|

市场调查报告书

商品编码

1438393

机上盒 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Set-Top Box - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

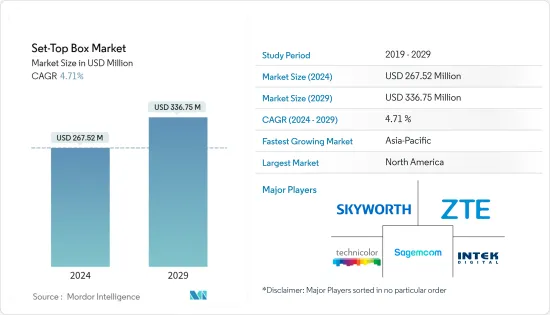

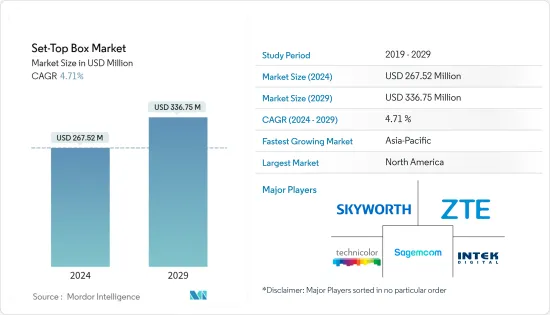

机上盒市场规模预计到2024年为2.6752亿美元,预计到2029年将达到3.3675亿美元,在预测期内(2024-2029年)CAGR为4.71%。

政府在 COVID-19 大流行期间实施封锁以阻止病毒传播,这影响了许多电信服务供应商的供应链。

主要亮点

- 对更高影像解析度的需求推动了对提供高清和超高清内容的机上盒的需求,这与高清电视销量的成长并行。此外,对安卓机上盒的强劲需求主要推动了市场的成长,以提高与订户的互动并为每位会员的家庭娱乐服务创造价值。此外,随着机上盒提高了有线电视的质量,由于各种增值服务(例如高清频道、频道包订阅和互动视频)的优势,机上盒在有线电视网络中得到了广泛采用。

- STB 市场也受到政府规定强制安装机上盒、STB 製造商部署基于作业系统的设备以及发展中国家从类比关闭到数位关闭的转变的推动。例如,印度政府修订了《有线电视网络(监管)法》以强制要求机上盒。由于数位传输,机上盒提供了更好的观看体验,并有助于防止印度非法频道的广播。

- 技术创新导致了各种配备各种功能的机上盒的开发,使得各个机上盒提供者之间的竞争变得激烈。数位录影是最重要的功能,可以让观众观看和录製他们喜爱的节目。此外,由于大多数国家/地区都在开发 5G,市场参与者正在整合新功能,使机上盒与 5G 网路相容。

- 2021 年 9 月,为了解决 COVID-19 对供应链造成的干扰,Airtel DTH 部门宣布打算在 2021 年底前停止进口高清机上盒并生产本地生产的机上盒。在一项类似的策略倡议中,Airtel 的主要竞争对手 Tata Sky 与 Technicolor 合作,在印度国内生产机上盒套餐。

- 根据《2021 年欧洲数位电视产业调查》,约35% 的受访者认为机上盒是电视业者主张中极为有用的元素,但并非不可取代,另有36% 的受访者认为机上盒只是其中之一。电视运营商今天必须向客户提供的选项并不比任何其他选项更有价值。此外,10% 的受访者表示,机上盒是电视业者主张的核心,并将继续存在。

- OTT与机上盒的融合是推动市场成长的另一个突出因素。 OTT 的日益普及促进了混合机上盒的发展,可提供对直播电视的 OTT 内容存取。在 OTT 平台上花费的时间增加也带来了提供混合解决方案的新机会。此次疫情对OTT服务的普及也起到了非常重要的推动作用。 2021 年 8 月,家庭网路解决方案知名厂商康普宣布与 Evoca 合作,为其用户提供由 Android TV 和整合式双多模调谐器支援的机上盒解决方案。机上盒旨在将无线传输与网路传输 (OTT) 内容结合在一起。它符合 ATSC 3.0,有助于确保更高的视讯和音讯品质、提高压缩效率和个人化。

- COVID-19 大流行导致政府实施封锁以遏制病毒传播。各国实施的封锁影响了各个电信服务供应商的供应链。此外,封锁和在家工作的情况增加了看电视的时间。根据美国劳工统计局2021年美国人时间利用调查,美国人平均每天除了睡觉外,大部分时间都花在看电视上3.1小时,略多于工作时间。这可能会推动市场呈指数级增长。

机上盒市场趋势

高清解析度占据最大市场份额

- 全高清解析度宽度为 1920 像素,高度为 1080 像素。高画质机上盒可显示高画质和标清频道。相比之下,标准画质机上盒通常只能观看标清频道。此外,高清传输具有 16:9 的宽高比,而不是具有 4:3 宽高比并在当代大型电视显示器上留下两个黑边的标清。

- 根据全高清规格,水平解析度为1920像素,比最大水平视野的1/2窄,与超高清解析度相比,影像略有压缩。这个水平解析度换算成水平视野(FOV)时相当于「32度」。

- 由于过去五年 1080 像素显示器充斥市场,高清已成为新常态。由于对可靠内容以及将高清机上盒连接到显示器和电视的灵活性的需求不断增长,它们是观看体验的有用补充。此外,由于其他附加平台的出现,传统机上盒可以接触更多受众。例如,沃达丰电视于 2021 年 10 月在其机上盒中引入了 Facebook Watch,以加速其高清内容在欧洲的推出。

- 大多数机上盒继续提供高清内容作为中端市场产品,而高阶机上盒则转向 4K 和 8K 节目。相比之下,低阶机上盒主要提供标清。由于蓝光技术的发展,高清媒体得以扩展并成为业界的中流砥柱。高清串流媒体通常可以在机上盒订阅中与标清一起使用,但成本较高。高清机上盒也促进了市场从以前使用的 VGA 电缆转向 HDMI 电缆,后者允许透过单一电缆传输音讯和视讯。高清机上盒和类比电视之间的主要区别在于它们可以接收的频道数量。

- 据TRAI称,塔塔集团旗下公司Tata Sky在2021年上半年在印度DTH市场的份额最高,约为33%。在测量的时间内,该运营商领先Airtel,其次是Dish TV和太阳直接。除Dish TV市场份额下降外,其余DTH营运商当年进一步巩固了对市场的控制力。

预计北美将占据重要市场份额

- 北美在采用最新技术方面始终保持领先地位。技术进步、对更高品质视讯的日益重视以及强大的技术介面是推动该地区机上盒市场的主要因素。该地区的机上盒(STB)市场已达到严重饱和阶段。然而,区域供应商不断采取措施添加创新功能,以跟上市场的整体成长以及客户不断变化的需求。

- 由于付费电视服务的衰落,MobiTV 等公司已开始提供免机上盒的 IPTV 服务。由于付费电视用户的市场饱和和激烈的竞争,北美(一个较为成熟的行业)的供应商不断尝试为其机上盒添加功能,例如网关功能、安全性和高清功能。 2021 年 8 月,Evoca 选择全球家庭网路解决方案供应商康普为其用户提供配备 Android TV 以及双多模 ATSC 3.0 和 ATSC 1.0 调谐器的最新机上盒解决方案。

- OTT 渗透率的不断提高带动了该地区智慧电视渗透率的提高。因此,市场上的各个参与者都在推出新产品来满足不断增长的需求。例如,2021 年 9 月,亚马逊宣布销售其客製化的 4K 智慧电视系列。这些电视将与先锋和东芝合作製造,并内建 Alexa 和 Fire TV 软体。这些电视最初以 43 吋和 50 吋的小尺寸推出,计划在 2022 年中期推出 55 吋、66 吋和 75 吋的产品。这些电视预计仅在北美地区销售。因此,随着智慧电视销售的上升,该地区对机上盒的需求也预计将同步增加。

- 此外,2021年8月,TCL宣布推出新款5系列和6系列电视。这些电视在美国预售,随后在加拿大上市。具有免持语音控制功能的 TCL 系列 5 和 6 电视利用 Google Assistant 搜寻超过 700,000 部电影和电视剧集、回答问题以及管理智慧家庭设备等任务。

- 2022 年 1 月,Roku, Inc. 宣布与夏普合作,向美国客户推出夏普 Roku 电视机型。根据合作伙伴关係,夏普 Roku 电视型号将整合 Roku OS,为客户提供可自订的主萤幕、与三大语音生态系统的兼容性以及对多个频道的访问,包括 200 多个直播电视频道。

- 第二次年度「电视的未来」消费者研究结果显示,由于有线电视订阅量下降,约 27% 的美国有线电视订户希望在 2021 年底前取消订阅。 The Trade Desk 于 2020 年 12 月 4 日至 8 日期间进行了调查,样本量为 2,105 名美国受访者。因此,这将提高该地区机上盒的整体需求。

机上盒产业概况

机上盒行业在过去几年中经历了许多变化,并且变得比以往更加多样化。参与者不断创新,透过策略合併、收购和合作伙伴关係寻求市场扩张。

- 2021 年 9 月 - Technicolor 为 TIM 实施了下一代 Android 电视机上盒 (STB),让义大利家庭能够存取广播公司和 OTT (OTT) 供应商(例如 Netflix、Amazon、Infinity、迪士尼+和DAZN。这些机上盒基于 Technicolor Connected Home 的 JADE 平台构建,该平台配备 Wi-Fi 6、Android 10 以及可随时添加的外围设备,包括远场语音和 PVR。作为此部署的一部分,Technicolor Connected Home 打算发布更新的软体版本,以使目前的 TIM 客户能够存取附加服务。

- 2021 年 8 月 - Evoca 选择康普为用户提供最新一代 Android TV 机上盒,内建双多模 ATSC 3.0 和 ATSC 1.0 调谐器。这种技术组合正在向全体公众开放。此外,它使服务提供者能够利用其广播网路并为其美国客户提供先进的电视观看体验。

- 2021 年 8 月 - Tata Sky 推出了与 Technicolor Connected Home 和 Flextronics 合作创建的「印度製造机上盒」。 Technicolor Connected Home 与 Flextronics 合作,于 2021 年 6 月在钦奈开始批量生产为 Tata Sky 开发的高科技盒子。

- 2021 年 7 月 - Technicolor Connected Home 将 Google 的远场语音技术整合到其最新一代 STB(机上盒)中,使用户能够更换频道、搜寻内容,并透过 Google Assistant 更加免持。 Google Assistant 和 Technicolor 互联家庭机上盒的集成为消费者有效管理家庭安全自动化、智慧扬声器和其他物联网应用铺平了道路。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代品的威胁

- 产业利害关係人分析

- 评估 COVID-19 对市场的影响

- 技术简介

第 5 章:市场动态

- 市场驱动因素

- 高水准的技术创新

- 新兴市场越来越多地采用机上盒

- 基于作业系统的设备的部署

- 市场限制

- 不断发展的线上 OTT 服务/平台

第 6 章:技术概览

- 机上盒的演变、关键合作以及持续的技术发展

第 7 章:市场细分

- 依技术

- 卫星/DTH

- 网路电视

- 电缆

- 其他类型(DTT 和 OTT)

- 按分辨率

- 标清

- 高画质

- 超高清及更高

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 印度

- 世界其他地区

第 8 章:供应商市占率分析

- 供应商市占率 机上盒市场

第 9 章:竞争格局

- 公司简介

- ARRIS International PLC (CommScope Inc.)

- Technicolor SA

- Intek Digital Inc.

- HUMAX Electronics Co. Ltd

- ZTE Corporation

- Skyworth Digital Ltd

- Sagemcom SAS

- Gospell Digital Technology Co. Limited

- Kaon Media Co. Limited

- Shenzhen Coship Electronics Co. Ltd

- Evolution Digital LLC

- Shenzhen SDMC Technology Co. Ltd

第 10 章:投资分析

第 11 章:市场的未来

The Set-Top Box Market size is estimated at USD 267.52 million in 2024, and is expected to reach USD 336.75 million by 2029, growing at a CAGR of 4.71% during the forecast period (2024-2029).

The government imposed lockdowns during the COVID-19 pandemic to stop the virus's transmission, which had impacted the supply chains of numerous telecom service providers.

Key Highlights

- The need for set-top boxes that deliver HD and UHD content is driven by the need for higher picture resolution, which is parallel to the rising sales of high-definition TVs. In addition, the strong demand for an android set-top box for improving engagement with subscribers and creating value for every member's home entertainment service is primarily driving the market's growth. Moreover, as set-top box enhances the quality of cable networks, it is well adopted in cable networks due to the benefits of various value-added services, like HD channels, channel pack subscriptions, and interactive videos.

- The STB market is also being driven by government rules mandating the installation of set-top boxes, the deployment of OS-based devices by STB makers, and the move from analogue switch-off to digital switch-off in developing nations. For instance, the Cable Television Networks (Regulation) Act was amended by the Indian government to mandate STBs. Due to digital transmissions, set-top boxes offer a better viewing experience and aid in preventing the broadcast of illegal channels in India.

- Technological innovations led to the development of a wide range of STBs equipped with various features, making competition fierce among the various set-top-box providers. Digital video recording is the most crucial feature that allows viewers to watch and record their favourite shows. Additionally, market participants are incorporating new features to make the STB compatible with 5G networks since 5G is being developed throughout most countries.

- In September 2021, to address the disruption to the supply chain caused by COVID-19, the Airtel DTH unit announced intentions to stop importing high-definition set-top boxes by the end of 2021 and manufacture locally produced set-top boxes. In a comparable strategic move, Tata Sky, the key rival of Airtel, teamed up with Technicolor to create set-top packages domestically in India.

- According to Digital TV Europe Industry Survey 2021, about 35% of the respondents suggested that the set-top box is an extremely useful element in the TV operator's proposition but is not irreplaceable, while a further 36% take the view that it is only one option the TV operator must reach customers today and is no more valuable than any other. In addition, 10% of the respondents suggested that the box is central to the TV operator's proposition and is here to stay.

- The integration of OTT and set-top box is another prominent factor driving the market's growth. The growing popularity of OTT has led to the development of hybrid set-top boxes that offer OTT content access to live TV. The increased time spent on OTT platforms has also led to new opportunities to provide a hybrid solution. The pandemic has also played a very significant role in propelling the adoption of OTT services. In August 2021, CommScope, a prominent player in-home network solutions, announced that it has partnered with Evoca to provide its subscribers with set-top solutions powered by Android TV and integrated dual multimode tuners. The set-top box is designed to bring together over-the-air with over-the-top (OTT) content. It meets the ATSC 3.0, which helps in ensuring higher video and audio quality, improved compression efficiency, and personalization.

- The COVID-19 pandemic led to lockdowns enforced by the government to curb the spread of the virus. The lockdown imposed across countries has affected the supply chains of various telecom service providers. In addition, lockdowns and work-from-home scenarios increased the time spent watching television. As per the 2021 US Bureau of Labor Statistics' American Time Use Survey, apart from sleeping, Americans spend an average of 3.1 hours per day most of their time watching television, which is slightly more time than they spend working. This would likely propel the market growth exponentially.

Set Top Box Market Trends

HD Resolution Held the Largest Market Share

- There are 1920 pixels in width & 1080 pixels in height in full HD resolution. A High Definition set-top box can display both high-definition and standard definition channels. In contrast, a Standard Definition set-top box can often only view standard definition channels. Moreover, instead of SD, which has a 4:3 aspect ratio and leaves the two black margins on contemporary large TV displays, HD transmissions have a 16:9 wide aspect ratio.

- According to the Full HD specifications, the horizontal resolution is 1920 pixels, which is narrower than 1/2 of the maximum horizontal field of view and results in a slightly compressed image compared to UHD resolutions. This horizontal resolution is equivalent to "32 degrees" when converted into the horizontal field of view (FOV).

- Since 1080-pixel monitors have inundated the market over the past five years, HD has emerged as the new norm. Due to the rising need for reliable content and the flexibility of connecting HD STBs to monitors and TVs, they are a useful addition to watching experiences. Moreover, due to the advent of other additional platforms, a bigger audience can be reached by conventional STBs. For instance, Vodafone TV introduced Facebook Watch to its STB to accelerate its HD content rollout in Europe in October 2021.

- The majority of STBs continue to offer HD content as their median market product offering, with the higher-end STBs shifting toward 4K and 8K programming. In contrast, the lower-end STBs mainly offer SD. HD media expanded and became a mainstay in the industry due to the development of Blu-ray technology. HD streaming is often available with SD in STB subscriptions but at a higher cost. The market's move from previously utilized VGA cables to HDMI cables, which allowed for the transfer of both audio and video over a single cable, was also facilitated by HD STBs. The main distinction between HD set-top boxes and analogue TVs is the number of channels they can receive.

- According to TRAI, Tata Sky, a company of the Tata Group, recorded the highest share of about 33% of the Indian DTH market during the first half of 2021. During the measured time, the operator was ahead of Airtel, followed by Dish TV and Sun Direct. The remaining DTH operators further solidified their control of the market that year, except for Dish TV, which suffered a fall in its market shares.

North America is Expected to Hold a Significant Share of the Market

- North America has consistently maintained the lead in adopting the latest technologies. The technological advancements, the growing emphasis on better quality videos, and powerful technological interfaces are the major factors driving the set-top box market in the region. The region's market for set-top boxes (STBs) has reached a significant saturation stage. However, the regional providers are constantly taking initiatives to add innovative features to keep up with the overall growth of the market as well as the changing requirements of the customer.

- Players like MobiTV have started offering set-top box-free IPTV services due to the decline of the pay-TV offerings. Vendors in North America (a somewhat mature industry) are continually attempting to add features to their STBs, such as gateway capabilities, security, and HD functionality, due to the market saturation of pay-TV users and fierce competition. In August 2021, Evoca chose CommScope, a global provider of home network solutions, to provide its subscribers with the newest set-top solutions outfitted with Android TV and dual multimode ATSC 3.0 and ATSC 1.0 tuners.

- The increasing penetration of OTT has led to the increased penetration of smart televisions across the region. Therefore, various players in the market are launching new products to cater to the growing demand. For instance, in September 2021, Amazon announced the sale of its customized line-up of 4K smart televisions. These TVs will be made in collaboration with Pioneer and Toshiba and feature built-in Alexa and Fire TV software. These TVs were initially launched in small 43-inch and 50-inch sizes and are planned to be launched in 55-, 66-, and 75-inch offerings by mid-2022. These TVs are slated to be sold exclusively in the North American region. Hence, with the rise in the sales of smart televisions, the demand for Set-Top boxes is also expected to increase in the region simultaneously.

- Furthermore, in August 2021, TCL announced the launch of new five and 6-series TVs. These TVs were made available for pre-sale in the United States, followed by a launch in Canada. TCL Series 5 and 6 televisions with hands-free voice control leverage Google Assistant to search over 700,000 movies and TV episodes, answer questions, and manage smart home devices, among other tasks.

- In January 2022, Roku, Inc. announced partnering with Sharp to bring Sharp Roku TV models to US customers. According to the partnership, Sharp Roku TV models will come integrated with Roku OS, providing the customers with a customizable home screen, compatibility with the three major voice ecosystems, and access to many channels, including over 200 live TV channels.

- Around 27% of US cable TV subscribers want to cancel their subscriptions by the end of 2021 due to the decline in cable TV subscriptions, according to the results of the second annual "Future of TV" consumer study. The Trade Desk surveyed between December 4 and 8, 2020, using a sample size of 2,105 persons in the US. Thus, this will enhance the overall demand for Set-Top boxes in the region.

Set Top Box Industry Overview

The Set-Top Box industry has witnessed many changes over the past several years and has become more diverse than ever. The players continuously innovate and seek market expansion through strategic mergers, acquisitions, and partnerships.

- September 2021 - Technicolor implemented next-generation Android TV set-top boxes (STBs) for TIM to provide Italian homes with access to premium services offered by broadcasters and over-the-top (OTT) providers, such as Netflix, Amazon, Infinity, Disney+, and DAZN. The STBs are built on the JADE platform from Technicolor Connected Home, which features Wi-Fi 6, Android 10, and ready-to-add-on peripherals, including far-field voice and PVRs. Technicolor Connected Home intends to release an updated software version as part of this deployment to give current TIM customers access to additional services.

- August 2021 - Evoca chose Commscope to provide subscribers with the recent generation of Android TV-powered set-top boxes with built-in dual multimode ATSC 3.0 and ATSC 1.0 tuners. This technology combination is being made accessible to the entire public. Moreover, it enables the service provider to take advantage of its broadcast network and offer its American clients a sophisticated TV viewing experience.

- August 2021 - The "Made in India set-top boxes," created in collaboration with Technicolor Connected Home and Flextronics, were introduced by Tata Sky. The mass production of high-tech boxes developed for Tata Sky by Technicolor Connected Home started in Chennai, in collaboration with Flextronics, in June 2021.

- July 2021 - Technicolor Connected Home integrated Google's far-field voice technology into its latest generation of STBs (set-top boxes), enabling users to change channels, search for content, and be more hands-free with Google Assistant. Integrating Google Assistant and Technicolor Connected Home STBs paves the way for consumers to effectively manage home security automation, smart speakers, and other IoT applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Levels of Technological Innovations

- 5.1.2 Increasing Adoption of Set-Top Boxes in the Emerging Markets

- 5.1.3 Deployment of OS-based Devices

- 5.2 Market Restraints

- 5.2.1 Growing Online OTT Services/Platform

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Set-top Boxes, Key Collaborations, and Ongoing Technological Developments

7 MARKET SEGMENTATION

- 7.1 By Technology

- 7.1.1 Satellite/DTH

- 7.1.2 IPTV

- 7.1.3 Cable

- 7.1.4 Other Types (DTT and OTT)

- 7.2 By Resolution

- 7.2.1 SD

- 7.2.2 HD

- 7.2.3 Ultra-HD and Higher

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.3.1 India

- 7.3.4 Rest of the World

8 VENDOR MARKET SHARE ANALYSIS

- 8.1 Vendor Market Share Set-top Box Market

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 ARRIS International PLC (CommScope Inc.)

- 9.1.2 Technicolor SA

- 9.1.3 Intek Digital Inc.

- 9.1.4 HUMAX Electronics Co. Ltd

- 9.1.5 ZTE Corporation

- 9.1.6 Skyworth Digital Ltd

- 9.1.7 Sagemcom SAS

- 9.1.8 Gospell Digital Technology Co. Limited

- 9.1.9 Kaon Media Co. Limited

- 9.1.10 Shenzhen Coship Electronics Co. Ltd

- 9.1.11 Evolution Digital LLC

- 9.1.12 Shenzhen SDMC Technology Co. Ltd

![美洲机上盒市场规模和预测(2020 - 2030)、区域份额、趋势和成长机会分析报告范围:按产品(有线、卫星和基于互联网的以及 DTT)和内容品质 [IPTV 和标清 (SD) )]](/sample/img/cover/42/1362434.png)