|

市场调查报告书

商品编码

1910504

功率半导体:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Power Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

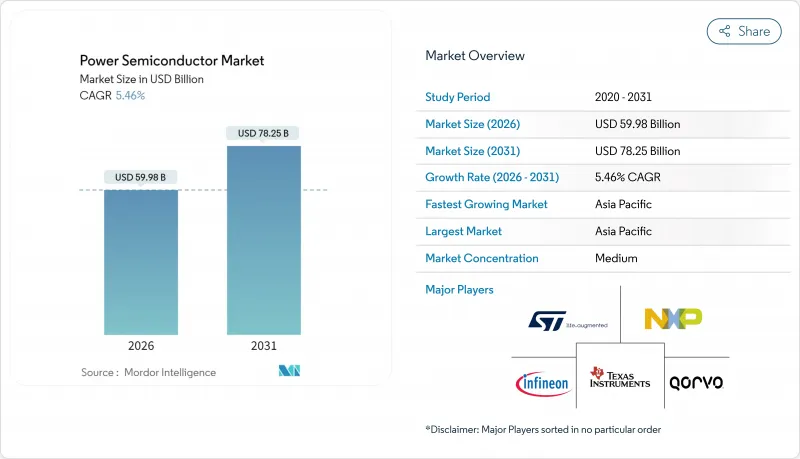

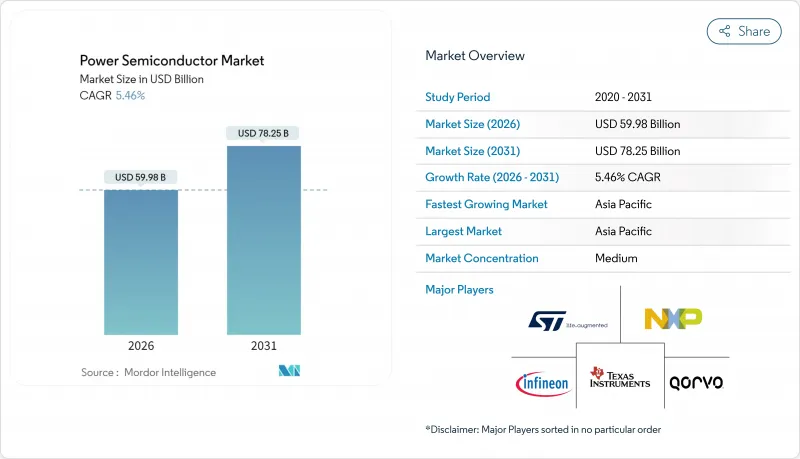

2025年功率半导体市场价值为568.7亿美元,预计到2031年将达到782.5亿美元,而2026年为599.8亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 5.46%。

儘管其他行业週期性放缓,但电动车、可再生能源系统和数据密集型电子产品对高效功率转换的强劲需求,支撑了功率半导体市场保持稳健成长。宽能带隙(WBG)材料,主要是碳化硅(SiC)和氮化镓(GaN),由于其在高压和高频条件下优于硅的性能,因此价格较高。汽车电气化推动了市场规模的成长,而太阳能发电加储能係统的应用、5G基础设施的部署以及工厂自动化程度的提高,则推动了市场的快速成长。美国《晶片和半导体产品法案》(CHIPS Act)和欧洲《晶片和半导体产品法案》(CHIPS Act)等区域供应链政策正在推动国内製造业投资,而亚太地区则凭藉其端到端的製造规模优势,保持主导地位。

全球功率半导体市场趋势及展望

电动车和充电基础设施的需求激增

电动车越来越依赖碳化硅(SiC)MOSFET来提高驱动效率和加快充电速度。汽车製造商在向800V系统过渡的过程中,指定使用SiC来降低逆变器损耗。而像安森美半导体(ON Semiconductor)与大众汽车(Volkswagen)达成的、由FORVIA支持的垂直整合晶片到模组(C2M)解决方案,则提供了成熟的解决方案,确保了供应并降低了分配风险。并联直流快速充电桩的部署需要8kW至1MW的功率模组,这实际上使每辆车的SiC需求翻了一番。车规级产量比率仍然是一个挑战,这促使整合元件製造商(IDM)提高自身的基板製造能力,以稳定成本曲线并保护利润率。

5G基地台的分布

在6GHz以下和毫米波频段,GaN高电子移动性电晶体比LDMOS具有更高的增益和效率。随着通讯业者为应对不断上涨的电力成本而提高小型基地台密度,预计未来10年内GaN的出货量将成长四倍。恩智浦半导体(NXP)提供将Si LDMOS和GaN晶粒整合到多晶片大规模MIMO模组中的解决方案,这些模组整合了天线阵列并简化了散热设计。功率半导体供应商正在添加烧结晶片黏接材料,以解决超过225°C的热点问题。随着通讯业日益关注整体拥有成本(TCO),效率的逐步提升将转化为营运成本(OPEX)的降低,从而巩固GaN在下一代部署中的应用。

硅片供应週期

目前晶圆总需求已超过核定产能,记忆体供应商的库存削减正在影响近期采购行为。地缘政治摩擦推高了晶圆厂建设成本,而缺水地区的用水限制则限制了新建工厂。来自中国新参与企业的价格竞争正在挤压整个供应链的利润空间。前端设备订单显示出復苏迹象,但个人电脑和智慧型手机终端市场的疲软限制了销售成长,这反映出市场存在结构性而非週期性失衡。

细分市场分析

到2025年,功率积体电路(PIC)将成为功率半导体市场规模的重要组成部分,预计到2031年将以6.02%的复合年增长率成长。汽车电池管理单元需要多轨稳压器和功能安全诊断功能,而这些功能都整合在紧凑的PMIC封装中。英飞凌符合ISO 26262标准的OPTIREG TLF35585支援安全相关的电控系统,体现了单晶片电源管理的发展趋势。分立元件仍然是高电流路径的关键组成部分,占44.60%的收入份额。然而,随着设计人员在空间受限的子系统中倾向于选择成本优化的模组或IC解决方案,分立产品的份额正在下降。

供应商的蓝图正在将GaN或SiC晶粒整合到智慧功率模组中,这些模组整合了闸极驱动、感测和保护功能,以加快逆变器和充电器组件的上市速度。模组整合使那些没有自有封装技术的中型工业和住宅能源客户受益。同时,消费性电子产品ODM厂商持续采购分离式MOSFET用于转接器设计,以利用基板级柔软性和价格优势。分离式、模组和积体电路形式的共存丰富了功率半导体市场,实现了可自订的性能和成本权衡。

区域分析

亚太地区预计到2025年将占据功率半导体市场51.35%的份额,并在2031年之前保持6.74%的复合年增长率。中国在国家补贴和垂直整合的供应链支持下,主导碳化硅(SiC)和氮化镓(GaN)产能的扩张。印度正在快速推进一个投资760亿卢比的OSAT(外包半导体组装测试)园区项目,目标产能为每日1500万片,并表明其有意在国内进行组装。台湾和韩国分别在先进封装和记忆体领域保持主导,而日本则在上游材料领域巩固其主导地位。

在北美,500亿美元的《晶片製造和生产法案》(CHIPS Act)激励措施正鼓励沃尔夫斯皮德(Wolfspeed)、博世(Bosch)等国际公司改造现有工厂并新建工厂。汽车、国防和资料中心产业的集中发展正在集中需求,并提高在地采购的要求。 SEMI预测,到2027年,区域製造设备投资将翻一番,达到247亿美元,凸显了长期规模扩张的趋势。

欧洲将利用汽车产业与可再生能源政策的合作,促进碳化硅(SiC)和氮化镓(GaN)技术的应用。德国核准德勒斯登工厂(投资50亿欧元)就是一个公私合营提高能源自给率的良好范例。法国和义大利将提供额外的津贴方案,以维持尖端组件和基板技术的发展。中东、非洲和拉丁美洲等注重成本的新兴市场正积极采用成熟的硅平台,同时逐步试行白光发光二极体(WBG)技术,用于大规模太阳能发电和铁路电气化。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车和充电基础设施的需求激增

- 5G基地台的分布

- 可再生能源主导的电力转型成长

- 工业自动化和电机驱动装置升级

- 高空平台系统与全电动飞机动力传动系统

- 亚洲两轮和三轮电动车的快速充电架构

- 市场限制

- 硅片供应週期

- 宽能带隙(WBG)装置高成本/设计复杂

- 高密度电动车逆变器的热限制

- 氮化镓外延设备的出口限制

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 离散的

- 整流器

- 双极

- MOSFET

- IGBT

- 其他分立元件(闸流体、HEMT 等)

- 模组

- 闸流体模组

- IGBT模组

- MOSFET模组

- 智慧型电源模组(IPM)

- 功率积体电路

- PMIC(多通道)

- 开关稳压器(AC/DC、DC/DC、隔离式/非隔离式)

- 线性稳压器

- 电池管理积体电路

- 其他电源积体电路

- 离散的

- 材料

- 硅

- 碳化硅(SiC)

- 氮化镓(GaN)

- 其他的

- 按最终用户行业划分

- 车

- 家用电子电器和家用电器

- 资讯与通讯科技(ICT)

- 工业和製造业

- 能源与电力(可再生能源、电网)

- 航太/国防

- 医疗设备

- 其他(铁路、船)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Infineon Technologies AG

- Texas Instruments Incorporated

- Qorvo Inc.

- STMicroelectronics NV

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Broadcom Inc.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Semikron Danfoss GmbH and Co. KG

- Wolfspeed Inc.

- ROHM Co., Ltd.

- Vishay Intertechnology Inc.

- Nexperia BV

- Alpha and Omega Semiconductor Ltd.

- Magnachip Semiconductor Corp.

- Microchip Technology Inc.

- Littelfuse Inc.

- Navitas Semiconductor Corp.

- Power Integrations Inc.

- Monolithic Power Systems Inc.

第七章 市场机会与未来展望

The power semiconductor market was valued at USD 56.87 billion in 2025 and estimated to grow from USD 59.98 billion in 2026 to reach USD 78.25 billion by 2031, at a CAGR of 5.46% during the forecast period (2026-2031).

Strong demand for efficient power conversion across electric vehicles, renewable energy systems, and data-intensive electronics keeps the power semiconductor market resilient even as cyclical slowdowns emerge elsewhere. Wide-bandgap (WBG) materials-chiefly silicon carbide (SiC) and gallium nitride (GaN)-command premium pricing because they outperform silicon in high-voltage and high-frequency conditions. Automotive electrification anchors volume, yet rapid growth stems from solar-plus-storage installations, 5G infrastructure rollouts, and factory automation upgrades. Regional supply-chain policies such as the U.S. CHIPS Act and the European Chips Act intensify domestic fabrication investments, while the Asia Pacific leverages its end-to-end manufacturing scale to maintain leadership.

Global Power Semiconductor Market Trends and Insights

Surging Demand for EVs and Charging Infrastructure

Electric vehicles increasingly rely on SiC MOSFETs that raise drivetrain efficiency and shorten charging times. Automakers shifting to 800 V systems specify SiC to trim inverter losses, evidenced by FORVIAs, such as onsemi's agreement with Volkswagen, secure vertically integrated chip-to-module deliveries, mitigating allocation risks. Parallel DC fast-charger roll-outs require 8 kW to 1 MW power blocks, effectively doubling SiC demand from vehicle content alone. Automotive-grade yields stay challenging, so IDMs add captive substrate capacity to stabilize cost curves and safeguard margins.

Proliferation of 5G Base-Stations

GaN high-electron-mobility transistors deliver higher gain and efficiency than LDMOS at sub-6 GHz and mmWave frequencies. Small-cell densification pushes GaN shipments to quadruple by decade-end as operators combat escalating energy bills. NXP couples Si LDMOS with GaN die in multichip massive-MIMO modules that integrate antenna arrays and simplify thermal design. Power semiconductor suppliers add sintered die-attach materials to cope with hot-spot temperatures above 225 °C. The telecom sector's focus on total-cost-of-ownership converts incremental efficiency gains into reduced opex, cementing GaN adoption in next-phase rollouts.

Silicon Wafer Supply Tightness Cycles

Total wafer demand now eclipses qualified capacity, and inventory drawdown at memory suppliers distorts short-term purchasing behavior . Geopolitical friction inflates fab-construction costs, while water-usage limits restrict greenfield sites in drought-prone zones. Chinese entrants pursue price competition that compresses margins across the chain. Although front-end equipment bookings hint at recovery, end-market weakness in PCs and smartphones tempers volume pick-up, exposing structural rather than cyclical imbalances.

Other drivers and restraints analyzed in the detailed report include:

- Renewables-Led Power Conversion Growth

- Industrial Automation and Motor-Drive Upgrades

- High Cost / Design Complexity of WBG Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power integrated circuits contributed significantly to the power semiconductor market size in 2025 and will climb at a 6.02% CAGR through 2031. Automotive battery-management units require multi-rail regulators and functional-safety diagnostics delivered in a compact PMIC footprint. Infineon's ISO 26262-compliant OPTIREG TLF35585 underpins safety-related electronic control units, illustrating the trend toward single-chip power management . Discrete devices remain indispensable for high-current paths, preserving 44.60% revenue share; nevertheless, the discrete share edges lower as designers favor cost-optimized module or IC solutions in space-constrained subsystems.

Supplier roadmaps bundle GaN or SiC dies within intelligent power modules that integrate gate drive, sensing, and protection, shortening time-to-market for inverter and charger assemblies. Module consolidation benefits mid-volume industrial and residential energy customers who lack in-house packaging expertise. Conversely, consumer-electronics ODMs still procure discrete MOSFETs for adapter designs to exploit board-level flexibility and price advantages. The coexistence of discrete, module, and IC formats enriches the power semiconductor market, enabling tailored performance-cost trade-offs.

The Power Semiconductor Market Report is Segmented by Component (Discrete, Modules, Power IC), Material (Silicon, Silicon Carbide, Gallium Nitride, Others), End-User Industry (Automotive, Consumer Electronics and Appliances, ICT, Industrial and Manufacturing, Energy and Power, Aerospace and Defense, Healthcare and Equipment, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 51.35% of the power semiconductor market share in 2025 and sustained a 6.74% CAGR through 2031. China spearheads SiC and GaN capacity ramps, aided by state subsidies and vertically integrated supply chains. India fast-tracks an INR 7,600 crore OSAT campus targeting 15 million units per day, signaling intent to onshore assembly. Taiwan and South Korea guard leadership in advanced packaging and memory, respectively, while Japan fortifies upstream materials command.

North America benefits from USD 50 billion in CHIPS Act incentives that unlock brownfield conversions and greenfield fabs by Wolfspeed, Bosch, and overseas entrants. Automotive, defense, and data-center clusters concentrate demand, boosting local content requirements. SEMI projects regional fab-equipment outlays doubling to USD 24.7 billion by 2027, underscoring long-term scale-up .

Europe leverages its automotive and renewable energy policy alignment to catalyze SiC and GaN uptake. Germany's EUR 5 billion Dresden fab approval exemplifies public-private alignment to elevate self-sufficiency. France and Italy offer additional grant packages to preserve leading-edge module and substrate know-how. Emerging markets across the Middle East, Africa, and Latin America stay value-conscious, adopting mature silicon platforms while gradually trialing WBG for utility-scale solar and railway electrification.

- Infineon Technologies AG

- Texas Instruments Incorporated

- Qorvo Inc.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Broadcom Inc.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Semikron Danfoss GmbH and Co. KG

- Wolfspeed Inc.

- ROHM Co., Ltd.

- Vishay Intertechnology Inc.

- Nexperia B.V.

- Alpha and Omega Semiconductor Ltd.

- Magnachip Semiconductor Corp.

- Microchip Technology Inc.

- Littelfuse Inc.

- Navitas Semiconductor Corp.

- Power Integrations Inc.

- Monolithic Power Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for EVs and charging infrastructure

- 4.2.2 Proliferation of 5G base-stations

- 4.2.3 Renewables-led power conversion growth

- 4.2.4 Industrial automation and motor-drive upgrades

- 4.2.5 HAPS and all-electric aircraft powertrains

- 4.2.6 Fast-charging 2-/3-wheeler EV architectures in Asia

- 4.3 Market Restraints

- 4.3.1 Silicon wafer supply tightness cycles

- 4.3.2 High cost / design complexity of WBG devices

- 4.3.3 Thermal limits in high-density EV inverters

- 4.3.4 Export controls on GaN epitaxy tools

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Discrete

- 5.1.1.1 Rectifier

- 5.1.1.2 Bipolar

- 5.1.1.3 MOSFET

- 5.1.1.4 IGBT

- 5.1.1.5 Other Discrete Components (Thyristor, HEMT, etc.)

- 5.1.2 Modules

- 5.1.2.1 Thyristor Module

- 5.1.2.2 IGBT Module

- 5.1.2.3 MOSFET Module

- 5.1.2.4 Intelligent Power Module (IPM)

- 5.1.3 Power IC

- 5.1.3.1 PMIC (Multichannel)

- 5.1.3.2 Switching Regulators (AC/DC, DC/DC, Iso/Non-iso)

- 5.1.3.3 Linear Regulators

- 5.1.3.4 Battery Management IC

- 5.1.3.5 Other Power ICs

- 5.1.1 Discrete

- 5.2 By Material

- 5.2.1 Silicon

- 5.2.2 Silicon Carbide (SiC)

- 5.2.3 Gallium Nitride (GaN)

- 5.2.4 Others

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Consumer Electronics and Appliances

- 5.3.3 ICT (IT and Telecom)

- 5.3.4 Industrial and Manufacturing

- 5.3.5 Energy and Power (Renewables, Grid)

- 5.3.6 Aerospace and Defense

- 5.3.7 Healthcare Equipment

- 5.3.8 Others (Rail, Marine)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Israel

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Texas Instruments Incorporated

- 6.4.3 Qorvo Inc.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 NXP Semiconductors N.V.

- 6.4.6 ON Semiconductor Corporation

- 6.4.7 Renesas Electronics Corporation

- 6.4.8 Broadcom Inc.

- 6.4.9 Toshiba Corporation

- 6.4.10 Mitsubishi Electric Corporation

- 6.4.11 Fuji Electric Co., Ltd.

- 6.4.12 Semikron Danfoss GmbH and Co. KG

- 6.4.13 Wolfspeed Inc.

- 6.4.14 ROHM Co., Ltd.

- 6.4.15 Vishay Intertechnology Inc.

- 6.4.16 Nexperia B.V.

- 6.4.17 Alpha and Omega Semiconductor Ltd.

- 6.4.18 Magnachip Semiconductor Corp.

- 6.4.19 Microchip Technology Inc.

- 6.4.20 Littelfuse Inc.

- 6.4.21 Navitas Semiconductor Corp.

- 6.4.22 Power Integrations Inc.

- 6.4.23 Monolithic Power Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment