|

市场调查报告书

商品编码

1687923

MLCC-市场占有率分析、产业趋势与统计、成长预测(2024-2029)MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

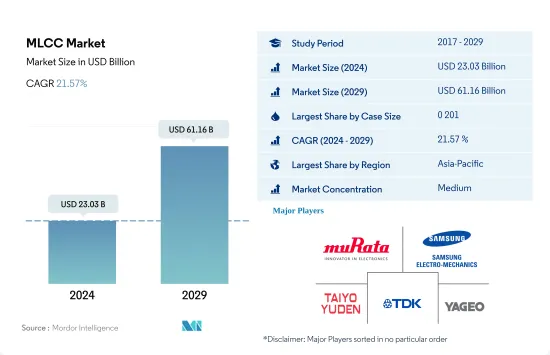

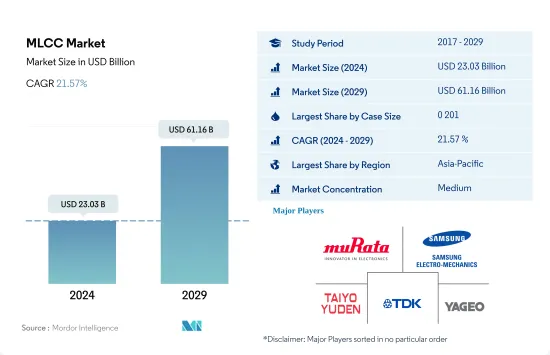

MLCC 市场规模预计在 2024 年为 230.3 亿美元,预计到 2029 年将达到 611.6 亿美元,预测期内(2024-2029 年)的复合年增长率为 21.57%。

政府对军事装备的投资不断增加、通讯领域的快速扩张以及穿戴式装置的使用日益增多,正在推动对 MLCC 的需求。

- 0201 型箱体尺寸子区隔已成为领跑者,在 2022 年占据了 71.35% 的最大市场占有率,其次是 0402 型箱体尺寸,占 11.79%,0603 型箱体尺寸占 7.65%。

- 外壳尺寸 0201 是可用的最小选项之一,允许电路基板具有更大的元件密度。在日本、印度、韩国和中国等亚太国家,行动通讯设备的功能不断提高,推动了对小型化模组以及穿戴式装置、智慧型手机、个人电脑和游戏机的需求。 0201 尺寸 MLCC 的需求正在增加。

- 电力和公共业务部门正在推动对 0402 尺寸 MLCC 的需求。在英国,智慧电錶、电动车充电器和其他相关智慧电网基础设施技术等智慧电网技术的投资和采用不断增加,预计将在未来几年推动市场发展。英国政府越来越多地将智慧电网技术视为一项战略性基础设施投资,这将有助于该国的长期经济成长并使其能够实现碳排放目标。

由于人口对家用电子电器的需求不断增长,预计亚太地区将占据市场主导地位

- 以金额为准村田製作所和国巨等主要参与者的存在,亚太地区在 2020 年占据了 62.01% 的最大市场占有率。日本、中国、韩国和台湾等国家拥有先进的製造能力和专业知识,能够有效率且经济地大规模生产 MLCC。电子产业迄今一直是MLCC的最大用户,预计未来将继续占据较大的市场份额。中国在家用电子电器製造业占据主导地位。多家公司正在开发MLCC,预计2023年约有61%的中国行动电话用户将转向智慧型手机,这意味着消费者偏好发生了相当大的变化。

- 欧洲在 2020 年占据了 15.49% 的市场占有率,该地区强大的工业基础(其中大部分与汽车工业相关)继续对电子设备和系统中的 MLCC 产生巨大需求。德国以其先进的汽车工业而闻名,并计划在63亿欧元的巨额投资的支持下,到2030年将其充电站基础设施增加到100万个。预计到2030年,德国道路上的电动车数量将达到1,500万辆。

- 以金额为准,北美在 2020 年占据了 13.90% 的市场占有率。该地区电动车的普及度正在不断提高,预计这将刺激对 MLCC 的需求。 2022年,加拿大政府宣布将强制销售零排放汽车,目标是到2026年,加拿大销售的新车中20%以上将是零排放汽车。

全球MLCC市场趋势

小型化趋势推动需求

- 查看 01005 MLCC 的前置作业时间资料,我们可以看到在分析期间对 MLCC 的需求保持稳定和一致。前置作业时间变化保持在 15 至 18 週的相对较窄范围内,显示 01005 MLCC 的供应和交货稳定。前置作业时间的稳定性表明供应商正在有效地管理需求,确保依赖这些零件的製造商的供应链顺畅。

- 01005 MLCC 的应用范围十分广泛,尤其适用于智慧型手机、穿戴式装置、物联网装置等小型电子设备。它们外形规格小、电容高,非常适合空间受限的设计。对这些 MLCC 的需求受到持续的小型化趋势和更高组件密度的需求的推动。 01005 MLCC在各行业都有广泛的应用。在家用电子电器领域,它们是智慧型手机、穿戴式装置和物联网设备製造中必不可少的组件,使製造商能够在不影响效能的情况下实现时尚紧凑的设计。在汽车产业,01005 MLCC 广泛用于 ADAS(高级驾驶辅助系统)、资讯娱乐系统和引擎控制单元 (ECU),有助于提高汽车的整体功能和连接性。总体而言,01005 MLCC 在各个行业的广泛使用证明了它们在为各种电子设备和系统供电和提供支援方面的重要性。

- 01005 MLCC 的稳定前置作业时间有助于供应商满足依赖这些组件的电子设备的需求并确保连续的生产流程。这有助于防止製造和交付延迟。

严格的政府法规推动电动车的普及

- 电动车部分或全部由电力驱动。 MLCC 因其耐高温和易于表面黏着技术的特性,已成为电动车电子设备和子系统的首选组件。一辆电动车大约使用 8,000 到 10,000 个 MLCC。电动车中的 MLCC 通常用于电池管理系统、车载充电器和 DC/DC 转换器。除了满足这些电动车子系统所需的典型规格并能够在电动车内部的恶劣环境中可靠运作外,零件製造商还必须通过 IATF16949 认证并符合 AEC-Q200 标准。

- 预计 2022 年电动车出货量将达到 1,539 万辆,到 2029 年将成长至 2,376 万辆,2023-2029 年预测期间的复合年增长率为 9.93%。为了减少温室气体排放和应对气候变化,一些国家实施了严格的环境法规。因此,汽车製造商面临越来越大的压力,需要生产更多的电动车并减少对石化燃料的依赖。消费者的环保意识也越来越强,正在寻求传统汽油动力汽车的可持续替代品。

- 新冠疫情和俄乌战争扰乱了全球供应链,对汽车产业造成了重大衝击。然而,从长远来看,政府和企业努力支持公共充电基础设施的部署是电动车销售成长的坚实基础,这有助于促进世界某些地区的市场销售。全球共有近 180 万个公共充电桩,2021 年安装量约 50 万个,其中三分之一是快速充电桩。

MLCC产业概况

MLCC市场呈现适度整合态势,前五大厂商的市占率达62.12%。市场的主要企业是村田製作所、三星电机、太阳诱电、TDK株式会社和国巨株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 价格趋势

- 铜价走势

- 镍价趋势

- 油价趋势

- 钯金价格趋势

- 白银价格趋势

- 锌价趋势

- MLCC前置作业时间

- 01005 MLCC

- 0201 MLCC

- 0201/0402 MLCC-HI CV

- 0402 MLCC

- 0603 MLCC

- 0603 MLCC-高CV

- 0603 MLCC-高压

- 0805 MLCC

- 0805 MLCC-高CV

- 0805 MLCC-高压

- 1206 MLCC

- 1206 MLCC-高压

- 1206 MLCC-高压

- 1210~1825-高真空

- 1210~1825 MLCC

- 1210+MLCC-高压

- 2220+MLCC

- 2220+MLCC-高压

- 汽车销售

- 全球BEV(纯电动车)产量

- 全球电动车销量

- 全球FCEV(燃料电池电动车)产量

- 全球HEV(混合动力电动车)产量

- 全球重型商用车销售

- 全球ICEV(内燃机汽车)产量

- 全球轻型商用车销售

- 非电动车的全球销量

- 全球插电式混合动力汽车(PHEV)产量

- 全球乘用车销量

- 全球摩托车销售

- 家用电子电器产品销售

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- HDD 和 SSD 销售

- 笔记型电脑销售

- 印表机销售

- 冰箱销售

- 智慧型手机销量

- 智慧型手錶

- 平板电脑销量

- 电视销售

- 电动汽车销售

- 全球BEV(纯电动车)产量

- 全球FCEV(燃料电池电动车)产量

- 全球HEV(混合动力电动车)产量

- 全球ICEV(内燃机汽车)产量

- 全球PHEV(插电式混合动力电动车)产量

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 高范围电压(1,000V 或更高)

- 低范围电压(500V 或更低)

- 中檔电压(500V 至 1,000V)

- 电容

- 高电容(1,000μF 以上)

- 低电容(100μF或更低)

- 中等电容(100μF至1,000μF)

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面贴装

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 其他的

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 66905

The MLCC Market size is estimated at 23.03 billion USD in 2024, and is expected to reach 61.16 billion USD by 2029, growing at a CAGR of 21.57% during the forecast period (2024-2029).

The government's increasing investments in military equipment, the rapid expansion of telecommunications sector, and the increasing usage of wearable devices are driving the MLCC demand

- The 0 201 case size sub-segment emerged as the frontrunner, capturing the largest market share of 71.35%, followed by the 0 402 case size with 11.79% and the 0 603 case size with 7.65% in terms of volume in 2022.

- The 0 201 case size is one of the smallest available options, which allows for a higher component density on the circuit boards. In Asia-Pacific countries like Japan, India, South Korea, and China, the capabilities of mobile communication devices are increasing, and the demand for smaller modules and wearable devices, smartphones, PCs, and gaming consoles is increasing. There is an increasing demand for MLCCs of 0 201 case size.

- The demand for 0 402 MLCCs is driven by the power and utilities sector. Factors such as the increased investment and the deployment of smart grid technologies such as smart meters, EV chargers, and other associated smart grid infrastructure technologies in the United Kingdom are expected to drive the market in the coming years. The UK government is increasingly considering smart grid technology as a strategic infrastructure investment that will contribute to the country's economic growth in the long term and enable the achievement of its carbon emission reduction objectives.

Asia-Pacific expected to dominate the market owing to the population's increasing demand for consumer electronics

- Asia-Pacific held the largest market share of 62.01% in terms of value in 2020, owing to the presence of major players such as Murata Manufacturing Co. Ltd, and Yageo Corporation. Countries such as Japan, China, South Korea, and Taiwan possess advanced manufacturing capabilities and expertise, allowing for the efficient and cost-effective production of MLCCs in large volumes. The electronics industry has been the largest user of MLCCs in the past and is expected to hold a significant share in the future. China holds a prominent position in the consumer electronics manufacturing industry. With several companies developing MLCCs, approximately 61% of Chinese mobile phone users were expected to transition to smartphones by 2023, signifying a considerable shift in consumer preferences.

- Europe held a market share of 15.49% in 2020 and continues to generate significant demand for MLCCs in electronics equipment and systems due to the region's powerful industrial base, most of which is related to the automotive industry. Germany is known for its advanced technologies in the automotive industry, and the country plans to increase its charging station infrastructure to 1 million by 2030, supported by a significant investment of EUR 6.3 billion. The number of EVs in Germany is expected to reach 15 million by 2030.

- North America held a market share of 13.90% in 2020 in terms of value. The growing adoption of EVs in the region is expected to fuel the demand for MLCCs. In 2022, the Canadian government announced a sales mandate for zero-emission vehicles, with the aim that at least 20% of new passenger vehicles sold in Canada must be zero-emission vehicles by 2026, which is expected to increase to 60% by 2030 and jump to 100% by 2035.

Global MLCC Market Trends

The ongoing trend of miniaturization is propelling the demand

- The lead time data for 01005 MLCCs highlights a stable and consistent demand for these components over the analyzed period. The lead time variations within a relatively narrow range of 15-18 weeks suggest a consistent availability and delivery of 01005 MLCCs. This stability in lead times indicates that suppliers have effectively managed the demand, ensuring a smooth supply chain for manufacturers relying on these components.

- The usage of 01005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices. Their small form factor and high capacitance make them ideal for space-constrained designs. The demand for these MLCCs is driven by the ongoing trend of miniaturization and the need for higher component density. The usage of 01005 MLCCs extends to a wide range of applications in various industries. In the consumer electronics sector, these MLCCs are vital components in the production of smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. The automotive industry heavily relies on 01005 MLCCs for advanced driver assistance systems (ADAS), infotainment systems, and engine control units (ECUs), contributing to the overall functionality and connectivity of vehicles. Overall, the widespread usage of 01005 MLCCs across multiple industries underscores their significance in powering and enabling various electronic devices and systems.

- The stability in lead times for 01005 MLCCs helps suppliers meet the demands and ensure a continuous flow of production for electronic devices that rely on these components. This, in turn, prevents potential delays in manufacturing and delivery timelines.

Stringent government regulations increase the penetration of electric vehicles

- Electric vehicles are either partially or fully powered by electric power. MLCCs have emerged as a perfect component for EV electronics and subsystems, offering high-temperature resistance and an easy surface-mount form factor. Approximately 8,000-10,000 MLCCs are used in an electric vehicle. MLCCs in EVs are commonly used in battery management systems, onboard chargers, and DC/DC converters. In addition to meeting the general specifications required for these EV subsystems, plus having the ability to function reliably in harsh environments inside an EV, component manufacturers should also be IATF 16949-certified and compliant with AEC-Q200.

- Electric vehicle shipment amounted to 15.39 million units in 2022 and is expected to increase to 23.76 million units in 2029, registering a CAGR of 9.93% during the forecast period 2023- 2029. Several countries have implemented strict environmental regulations to reduce greenhouse gas emissions and combat climate change. As a result, automakers are under increasing pressure to produce more electric vehicles and reduce their reliance on fossil fuels. Consumers are becoming more environmentally conscious and are looking for more sustainable alternatives to traditional gasoline-powered vehicles.

- The COVID-19 pandemic and the Russia-Ukraine War disrupted global supply chains and heavily impacted the automotive industry. However, in the longer term, the market is witnessing sales growth in some regions of the world as government and corporate efforts to support the deployment of publicly available charging infrastructure provide a solid basis for the increase in EV sales. Publicly accessible chargers worldwide approached 1.8 million, with nearly 500,000 chargers installed in 2021, of which a third were fast chargers.

MLCC Industry Overview

The MLCC Market is moderately consolidated, with the top five companies occupying 62.12%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, TDK Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Palladium Price Trend

- 4.1.5 Silver Price Trend

- 4.1.6 Zinc Price Trend

- 4.2 Mlcc Lead Times

- 4.2.1 01005 MLCC

- 4.2.2 0201 MLCC

- 4.2.3 0201/0402 MLCC-HI CV

- 4.2.4 0402 MLCC

- 4.2.5 0603 MLCC

- 4.2.6 0603 MLCC - HI CV

- 4.2.7 0603 MLCC - HI VOLT

- 4.2.8 0805 MLCC

- 4.2.9 0805 MLCC - HI CV

- 4.2.10 0805 MLCC - HI VOLT

- 4.2.11 1206 MLCC

- 4.2.12 1206 MLCC - HI CV

- 4.2.13 1206 MLCC - HI VOLT

- 4.2.14 1210 TO 1825 - HI CV

- 4.2.15 1210 TO 1825 MLCC

- 4.2.16 1210+ MLCC - HI VOLT

- 4.2.17 2220+ MLCC

- 4.2.18 2220+ MLCC - HI CV

- 4.3 Automotive Sales

- 4.3.1 Global BEV (Battery Electric Vehicle) Production

- 4.3.2 Global Electric Vehicles Sales

- 4.3.3 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.3.4 Global HEV (Hybrid Electric Vehicle) Production

- 4.3.5 Global Heavy Commercial Vehicles Sales

- 4.3.6 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.3.7 Global Light Commercial Vehicles Sales

- 4.3.8 Global Non-Electric Vehicle Sales

- 4.3.9 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.3.10 Global Passenger Vehicles Sales

- 4.3.11 Global Two-Wheeler Sales

- 4.4 Consumer Electronics Sales

- 4.4.1 Air Conditioner Sales

- 4.4.2 Desktop PC's Sales

- 4.4.3 Gaming Console Sales

- 4.4.4 HDDs and SSDs Sales

- 4.4.5 Laptops Sales

- 4.4.6 Printers Sales

- 4.4.7 Refrigerator Sales

- 4.4.8 Smartphones Sales

- 4.4.9 Smartwatches Sales

- 4.4.10 Tablets Sales

- 4.4.11 Television Sales

- 4.5 Ev Sales

- 4.5.1 Global BEV (Battery Electric Vehicle) Production

- 4.5.2 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.5.3 Global HEV (Hybrid Electric Vehicle) Production

- 4.5.4 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.5.5 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 High-Range Voltage (More than 1000V)

- 5.3.2 Low-Range Voltage (Less than 500V)

- 5.3.3 Mid-Range Voltage (500V to 1000V)

- 5.4 Capacitance

- 5.4.1 High-Range Capacitance (More than 1000µF)

- 5.4.2 Low-Range Capacitance (Less than 100µF)

- 5.4.3 Mid-Range Capacitance (100µF to 1000µF)

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

- 5.7 Region

- 5.7.1 Asia-Pacific

- 5.7.2 Europe

- 5.7.3 North America

- 5.7.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219