|

市场调查报告书

商品编码

1433513

全球线上广告市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Online Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

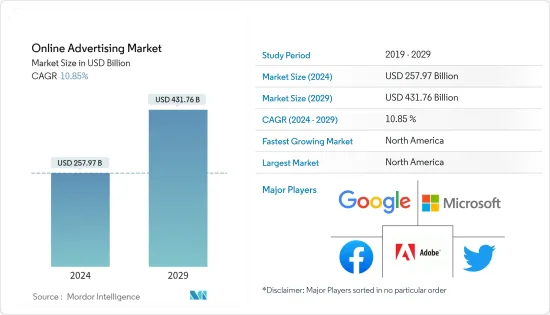

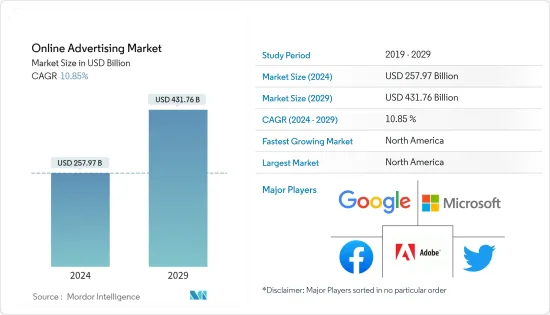

根据预测,2024年全球线上广告市场规模预计为2,579.7亿美元,2029年达到4,317.6亿美元,预测期(2024-2029年)复合年增长率为10.85%。

网路广告市场是指包含网路上广告空间买卖的行业。它包括各种型态的数位广告,例如展示广告、搜寻引擎行销(SEM)、影片媒体广告、影片广告和原生广告。

主要亮点

- 在网路和数位设备使用不断增加的推动下,线上广告市场多年来经历了显着增长。随着智慧型手机的普及和社群媒体平台的兴起,网路广告已成为世界各地企业行销策略的重要组成部分。

- 从传统广告向线上广告的日益转变也为网路广告市场的成长提供了重大推动力。网路的普及和网路用户数量的增加导致可以透过网路广告接触到更多的受众。人们在网路上工作、娱乐或社交的时间越来越多,广告商可以透过数位管道接触到他们。

- 新颖的广告技术与基于行动应用程式的广告的兴起相结合,正在推动线上广告市场的成长。广告商越来越多地采用这种方法,以更个人化和更具吸引力的方式与消费者建立联繫,并利用数位平台的力量来实现其行销目标。

- 在成熟的最终用途行业中,对营运复杂性和沟通有效性的担忧以及现有企业的存在可能会带来挑战并限制线上广告市场的成长。

- COVID-19 的疫情对网路广告产业产生了重大影响。虽然疫情最初为网路广告产业带来了挑战,但它也创造了新的机会,并加速了数位策略的采用。随着世界继续应对这一流行病的持续影响,线上广告产业可能会在各行业企业的復苏和未来成长中发挥关键作用。

网路广告市场的趋势

行动装置的使用和数位内容的消费增加预计将推动市场成长

- 智慧型手机和平板电脑的普及彻底改变了我们存取网路和消费内容的方式。行动装置已成为我们日常生活的重要组成部分,提供便利和持续的连接。因此,广告商越来越多地透过针对行动装置优化的网站、行动应用程式和基于位置的广告来瞄准行动用户。

- 行动装置已成为许多人存取网路的主要方式。行动互联网的使用量已超过桌面使用量,广告商将广告预算的很大一部分分配给行动平台。广告主可以透过行动装置专用的广告格式(例如应用程式内广告、行动影片广告和行动搜寻广告)来覆盖使用者。

- 行动应用程式正在经历爆炸性增长,为广告商提供了许多机会。应用程式内广告允许广告主在使用者使用他们喜欢的应用程式时与他们互动。这包括各种广告格式,例如横幅广告、插播式广告、原生广告和行动应用程式内的奖励影片广告。

- 社群媒体平台正在经历向行动使用的重大转变。 Facebook、Instagram、Twitter 和 Snapchat 等平台主要透过行动装置存取。广告商正在利用这一趋势,投资行动社群媒体广告,以吸引高度参与的行动用户并针对特定人群。

- 行动装置的使用和数位内容消费的增加正在再形成广告格局。爱立信预计,2019年至2027年间,全球整体5G用户数预计将从1,200万以上增加到40亿以上。预计订阅数量最多的地区是东北亚、东南亚、印度、尼泊尔和不丹。广告主正在认识到在消费者最常使用的设备和平台上吸引消费者的重要性,并正在向以行动装置为中心的广告策略进行重大转变。随着行动装置使用量的不断增加,线上广告市场预计将在行动广告格式和定位功能方面持续成长和创新。

预计北美将占据较大市场占有率

- 由于网路普及高、数位基础设施先进以及大型科技公司的存在,北美线上广告市场规模庞大。它拥有高度发展的数位生态系统,包括Google、Facebook 和亚马逊等着名广告平台。美国拥有全球最大的广告支出,吸引了各行各业的广告主。

- 在智慧型手机和平板电脑普及的推动下,北美的行动广告正在经历显着成长。广告商正在大力投资行动广告格式,以吸引越来越多的受众。行动广告包括应用程式内广告、行动搜寻广告、行动影片广告和行动优化网站广告等格式。

- 程序化广告使用自动化流程来买卖广告库存,在北美获得了巨大的关注。广告主和发布商利用程式化平台来简化广告购买、定位和最佳化流程,从而实现更有效率、资料主导的广告宣传。

- Facebook、Instagram、Twitter 和 LinkedIn 等社群媒体平台在北美广泛用于广告。广告主利用这些平台来接触特定的目标受众、与使用者互动并推广他们的产品和服务。社群媒体广告提供复杂的定位选项、互动广告格式和强大的分析。

- 此外,Google非常注重推出新功能,旨在允许广告主使用其服务,使其产品在网路搜寻结果和其他平台上更加突出。该公司的一项新功能将允许Google搜寻用户设定广告,让Google从广告商的线上资料中提取相关图像并将这些图像包含在搜寻结果中。预计这将鼓励企业在预测期内对广告进行投资并推动市场成长,尤其是在美国。

- 此外,亚马逊等该地区的电子商务巨头正在大力投资以扩大市场占有率。在美国,现在在亚马逊上搜寻产品的用户多于在谷歌上搜寻产品的用户,迫使广告商投资该公司的线上广告。 Facebook 和Google等公司的广告收益大多来自北美地区。因此,由于社群媒体使用量和广告支出的增加,该地区预计将占据重要的市场占有率。

网路广告产业概述

网路广告市场高度分散,主要公司包括 Google LLC、Facebook Inc.、Microsoft Corporation、Twitter Inc. 和 Adobe Systems Inc.。市场公司正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 7 月 - Netflix 宣布选择微软为其全球广告技术和销售合作伙伴。事实证明,微软有能力支持您的所有广告需求,我们将共同努力建立新的广告支援服务。更重点,微软为长期创新提供了弹性,包括技术和商业方面的灵活性,并为其成员提供了强有力的隐私保护。

- 2022 年 5 月 - Written Word Media 宣布推出 Reader Reach Amazon Ads,这是其为作者和出版商提供的现有 Reader Reach 广告服务的扩展。 Reader Reach 是资料主导的全方位服务广告解决方案,为作者提供了一种在其图书上放置有针对性的广告的简单方法。除了现有的 Reader Reach Facebook 广告服务之外,亚马逊广告的扩展使作者可以轻鬆地在亚马逊上向读者做广告。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 市场驱动因素

- 从传统广告向网路广告的持续转变

- 行动装置的使用和数位内容的消费增加

- 新颖的广告方式的出现以及使用行动应用程式进行广告的成长趋势

- 市场限制因素

- 由于现有企业的存在,人们对成熟最终用途行业的营运复杂性和沟通有效性感到担忧

- 产业价值链分析

- COVID-19 对网路广告产业的影响

- 从传统广告向数位媒体的转变经历了显着增长

- 由于收益下降,2020年主要类别的广告支出将下降

- 企业转向有针对性的广告作为优化支出的一种方式

- 数位消费行为的改变对网路广告产业的影响

第 5 章:主要社群媒体平台线上/数位广告收益分析 - FACEBOOK、GOOGLE、TWITTER 等。

第六章市场区隔

- 按广告格式

- 社群媒体

- 搜寻引擎

- 影片

- 电子邮件

- 其他广告格式

- 按平台

- 移动的

- 桌上型电脑和笔记型电脑

- 其他平台

- 按最终用途行业

- 车

- 零售

- 卫生保健

- BFSI

- 通讯

- 其他最终用途产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 荷兰

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第7章:竞争形势

- 公司简介

- Google LLC

- Facebook, Inc

- Microsoft Corporation

- Twitter Inc.

- Adobe Systems Inc.

- Baidu, Inc.

- Yahoo Inc.

- IAC/InterActiveCorp

- Amazon.com, Inc

第八章投资分析

第9章市场的未来

The Online Advertising Market size is estimated at USD 257.97 billion in 2024, and is expected to reach USD 431.76 billion by 2029, growing at a CAGR of 10.85% during the forecast period (2024-2029).

The online advertising market refers to the industry encompassing the buying and selling advertising space on the internet. It involves various forms of digital advertising, such as display ads, search engine marketing (SEM), social media advertising, video advertising, native advertising, and more.

Key Highlights

- The online advertising market has experienced significant growth over the years, driven by the increasing use of the internet and digital devices. With the widespread adoption of smartphones and the rise of social media platforms, online advertising has become a crucial component of marketing strategies for businesses worldwide.

- The ongoing shift from traditional to online advertising has been a significant driver of the growth of the online advertising market. The widespread availability of the internet and the growing number of internet users have led to a larger audience that can be reached through online advertising. People spend more time online for work, entertainment, or socializing, allowing advertisers to reach them through digital channels.

- The combination of novel advertising techniques and the growing prominence of mobile apps-based advertising has fueled the online advertising market's growth. Advertisers are increasingly adopting these approaches to connect with consumers more personalized and engagingly, leveraging the power of digital platforms to achieve their marketing goals.

- Operational complexities and concerns over communication effectiveness in mature end-user industries, along with the presence of incumbents, can pose challenges and restrain the growth of the online advertising market.

- The COVID-19 pandemic has had a significant impact on the online advertising industry. While the pandemic initially presented challenges for the online advertising industry, it also created new opportunities and accelerated the adoption of digital strategies. As the world continues to navigate the ongoing effects of the pandemic, the online advertising industry is likely to play a crucial role in the recovery and future growth of businesses across sectors.

Online Advertising Market Trends

Increasing Use of Mobile Devices and Consumption of Digital Content is Expected to Drive the Market Growth

- The widespread adoption of smartphones and tablets has revolutionized how people access the internet and consume content. Mobile devices have become integral to daily life, offering convenient and constant connectivity. As a result, advertisers are increasingly targeting mobile users through mobile-optimized websites, mobile apps, and location-based advertising.

- Mobile devices have become the primary means of internet access for many people. Mobile internet usage has surpassed desktop usage, driving advertisers to allocate a significant portion of their advertising budgets to mobile platforms. Advertisers can reach users through mobile-specific ad formats like in-app, mobile video, and mobile search ads.

- Mobile apps have experienced explosive growth, offering advertisers many opportunities. Advertisers can leverage in-app advertising to engage with users while interacting with their favorite apps. This includes various ad formats like banner ads, interstitial ads, native ads, and rewarded video ads within mobile apps.

- Social media platforms have witnessed a significant shift towards mobile usage. Platforms like Facebook, Instagram, Twitter, and Snapchat are predominantly accessed through mobile devices. Advertisers are capitalizing on this trend by investing in mobile social media advertising to reach highly engaged mobile users and target specific demographics.

- The increasing use of mobile devices and digital content consumption have reshaped the advertising landscape. According to Ericsson, 5G subscriptions are expected to increase globally between 2019 and 2027, from over 12 million to over 4 billion. Subscriptions are expected to be maximum in North East Asia, South East Asia, India, Nepal, and Bhutan. Advertisers recognize the importance of reaching consumers on the devices and platforms they use most frequently, leading to a significant shift towards mobile-focused advertising strategies. As mobile usage continues to rise, the online advertising market is poised for continued growth and innovation in mobile advertising formats and targeting capabilities.

North America is Expected to Hold the Significant Market Share

- The online advertising market in North America is substantial, driven by the region's high internet penetration rates, advanced digital infrastructure, and the presence of major technology companies. It has a highly developed digital ecosystem, including prominent advertising platforms like Google, Facebook, and Amazon. The United States represents significant global ad spending, attracting advertisers from various industries.

- Mobile advertising has experienced substantial growth in North America, fueled by the widespread use of smartphones and tablets. Advertisers invest heavily in mobile ad formats to reach the growing user base. Mobile advertising includes formats such as in-app ads, mobile search ads, mobile video ads, and mobile-optimized website ads.

- Programmatic advertising, which uses automated processes to buy and sell ad inventory, has gained significant traction in North America. Advertisers and publishers leverage programmatic platforms to streamline ad buying, targeting, and optimization processes, leading to more efficient and data-driven advertising campaigns.

- Social media platforms, including Facebook, Instagram, Twitter, and LinkedIn, are widely used for advertising in North America. Advertisers leverage these platforms to reach specific target audiences, engage with users, and promote their products or services. Social media advertising offers sophisticated targeting options, interactive ad formats, and robust analytics.

- Furthermore, Google is highly focused on launching new features aimed at helping advertisers use the company's services to make their products stand out in web search results and other platforms. One of the new features from the company lets Google Search users configure their ads in a manner that has Google fetch relevant images from the advertiser's online materials and include those images within the search results. Thus, this is expected to encourage companies to invest in ads, propelling market growth, especially in the United States, over the forecast period.

- Furthermore, e-commerce giants in the region, such as Amazon, have been investing heavily in the region to increase their market share. Many users in the United States are now searching for products more on Amazon than on Google, compelling advertisers to invest in online ads in the company. Companies such as Facebook and Google obtain most of their ad revenue from the North American region. Thus, owing to increasing social media usage and advertising expense, this region is expected to hold a prominent market share.

Online Advertising Industry Overview

The Online Advertising Market is highly fragmented, with the presence of major players like Google LLC, Facebook Inc, Microsoft Corporation, Twitter Inc., and Adobe Systems Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2022 - Netflix announced that they had selected Microsoft as the global advertising technology and sales partner. Microsoft has the proven ability to support all advertising needs as it works together to build a new ad-supported offering. More importantly, Microsoft offered the flexibility to innovate over time on both the technology and sales side, as well as strong privacy protections for the members.

- May 2022 - Written Word Media announced the launch of Reader Reach Amazon Ads, an expansion of their existing Reader Reach Ads service for authors and publishers. Reader Reach is a data-driven full-service ads solution that offers an easy way for authors to run targeted ads for their books. The expansion to Amazon Ads enables authors to easily advertise to readers on Amazon in addition to the existing Reader Reach Facebook Ads service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Ongoing shift from Traditional to Online Advertising

- 4.3.2 Increasing Use of Mobile Devices and Consumption of Digital Content

- 4.3.3 Emergence of Novel Advertising Techniques Coupled with Growing Trend of Mobile Apps-based Advertising

- 4.4 Market Restraints

- 4.4.1 Operational Complexities and Concerns over Effectiveness of Communication in Mature End-user Industries due to Presence of Incumbents

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Online Advertising Industry

- 4.6.1 Shift from traditional advertising to digital medium has witnessed considerable growth

- 4.6.2 Overall ad spending across major categories to witness a decline in 2020 due to falling revenues

- 4.6.3 Organizations looking at targeted advertising as a means to optimize spending

- 4.6.4 Impact of changing digital consumption behavior on the online advertising industry

5 ANALYSIS OF REVENUE ACCRUED BY THE MAJOR SOCIAL MEDIA PLATFORMS FROM ONLINE/DIGITAL ADVERTISING - FACEBOOK, GOOGLE, TWITTER, ETC.

6 MARKET SEGMENTATION

- 6.1 By Advertising Format

- 6.1.1 Social Media

- 6.1.2 Search Engine

- 6.1.3 Video

- 6.1.4 Email

- 6.1.5 Other Advertising Formats

- 6.2 By Platform

- 6.2.1 Mobile

- 6.2.2 Desktop and Laptop

- 6.2.3 Other Platforms

- 6.3 By End-user Vertical

- 6.3.1 Automotive

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 BFSI

- 6.3.5 Telecom

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.2.6 Netherlands

- 6.4.2.7 Poland

- 6.4.2.8 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC

- 7.1.2 Facebook, Inc

- 7.1.3 Microsoft Corporation

- 7.1.4 Twitter Inc.

- 7.1.5 Adobe Systems Inc.

- 7.1.6 Baidu, Inc.

- 7.1.7 Yahoo Inc.

- 7.1.8 IAC/InterActiveCorp

- 7.1.9 Amazon.com, Inc