|

市场调查报告书

商品编码

1892652

B2B香水产品市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)B2B Fragrance Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

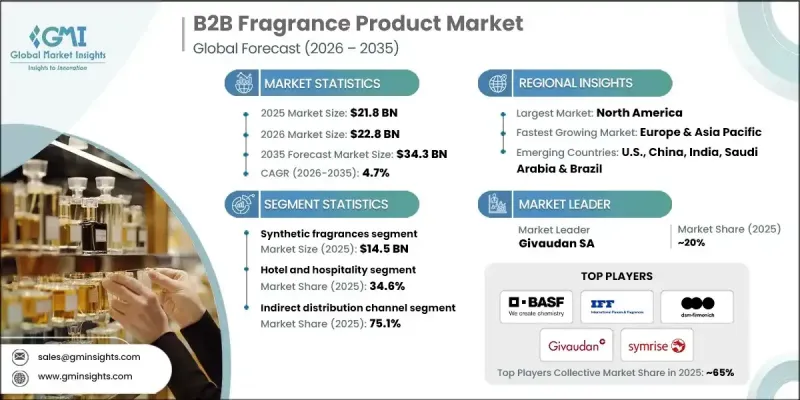

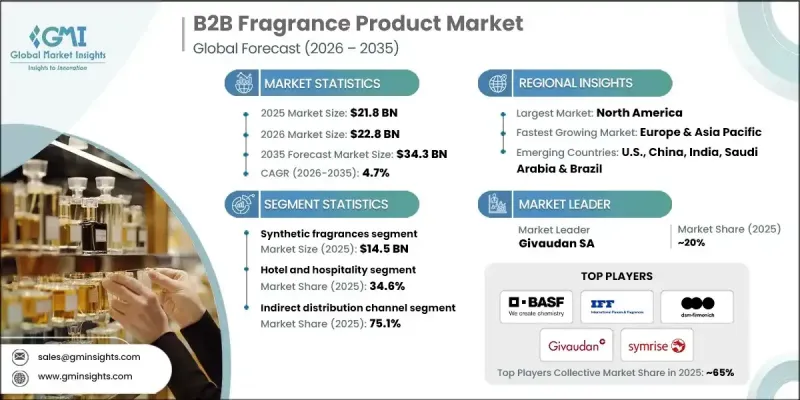

2025年全球B2B香水产品市场价值218亿美元,预计2035年将以4.7%的复合年增长率成长至343亿美元。

由于个人护理和化妆品领域对香氛的需求不断增长,市场正在扩张。消费者越来越追求兼具功能性和沈浸式感官体验的产品。香氛已成为护肤、护髮和彩妆产品品牌形象的关键要素。清洁美容、无过敏配方和纯素产品等趋势正在推动创新,并影响合规要求。社群媒体和电商平台为B2B供应商提供了满足消费者对独特、持久和个人化香氛日益增长的需求的机会。此外,家居和空气护理产业也发挥关键作用,曾经被视为奢侈品的产品如今已成为主流,使消费者能够打造个人化、舒缓的生活环境。总而言之,这些因素共同促进了B2B香氛产品在各行各业的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 218亿美元 |

| 预测值 | 343亿美元 |

| 复合年增长率 | 4.7% |

2025年,合成香料市场规模达到145亿美元,预计2026年至2035年将以4.6%的复合年增长率成长。这些香料因其能够大规模、稳定地复製复杂的香调而备受青睐,确保个人护理、家居护理和工业应用领域品质的一致性。合成成分还具有更高的稳定性和更长的保质期,使其适用于暴露于不同环境条件下的产品。人们对异国风情和创新香氛日益增长的兴趣,以及合成香料能够在不影响生态环境的前提下模仿稀有或濒危天然成分的特性,进一步推动了其广泛应用。

至2025年,间接配销通路的市占率达到75.1%,预计2026年至2035年将以4.6%的复合年增长率成长。经销商、批发商和第三方代理商使香水製造商能够有效率地进入多元化的区域市场,而无需在内部销售网路方面投入大量资金。这项策略使服务于个人护理、家居护理、酒店和汽车等多个行业的全球香水公司和中型生产商受益匪浅,业务遍及不同地区。

2025年,美国B2B香氛产品市场规模达56亿美元,预计2026年至2035年将以4.6%的复合年增长率成长。个人护理和家居护理产品日益普及,以及零售、酒店和汽车行业对香氛行销策略的广泛应用,是推动市场成长的主要因素。美国企业正投资于创新香氛技术,例如基于人工智慧的香氛个人化和智慧输送系统,以满足消费者对独特、永续和健康导向产品的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 个人护理和化妆品需求不断增长

- 家庭和空气护理业务拓展

- 高端化及富有表现力的香水形式

- 产业陷阱与挑战

- 原物料和商品价格波动

- 供应链中断与韧性

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 个人护理及美容

- 保养

- 护髮

- 身体护理

- 化妆品

- 其他的

- 家用产品

- 打扫

- 洗衣店

- 居家香氛系统

- 其他的

- 工业本质

- 高级香水和香氛

- 其他的

第六章:市场估算与预测:依香型划分,2022-2035年

- 自然的

- 合成的

第七章:市场估算与预测:依应用领域划分,2022-2035年

- 饭店及招待业

- 水疗和康体中心

- 零售

- 企业

- 其他(教育机构、医疗机构等)

第八章:市场估算与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Alpha Aromatics

- Aroma360

- BASF SE

- dsm-firmenich

- Givaudan SA

- Global Perfumes Company

- International Flavors & Fragrances (IFF)

- LEUXSCENT

- Mane SA

- Prolitec

- Robertet SA

- Sensient Technologies

- Symrise AG

- Takasago International Corporation

- Vioryl SA

The Global B2B Fragrance Product Market was valued at USD 21.8 billion in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 34.3 billion by 2035.

The market is expanding due to rising demand for fragrances across personal care and cosmetics products, where consumers increasingly seek items that offer both functionality and an immersive sensory experience. Fragrance has become a crucial element of brand identity for skincare, haircare, and makeup products. Trends such as clean beauty, allergen-free formulations, and vegan products are driving innovation and shaping compliance requirements. Social media and e-commerce platforms provide opportunities for B2B suppliers to meet growing consumer demand for unique, long-lasting, and personalized scents. Additionally, the home and air care sectors play a key role, as products once considered luxury items are now mainstream, enabling consumers to create personalized, calming living environments. Overall, these factors collectively boost the adoption of B2B fragrance products across diverse industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.8 billion |

| Forecast Value | $34.3 billion |

| CAGR | 4.7% |

The synthetic fragrances segment generated USD 14.5 billion in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. These fragrances are favored for their ability to replicate complex scent profiles consistently at scale, ensuring uniform quality across personal care, home care, and industrial applications. Synthetic ingredients also provide enhanced stability and longer shelf life, making them suitable for products exposed to varying environmental conditions. Growing interest in exotic and innovative scents, alongside the ability to mimic rare or endangered natural ingredients without ecological impact, further supports their widespread use.

The indirect distribution channel held a 75.1% share in 2025 and is projected to grow at a CAGR of 4.6% from 2026 to 2035. Distributors, wholesalers, and third-party agents allow fragrance manufacturers to access diverse regional markets efficiently without investing heavily in in-house sales networks. This strategy benefits global fragrance companies and mid-sized producers serving multiple sectors, including personal care, home care, hospitality, and automotive, across varied geographies.

U.S. B2B Fragrance Product Market reached USD 5.6 billion in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. Growth is fueled by the rising popularity of personal care and home care products and the adoption of scent marketing strategies across retail, hospitality, and automotive sectors. U.S. companies are investing in innovative fragrance technologies, such as AI-based scent personalization and smart delivery systems, to cater to consumer demand for unique, sustainable, and wellness-oriented products.

Key players in the Global B2B Fragrance Product Market include Alpha Aromatics, Aroma360, BASF SE, DSM-Firmenich, Givaudan SA, Global Perfumes Company, International Flavors & Fragrances (IFF), LEUXSCENT, Mane SA, Prolitec, Robertet SA, Sensient Technologies, Symrise AG, Takasago International Corporation, and Vioryl S.A. Companies in the Global B2B Fragrance Product Market are leveraging several strategies to strengthen their presence and market position. They are focusing on research and development to launch innovative scent profiles, sustainable ingredients, and allergen-free solutions. Strategic collaborations with brands across personal care, home care, and automotive sectors help expand reach and influence. Firms are adopting digital marketing and e-commerce platforms to engage B2B clients, while AI-driven personalization tools and smart delivery technologies enhance product differentiation. Expanding global distribution networks through partnerships with distributors and wholesalers allows companies to serve multiple regions efficiently.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Fragrance type

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in personal care & cosmetics

- 3.2.1.2 Expansion of home & air care

- 3.2.1.3 Premiumization & expressive fragrance formats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Raw material & commodity price volatility

- 3.2.2.2 Supply chain disruptions & resilience

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Personal care & beauty

- 5.2.1 Skincare

- 5.2.2 Haircare

- 5.2.3 Body care

- 5.2.4 Cosmetics

- 5.2.5 Others

- 5.3 Household products

- 5.3.1 Cleaning

- 5.3.2 Laundry

- 5.3.3 Home fragrance systems

- 5.3.4 Others

- 5.4 Industrial essence

- 5.5 Fine fragrance and perfume

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Fragrance Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Hotel and hospitality

- 7.3 Spa and wellness centers

- 7.4 Retail

- 7.5 Corporates

- 7.6 Others (Educational institutes, healthcare, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alpha Aromatics

- 10.2 Aroma360

- 10.3 BASF SE

- 10.4 dsm-firmenich

- 10.5 Givaudan SA

- 10.6 Global Perfumes Company

- 10.7 International Flavors & Fragrances (IFF)

- 10.8 LEUXSCENT

- 10.9 Mane SA

- 10.10 Prolitec

- 10.11 Robertet SA

- 10.12 Sensient Technologies

- 10.13 Symrise AG

- 10.14 Takasago International Corporation

- 10.15 Vioryl S.A.