|

市场调查报告书

商品编码

1432425

智慧包装:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Smart Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

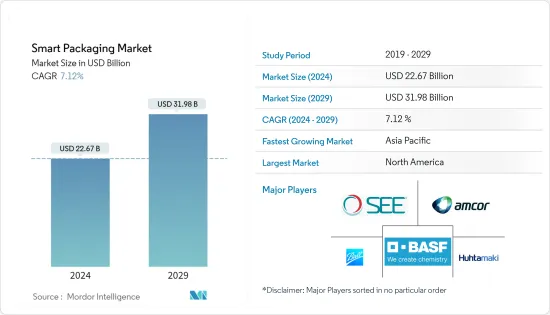

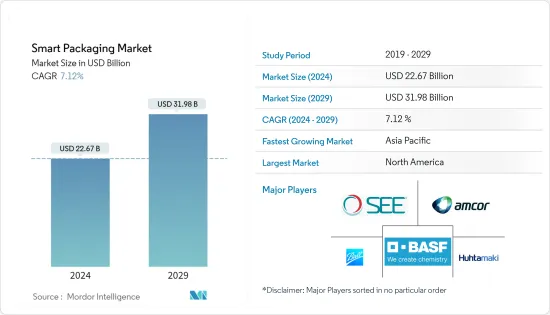

预计2024年智慧包装市场规模为226.7亿美元,到2029年将达319.8亿美元,预测期间(2024-2029年)复合年增长率为7.12%。

智慧包装是指配备感测器的特定类型的包装系统,用于食品和药品等各种物品。智慧包装中使用的技术有助于监控产品品质、保质期、新鲜度,并提高客户和产品安全。当产品使用智慧技术包装时,这些系统会提供有关产品品质和新鲜度的详细资讯。

主要亮点

- 快速都市化带来的消费者生活方式的变化以及前沿整合创新带来的个人化个人物品的使用增加,推动了智慧包装市场的成长。此外,全球包装市场业务依赖未开发的地理区域,这为市场竞争对手的成长提供了巨大的机会。世界各地对永续包装有机食品的需求不断增加,特别是自大流行以来,随着健康和卫生问题的增加。

- 根据《全球有机贸易指南》,2016年美国有机加工食品的消费额估计为149.6亿美元,预计到2022年将超过210亿美元。此外,在印度、中国、泰国和印尼等新兴国家,有机加工食品的市场规模近年来也不断扩大。这可能会增加这些国家未来对智慧包装的需求。

- 世界各地的多家智慧包装製造商不断创新其产品,始终致力于支持环境永续性与智慧包装计画相结合。 2022 年 12 月,3D 扫描和检测解决方案製造商 LMI Technologies (LMI) 宣布,将停止在其产品包装中使用一次性塑胶发泡体和其他塑胶材料,并将开始包装和出货所有产品。它已经开始了。由 100% 可回收和生物分解性的材料製成。向新 EcoSmart 包装的过渡正在进行中,该公司预计其大部分产品将在 2023 年初进行更换。新的 EcoSmart 包装在盒子外侧印有二维码。连线至包含所有目前可用产品快速入门指南 (QSG) 的网页。客户可以透过智慧型手机扫描包装盒上的二维码并在相关主页上查看 QSG,立即下载与 LMI 新产品相容的 PDF 版本。

- 然而,分期付款的高资本成本、安全问题、製造与当前包装标准相容的传感器和指示器的新技术、消费者意识等是市场成长的主要限制因素,这已成为一个问题。

- 疫情爆发后,欧洲包装和环境署向欧盟委员会表示,包装是产品组的重要组成部分,对于这些产品组来说,包装对于保持生鲜产品不间断的流通至关重要,特别是易腐烂的货物食品。我让他们认识到它是一个元素。对此,为欧洲国家提供解决方案的StePac开发了先进的调气包装,可有效减少食品的催熟和老化过程。

- 预计未来推动市场的另一个因素是电子商务或线上购买。到目前为止,线上杂货购物仅限于国际城市和大城市,但它可能很快就会成为小城市和城镇的首选购买方式。这预计将进一步加速包装行业的成长,并鼓励主动和智慧包装的发展。

智慧包装市场趋势

活性包装获得主要市场份额

- 活性包装的作用不仅仅是容纳和保护您的产品。它与包装内容物相互作用,以增加新鲜度并延长保质期。包装中含有添加或去除的成分,以调节湿度、含氧量、气味和风味等条件。活性包装主要用于食品和饮料。

- 活性包装的工作原理是将活性元素放置在包装内。小包装、信封或标籤与产品一起放置在包装内。例如,这可以释放抗菌剂以减缓腐败过程或去除氧气以防止食品腐败。活性包装的另一种工作方式是透过挤压、层压或印刷将活性元素融入包装材料中。这种机制对消费者更有吸引力,因为包装没有任何令人困惑或奇怪的地方。

- 活性包装技术为包装产品增加了功能,使其作用方式适应产品的保护功能和需求,并限制破坏性过程,而不仅仅是遏制、保护和传播。建立在传统包装概念的基础上。因此,活性包装提供了一种新方法,可以在供应链需求增加期间减少食品浪费和损失,同时维持现有的製造系统。

- 此外,对安全和追踪解决方案的需求不断增长将推动主动和智慧包装市场的成长。例如,RFID 标籤提供识别、控制和管理食品供应链的能力。与传统条码标籤相比,它们在食品追溯方面更加先进、可靠和高效。用于监控产品温度、相对湿度、压力、pH 值和光照的 RFID 标籤已上市,有助于提高食品品质和安全性。 2022 年 4 月,全球领先的食品连锁店 Chipotle Mexican Grill 开始探索 RFID 技术,以改善其芝加哥配销中心以及芝加哥大都会圈约 200 家餐厅的库存和追溯系统。

- 根据美国製造公司 Zebra Technologies 的一项研究,到 2024 年,市场领先的包装製造商和最终用户可能会倾向于实施更全面的汽车解决方案。报告称,RFID、感测器和扩增实境等技术的投资预计将从 2019 年的 29%、29% 和 22% 增至 2024 年的 35%、35% 和 29% 马苏。在欧洲,预计将有更多的出境活动使用RFID和定位技术,其中超过五分之一的人将其用于包装(25%)、库存管理(20%)和拣货(19%)。我们预计RFID将被使用。 2024 年。

预计北美将占据重要市场占有率

- 有利的监管条件、对永续性的日益关注以及各个最终用户领域(尤其是食品和医疗保健行业)对活性和智慧包装不断增长的需求,推动了美国智慧包装市场的显着成长。

- 根据美国粮食及农业组织估计,美国每年浪费了 1,330 亿磅食物,金额1,610 亿美元。减少食品废弃物的努力是多方面的,包括增加将食品转移到食物银行、教育和宣传,以及努力标准化食品标籤上的日期标籤。此外,使用智慧包装减少食品废弃物在美国引起了广泛关注。

- 此外,食品业智慧包装的成长很大程度上得益于政府的倡议,这不仅可以帮助减少食品废弃物和确保食品安全,还可以追踪食品的位置和状况。例如,美国国防部(DOD)和食品药品协会(FDA)鼓励使用RFID技术进行供应链管理以及对需要智慧包装的产品进行追踪和追溯。

- 预计加拿大在预测期内将出现显着成长。转向更健康、加工更少的食品,这些食品经过有效包装,可确保安全、免受污染并延长保质期,这表明全国各地的客户对智慧包装解决方案的偏好。

- 加拿大印刷电子工业协会与包装联盟PAC 合作,创建了 IntelliPACK 领导委员会,以加速新智慧包装产品和应用的采用。 IntelliPACK 联合计画于 2017 年启动,旨在加速使用可印刷、柔性或有机电子 (PE) 实现的智慧包装的开发和实施。

- 此外,intelliPACK Business Network 还与一些组织合作,协助开发在加拿大使用可印刷和有机电子 (PE) 实现智慧包装的能力。例如,这些组织最近与 PAC、包装联盟(PAC) 和 IntelliFLEX 签订了策略合作协议,以加速在加拿大各地普及主动智慧包装。此外,加拿大政府也支持产业努力寻找对环境负责的方法来解决农业问题,造福经济和子孙后代。

智慧包装产业概况

在所研究的智慧包装市场中,竞争公司之间的竞争强度中等偏高,预计在预测期内将维持在相似水准。市场上一些主要的参与者包括 Sealed Air Corporation、Amcor PLC、Ball Corporation、 BASF SE、Huhtamaki OYJ 等。市场公司正在采取合作伙伴关係、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

2023 年 5 月,设计和製造负责任包装解决方案的全球公司 Amcor PLC 宣布已达成收购 ModaSystems 的最终协议。 ModaSystems 是一家最先进的自动化蛋白质包装机製造商。 ModaSystems 为肉类、家禽和乳製品行业开发、组装和支援创新的高性能模组化真空包装解决方案。

2023 年 3 月,艾利丹尼森宣布对其 Atma-io 互联产品云进行最新更新,以帮助品牌转变其供应链。该平台管理着服装、零售、食品和医疗保健等品牌的超过 280 亿件商品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 后智慧包装市场的影响评估

第五章市场动态

- 市场驱动因素

- 食品包装品质检测技术的进步

- 食品安全意识不断增强

- 智慧包装的多种应用推动印刷业发展

- 市场限制因素

- 由于初始要求而导致成本较高

第六章市场区隔

- 依技术

- 活性包装

- 智慧包装

- 按行业分类

- 食品

- 饮料

- 卫生保健

- 个人护理

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Sealed Air Corporation

- Amcor PLC

- Ball corporation

- BASF SE

- Huhtamaki OYJ

- Stora Enso

- Avery Dennison Corporation

- Zebra Technologies Corporation

- 3M Company

- International Paper Company

第八章投资分析

第9章市场的未来

The Smart Packaging Market size is estimated at USD 22.67 billion in 2024, and is expected to reach USD 31.98 billion by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

Smart packaging refers to a specific type of sensor-equipped packaging system used for various items, including food and medication. The technology used in smart packaging helps to increase product quality, shelf life, freshness monitoring, and customer and product safety. When products are packaged using intelligent technology, these systems provide details about the product's quality and freshness.

Key Highlights

- The smart packaging market's growth is driven by consumer lifestyle changes brought on by rapid urbanization and increased use of individualized personal items with cutting-edge integrated innovation. In addition, the global packaging market business depends on the untapped geographic areas that offer enormous open doors for market competitors for its growth. Owing to increasing concern about health hygiene, especially after the pandemic, there has been an increased demand for sustainably packaged organic food worldwide.

- According to the Global Organic Trade Guide, the consumption of organic packaged foods in the United States was estimated to be worth USD 14.96 billion in 2016, and it is expected to have surpassed USD 21 billion in 2022. Moreover, even in developing countries like India, China, Thailand, and Indonesia, the market size for organic packaged food has been positive in the past few years. This may have consequently pushed the demand for smart packaging in these countries for the future.

- Several smart packaging manufacturers across the globe are constantly innovating products with their consistent effort to support environmental sustainability coupled with smart packaging initiatives. In December 2022, LMI Technologies (LMI), the manufacturer of 3D scanning and inspection solutions, announced that it had stopped using single-use, plastic-based foams and any other plastic materials in product packaging and had begun packaging and shipping all its products with 100% recyclable and biodegradable materials. The transition to the new eco-smart packaging was underway, and the company anticipated to have switched over the great majority of its products by the beginning of 2023. The new eco-smart packaging features a printed QR code on the outside of the box that connects to a webpage with all the product quick start guides (QSG) that are currently available. Customers can quickly download the PDF version corresponding to their new LMI product by scanning the QR code on the box with their smartphone and then perusing the QSGs on the associated homepage.

- However, the high cost of capital for instalments, security issues, new techniques for fabricating such sensors and indicators compatible with current packaging standards, and awareness among consumers are key restraints and challenges to the market's growth.

- After the pandemic outbreak, the European Organization for Packaging and the Environment called on the European Commission to recognize packaging as an essential component of the product groups identified as critical, like perishable goods, especially food items, to maintain the uninterrupted flow of goods. In this context, StePac, which supplies its solutions in European countries, developed an advanced modified atmosphere packaging, effectively reducing the food products' ripening and ageing processes.

- Another factor expected to drive the market in the future is e-commerce or online purchasing. Until now, online buying of groceries was limited only to cosmopolitan or metro cities, but soon, it may be a preferred mode of buying in small cities and towns. This is further anticipated to create growth in the packaging sector and boost the development of active and intelligent packaging.

Smart Packaging Market Trends

Active Packaging to Hold Major Share in the Market

- Active packaging does more than contain and protect the product. It interacts with the contents of the package to enhance freshness or extend shelf life. The packaging includes added or removed ingredients to adjust conditions such as humidity, oxygen levels, odors, and flavors. Active packaging is mainly used for food and beverages.

- Active packaging works by placing the active element inside the package. A small packet, envelope, or label is placed inside the package with the product. This can, for instance, release antibacterial agents to slow the spoilage process or remove oxygen to keep food from spoiling. Another way active packaging works is by incorporating active elements into the packaging material by extrusion, lamination, or printing. This mechanism is more appealing to consumers as there are no confusing or odd items on the packaging.

- Active packaging technology builds on the traditional concept of packaging by adding functionality to the packaged product, adapting its mode of action to the protective function and needs of the product, and going beyond mere containment, protection, and transmission to limit destructive processes. Active packaging, therefore, offers a new approach to reducing food waste and loss during increased demand in the supply chain while maintaining current manufacturing systems.

- Furthermore, increasing demand for security and tracking solutions drives growth for the active and intelligent packaging market. For instance, RFID tags provide the ability to identify, control, and manage the food supply chain. These are more advanced, reliable, and efficient for food traceability than conventional barcode tags. RFID tags for monitoring the products' temperature, relative humidity, pressure, pH, and light exposure are already available on the market, aiding in enhancing food quality and safety. In April 2022, major worldwide food chain Chipotle Mexican Grill started exploring RFID technology to improve its inventory and traceability systems at its Chicago distribution center and roughly 200 restaurants in the greater Chicago area.

- According to the research of ZebraTechnologies, a US-based manufacturing company, by 2024, the market-leading packaging manufacturers and end users are likely to gravitate toward incorporating more comprehensive automotive solutions. According to the report, the investment in technologies, including RFID, sensors, and augmented reality, is expected to be up from 29%, 29%, and 22%, respectively, in 2019 to 35%, 35%, and 29% in 2024. In Europe, it is expected that more outbound activities may employ RFID and location technology, with more than one in five expecting to utilize it for packaging (25%), inventory management (20%), and picking (19%) by 2024.

North America is Expected to Hold Significant Market Share

- Due to favorable regulatory conditions, a growing focus on sustainability, and rising demand for active and intelligent packaging across various end-user segments, particularly the food and healthcare industries, the smart packaging market in the United States has experienced significant growth over the past few years.

- According to the Food and Agriculture Organization of the United States, in the US, an estimated 133 billion pounds of food, at a value of USD 161 billion, is wasted yearly. Efforts to reduce food waste are multifaceted, including increased diversion of food-to-food banks, education and outreach, and efforts to standardize date markings on food labels. Further, reducing food waste using smart packaging is gaining significant traction in the United States.

- Moreover, the growth of intelligent packaging in the food industry is significantly attributed to government efforts, as beyond reducing food waste or helping to ensure food safety, intelligent packaging also can track the location and condition of food. For instance, the US Department of Defense (DOD) and the Food and Drugs Association (FDA) have encouraged using RFID technology for supply chain management and tracking and tracing products requiring smart packaging.

- Canada is expected to register significant growth over the forecast period. The shift towards healthier, less processed food that has been effectively packaged to ensure safety from contamination and lengthen the shelf life indicates customer preferences towards smart packaging solutions nationwide.

- The Canadian Printable Electronics Industry Association has formed the IntelliPACK Leadership Council, in partnership with PAC, Packaging Consortium, to speed up the adoption of new intelligent packaging products and applications. The joint IntelliPACK program was launched in 2017 to drive the development and adoption of intelligent packaging enabled with printable, flexible, or organic electronics (PE).

- Further, the intelliPACK Business Network is working with organizations that can help develop the capability to enable intelligent packaging using Printable and Organic Electronics (PE) in Canada. For instance, the organizations recently made a strategic collaboration agreement with the PAC, Packaging Consortium (PAC), and intelliFLEX to facilitate the widespread adoption of active and intelligent packaging across Canada. Furthermore, the Canadian government assists industry efforts to identify environmentally sound approaches to agricultural problems that will benefit the economy and future generations.

Smart Packaging Industry Overview

The intensity of competitive rivalry in the Smart Packaging Market studied is moderately high and is expected to remain the same during the forecast period. Some of the major players in the market are Sealed Air Corporation, Amcor PLC, Ball Corporation, BASF SE, and Huhtamaki OYJ. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, Amcor PLC, a global player in the design and manufacture of responsible packaging solutions, announced that it signed a definitive agreement to acquire ModaSystems. ModaSystems is a manufacturer of state-of-the-art automated protein packaging machines. ModaSystems develops, assembles, and supports innovative, high-performance, modular vacuum packaging solutions for the meat, poultry, and dairy industries.

In March 2023, Avery Dennison Corporation announced its latest Atma-io-connected product cloud updates to help brands transform their supply chains. The platform manages over 28 billion items for brands across apparel, retail, food, and healthcare.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Post-COVID-19 Impact on the Smart Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancement in Technology in Food Packaging for Quality Inspection

- 5.1.2 Rising Awareness Regarding Food Safety

- 5.1.3 Development in the Printing Industry Due to Various Applications of Smart Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs Due to Initial Requirement

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Active Packaging

- 6.1.2 Intelligent Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sealed Air Corporation

- 7.1.2 Amcor PLC

- 7.1.3 Ball corporation

- 7.1.4 BASF SE

- 7.1.5 Huhtamaki OYJ

- 7.1.6 Stora Enso

- 7.1.7 Avery Dennison Corporation

- 7.1.8 Zebra Technologies Corporation

- 7.1.9 3M Company

- 7.1.10 International Paper Company