|

市场调查报告书

商品编码

1934728

西班牙第三方物流(3PL) 市场:份额分析、产业趋势与统计、成长预测 (2026-2031)Spain 3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

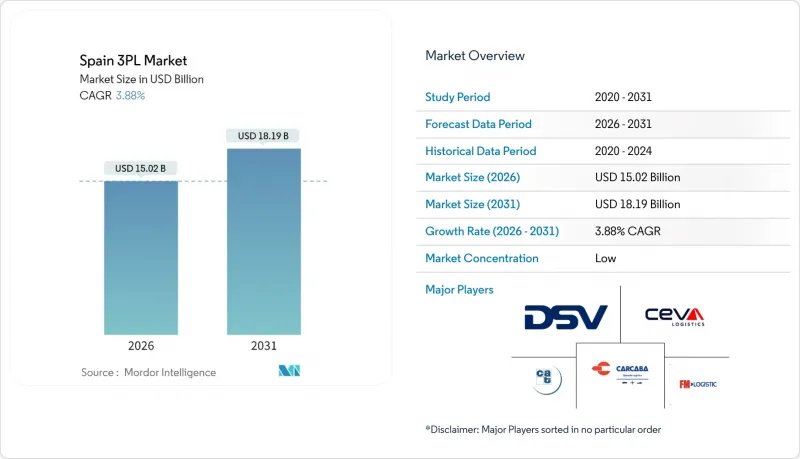

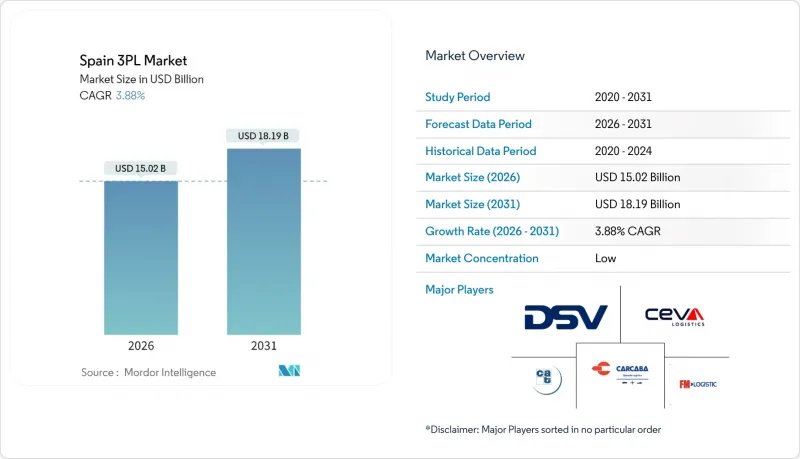

2025年西班牙第三方物流(3PL)市值为144.6亿美元,预计2031年将达到181.9亿美元,高于2026年的150.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.88%。

西班牙作为欧洲门户的地位、外包履约的快速发展以及多模态走廊的升级改造,都支撑着这一上升趋势。电子商务的地理扩张已超越马德里和巴塞隆纳,北欧近岸外包业务的强劲涌入,以及政府支持的铁路电气化计划,共同扩大了第三方物流服务供应商的潜在基本客群。数位化税收优惠政策鼓励人工智慧驱动的路线优化,而绿色出行政策则刺激了都市区配送对电动车的需求。国内和跨国承运商之间日益激烈的竞争,加速了价格透明化进程,并促使企业采用增值仓储、即时视觉化平台以及降低资本风险的轻资产合作模式。

西班牙第三方物流市场趋势与洞察

电子商务交易量的快速成长对物流外包服务提出了更高的要求。

预计到2025年,西班牙的网购用户将达到4,000万,将进一步巩固对全国性合约履约合作伙伴的依赖。亚马逊在阿斯图里亚斯投资3.27亿美元兴建的物流中心,正是保障48小时送达所需基础建设规模的典范。第三方物流供应商正积极回应,建造微型仓配中心,将库存放置在更靠近人口中心的地方。研究表明,巴塞隆纳需要超过1000个城市配送中心才能处理其目前的小包裹量,这也印证了这一转变。机器人分类线和人工智慧驱动的货位分配方案进一步缩短了高峰期的履约週期。然而,不断提高的配送频率迫使第三方物流公司重新设计其主干路线,以便让大容量拖车在夜间为都市区补给,从而降低白天的交通拥堵成本。

药品和食品业对温控物流的需求日益增长

疫苗分发范围扩大、欧盟食品安全法规更加严格以及消费者转向生鲜食品,这些因素共同推动了西班牙低温运输的普及。 Schmitz Cargobull 收购西班牙远端资讯处理公司 Atlantis Global Systems,表明拖车製造商正在整合感测器网络,以检验货物测量的全程可验证。人工智慧需求预测是运力规划的基础,它允许动态分配冷藏运输时段,而非采用固定合同,从而在能源价格波动的情况下维持利润率。在製药业,符合良好分销规范 (GDP) 正在推动 GDP 认证仓储区域的溢价,从而在竞争激烈的环境中保护收入基础。新兴的气调保鲜室正在拓展农产品出口选择,并延长地中海生鲜食品北运的保存期限。区块链试点计画正在增加不可窜改的可追溯性,随着西班牙监管机构加强低温运输审核,这已成为一项必备功能。

柴油价格上涨推高了运输成本。

燃油成本约占公路货运总成本的四分之一,而2025年的价格波动意味着即使加上法定附加费,利润率仍然很低。 2024年第四季度,马德里至巴黎路线的合约运费经外汇折算后上涨3.5%至1,588美元,显示復苏势头脆弱。货运公司正在采用动态路线,将通行费、交通状况和加油点等因素考虑在内,以避免全面提价,同时维持服务水准协议。车队所有者正在利用政府补贴,并在需求量大的路线上试用液化天然气动力和混合动力卡车,以实现能源多元化。然而,持续的波动促使托运人更多地考虑铁路运输,以确保预算规划的可预测性,这在一定程度上抑制了西班牙第三方物流市场对长途卡车运输的需求。

细分市场分析

到2025年,国内运输管理将维持52.48%的收入份额,这印证了西班牙以公路为中心的货运模式以及对全国范围内的循环取货和配送服务的持续需求。西班牙第三方物流市场,尤其是加值仓储和配送服务市场,预计将以7.42%的复合年增长率成长,超过其他服务领域。电子商务退货、客製化和套件化需求的增加,正促使仓库业者采用自动化分类机、语音拣选系统和纸箱尺寸调整机。同时,由于地中海港口维修提升了吞吐能力,国际运输管理业务正在加速发展,推动马格里布地区的贸易流向西班牙北部的物流枢纽。 CEVA物流位于塔拉戈纳的18,000平方米的物流中心表明,诸如太阳能屋顶和LED照明等永续性增值设施正成为赢得合约的先决条件。

在国家电气化补贴的推动下,货运铁路的復兴正在催生出将始发地和目的地卡车运输与中程铁路运输相结合的综合服务模式。空运货运量虽然吨位小规模,但对于需要2至8摄氏度温控运输的生命科学托运人来说,却能带来可观的利润。大宗货物主要透过沿海滚装船和货柜码头运输,但随着全通路零售商要求一小时内送货上门,许多第三方物流(3PL)业者开始交叉销售清关和贸易融资单证服务,以拓展除吨位费之外的收入来源。此外,在现有配送中心(DC)内增设微型仓配能力的做法也日益增多,这印证了西班牙第三方物流市场合约中库存接近性的趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务交易量的快速成长正在推动对物流外包服务的需求。

- 医药和食品业对温控物流的需求不断增长

- 政府对多式联运走廊的基础建设投资

- 欧洲供应链向西班牙近岸外包推动了仓储需求。

- 为因应零排放区,城市微型合作中心应运而生

- 数位化税收优惠促进人工智慧驱动的第三方物流运营

- 市场限制

- 柴油价格上涨导致运输成本增加

- 司机短缺和工资压力

- 都市区因噪音和排放法规而限制夜间送货

- 铁路网互通性的限制降低了多模态的效率

- 价值/供应链分析

- 监管环境

- 仓储市场趋势

- 电子商务成长的影响

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务

- 国内运输管理(DTM)

- 道路运输

- 铁路

- 空运

- 水道

- 国际运输管理(ITM)

- 道路运输

- 铁路

- 空运

- 水道

- 加值仓储及配送服务 (VAWD)

- 国内运输管理(DTM)

- 最终用户

- 车

- 能源与公共产业

- 製造业

- 生命科学与医疗保健

- 科技与电子

- 电子商务

- 消费品/日用必需品

- 食品/饮料

- 其他的

- 透过物流模型

- 轻资产(管理型)

- 资产密集型(拥有车辆和仓库)

- 杂交种

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Carcaba

- CEVA Logistics

- DSV

- FM Logistic

- Groupe CAT

- Naeko

- OIA Global

- Rhenus Logistics

- TIBA

- XPO Logistics

- DHL Supply Chain

- Kuehne+Nagel

- Grupo Sese

- Logista

- STEF Iberia

- ID Logistics

- Geodis

- Noatum Logistics

- Hellmann Worldwide Logistics

- Transportes Iruna, SA

第七章 市场机会与未来展望

The Spain 3PL Market was valued at USD 14.46 billion in 2025 and estimated to grow from USD 15.02 billion in 2026 to reach USD 18.19 billion by 2031, at a CAGR of 3.88% during the forecast period (2026-2031).

Spain's role as a European gateway, the rapid shift toward outsourced fulfillment, and multimodal corridor upgrades underpin the upward trajectory. E-commerce's geographic spread beyond Madrid and Barcelona, resilient nearshoring inflows from Northern Europe, and government-backed rail electrification projects jointly widen the addressable base for third-party logistics service providers. Digital tax incentives now reward AI-enabled route optimization while green-mobility policies raise demand for electric urban fleets. Heightened competition among domestic and multinational carriers accelerates pricing transparency and forces broader adoption of value-added warehousing, real-time visibility platforms, and asset-light alliances that de-risk capital exposure.

Spain 3PL Market Trends and Insights

Surge in E-commerce Volumes Requiring Outsourced Logistics Services

Spain's online buyer base is expected to climb toward 40 million users in 2025, solidifying nationwide reliance on contracted fulfillment partners. Amazon's USD 327 million logistics center in Asturias typifies the infrastructure scale now demanded by 48-hour delivery guarantees. Third-party providers respond with micro-fulfillment hubs that position inventory nearer to dense consumer pockets, a shift illustrated by studies showing Barcelona needs more than 1,000 such urban sites to meet current parcel volumes. Robotics-enabled sortation lines and AI-driven slotting solutions further compress fulfillment cycle times during peak shopping seasons. Greater delivery frequency, however, compels 3PLs to redesign trunk routes so that high-capacity trailers replenish urban depots overnight, mitigating daytime congestion costs.

Growing Demand for Temperature-Controlled Logistics for Pharma & Food

Heightened vaccine distribution, stricter EU food-safety rules, and a switch to fresh consumer habits combine to lift Spain's cold-chain utilization. Schmitz Cargobull's acquisition of Spanish telematics firm Atlantis Global System demonstrates how trailer makers are embedding sensor networks to keep payload readings verifiable end-to-end. AI demand forecasting now underpins capacity planning so that refrigerated slots are allocated dynamically rather than by static contracts, preserving margins despite energy-price volatility. On the pharmaceutical side, compliance with Good Distribution Practice drives premium tariffs for GDP-certified storage zones, offering revenue defense in an otherwise price-competitive landscape. Emerging controlled-atmosphere chambers broaden produce export options, extending shelf life for Mediterranean perishables shipped northward. Blockchain pilots add immutable traceability, an essential feature as Spanish regulators intensify random cold-chain audits.

High Diesel Fuel Prices Increasing Transport Costs

Fuel accounts for about one-quarter of total road freight expense, and 2025 volatility keeps margins thin despite statutory surcharge clauses. Madrid-Paris contract rates climbed 3.5% in Q4 2024 to USD 1,588 after currency conversion, illustrating the fragile rebound phase. Carriers resort to dynamic routes that weigh tolls, traffic, and refueling points so service-level agreements remain intact without blanket price hikes. Fleet owners test LNG and hybrid trucks on high-volume corridors, leveraging government subsidies to diversify energy exposure. Persistent variability nevertheless prompts shippers to explore rail for predictable budget planning, moderately dampening Spain third-party logistics market demand for long-haul trucking.

Other drivers and restraints analyzed in the detailed report include:

- Government Infrastructure Investments in Intermodal Transport Corridors

- Nearshoring of European Supply Chains to Spain Boosting Warehousing Demand

- Driver Shortage and Wage Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Domestic Transportation Management retained a 52.48% revenue slice in 2025, underscoring Spain's highway-centric freight patterns and the enduring need for nationwide milk-run schedules. Spain third-party logistics market size for Value-Added Warehousing & Distribution is projected to expand at 7.42% CAGR, faster than any other service line. Rising e-commerce returns handling, customization, and kitting tasks push warehouse operators to embed automated sorters, pick-by-voice, and carton right-sizing machines. Meanwhile, International Transportation Management accelerates on the back of refurbished Mediterranean port capacity that funnels Maghreb trade into northern Spain depots. CEVA Logistics' 18,000 m2 Tarragona facility illustrates how sustainability add-ons-photovoltaic roofing and LED lighting-are now table stakes for contract awards.

The resurgence of freight rail, spurred by state electrification grants, sparks integrated service packages where truck drayage at origin and destination bookends a rail middle-haul. Air freight volumes, though minor by tonnage, yield attractive margins for life-science shippers demanding two-to-eight-degree routings. Bulk commodities funnel through coastal Ro-Ro and container terminals, yet many 3PLs cross-sell customs clearance and trade-finance documentation to lift yields above pure tonnage fees, as omnichannel retailers seek one-hour click-to-door delivery, micro-fulfillment add-ons inside legacy DCs proliferate, validating the premium placed on inventory proximity in Spain third-party logistics market contracts.

The Spain Third-Party Logistics (3PL) Market Report is Segmented by Service (Domestic Transportation Management, International Transportation Management, and More), by End User (Automotive, Energy & Utilities, Manufacturing, Life Sciences & Healthcare, Technology & Electronics, E-Commerce, and More), and by Logistics Model (Asset-Light, Asset-Heavy, Hybrid). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Carcaba

- CEVA Logistics

- DSV

- FM Logistic

- Groupe CAT

- Naeko

- OIA Global

- Rhenus Logistics

- TIBA

- XPO Logistics

- DHL Supply Chain

- Kuehne + Nagel

- Grupo Sese

- Logista

- STEF Iberia

- ID Logistics

- Geodis

- Noatum Logistics

- Hellmann Worldwide Logistics

- Transportes Iruna, S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce volumes requiring outsourced logistics services

- 4.2.2 Growing demand for temperature-controlled logistics for pharma & food

- 4.2.3 Government infrastructure investments in intermodal transport corridors

- 4.2.4 Nearshoring of European supply chains to Spain boosting warehousing demand

- 4.2.5 Rise of collaborative urban micro-hubs to meet zero-emission zones

- 4.2.6 Digitization tax incentives spurring AI-enabled 3PL operations

- 4.3 Market Restraints

- 4.3.1 High diesel fuel prices increasing transport costs

- 4.3.2 Driver shortage and wage pressures

- 4.3.3 Urban noise & emission regulations limiting night-time deliveries

- 4.3.4 Rail network interoperability constraints reduce multimodal efficiency

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Warehousing Market Trends

- 4.7 E-commerce Growth Impact

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Domestic Transportation Management (DTM)

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Airways

- 5.1.1.4 Waterways

- 5.1.2 International Transportation Management (ITM)

- 5.1.2.1 Roadways

- 5.1.2.2 Railways

- 5.1.2.3 Airways

- 5.1.2.4 Waterways

- 5.1.3 Value-Added Warehousing & Distribution (VAWD)

- 5.1.1 Domestic Transportation Management (DTM)

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Energy & Utilities

- 5.2.3 Manufacturing

- 5.2.4 Life Sciences & Healthcare

- 5.2.5 Technology & Electronics

- 5.2.6 E-commerce

- 5.2.7 Consumer Goods & FMCG

- 5.2.8 Food & Beverages

- 5.2.9 Others

- 5.3 By Logistics Model

- 5.3.1 Asset-Light (Management-Based)

- 5.3.2 Asset-Heavy (Own Fleet & Warehouses)

- 5.3.3 Hybrid

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Carcaba

- 6.4.2 CEVA Logistics

- 6.4.3 DSV

- 6.4.4 FM Logistic

- 6.4.5 Groupe CAT

- 6.4.6 Naeko

- 6.4.7 OIA Global

- 6.4.8 Rhenus Logistics

- 6.4.9 TIBA

- 6.4.10 XPO Logistics

- 6.4.11 DHL Supply Chain

- 6.4.12 Kuehne + Nagel

- 6.4.13 Grupo Sese

- 6.4.14 Logista

- 6.4.15 STEF Iberia

- 6.4.16 ID Logistics

- 6.4.17 Geodis

- 6.4.18 Noatum Logistics

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Transportes Iruna, S.A.