|

市场调查报告书

商品编码

1441667

AR(扩增实境):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Augmented Reality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

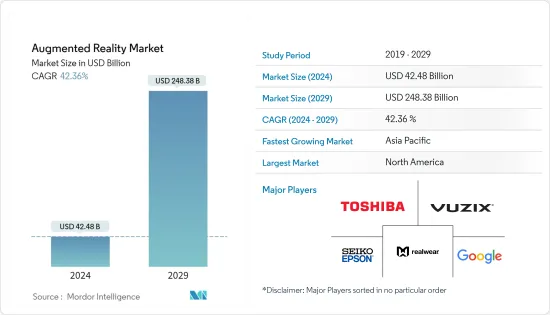

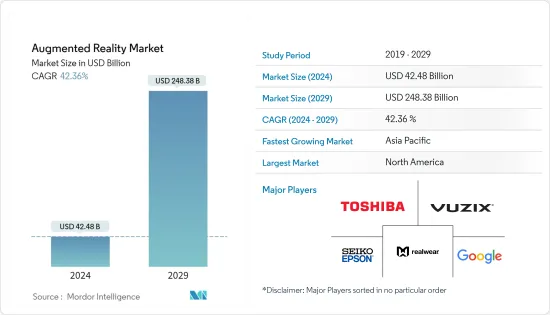

AR(扩增实境)市场规模预计在2024年为424.8亿美元,预计到2029年将达到2,483.8亿美元,在预测期内(2024-2029年)复合年增长率为42.36%。

AR 有潜力提供新的方式来吸引和扩展零售商的能力。 AR 的可能性是无限的,尤其是与不断发展的无线技术相结合时。这使得行动装置和消费性电子产品能够整合,为最终用户提供增强的连接体验。生物技术和医疗保健领域的巨大潜在机会预计将在预测期内推动 AR 市场的成长。

主要亮点

- 儘管AR距离充分发挥其市场潜力还有十多年的时间,但太空产业的技术进步在过去两年加速了市场探索。内容可用性的增加和 ARKit 等开发人员工具的推出正在推动该细分市场的成长。提高云端的采用率和可用性也是 AR 市场的关键驱动力。提供平台和基础设施来解决本地 AR 体验的可扩展性限制。

- 预计在预测期内,约 8 亿部智慧型手机将配备支援 AR 的硬体、处理单元、图形处理单元 (GPU)、数位讯号处理器 (DSP) 以及为其提供动力的神经晶片。标准作业系统内的专用AR 支援预计将在不久的将来降低 AR 应用程式的开发成本并扩大已开发的市场。

- 汽车产业也在向AR业务迈进。许多汽车公司正在利用人工智慧技术和 AR(透过抬头显示器)在市场上展现自己的存在。 BMW、梅赛德斯-贝兹、雪佛兰、丰田和沃尔沃等製造商已经配备了 AR 功能。此外,新兴汽车製造商正在该领域进行投资,探索新的应用。

- AR 技术改变室内导航的潜力。例如,软体开发公司MobiDev使用AR技术来修改车载导航。该公司的 ARcore 技术可让您提案前往所需位置的最佳途径,并将其显示在您的行动装置上。在户外导航方面,AR技术可以透过AR为基础的虚拟旅游帮助游客找到旅游景点和合适的住宿设施。例如,Premier Inn 旗下的 Hub Hotels 使用 AR 技术将其客房转变为城市地图,引导游客前往该地区的热门景点。因此,随着导航中 AR 技术的增加,旅行和旅游业的现有参与者预计将寻求更多基于 AR 的解决方案。

- 此外,COVID-19 危机期间关键地区的实体封锁可能会对 AR/VR 硬体需求产生正面影响。世界各地的公司都在试图弄清楚其内部和地理位置分散的团队如何在危机期间沟通、协作并找到前进的道路。这场危机可能会加速企业采用 AR/VR 的既有趋势。

AR市场趋势

硬体呈现更高成长

- AR技术的一大特点是所使用的硬体类型,因为AR可以在没有任何外部设备的情况下实现。从硬体角度来看,具有早期人工智慧 (AI) 形式的抬头显示器迫使组织尝试利用 AR 潜力的工具。 AR 可以透过将数位资讯和物件迭加在实体环境的“之上”,将消费者互动提升到一个新的水平。

- Daqri、Meta、ODG、Vuzix、Options 等大多数公司都为其设备创建了专注于企业应用的 AR 耳机。例如,2022年9月,Magic Leap企业AR平台的第二版推出,即Magic Leap 2。 Magic Leap 2 现已可供全球所有消费者使用。 Magic Leap 2 是专为企业打造的最小、最轻的 AR 工具。由于硬体设备的可用性不断增加,市场在预测期内可能会成长。

- 此外,随着竞争激烈的消费性电子领域的公司不断提高行动电话、笔记型电脑、数位录音机和其他设备的质量,晶片消费量也将增加。游戏社群的成长、行动装置和游戏主机的采用以及技术进步将在预测期内推动这种扩张。

- 由于对硬体的高度依赖,预计对精确测量的需求将推动硬体的变化,特别是所有涉及感测器的时脉同步。预计将开发与各种红外线感测器和 IMU 相结合的高解析度相机以及 3D 空间中的精确估计。预计半导体公司也会出现类似的趋势,他们将这些技术融入最新的晶片中,以支援精确的 AR 框架。

- 此外,公司依靠 MR 设备透过将资讯迭加到现实世界来显着增加人们对世界的了解。您还可以透过允许远端团队即时查看他们的工作并提供更好、更准确的回馈来改善协作。对于娱乐产业来说,成功的混合实境内容需要观众与体验之间建立情感连结。

北美地区录得显着成长

- 由于众多供应商对市场创新的大量投资以及美国在全球软体市场的主导地位,预计北美 AR 市场在预测期内将大幅成长。

- 该地区是最尖端科技的中心。工业化和工业安全意识的提高被认为是市场扩张的原因。此外,AR在零售和汽车行业的不断增长的应用正在支撑市场规模。

- 美国预计将成为最具创新性的 AR 市场之一。大多数在这项技术上取得进展的公司都位于美国。先进技术和智慧型设备的易用性创造了一个强大的区域 AR 市场。微软的AR产品Hololens首先在美国和加拿大发布,并获得了该国消费者的积极回应。

- 此外,该地区的智慧型装置采用率最高,特别是智慧型手錶和智慧眼镜。由于智慧型装置(尤其是智慧型手机)在 AR 市场的发展中发挥关键作用,因此该地区在预测期内为受访市场提供了巨大的机会。

- 智慧眼镜是 AR 技术在该地区显着普及的另一个领域,预计在预测期内将显着增长。例如,2022 年初,Snapchat 宣布推出新的 AR 购物体验、装扮工具等。利用 Snapchat 的最新技术,品牌商店可以开发 AR 镜头,让顾客可以在 AR 中试穿自有品牌鞋款和服装。

AR产业概况

AR市场的竞争变得越来越激烈。许多公司透过赢得新合约和开拓新市场来扩大其市场份额。 Vuzix 和 Meta 等公司正在与财富 500 强公司以及卡特彼勒、保时捷和 SAP 等大型科技公司合作,以增加 AR 智慧眼镜的销售量。

- 2022 年 2 月 - AR 提供者 Altoida Inc. 与 Click Therapeutics 合作,使用 AR 技术来了解基准认知指标及其对患者结果的影响。已宣布。

- 2022 年 9 月 - Meta Immersive Learning 与教育科技技能平台 Simplilearn 合作创建培训产品 Spark AR。该程式使用 AR 来提供有关创建基本效果所需的能力的知识。学生可以使用 Spark AR Studio 的 3D 建模、纹理和其他功能来提高他们的研究和专业知识。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 市场定义和范围

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场动态

- 市场驱动因素

- AR应用增加

- 对基于移动的 AR 的高需求

- 市场挑战

- 技术和监管问题

- COVID-19 对 AR 及相关市场的影响

第六章 关键技术投资

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

第七章市场区隔

- 按类型

- 硬体

- 软体

- 按最终用户

- 游戏

- 教育

- 卫生保健

- 零售/行销

- 车

- 军事/国防

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第八章 竞争形势

- 公司简介

- Google LLC(ALPHABET INC.)

- Seiko Epson Corporation

- Vuzix Corporation

- Realwear Inc.

- Dynabook Europe GmbH

- Daqri

- Optinvent

- Kopin Corporation

- Lenovo Group Limited

- Fujitsu Limited

第九章投资分析

第十章市场机会与展望

The Augmented Reality Market size is estimated at USD 42.48 billion in 2024, and is expected to reach USD 248.38 billion by 2029, growing at a CAGR of 42.36% during the forecast period (2024-2029).

Augmented reality will likely present a new way to engage and expand retailers' abilities. The possibilities of augmented reality are endless, especially when combined with the ever-evolving wireless technology, which enables the integration of mobile devices and home appliances to provide an enhanced connected experience for the end-users. Tremendous potential opportunities in biotechnology and healthcare are expected to drive the growth of the augmented reality market over the forecast period.

Key Highlights

- While AR is still over a decade away from achieving its full market potential, technological advancements in the space industry have accelerated the market studied over the past two years. The increasing availability of content and the launch of developer tools, such as ARKit, drive this segment's growth. Also, the growing adoption and availability of the cloud have been significant drivers for the AR market. It provides the platform and infrastructure to address the scalability limitation of on-premise AR experiences.

- During the forecast period, around 800 million smartphones are expected to be equipped with AR-supported hardware, processing units, graphics processing units (GPUs), digital signal processors (DSPs), and neural chips to power them. Dedicated AR support within a standard OS with lower costs of developing AR apps is expected to augment the market studied in the near future.

- The automobile industry is also moving toward the augmented reality business. Many automobile companies are using artificial intelligence technologies and augmented reality (through head-up displays) to mark their presence in the market. Manufacturers, including BMW, Mercedes-Bez, Chevrolet, Toyota, and Volvo, have already included augmented reality features. Furthermore, new auto manufacturers are investing in this space to explore new applications.

- The potential of augmented reality technology to transform interior navigation; for instance, the software development company MobiDev has changed interior navigation using AR technology. With the aid of the company's ARcore technology, the best path to the desired location can be suggested and displayed on a mobile device. Regarding outdoor navigation, augmented reality (AR) technology can assist tourists in finding tourist attractions and suitable lodging via AR-based virtual tours. For instance, Hub Hotels by Premier Inn uses augmented reality technology to turn its rooms into city maps that direct visitors to the area's top attractions. As a result, it is anticipated that existing players in the travel and tourism sector will want more AR-based solutions as AR technology in navigation increases.

- Additionally, amidst the COVID-19 crisis, physical lockdowns across significant regions may positively affect the AR/VR hardware demand. Enterprises worldwide are trying to find ways to get their internal and wider geographically spread teams to communicate, collaborate, and find a path forward during the crisis. This crisis can act as an accelerator to the existing trends for enterprise AR/VR adoption.

Augmented Reality (AR) Market Trends

Hardware to Exhibit Higher Growth

- One of the outstanding features of AR technology is the type of hardware used, as AR can be achieved without any external devices. From the hardware perspective, heads-up displays with early forms of artificial intelligence (AI) have compelled organizations to experiment with tools that tap into augmented reality (AR) possibilities. By overlaying digital information and objects "on top" of physical environments, AR can take consumer interactions to the next level.

- Most companies, like Daqri, Meta, ODG, Vuzix, Options, etc., made AR headsets focusing on enterprise applications for their devices. For instance, in September 2022, the second edition of Magic Leap's augmented reality platform for businesses, known as Magic Leap 2, has now gone on sale. The Magic Leap 2 is currently accessible to all consumers worldwide. The smallest and lightest augmented reality tool created for businesses is the Magic Leap 2. The market will likely grow during the forecast period due to the increased availability of hardware devices.

- Further, as companies in the competitive consumer electronics sector keep improving the quality of cell phones, laptops, digital recorders, and other devices, the consumption of chips will rise. During the focal period, a growing gaming community, the adoption of mobile devices and gaming consoles, and technological advancements will fuel this expansion.

- With a strong dependency on hardware, the demand for accurate measurement is expected to drive hardware changes, particularly clock synchronization of all the sensors involved. The camera with high resolution, combined with a range of IR sensors and IMUs, is expected to be developed in line with estimating precisely in the 3D space. Similar trends are anticipated among the semiconductor companies incorporating these technologies into their latest chips to support accurate AR frameworks.

- Additionally, businesses rely on MR devices to vastly increase people's knowledge of the world by overlaying information in the real world. It can also improve collaboration by enabling remote teams to see the work in real-time to provide better feedback precisely. For the entertainment sector, successful mixed reality content requires an emotional connection between the viewer and their experience.

North America to Register Significant Growth

- The North American AR market is expected to grow significantly over the forecast period, owing to a large number of vendors also making considerable investments in market innovation, coupled with the dominance of the United States in the global software market.

- The region serves as a center for cutting-edge technology. Industrialization and increasing awareness of industrial safety is blamed for the market's expansion. Additionally, the expanding applications of augmented reality in the retail and automotive industries support the market size.

- The United States is expected to be one of the most highly innovative AR markets. Most companies advancing in this technology are based in the United States. High technology exposure and ease of availability of smart devices have created a solid regional AR market. Microsoft's AR product, Hololens, was first released in the United States and Canada, and it received a positive response from consumers in the country.

- Further, the region has the highest adoption rate of smart devices, especially smartwatches and smart glasses. As smart devices, especially smartphones, play a significant role in developing the AR market, the region offers a vast opportunity for the market studied over the forecast period.

- Smart glass is another segment witnessing a massive penetration of AR technologies in the region, and it is estimated to grow significantly in the forecast period. For instance, in early 2022, Snapchat revealed new augmented reality shopping experiences, the Dress Up tool, and more. With the help of Snapchat's latest technology, brand shops may develop AR Lenses that let customers try on shoes or apparel from their brands in augmented reality.

Augmented Reality (AR) Industry Overview

The augmented reality market is gaining competitiveness. Many companies are increasing their market presence by securing new contracts and tapping new markets. Companies like Vuzix, and Meta, among others, have partnered with fortune 500 companies and other large technology giants, like Caterpillar, Porsche, and SAP, to increase the sales of their AR smart glasses.

- February 2022 - Altoida Inc., a provider of augmented reality, announced a collaboration with Click Therapeutics to use AR technology to understand better baseline cognition metrics and how they may influence patient outcomes.

- September 2022 - Meta Immersive Learning and Simplilearn, an ed-tech skilling platform, cooperated to create the training product Spark AR. The program uses augmented reality to provide knowledge of the abilities needed to produce fundamental effects. Students can research using Spark AR Studio's 3D modeling, texturing, and other capabilities to advance their professions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Applications of Augmented Reality

- 5.1.2 High Demand for Mobile-based Augmented Reality

- 5.2 Market Challenges

- 5.2.1 Technical and Regulatory Issues

- 5.3 IMPACT OF COVID-19 ON THE AR AND ALLIED MARKETS

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.1.1 Standalone

- 7.1.1.2 Tethered

- 7.1.1.3 Screenless Viewer

- 7.1.2 Software

- 7.1.1 Hardware

- 7.2 By End User

- 7.2.1 Gaming

- 7.2.2 Education

- 7.2.3 Healthcare

- 7.2.4 Retail and Marketing

- 7.2.5 Automotive

- 7.2.6 Military and Defense

- 7.2.7 Other End-user Verticals

- 7.3 Geography

- 7.3.1 North America

- 7.3.1.1 US

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 UK

- 7.3.2.3 France

- 7.3.2.4 Italy

- 7.3.2.5 Rest of Europe

- 7.3.3 Asia Pacific

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Japan

- 7.3.3.4 Rest of Asia-Pacific

- 7.3.4 Rest of the World

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Google LLC (ALPHABET INC.)

- 8.1.2 Seiko Epson Corporation

- 8.1.3 Vuzix Corporation

- 8.1.4 Realwear Inc.

- 8.1.5 Dynabook Europe GmbH

- 8.1.6 Daqri

- 8.1.7 Optinvent

- 8.1.8 Kopin Corporation

- 8.1.9 Lenovo Group Limited

- 8.1.10 Fujitsu Limited