|

市场调查报告书

商品编码

1408392

电子书阅读器:市场占有率分析、产业趋势与统计、2024年至2029年成长预测E-Reader - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

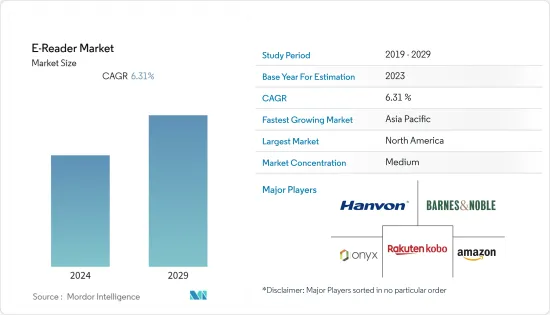

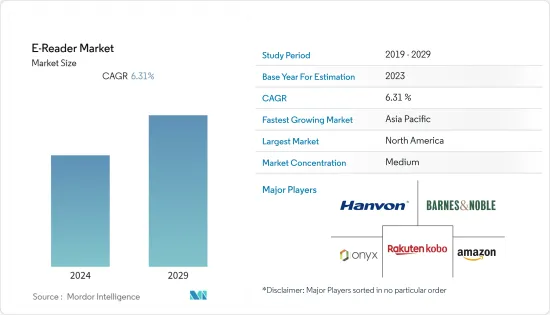

目前全球电子书阅读器市场规模为73.6亿美元,预计未来五年将达到100亿美元,预测期内复合年增长率为6.31%。

市场的成长受到多种因素的推动,例如电子书使用量的增加、电子阅读器电池寿命的延长以及电子阅读器的无眩光/光污染特性。电子书阅读器或电子书设备主要用于阅读书籍的电子副本。该设备可以在萤幕上显示文本,并根据读者的喜好优化字体大小、亮度和文字层级。

主要亮点

- 电子阅读器在萤幕技术方面更为先进。现今的高解析度显示器可提高对比度、提高色彩准确度并减少眩光。这使得电子阅读器更类似于印刷书籍,为使用者提供更舒适的阅读体验。一些电子阅读器具有可调节的色温,允许读者根据自己的喜好自订显示。许多电子书平台现在提供线上读书俱乐部和论坛等功能,让读者可以与具有相似兴趣的人联繫。还有一个平台,您可以与其他读者共用您的笔记和註释,创造更互动的阅读体验。这种趋势很可能会持续下去,社交阅读在电子阅读中将变得越来越重要。

- 包括挪威在内的欧盟经济和金融理事会成员国已宣布降低适用于电子出版物的增值税。最近,德国承诺颁布立法,将电子书、线上日誌和报纸的付加税率从 19% 降低至 7%。此举是在欧盟理事会同意允许各国将电子书与减价/免税实体书相匹配之后做出的。这项削减措施已在多个欧盟国家实施。电子出版 (EPUB) 是由国际数位出版论坛(万维网联盟的一部分)开发的最广泛采用的电子书文件格式。另一种主要的电子书格式是由 Adobe 开发的 PDF。 PDF 格式因其易用性而在网路上广泛使用。

- 电子书终端已发展成为单独的销售点,允许用户浏览无限数量的书籍和内容,从新版本到旧书再到长期绝版书籍。数位化正在扩大阅读和学习体验,为出版商提供了发现人才的新来源,并为作家和插画家提供了新的表达方式。例如,阿歇特图书公司 (Hachette Livre) 在技术开发和创新方面走在图书行业的前沿。阿歇特·利弗 (Hachette Livre) 应对新的阅读方式和不断变化的消费行为。另一方面,作为作者经济利益的守护者,阿歇特·利弗热衷于保证每本书的真实价值。

- 相反,音讯使用的增加可能会阻碍所研究的市场。有音讯是逐字或缩写地大声朗读文本的口头录音。音讯是普通书籍的有用资讯来源,也是视觉障碍者的重要资讯来源。大多数数位装置都可以播放 MP3 檔案等音讯格式,Google Books 和 Amazon 等公司提供对广泛书籍库的存取。此外,Audiobook Creation Exchange (ACX) 可以轻鬆建立和分发数位有声音讯。 ACX Marketplace 让专业音讯创建数位音讯版本并赚取高达 40% 的版税。 ACX 与数百家音讯製作人、演员和工作室建立了联繫,可以透过版税共用合作伙伴关係付费或免费聘用他们。

- 在 COVID-19 大流行期间,确保学生和教师只能在线上存取学习资源是当务之急。除了成长机会外,电子阅读器还为出版商提供了一个很好的机会,可以摆脱传统书店模式,透过数位平台直接接触消费者,从而增加利润。疫情爆发的最初几个月,市场实体结构的危机导致教育内容转向直接面向家长,供应链的压缩增加了出版商对电子书的积极接受度。

电子书阅读器市场趋势

数位学习的新兴趋势可望推动市场发展

- 远距教学的日益普及以及这些服务在智慧型手机、平板电脑、其他行动装置和穿戴式技术上的使用越来越多,数位学习产业可能会受益。这些变数为数位学习和服务业务提供了各种成长机会。学校和培训机构正在将智慧技术融入其数位学习环境,而不是传统的黑板方法。在大学层面,采用智慧学习等多种方法,为学生获取符合产业需求的相关有用技能提供替代途径和可能性。这种数位学习趋势预计将推动受访市场的发展。

- 卡达的国家电子学习入口网站提供各种资讯科技和商业领域的线上课程。从 2,500 多个课程中进行选择,享受灵活的学习。数位学习入口网站已被卡达 24 个组织和 37 家中小企业使用,已完成 4,000 多门课程。此外,哈马德医疗公司、多哈银行和卡达石油公司已获得资讯和通讯技术最高委员会批准,将卡达国家数位学习入口网站的课程纳入其就业发展计划,被称讚为成功实施。 HMC 被评为顶级组织。

- 行动学习课程设计者面临的挑战是建立不需要下载大量资料的课程。透过 MLearning,资讯可以透过行动装置共用。因此,数位学习模组必须针对小萤幕进行客製化。数位学习课程中应允许使用需要更详细资讯、复杂视觉效果或更多资料或频宽的媒体。每个萤幕一个想法的小型模组、突出的按钮和简单的导航是呈现资讯的理想方式,并且各种供应商都有望满足这一需求。

- 另一方面,再培训是指学习或教导新技能,以便胜任同一公司内或公司外的不同工作。例如,如果某项工作被自动化取代,则该工作的员工必须培养管理技术的技能或将其转移到完全不同的角色。超过三分之一 (37%) 的公司目前正在实施再技能培训,近五分之三 (56%) 计划在明年内实施。以下是公司对个人进行新工作再培训最常见的方式。其中包括辅导和指导(57%)、工作见习(41%)和在职训练(65%)。新兴市场的开拓预计将推动受访市场的发展。

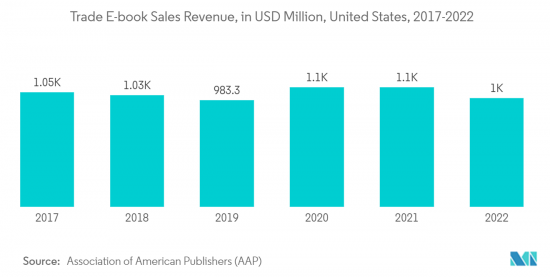

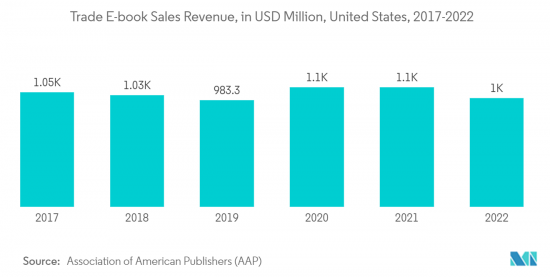

- 根据美国出版商协会 (AAP) 统计,美国电子书销售额估计为 10 亿美元。市场上智慧型手机、平板电脑和笔记型电脑等行动装置的普及预计将对电子书市场的成长产生积极影响。据爱立信预计,2027年西欧的行动/行动电话用户数量预计将达到7,800万,中欧和东欧将达到6,900万。这些数字预计将呈指数级增长,从而增加对数位阅读订阅的需求。

预计北美将占据很大的市场份额

- 预计北美将在预测期内占据最大份额并占据重要的市场占有率。智慧型手机、平板电脑和 iPad 等连网装置的日益普及增加了对电子书阅读器的需求。该国的竞争对手正专注于开发电子阅读器和电子书,以增加市场竞争。例如,乐天工房公司推出了一款创新的数位阅读技术设备「Kobo Libra H2O」。这款电子书阅读器是一款7吋防水轻巧设备,旨在为最终用户提供更好的阅读体验。

- 电子书的日益普及和普及正在极大地改变出版业,但电子书的性质和范围因公司和类型而异。此外,透过互动式和动画电子书,电子出版业务使许多出版商和作者能够以更快、更先进的方式将他们的作品推向市场。能够提供数位媒体的设备的激增和互联网普及的提高使消费者能够随时随地访问他们喜爱的媒体内容,包括资讯、娱乐和社交活动。

- 该地区的参与企业正在策略性地开发新的行销技术,以赢得市场占有率。例如,亚马逊以固定价格提供电子书,为 Prime 会员提供特殊优惠,并为作者提供自助出版服务。一些消费者和出版商批评这种封闭的环境,怀疑亚马逊将主导这一领域。 Kindle Direct Publishing(KDP)服务允许作者在亚马逊平台上自助出版书籍,并在短短 24 小时内赚钱。该公司正在扩大其电子书库,让作者更容易、更平易近人。该公司正在透过各种设备的应用程式提供电子书来扩展其电子书业务。

- 截至 2023 年 7 月,Overdrive 是公共图书馆最着名的数位发行商,为大多数图书馆的音讯和电子书馆藏提供支援。如果图书馆需要一位畅销书作者的多本书,就必须为每本书支付费用。费用因出版商而异,有些书籍在藉阅一定数量后就会过期。图书馆为其顾客购买音讯和电子书的最常见方式是透过一份、一个使用者模型。如果图书馆购买一本畅销书,一次只能藉一本。大型图书馆系统可能有足够的副本来满足需求,而较小的分行可能只能购买少量副本。

- 同样,亚马逊最近发布了三款新的电子阅读器:Kindle Paperwhite、Kindle Paperwhite Signature 和 Kindle Paperwhite Kids。这些型号配备新处理器、更大的 6.8 吋萤幕、10 週的电池寿命、暖光支援和新的 USB-C 充电。

电子书阅读器产业概况

全球电子书阅读器市场适度整合,有亚马逊公司、Barnes & Noble Inc.、Rakuten Kobo Inc.、Hanvon Technology 和 Onyx International Inc. 等多家参与企业。公司不断投资于策略联盟和产品开拓,以获得显着的市场占有率。近期市场开拓如下。

2023年5月,提供电子纸技术的E Ink元太科技宣布与联发科加强合作,透过系统晶片开发进军全球电子书阅读器市场。凭藉E Ink元太科技的电子纸及系统技术与联发科技先进的晶片解决方案的整合,两家公司将为台湾製造商在全球电子书阅读器市场带来新的业务前景。

2023 年 4 月,数位书籍销售和出版公司 Rakuten Kobo 宣布将开始在美国和英国提供 Kobo Plus。 Kobo Plus 是一项无限阅读服务,每月提供超过 130 万本电子书和 10 万本音讯,非常适合书籍爱好者。 Kobo Plus 是一项无限阅读订阅服务,非常适合收集经典文学遗愿清单、完整的作者目录或深入研究新的兴趣领域。透过每月支付较低费用的定期订阅,您可以试阅您以前从未读过的作者或类型的书籍的几页,如果您不喜欢它,请继续阅读其他内容否则不用感到内疚..

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 数位学习市场的新趋势

- 低成本电子书阅读器的普及

- 市场抑制因素

- 供应商/开发人员合作伙伴关係和基础设施需求可能是该行业面临的挑战

第六章市场区隔

- 按萤幕大小

- 6吋以下

- 6-8英寸

- 8吋或以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 中东/非洲

- 拉丁美洲

- 北美洲

第七章 竞争环境

- 公司简介

- Amazon.com Inc.

- Barnes & Noble Inc.

- Rakuten Kobo Inc

- Hanvon Technology Co. Ltd.

- Onyx International Inc.

- Bookeen

- PocketBook International SA

- Sony Corportation

- Apple Inc

- ECTACO Inc.

第八章投资分析

第九章 市场机会及未来趋势

The global E-Reader market is valued at USD 7.36 billion in the current year and is expected to register a CAGR of 6.31% during the forecast period to reach a value of USD 10.00 billion by the next five years. The market's growth depends on various factors, including the growing use of E-books, E-readers' more extended battery life, and E-readers' glare/light pollution-free nature. An E-book reader or E-book device is predominantly used to read electronic copies of the book. The device can display text on the screen and optimize font size, brightness, and text level according to the reader's preferences.

Key Highlights

- E-readers are becoming more advanced in terms of their screen technology. Today's high-resolution displays deliver improved contrast, better color accuracy, and reduced glare. This makes e-readers more similar to print books, providing users with a more comfortable reading experience. Some e-readers also feature adjustable color temperature, allowing readers to customize the display to their preferences. Many e-reading platforms now offer features enabling readers to connect with others who share their interests, such as online book clubs and discussion forums. Some platforms also allow readers to share notes and annotations with others, creating a more interactive reading experience. This trend will likely continue, with social reading becoming increasingly important in the e-reading landscape.

- EU Economic and Financial Affairs Council members, including Norway, have announced a cut VAT applicable on electronic publications. Recently, Germany committed to enacting laws to cut the VAT rate for e-books, online journals, and newspapers from 19% to 7%. The move comes after the EU Council agreed to allow countries to align their reduced/nil-rated physical books with their electronic counterparts. The cut has already been applied in several EU countries. Electronic Publication (EPUB) is the most widely adopted e-book file format developed by the International Digital Publishing Forum (part of the World Wide Web Consortium). Another major e-book format is the PDF, developed by Adobe. PDF format is widely used around the web because of its ease of use.

- E-reader devices have evolved into individual points of sale, allowing users to browse an unlimited selection of books and content, ranging from new releases to backlist titles to long-out-of-print titles. Digital is expanding the reading and learning experience, offering publishers new ground for talent scouting and providing authors and illustrators with new avenues for expression. For instance, Hachette Livre has been at the forefront of the book industry's response to technical developments and innovations. It has adapted to new kinds of reading and developing consumer behavior. On the other hand, Hachette Livre is keen to guarantee that each book's genuine value is recognized as the custodian of its authors' financial interests.

- On the contrary, the increase in the usage of audiobooks may hamper the studied market. An audiobook records a reading text orally, either word for word or shortened. It is a helpful alternative to regular books and a vital source of information for the visually impaired. Most digital devices can play audio formats like MP3 files, and companies such as Google Books and Amazon provide access to extensive libraries of books. Further, The Audiobook Creation Exchange (ACX) allows making and distributing digital audiobooks simple. ACX's marketplace of professional audiobook creates a digital audiobook edition of the book and earn up to 40% royalties. ACX connects with hundreds of audiobook producers, actors, and studios who may be hired for a fee or a royalty-sharing partnership at no cost.

- During the COVID-19 pandemic, providing students and teachers with online-only access to learning resources was a priority, and it will continue to be a goal as colleges and universities offer hybrid learning and teaching settings. Apart from the growth, e-readers provided a prime opportunity for publishers to switch from conventional bookstore models and directly reach consumers via digital platforms, thus increasing their profits. The crisis in the brick-and-mortar structure in the market during the initial months of the pandemic resulted in direct-to-parents for educational content, and compression of the supply chain increased the positive reputation of the e-book in publishers' minds.

E-Reader Market Trends

Emerging Trends in the E-Learning is Expected to Drive the Market

- The E-learning industry will most likely benefit from the growing popularity of distance learning and the increased use of these services on smartphones, tablets, other mobile devices, and wearable technology. These variables open up various growth opportunities for the E-learning and services businesses. Schools and training facilities are incorporating smart technology into E-learning environments rather than using the traditional blackboard method. Different methods, such as smart learning, are being used at the university level to give alternative pathways and possibilities for students to build relevant and useful skills in line with industry demands. Such trends toward E-learning are expected to drive the studied market.

- Qatar's National e-Learning Portal offers online courses on various information technology and business disciplines. It has over 2,500 different courses to choose from and flexible learning. The e-Learning Portal is already used by 24 organizations and 37 small and medium businesses in Qatar, with over 4,000 courses completed. Further, Hamad Medical Corporation, Doha Bank, and Qatar Petroleum were recognized for successfully incorporating courses available on the Qatar National e-Learning Portal into employment development plans by the Supreme Council of Information and Communication Technology. HMC was recognized as the top organization.

- The difficulty for course designers in mobile learning is building courses that do not require a large amount of data download. Information is shared via mobile devices in mLearning. Hence, eLearning modules must be tailored for small screens. More detailed information, complex visuals, or media that demand a lot of data or bandwidth should be allowed in eLearning courses. Bite-sized modules with one idea per screen, prominent buttons, and simple navigation are the ideal way to present information, and various vendors are expected to cater to this demand.

- Reskilling, on the other hand, entails learning or teaching new skills for a person to be qualified for a different job within the same firm or outside. Employees in those roles, for example, must be reskilled to manage that technology or transfer it into a completely different capacity when a job function is replaced by automation. More than one-third of firms (37%) now offer reskilling training, and nearly three-fifths (56%) expect to do so within the following year. The following are the most prevalent methods through which firms reskill individuals for new jobs: Coaching or mentoring (57%), job shadowing (41%), and on-the-job training (65%). Such developments are expected to drive the studied market.

- According to the Association of American Publishers (AAP), the E-book sales in the United States were estimated to be USD 1,000 Million. The proliferation of mobile devices, such as smartphones, tablets, and laptops in the market is expected to positively impact the growth of e-books in the market. According to Ericsson, in 2027, the number of estimated mobile/cellular subscriptions will account for 78 million in Western Europe and 69 million in Central and Eastern Europe. These numbers are expected to increase exponentially, which will create increased demand for digital reading subscriptions.

North America is Expected to Hold Significant Share of the Market

- North America is expected to have a significant market share by capturing the maximum share during the forecast period. The rising penetration of connected gadgets such as smartphones, tablets, iPads, and others has generated a high demand for eReaders.Also, the technological advancements and the increasing ITC expenditure among area is anticipated to drive the market. Critical firms in this country are focused on establishing eReaders and eBooks to gain a competitive edge in the market. For instance, Rakuten Kobo Inc. launched an innovative digital reading technology device - 'Kobo Libra H2O'. This eReader is a 7-inch waterproof and lightweight device designed to give the end-user a better reading experience.

- The widespread availability and rising popularity of e-books are transforming the publishing industry, while the nature and scope of e-books changes differ significantly from company to company and genre to genre. Further, With interactive e-books and animated e-books, e-publishing businesses have enabled many publishers and authors to get their works to market faster and in an advanced way. The growing number of devices capable of providing digital media and the increasing internet penetration have allowed consumers to access media content of their choice, in terms of information, entertainment, or social activity, anywhere.

- The players in the region are strategically developing new marketing techniques to capture the market share. For example, Amazon provides e-books at a flat rate, special offers for Prime customers, and a self-publishing service for authors. Some consumers and publishers have been criticizing this closed environment, as they are suspicious that Amazon might dominate the segment. The Kindle Direct Publishing (KDP) service allows authors to self-publish books on the Amazon platform and earn money in as little as 24 hours. By making it easier and more approachable for authors, the company is expanding its e-book library. By making e-books accessible through apps for different devices, the company is increasing its e-book business.

- In July 2023, Overdrive is the most prominent digital distributor for public libraries, and they power audiobook and e-book collections of the vast majority of them. If libraries wanted many books by a bestselling author, they had to pay for each title individually. Each publisher has different rates; some books expire after a certain number of loans. The most popular method for libraries to buy audiobooks and e-books for their patrons is under the one copy, one user model. If a library buys a bestselling title, only one copy can be loaned out at a time. Larger library systems can ensure enough copies to meet the demand, while smaller branches can only buy a few copies.

- Similarly, recently, Amazon announced the launch of three new Kindle Paperwhite e-readers: the Kindle Paperwhite, Kindle Paperwhite Signature, and Kindle Paperwhite Kids. The models feature a new processor, a larger 6.8-inch screen, ten weeks of battery life, warm light support, and new USB-C charging.

E-Reader Industry Overview

The global E-Reader market is moderately consolidated with the presence of several players like Amazon.com Inc., Barnes & Noble Inc., Rakuten Kobo Inc., Hanvon Technology Co. Ltd., Onyx International Inc., etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In May 2023, E Ink, the provider of ePaper technology, announced the enhancement of its collaboration with MediaTek to enter the global eReader market through system chip development. By integrating E Ink's ePaper and system technology with MediaTek's advanced chip solutions, the two companies are poised to offer new enterprise prospects for Taiwanese manufacturers in the global eReader market.

In April 2023, The digital reading retailer and publisher Rakuten Kobo announced the US and UK launches of Kobo Plus, the all-you-can-enjoy subscription offering book lovers unlimited access to over 1.3 million e-books and over 100,000 audiobooks for a low monthly fee. The Kobo Plus subscription is an ideal way to come up with a bucket list of literary classics, an entire author's catalog, or to dive into a new field of interest. With endless reading for one low monthly payment, the subscription allows readers to sample a few pages from an author or genre they have never read and move on to another book guilt-free if it's not to their taste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging trends in the eLearning market

- 5.1.2 The proliferation of low-cost e-reader devices

- 5.2 Market Restrains

- 5.2.1 Vendor-developer partnerships and need for the developed infrastructure may pose challenges to the industry.

6 MARKET SEGMENTATION

- 6.1 By Screen Size

- 6.1.1 Below 6 Inch

- 6.1.2 6-8 Inch

- 6.1.3 More than 8 Inch

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Others

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Others

- 6.2.4 Middle East and Africa

- 6.2.5 Latin America

- 6.2.1 North America

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Barnes & Noble Inc.

- 7.1.3 Rakuten Kobo Inc

- 7.1.4 Hanvon Technology Co. Ltd.

- 7.1.5 Onyx International Inc.

- 7.1.6 Bookeen

- 7.1.7 PocketBook International SA

- 7.1.8 Sony Corportation

- 7.1.9 Apple Inc

- 7.1.10 ECTACO Inc.