体公司、Wolfspeed公司、Littelfuse公司和富士电机株式会社。为了巩固市场地位,电动车功率半导体领域的企业正在实施以扩大产能和加速材料创新为核心的策略。许多企业正在扩大碳化硅(SiC)和氮化镓(GaN)生产线,以满足电动车的长期需求,同时投资于垂直整合的供应链,以稳定晶圆供应并降低生产成本。各公司也正在设计针对OEM性能目标量身定制的应用专用模组,从而建立更强大的技术合作伙伴关係。研发工作重点在于降低开关损耗、改善散热管理以及支援更高的功率密度。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 全球电动车普及率不断提高。

- 对高效能低损耗电力电子产品的需求日益增长

- 再生能源与电动车充电基础设施的整合发展

- 策略合作加速电动车半导体创新

- 电动车充电网路和快速充电技术的扩展

- 产业陷阱与挑战

- 先进功率半导体(SiC、GaN)成本高

- 供应链限制和原料短缺

- 市场机会

- 市场对更有效率下一代电动车的需求日益增长

- 快速充电基础设施和智慧电网的扩建

- 电动商用车和巴士的出现

- 半导体产业的策略伙伴关係与合作

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 定价策略

- 新兴商业模式

- 合规要求

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 对主要参与者进行竞争基准分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导人

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估算与预测:依组件类型划分,2021-2034年

- 主要趋势

- MOSFET

- IGBT

- 二极体

- 功率积体电路

- 闸流管

- 其他的

第六章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 硅(Si)

- 碳化硅(SiC)

- 氮化镓(GaN)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 牵引逆变器系统

- 车用充电器(OBC)

- 直流-直流转换器

- 马达驱动装置

- 电池管理系统(BMS)

- 其他的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 电池电动车(BEV)

- 插电式混合动力车(PHEV)

- 混合动力电动车(HEV)

第九章:市场估算与预测:依销售管道划分,2021-2034年

- 主要趋势

- OEM(原始设备製造商)

- 售后市场

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球关键参与者

- Infineon Technologies AG

- Onsemi

- Microchip Technology Inc.

- STMicroelectronics NV

- Wolfspeed, Inc.

- 区域关键参与者

- 北美洲

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

- Diodes Incorporated

- 欧洲

- Semikron-Danfoss Group

- Hitachi

- SanRex Corporation

- 亚太地区

- Mitsubishi Electric Corp.

- ROHM Co., Ltd.

- Renesas Electronics Corp.

- 北美洲

- 小众玩家/颠覆者

- Toshiba Electronic Devices & Storage Corporation

- Fuji Electric Co., Ltd.

- Starpower Semiconductor Ltd.

- Navitas Semiconductor Corporation

The Global Power Semiconductors for EVs Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 24.1% to reach USD 68.2 billion by 2034.

The rapid acceleration of electric vehicle adoption is driving substantial demand for advanced power electronics capable of supporting battery systems, high-speed charging, and optimized vehicle performance. Rising global EV sales, which grew 35% year over year in the first quarter of 2025, reflect the momentum behind the electrification movement and reinforce the essential role of power semiconductors in ensuring efficient power conversion, reduced thermal losses, and enhanced system reliability. As EV platforms evolve, manufacturers require components that can withstand high temperatures, support faster charging, and maintain stable efficiency across demanding conditions. This shift continues to influence investments, technology roadmaps, and product upgrades within the semiconductor ecosystem. Collaborative efforts between automotive brands and semiconductor developers are accelerating the deployment of next-generation materials, while creating stronger supply chain frameworks to meet the rising volume and performance expectations of the global EV sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $68.2 Billion |

| CAGR | 24.1% |

The silicon carbide segment held a 33.2% share in 2024 as SiC devices gain traction due to their superior switching behavior, heat resistance, and charging performance. OEMs are increasingly integrating SiC MOSFETs into traction inverters and fast-charging architectures to improve energy efficiency and extend vehicle range. Manufacturers continue to scale SiC wafer capacity and pursue vertical integration, along with engineering tailored modules that align with the performance requirements of individual EV platforms.

The MOSFET segment is expected to reach USD 20.3 billion by 2034, supported by strong demand across onboard chargers, auxiliary circuits, and DC-DC converters. Producers are working to enhance voltage ratings and thermal durability to accommodate the growing electrical loads and higher power densities of modern EV designs.

United States Power Semiconductors for EVs Market generated USD 1.9 billion in 2024. Recent funding initiatives, including federal support for power module development, highlight ongoing national efforts to strengthen charging infrastructure. This environment encourages semiconductor suppliers to prioritize high-performance SiC and GaN technologies and to collaborate closely with domestic automotive companies to address fast-charging demands and high-voltage system challenges.

Key participants in the Power Semiconductors for EVs Market include Infineon Technologies AG, ROHM Co., Ltd., Onsemi, Mitsubishi Electric Corp., Renesas Electronics Corp., Microchip Technology Inc., STMicroelectronics N.V., Wolfspeed, Inc., Littelfuse, Inc., and Fuji Electric Co., Ltd. To reinforce their market position, companies in the power semiconductors for EVs sector are implementing strategies centered on scaling production capacity and accelerating material innovation. Many are expanding SiC and GaN manufacturing lines to meet long-term EV demand while investing in vertically integrated supply chains that stabilize wafer availability and reduce production costs. Firms are also designing application-specific modules tailored to OEM performance targets, enabling stronger technical partnerships. R&D efforts focus on reducing switching losses, improving thermal management, and supporting higher power densities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component type trends

- 2.2.2 Material type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.2.5 Sales channel trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of electric vehicles globally

- 3.2.1.2 Rising demand for high-efficiency and low-loss power electronics

- 3.2.1.3 Growth in renewable energy integration with EV charging infrastructure

- 3.2.1.4 Strategic collaborations to accelerate EV semiconductor innovation

- 3.2.1.5 Expansion of EV charging networks and fast-charging technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced power semiconductors (SiC, GaN)

- 3.2.2.2 Supply chain constraints and raw material shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for next-generation EVs with higher efficiency

- 3.2.3.2 Expansion of fast-charging infrastructure and smart grids

- 3.2.3.3 Emergence of electric commercial vehicles and buses

- 3.2.3.4 Strategic partnerships and collaborations in semiconductor industry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 MOSFETs

- 5.3 IGBTs

- 5.4 Diodes

- 5.5 Power ICs

- 5.6 Thyristor

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Silicon (Si)

- 6.3 Silicon Carbide (SiC)

- 6.4 Gallium Nitride (GaN)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Traction inverter systems

- 7.3 Onboard Chargers (OBC)

- 7.4 DC-DC converters

- 7.5 Electric drive motors

- 7.6 Battery Management Systems (BMS)

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEVs)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.4 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEMs (Original Equipment Manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Infineon Technologies AG

- 11.1.2 Onsemi

- 11.1.3 Microchip Technology Inc.

- 11.1.4 STMicroelectronics N.V.

- 11.1.5 Wolfspeed, Inc.

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Vishay Intertechnology, Inc.

- 11.2.1.2 Littelfuse, Inc.

- 11.2.1.3 Diodes Incorporated

- 11.2.2 Europe

- 11.2.2.1 Semikron-Danfoss Group

- 11.2.2.2 Hitachi

- 11.2.2.3 SanRex Corporation

- 11.2.3 APAC

- 11.2.3.1 Mitsubishi Electric Corp.

- 11.2.3.2 ROHM Co., Ltd.

- 11.2.3.3 Renesas Electronics Corp.

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Toshiba Electronic Devices & Storage Corporation

- 11.3.2 Fuji Electric Co., Ltd.

- 11.3.3 Starpower Semiconductor Ltd.

- 11.3.4 Navitas Semiconductor Corporation