|

市场调查报告书

商品编码

1913404

第三方物流市场机会、成长要素、产业趋势分析及2026年至2035年预测Third-Party Logistics (3PL) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

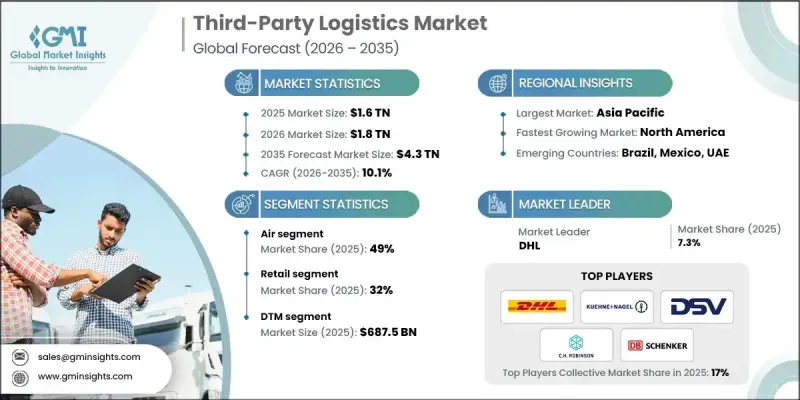

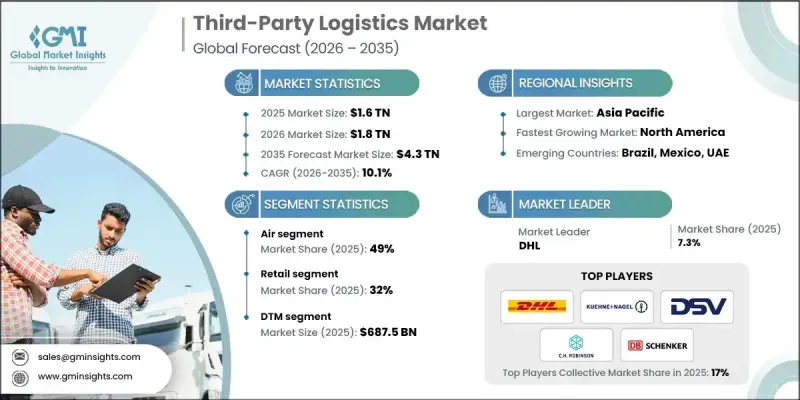

全球第三方物流(3PL) 市场预计到 2025 年将达到 1.6 兆美元,到 2035 年将达到 4.3 兆美元,年复合成长率为 10.1%。

推动市场成长的因素包括电子商务的快速扩张、供应链日益全球化、客户对更快交付的需求不断增长以及物流和配送网路的日益复杂化。企业越来越多地将物流职能外包给专业的第三方物流 (3PL) 服务商,以实现成本效益、营运柔软性、即时可视性和扩充性的供应链营运。基于云端的运输管理系统 (TMS)、仓库管理系统 (WMS)、利用人工智慧和机器学习的路线优化、物联网货物追踪、机器人技术、仓库自动化和进阶数据分析等技术创新正在变革传统物流。这些解决方案提高了库存准确性、优化了运输、缩短了运输时间并改善了需求预测。全通路零售、跨境贸易和最后一公里配送解决方案的日益普及,进一步推动了全球对整合、柔软性且技术主导的第三方物流服务的需求。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1.6兆美元 |

| 预测金额 | 4.3兆美元 |

| 复合年增长率 | 10.1% |

预计到2025年,航空货运市占率将达到49%,并在2026年至2035年间以11.2%的复合年增长率成长。航空物流凭藉其在保障时效性强、高价值和紧急货物运输方面的关键作用,占据主导地位。各行业对快速交付的强劲需求,推动了跨境运输、即时库存管理和高端物流需求对航空货运的日益青睐。先进的货物处理、即时追踪、优先交付和一体化快递网络,确保了运输的速度、可靠性和优质服务,使航空运输成为紧急和高价值货物运输的首选解决方案。

预计2025年,国内运输管理(DTM)市场规模将达6,875亿美元。 DTM解决方案对于国内运输至关重要,因为国内运输需要高频率、准时性和成本效益。这些解决方案提供最佳化的路线规划、承运商选择、货物追踪和最后一公里配送管理。这些功能对于实现电子商务、零售、快速消费品和製造业供应链中的快速履约、准时交付和可扩展营运至关重要。对于寻求效率和可靠性的托运人和物流服务供应商而言,DTM仍然是他们关注的重点领域。

预计2025年,中国第三方物流(3PL)市场规模将达到3,749亿美元,占全球市场份额的57%。该地区的成长主要得益于电子商务的蓬勃发展、製造业的高产出以及技术主导物流解决方案的日益普及。对基于人工智慧的路线优化、云端运输管理系统/仓库管理系统(TMS/WMS)、即时追踪和自动化履约系统的投资正在加速提升该地区的物流能力。先进的基础设施、庞大的货运量以及不断完善的监管标准进一步巩固了亚太地区在全球第三方物流(3PL)市场中的地位。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 电子商务和全通路零售的快速成长

- 供应链日益复杂化和全球贸易的发展

- 技术采纳与数位转型

- 成本优化和轻资产经营模式

- 产业潜在风险与挑战

- 营运和人事费用上升

- 监管和合规的复杂性

- 市场机会

- 最后一公里配送与加值物流服务

- 数位化和永续物流解决方案

- 人工智慧、机器学习和物联网技术的应用

- 永续性与绿色物流服务

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 美国运输部(DOT) 和联邦汽车运输安全管理局 (FMCSA) 的法规

- 美国环保署排放标准

- 加拿大运输部标准

- 欧洲

- 符合德国TUV和BaFin标准

- 法国DGCCRF和CNIT指南

- 英国车辆标准局 (DVSA) 和金融行为监理局 (FCA) 监管

- 义大利运输部合规

- 亚太地区

- 中国工业和资讯化部(工信部)指南

- 日本金融服务厅汽车合规

- 韩国国土交通部和金融服务委员会的规定

- 印度标准协会 (BIS) 和汽车研究协会指南

- 拉丁美洲

- 巴西ANTT和DENATRAN法规

- 墨西哥环境与自然资源部 (SEMARNAT) 和墨西哥运输部部 (SCT) 的指导方针

- 中东和非洲

- 阿联酋道路和交通管理局指南

- 沙乌地阿拉伯运输总局(GAT)规章

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 自动化和机器人技术

- 人工智慧(AI)和机器学习

- 物联网 (IoT)

- 基于云端的供应链平台

- 新兴技术

- 超互联供应链

- 机器人即服务 (RAAS)

- 人工智慧驱动的动态定价和容量管理

- 扩增实境(AR)和穿戴式设备

- 当前技术趋势

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 使用案例场景

- 区域基础设施和发展趋势

- 交通和物流基础设施评估

- 数位化和连接准备情况

- 港口、铁路和多式联运能力趋势

- 智慧物流枢纽与自由区

- 需求侧和供给侧评估

- 供给侧分析

- 供应商容量、基础设施和能力

- 技术采纳和营运效率

- 成本结构和盈利

- 需求面分析

- 最终用户行业要求

- 数量、频率和服务水准预期

- 价格敏感度和采用趋势

- 供给侧分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 依解决方案分類的市场估算与预测,2022-2035年

- 专用合约运输 (DCC)

- 专用运输管理 (DTM)

- 国际运输管理(ITM)

- 仓储/配送

- 物流软体

第六章 按模式分類的市场估算与预测,2022-2035年

- 航空

- 海上运输

- 铁路和公路

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 食品/饮料

- 卫生保健

- 零售

- 车

- 製造业

- 电子商务与物流

- 化学品/石油化工产品

- 製药

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 瑞士

- 奥地利

- 挪威

- 丹麦

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 马来西亚

- 泰国

- 菲律宾

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥伦比亚

- 秘鲁

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 以色列

- 卡达

第九章:公司简介

- Global Player

- CH Robinson Worldwide

- Ceva Logistics

- DB Schenker Logistics

- DHL Supply Chain &Global Forwarding

- DSV A/S

- Expeditors International of Washington

- FedEx Supply Chain

- Kuehne+Nagel International AG

- Nippon Express

- XPO Logistics

- Regional Player

- Agility Logistics

- APL Logistics

- Bollore Logistics

- Geodis

- Hellmann Worldwide Logistics

- Hitachi Transport System

- Kerry Logistics

- Panalpina

- Toll Group

- Yusen Logistics

- 新兴企业

- eBike Diagnostic Solutions

- MotoTech Diagnostics

- NeoMotor Diagnostics

- RideScan Electronics

- SmartMoto Diagnostics

The Global Third-Party Logistics (3PL) Market was valued at USD 1.6 trillion in 2025 and is estimated to grow at a CAGR of 10.1% to reach USD 4.3 trillion by 2035.

The market is propelled by the rapid expansion of e-commerce, increasing globalization of supply chains, rising customer demand for faster deliveries, and the growing complexity of logistics and distribution networks. Businesses are increasingly outsourcing logistics functions to specialized 3PL providers to achieve cost efficiency, operational flexibility, real-time visibility, and scalable supply chain operations. Technological innovations such as cloud-based transportation management systems (TMS), warehouse management systems (WMS), AI- and ML-powered route optimization, IoT-enabled shipment tracking, robotics, warehouse automation, and advanced data analytics are transforming traditional logistics. These solutions enhance inventory accuracy, optimize transportation, reduce transit times, and improve demand forecasting. Rising adoption of omnichannel retail, cross-border trade, and last-mile delivery solutions further accelerates the demand for integrated, flexible, and technology-driven 3PL services globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Trillion |

| Forecast Value | $4.3 Trillion |

| CAGR | 10.1% |

The air freight segment held 49% share in 2025 and is anticipated to grow at a CAGR of 11.2% from 2026 to 2035. Air logistics dominates due to its essential role in enabling time-sensitive, high-value, and express shipments. Strong demand from industries requiring rapid delivery has increased the adoption of air freight for cross-border deliveries, just-in-time inventory, and premium logistics needs. Advanced cargo handling, real-time tracking, priority shipping, and integrated express networks ensure speed, reliability, and service quality, positioning air transport as the preferred solution for urgent and high-value goods.

The domestic transportation management (DTM) segment reached USD 687.5 billion in 2025. DTM solutions are crucial for handling high-frequency, time-sensitive, and cost-efficient domestic shipments. They provide optimized route planning, carrier selection, shipment tracking, and last-mile delivery management. This functionality is critical for e-commerce, retail, FMCG, and manufacturing supply chains, enabling rapid fulfillment, just-in-time delivery, and scalable operations. DTM remains a key focus area for both shippers and logistics service providers seeking efficiency and reliability.

China Third-Party Logistics (3PL) Market held a 57% share, generating USD 374.9 billion in 2025. The region's growth is driven by the expansion of e-commerce, high manufacturing output, and increasing adoption of technology-driven logistics solutions. Investments in AI-based route optimization, cloud-based TMS/WMS, real-time tracking, and automated fulfillment systems are accelerating the region's logistics capabilities. Advanced infrastructure, large freight volumes, and evolving regulatory standards further strengthen Asia-Pacific's position in the Global Third-Party Logistics (3PL) Market.

Key players operating in the Global Third-Party Logistics (3PL) Market include DB Schenker Logistics, DHL, DSV A/S (UTi Worldwide, Inc.), C.H. Robinson Worldwide, Expeditors International of Washington, Ceva Logistics, Nippon Express, Kuehne + Nagel International AG, XPO Logistics, and SinoTrans (HK) Logistics Limited. Companies in the Global Third-Party Logistics (3PL) Market strengthen their presence through technology adoption, investing heavily in AI- and ML-powered logistics platforms, cloud-based TMS/WMS, IoT-enabled real-time tracking, and warehouse automation to enhance efficiency. Strategic partnerships with e-commerce firms, retailers, and manufacturers expand service reach. Firms focus on offering integrated end-to-end logistics solutions, optimizing last-mile delivery, and providing scalable operations to meet diverse client needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Mode

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Growth of E-commerce & Omnichannel Retail

- 3.2.1.2 Rising Supply Chain Complexity & Global Trade

- 3.2.1.3 Technology Adoption & Digital Transformation

- 3.2.1.4 Cost Optimization & Asset-Light Business Models

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising Operational & Labor Costs

- 3.2.2.2 Regulatory & Compliance Complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Last-Mile Delivery & Value-Added Logistics Services

- 3.2.3.2 Digital & Sustainable Logistics Solutions

- 3.2.3.3 Adoption of AI, ML, and IoT Technologies

- 3.2.3.4 Sustainability and Green Logistics Services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. DOT & FMCSA Regulations

- 3.4.1.2 EPA Emission Standards

- 3.4.1.3 Transport Canada Standards

- 3.4.2 Europe

- 3.4.2.1 Germany TUV & BaFin Compliance

- 3.4.2.2 France DGCCRF & CNIT Guidelines

- 3.4.2.3 United Kingdom DVSA & FCA Regulations

- 3.4.2.4 Italy Ministry of Infrastructure & Transport Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MIIT Guidelines

- 3.4.3.2 Japan FSA Automotive Compliance

- 3.4.3.3 South Korea MOT & FSC Regulations

- 3.4.3.4 India BIS & Automotive Research Association Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANTT & DENATRAN Regulations

- 3.4.4.2 Mexico SEMARNAT & SCT Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Roads & Transport Authority Guidelines

- 3.4.5.2 Saudi Arabia General Authority for Transport (GAT) Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Automation & robotics

- 3.7.1.2 Ai & machine learning

- 3.7.1.3 Internet of things (IOT)

- 3.7.1.4 Cloud-based supply chain platforms

- 3.7.2 Emerging technologies

- 3.7.2.1 Hyper-connected supply chains

- 3.7.2.2 Robotics-as-a-service (RAAS)

- 3.7.2.3 AI-driven dynamic pricing & capacity management

- 3.7.2.4 Augmented reality (AR) & wearables

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Regional Infrastructure & Deployment Trends

- 3.13.1 Transportation & logistics infrastructure scoring

- 3.13.2 Digital & connectivity readiness

- 3.13.3 Port, rail & intermodal capacity trends

- 3.13.4 Smart logistics hubs & free zones

- 3.14 Demand and Supply-Side Assessment

- 3.14.1 Supply-Side Analysis

- 3.14.1.1 Provider capacity, infrastructure, and capabilities

- 3.14.1.2 Technology adoption & operational efficiency

- 3.14.1.3 Cost structures and profitability

- 3.14.2 Demand-Side Analysis

- 3.14.2.1 End-user industry requirements

- 3.14.2.2 Volume, frequency, and service-level expectations

- 3.14.2.3 Pricing sensitivity and adoption trends

- 3.14.1 Supply-Side Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Dedicated contract carriage (DCC)

- 5.3 Dedicated transportation management (DTM)

- 5.4 International transportation management (ITM)

- 5.5 Warehousing & distribution

- 5.6 Logistics software

Chapter 6 Market Estimates & Forecast, By Mode, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Air

- 6.3 Sea

- 6.4 Rail & Road

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Healthcare

- 7.4 Retail

- 7.5 Automotive

- 7.6 Manufacturing

- 7.7 E-commerce & Logistics

- 7.8 Chemicals & Petrochemicals

- 7.9 Pharmaceuticals

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Belgium

- 8.3.7 Netherlands

- 8.3.8 Sweden

- 8.3.9 Switzerland

- 8.3.10 Austria

- 8.3.11 Norway

- 8.3.12 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 Singapore

- 8.4.6 South Korea

- 8.4.7 Vietnam

- 8.4.8 Indonesia

- 8.4.9 Malaysia

- 8.4.10 Thailand

- 8.4.11 Philippines

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Chile

- 8.5.5 Colombia

- 8.5.6 Peru

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

- 8.6.5 Israel

- 8.6.6 Qatar

Chapter 9 Company Profiles

- 9.1 Global Player

- 9.1.1 C.H. Robinson Worldwide

- 9.1.2 Ceva Logistics

- 9.1.3 DB Schenker Logistics

- 9.1.4 DHL Supply Chain & Global Forwarding

- 9.1.5 DSV A/S

- 9.1.6 Expeditors International of Washington

- 9.1.7 FedEx Supply Chain

- 9.1.8 Kuehne + Nagel International AG

- 9.1.9 Nippon Express

- 9.1.10 XPO Logistics

- 9.2 Regional Player

- 9.2.1 Agility Logistics

- 9.2.2 APL Logistics

- 9.2.3 Bollore Logistics

- 9.2.4 Geodis

- 9.2.5 Hellmann Worldwide Logistics

- 9.2.6 Hitachi Transport System

- 9.2.7 Kerry Logistics

- 9.2.8 Panalpina

- 9.2.9 Toll Group

- 9.2.10 Yusen Logistics

- 9.3 Emerging Players

- 9.3.1 eBike Diagnostic Solutions

- 9.3.2 MotoTech Diagnostics

- 9.3.3 NeoMotor Diagnostics

- 9.3.4 RideScan Electronics

- 9.3.5 SmartMoto Diagnostics