|

市场调查报告书

商品编码

1435894

航空货运:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Air Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

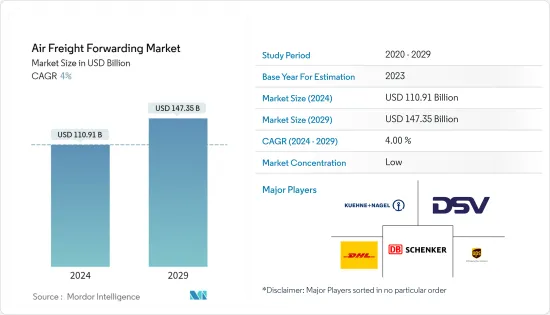

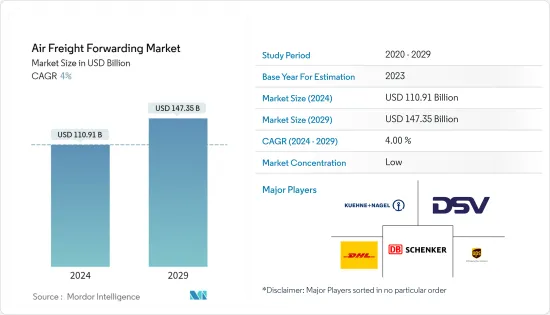

航空货运市场规模预计到 2024 年为 1,109.1 亿美元,预计到 2029 年将达到 1,473.5 亿美元,预测期内(2024-2029 年)复合年增长率为 4%。

儘管陆路和海上货运仍然是一个不错的选择,但空运被认为是最快且不受阻碍的方法。 10月份全球航空货运需求(以货运吨公里(CTK)计算)达211亿,季增3.5%。但产业CTK与前一年同期比较减13.6%,较2019年疫情前水准下降6.2%。 2022 年 10 月经季节性已调整的(SA)航空货运需求较上月略为放缓至 2.3%。较9月有所减少。与 CTK 类似,SA CTK与前一年同期比较%,较 2019 年 10 月下降 6.1%。

由于已开发国家通膨率高、全球货物和服务流动放缓、乌克兰持续战争以及美国异常坚挺,航空货运业的状况在2022年10月持续。所有这些因素都给航空货运成长带来下行压力。历史上,新出口订单一直是航空货运的领先指标,但仍然疲软。全球 PMI 仍低于 50 临界线,显示全球平均持续收缩。中国和韩国2022年10月录得新出口订单,略高于2022年9月,但仍低于50。其他主要国家均维持下降趋势。尤其是德国,自 3 月以来一直稳定在 50 以下,这表明东欧战争对经济的影响仍在持续。

与 9 月相比,以有效货运吨公里 (ACTK) 衡量的全行业航空货运能力增加了 2%。 10 月份行业货运载运率 (CLF) 为-7.4%,低于 9 月份的-7.0%。与 2021 年 10 月相比,该行业的 SA ACTK 大致保持在同一水平。拉丁美洲实现了 SA ACTK 最高的与前一年同期比较增长 20.3%。其次是北美,与前一年同期比较成长了 3%,中东则成长了 1.1%。相较之下,今年10月份SA ACTK与前一年同期比较负成长的地区是非洲(-7.5%)、欧洲(-5%)和亚太地区(-2.1%)。

航空货运市场趋势

电子商务的成长推动市场

预计未来五年全球电子商务将成长 14%。这对航空货运业来说是一个绝佳的机会,由于中美关税战,航空货运业经历了十年来最糟糕的一年。全球电子商务产业占航空货运业务总量的16%,预计将从2022年的3.5兆美元成长到2025年的7兆美元。

一些全球通讯业者正在努力抢占宅配市场的更大份额,该市场由亚马逊、阿里巴巴和京东等网路购物巨头主导。总部位于杜拜的阿联酋航空推出了“Emirates Delivers”,汉莎航空推出了 Hayday,英国航空的母公司 IAG 推出了 Zenda。不过,国际航空运输协会指出,儘管出现这种下降,11月的表现仍是八个月来的最高水平,也是自2019年3月以来与前一年同期比较减。

航空货运业处于有利位置,可以充分利用电子商务的成长。空运是为了处理电子商务而建立的,大约80%的企业对消费者跨境电子商务是透过航空运输的。对于电子设备,空运是首选的运输方式,因为与较昂贵的物品相比,空运的体积和吨位相对较低。

因此,随着网路购物增加了全球对小包裹递送服务的需求,电子商务预计将推动航空货运业的发展。空运满足客户需求,快速、有效率、可靠地交付货物。快速成长的跨境电商市场以及大大小小的电子零售商不断增加的国内货运量正在推动全球航空货运市场的成长。

亚太地区航空货运的最大贡献者

儘管由于许多亚太国家实行旅行限制,导致航空业因COVID-19感染疾病而放缓,但航空货运需求仍然相对强劲。然而,由于不确定性加剧和失业率上升,供应链中断、商业和消费者信心下降,对航空货运业务产生了负面影响。

亚太航空协会(AAPA)表示,航空货运业正积极努力运输重要的医疗设备和用品。许多亚太国家鼓励多家航空公司将客机暂时改装为航空货运。标准客机ATR72-600只能运载1.7吨的货物,但改装后的货机模型可以运载高达8吨的货物,适合太平洋岛国当地的需求和运营条件。我是。

2022年,韩国在亚太航空货运市场占有率中占据第四位。韩国拥有世界上最重要的航空货运业之一。当客运崩坏减少可用运输空间时,它受益于强劲的需求。该航空公司在声明中表示,货运销售受到该航空公司提高货机机队利用率和利用閒置客机进行运输的策略的支持。韩国最大的两家航空公司大韩航空和韩亚航空利用货运需求激增抵销旅客数量下降的机会,2021年营业收益大幅增加。

随着对COVID-19感染疾病套件和汽车零件的需求增加,海运需求转向空运,空运销售增加。因此,这将导致韩国航空货运市场显着成长。此外,大韩航空希望在 2022 年 6 月过渡到空中巴士和波音公司近几个月宣布的新型宽体货机,以满足持续高涨的货运需求。此外,由于长期货运需求强劲,空中巴士去年于2021年投入使用A350货机,波音于2022年1月推出777X货机。因此,货运服务飞机数量的增加将在预测期内推动亚太航空货运市场的发展。

航空货运业概况

航空货运市场集中度适度,国际知名企业云集。大多数服务供应商提供捆绑解决方案,例如包装、标籤、文件、包机服务和货运代理。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

- 分析调查方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 价值链/供应链分析

- 科技趋势

- 投资场景

- 政府法规和倡议

- 焦点 - 空运运输成本/运费

- 电商产业洞察

- COVID-19 对航空货运市场的影响

第五章市场动态

- 促进因素

- 航空货运能力的需求增加

- 电子商务的兴起

- 抑制因素

- 货物限制

- 机会

- 整合人工智慧和自动化

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第六章市场区隔

- 按服务

- 航空

- 邮政

- 其他服务

- 目的地

- 国内的

- 国际的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 荷兰

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 新加坡

- 马来西亚

- 印尼

- 韩国

- 其他亚太地区

- 中东和非洲

- 南非

- 埃及

- 海湾合作委员会国家

- 其他中东和非洲

- 南美洲

- 巴西

- 智利

- 南美洲其他地区

- 北美洲

第七章 竞争形势

- 市场集中度概况

- 公司简介

- DHL Supply Chain &Global Forwarding

- Kuehne+Nagel

- DB Schenker Logistics

- DSV Panalpina

- UPS Supply Chain Solutions

- Expeditors International

- Nippon Express

- Bollore Logistics

- Hellmann Worldwide Logistics

- Kintetsu World Express*

第八章市场机会及未来趋势

第九章 附录

The Air Freight Forwarding Market size is estimated at USD 110.91 billion in 2024, and is expected to reach USD 147.35 billion by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

Although land and ship cargo transportation remain outstanding options, goods transport by air is considered the quickest and unhindered mode. Global air cargo demand, measured by cargo tonne-kilometers (CTKs), was 21.1 billion in October, increasing by 3.5% month-on-month (MoM). However, industry CTKs fell by 13.6% YoY compared to the same month in 2022 and were also 6.2% lower than the pre-pandemic levels in 2019. Seasonally adjusted (SA) air cargo demand softened slightly in October 2022, with a 2.3% MoM decline compared with September. Similar to the CTKs, SA CTKs contracted by 13.1% YoY and were 6.1% lower than in October 2019.

The air cargo industry persisted in October 2022, including high inflation rates in advanced economies, weak performance in the global flows of goods and services, the ongoing war in Ukraine, and the unusual strength of the US dollar. All of these factors put downward pressure on air cargo growth. The new export orders, historically a leading indicator for air cargo shipments, were still not buoyant. The global PMI remains below the critical 50 lines, suggesting continued contraction on average globally. China and Korea registered slightly higher new export orders in October 2022 than in September 2022, although they remained below 50. Other significant economies maintained a downward trend. Notably, Germany moved sideways at levels below 50 since March, signaling the continuous impact on the economy of the war in Eastern Europe.

Industry-wide air cargo capacity, measured by available cargo tonne-kilometers (ACTKs), increased by 2% compared with September. It produced an industry cargo load factor (CLF) of -7.4% in October, down from -7.0% in September. Industry SA ACTKs remained at about the same level compared with October 2021. Latin America achieved the highest YoY growth in SA ACTKs, at 20.3%. North America follows this with 3% YoY and the Middle East with 1.1% on the same basis. In comparison, regions that saw negative YoY growth in SA ACTKs this October were Africa (-7.5%), Europe (-5%), and Asia Pacific (-2.1%).

Air Freight Forwarding Market Trends

The increase in E-Commerce is driving the Market

E-commerce is forecast to grow 14% globally over the next five years. It creates an excellent opportunity for the air cargo industry, which witnessed its worst year in a decade due to the US-China tariff war. The global e-commerce industry, which makes up 16% of the total air cargo business, is projected to increase from USD 3.5 trillion in goods in 2022 to USD 7 trillion by 2025.

Some global carriers are working to gain a more significant share of the door-to-door delivery market that online shopping giants such as Amazon, Alibaba, and JD.com dominate. Dubai-based Emirates launched Emirates Delivers, Lufthansa includes Heyday, and British Airways parent IAG includes Zenda. However, IATA pointed out that despite this decline, November's performance was the best in eight months, with the slowest year-on-year rate of contraction recorded since March 2019.

The air cargo industry is well-positioned to capitalize on the growth in e-commerce. Air cargo is built to handle e-commerce, and approximately 80% of business-to-consumer cross-border e-commerce is transported by air. Air cargo is the preferred way of shipment for electronics due to the relatively small volume or tonnage compared to high value.

Thus, e-commerce is expected to fuel the air cargo industry, as online shopping boosts the demand for parcel delivery services across the globe. Air cargo can serve customers' needs and deliver goods with speed, efficiency, and reliability. The fast-growing cross-border e-commerce market and the rising domestic volumes sent by large and small e-retailers are driving growth in the global air cargo market.

APAC Largest Contributor to Air Freight

Irrespective of a downfall in the airline sector during the COVID-19 pandemic due to travel restrictions imposed in many Asian-Pacific countries, air cargo demand held up relatively well. However, supply chain disruptions and weakening business and consumer confidence due to increased uncertainties and rising unemployment adversely affected the air cargo businesses.

The Association of Asia-Pacific Airlines (AAPA) states that the air cargo sector is active in transporting essential medical equipment and supplies. Many Asian-Pacific countries encouraged several airlines to modify their passenger aircraft for air freight transport temporarily. While a standard passenger ATR72-600 can only carry 1.7 metric tons of cargo, its freighter-modified model can carry up to 8 metric tons, making it suitable for Pacific Island countries, given the region's demand and operating conditions.

South Korea accounted for the fourth-largest market share in the Asia-Pacific air cargo market share in 2022. South Korea includes one of the world's most significant air cargo carrier industries. It benefitted from strong demand when the collapse of passenger traffic reduced available transport space. Cargo sales were underpinned by the airline's strategy to increase the cargo plane operation rate and utilize idle passenger planes for transport, the airline said in a statement. Korean Air and Asiana Airlines, South Korea's two largest airlines, increased their operational earnings significantly in 2021, harnessing surging demand for cargo transport to help offset low passenger traffic.

The need for COVID-19 diagnostic kits and auto parts increased, and the sea cargo demand transferred to air transport, driving air cargo sales. Therefore, this leads to significant air cargo market growth in South Korea. Further, in June 2022, as Korean Air continues to position itself for high cargo demand, it is considering a move for the new wide-body freighters released by Airbus and Boeing in recent months. Long-term strong cargo demand also prompted Airbus to launch its A350 freighter last year in 2021 and Boeing its 777X freighter in January 2022. Thus, increasing the number of aircraft in cargo service will boost the Asia-Pacific air cargo market during the forecast period.

Air Freight Forwarding Industry Overview

The Air Freight Forwarding Market is moderately concentrated with the presence of prominent international players. Most service providers offer bundled solutions, such as packaging, labeling, documentation, charter services, and freight transportation. Some of the existing major players in the market include - DHL Supply Chain & Global Forwarding, Kuehne + Nagel, DB Schenker Logistics, DSV Panalpina, UPS Supply Chain Solutions, Expeditors International, Nippon Express, Bollore Logistics, Hellmann Worldwide Logistics, and Kintetsu World Express.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Technological Trends

- 4.4 Investment Scenarios

- 4.5 Government Regulations and Initiatives

- 4.6 Spotlight - Air Freight Transportation Costs/Freight Rates

- 4.7 Insights on the E-commerce Industry

- 4.8 Impact of Covid-19 on Air Freight Forwarding Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increase in the demand for the Air Cargo Capacity

- 5.1.2 The Rise of E-commerce

- 5.2 Restraints

- 5.2.1 Cargo Restrictions

- 5.3 Opportunities

- 5.3.1 AI and Automation Integration

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Airlines

- 6.1.2 Mail

- 6.1.3 Other services

- 6.2 By Destination

- 6.2.1 Domestic

- 6.2.2 International

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Netherlands

- 6.3.2.4 United Kingdom

- 6.3.2.5 Italy

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia

- 6.3.3.4 India

- 6.3.3.5 Singapore

- 6.3.3.6 Malaysia

- 6.3.3.7 Indonesia

- 6.3.3.8 South Korea

- 6.3.3.9 Rest of Asia-Pacific

- 6.3.4 Middle East & Africa

- 6.3.4.1 South Africa

- 6.3.4.2 Egypt

- 6.3.4.3 GCC Countries

- 6.3.4.4 Rest of Middle East & Africa

- 6.3.5 South America

- 6.3.5.1 Brazil

- 6.3.5.2 Chile

- 6.3.5.3 Rest of South America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL Supply Chain & Global Forwarding

- 7.2.2 Kuehne + Nagel

- 7.2.3 DB Schenker Logistics

- 7.2.4 DSV Panalpina

- 7.2.5 UPS Supply Chain Solutions

- 7.2.6 Expeditors International

- 7.2.7 Nippon Express

- 7.2.8 Bollore Logistics

- 7.2.9 Hellmann Worldwide Logistics

- 7.2.10 Kintetsu World Express*