|

市场调查报告书

商品编码

1851317

随选视讯:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Video-on-Demand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

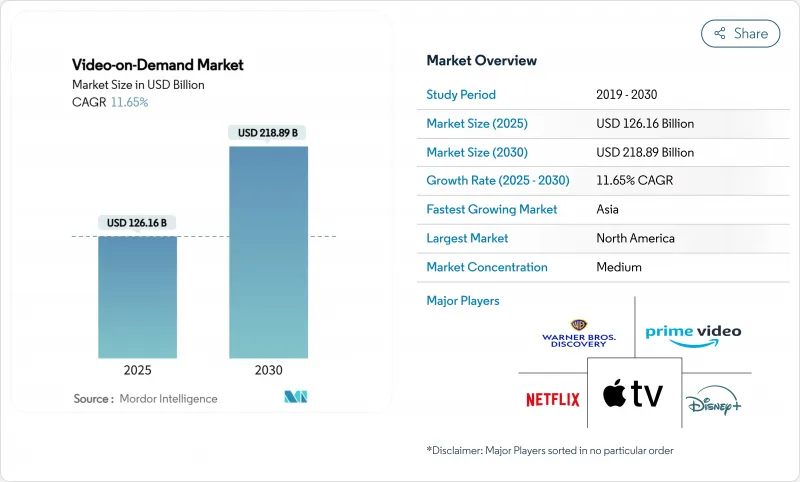

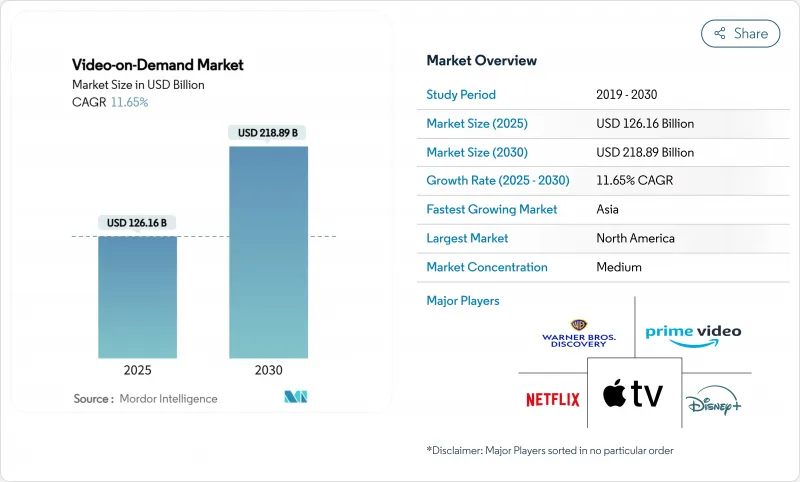

据估计,2025 年视讯点播市场价值为 1,261.6 亿美元,预计到 2030 年将达到 2,188.9 亿美元,2025 年至 2030 年的复合年增长率为 11.65%。

这种加速成长反映了观众观看方式从传统电视节目向点播串流媒体的稳定转变,而宽频的快速普及、设备的广泛应用以及内容库的日益丰富是推动这一转变的重要因素。北美和西欧的超高速光纤和5G网路的普及使得流畅的4K播放成为可能,而亚洲地区本地语言节目的製作预算正在吸引区域观众。在拉丁美洲,广告支持的观众群正在蓬勃发展,为价格敏感型家庭提供了新的切入点。市场竞争依然激烈,市场领导者透过内容独家性、跨服务捆绑销售和高性价比的配送网路来规避用户流失风险。

全球视讯点播市场趋势与洞察

亚太新兴市场AVOD平台的快速普及

亚太地区的观众欣然接受了平台低成本、高覆盖率的广告服务,这项策略使得该地区的影片收入总额在2023年达到了244亿美元(avia.org)。广告商估计,当年有14亿独立观众观看了总合约140亿小时的亚洲内容。预测显示,随着AVOD(广告支援的视讯点播)库存的扩大,到2030年,该地区将额外释放210亿美元的视讯收入(advanced-television.com)。多语言广告个人化和基于观众的采购推高了CPM(每千次展示成本),使平台能够弥补合约利润率的下降。这些因素共同推动AVOD在新兴经济体中从辅助性获利模式跃升为核心获利模式。

北美和西欧超高速宽频普及率不断提高

光纤到户的普及、5G固定无线存取以及动态CDN路由支援了超高清视讯的无缝传输。西欧的OTT剧集和电影收入将从2023年的310亿美元飙升至2029年的480亿美元(digitaltvnews.net)。业者正在试行多播辅助单播传输技术,该技术可在直播高峰期将频宽使用量降低90%(streamtvinsider.com)。观众可在电视、行动电话和车载萤幕上享受更快的播放速度和更少的缓衝。这些品质提升提高了用户参与度,并直接支援视讯点播市场稳定的每用户平均收入(ARPU)。

内容授权成本上涨对平台利润率带来压力。

多年来,各大公司竞标热门IP,导致最低版权费不断上涨,对服务盈利造成压力。一些中型服务商正在整合片库,将自身定位为独家热门IP的买家或透过出售庞大的经典片库来实现盈利的卖家。欧盟委员会指出,生成式人工智慧工具最终可能会降低製作成本,但短期内支出与收益之间的不平衡依然存在(ec.europa.eu)。因此,营运商要么提高价格,要么推出价格更低的广告支援套餐,从而强化了视讯点播市场中常见的两种获利模式。

细分市场分析

儘管SVOD将在2024年占据84.63%的收入份额,反映出其先行者的地位,但AVOD预计11.12%的复合年增长率表明,消费者对低成本娱乐的需求正在加速增长。随着全球广告支出转向连网萤幕,由AVOD驱动的随选视讯市场规模将进一步扩大。结合少量广告和适中费用的混合套餐模式将会出现,既能确保可预测的现金流,又能抑制订阅疲劳。小众的TVOD窗口期仍将对热门大片的首映保持重要性,而按次付费的体育赛事仍将保持较高的价格弹性。

新兴市场的消费者越来越倾向将AVOD视为首选服务,而非替代方案,这促使平台进行广告创新在地化并缩短广告载入时间。同时,广告商获得了堪比社群媒体的精准定向投放能力。对于SVOD领域的现有企业而言,逐步转向广告模式将有助于缓解ARPU(每位使用者平均收入)的下滑。这些转变优化了获利模式,但并未改变用户体验在整个视讯点播市场的核心地位。

预计到2024年,OTT串流媒体将占总营收的72%,并在2030年之前以11.3%的复合年增长率成长。与託管式IPTV不同,OTT透过开放的网际网路和自我调整位元率通讯协定实现全球规模化。 MAUD试验可将尖峰时段频宽需求降低高达90%,使直播活动更具成本效益(streamtvinsider.com)。因此,即使付费电视点播服务仍然存在,OTT频道的随选视讯市场也可能超越传统有线电视和卫星电视市场。

儘管IPTV在DSL或光纤捆绑服务的地区仍然占据主导地位,但欧洲HbbTV和巴西TV 3.0的普及凸显了混合模式。展望未来,视讯点播产业将整合边缘运算节点,以降低身临其境型体验(例如体积视讯)的延迟。

区域分析

2024年,北美将继续占据最大的收入份额,达到41.65%,这主要得益于宽频的早期普及和源源不绝的原创内容。行业捆绑套餐将于2025年推出,将多项关键服务整合到折扣套餐中,有效缓解用户订阅疲劳。联邦政府的基础设施补贴将继续推动农村地区光纤网路的普及,进一步巩固北美在视讯点播市场的主导地位。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到12.2%。 5G、云端运算和在地化等国家级措施将推动avia.org到2023年实现244亿美元的收入。印度和中国将引领用户成长,而日本和韩国则将输出国际知名的文化热门内容。强劲的数位广告支出将进一步推动成长,从而支撑AVOD模式在新兴经济体的可行性。

拉丁美洲的串流视讯点播 (SVOD) 市场正在快速成长,预计到 2029 年将拥有 1.65 亿个 SVOD 帐户。光是巴西一国的订阅用户就可能超过 5,900 万。通讯业者伙伴关係透过持续推进的光纤计划(例如 Entel 公司在 2024 年投资的 6.18 亿美元项目,entel.cl)来促进支付并满足频宽需求。儘管全球巨头占据主导地位,但本地平台仍然拥有 8% 的市场份额,这反映了该地区对视讯点播内容的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太新兴市场AVOD平台的快速普及

- 在北美和西欧扩大超高速宽频部署

- 全球串流媒体平台正在加大对原创本地语言内容的投资。

- 在南美洲,将视讯点播服务与通讯和付费电视订阅捆绑销售,推动了其普及。

- 云端原生CDN和边缘运算的日益普及将降低视讯点播延迟。

- 市场限制

- 内容授权成本上涨对平台利润率带来压力。

- 加强欧盟对独家内容交易的反垄断审查

- 在成熟的SVOD市场中,由于订阅疲劳导致解约率上升

- 监理展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按经营模式

- 订阅视讯点播 (SVOD)

- 点播影片广告(AVOD)

- 交易型/按次付费(TVOD)

- 混合动力及其他车型

- 透过交付技术

- Over-The-Top(OTT)

- 网路通讯协定电视(IPTV)随选视讯

- 付费电视点播

- 混合广播宽频电视(HbbTV)

- 依设备类型

- 智慧型手机和平板电脑

- 智慧型电视

- 个人电脑和笔记型电脑

- 连网串流媒体设备

- 其他的

- 按内容类型

- 娱乐与戏剧

- 运动的

- 儿童与家庭

- 教育和纪录片

- 其他(新闻、生活风格)

- 最终用户

- 住宅/个人

- 商业和企业(饭店、航空公司、医院)

- 教育机构

- 公共部门和政府

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- Strategic Developments

- Vendor Positioning Analysis

- 公司简介

- Amazon.com Inc.(Prime Video)

- Netflix Inc.

- The Walt Disney Company(Disney+and Hulu)

- Warner Bros. Discovery Inc.(Max)

- Apple Inc.(Apple TV+)

- Alphabet Inc.(YouTube Premium and YouTube TV)

- Comcast Corporation(Peacock and Xfinity On-Demand)

- Paramount Global(Paramount+)

- Roku Inc.

- Tencent Holdings Ltd.(Tencent Video)

- Alibaba Group(Youku Tudou)

- Baidu Inc.(iQIYI)

- Zee Entertainment Enterprises Ltd.(ZEE5)

- Reliance Industries Ltd.(JioCinema)

- Novi Digital Entertainment Pvt. Ltd.(Disney+Hotstar)

- KT Corporation(Olleh TV)

- Rakuten Group(Rakuten Viki)

- Sky Group Limited(NOW)

- Telstra Corporation(Telstra TV Box Office)

- PCCW Media(Viu)

- Globoplay(Grupo Globo)

- Shahid(MBC Group)

- Showmax(MultiChoice)

- Canal+Group(myCanal)

- Vubiquity Inc.

第七章 市场机会与未来展望

The Video-on-Demand market size is estimated at USD 126.16 billion in 2025 and is forecast to reach USD 218.89 billion by 2030, advancing at an 11.65% CAGR over 2025-2030.

This acceleration mirrors the steady shift from scheduled television to on-demand streaming, supported by rapid broadband rollouts, device proliferation, and richer content libraries. Ultra-high-speed fiber and 5G coverage in North America and Western Europe enable smooth 4K playback, while local-language production budgets in Asia keep regional viewers engaged. The surge of ad-supported tiers offers price-sensitive households alternative entry points, and telecom bundles are lowering acquisition costs in Latin America. The competitive intensity remains high as market leaders hedge churn risk through content exclusivity, cross-service bundles, and cost-efficient delivery networks.

Global Video-on-Demand Market Trends and Insights

Rapid Adoption of AVOD Platforms in Emerging Asia-Pacific Markets

Asia-Pacific audiences are embracing ad-supported offerings as platforms trade lower fees for higher reach, a tactic that garnered a USD 24.4 billion regional video revenue pool in 2023 avia.org. Advertisers value the 1.4 billion unique viewers who collectively streamed almost 14 billion hours of Asian content in the same year avia.org. Forecasts suggest the region will unlock another USD 21 billion in video earnings by 2030 as AVOD inventory scales advanced-television.com . Multilingual ad load personalization and audience-based buying is raising CPMs, allowing platforms to offset thinner subscription margins. Together, these dynamics elevate AVOD from a supplemental to a core monetization pillar across emerging economies.

Expansion of Ultra-High-Speed Broadband Rollout in North America & Western Europe

Fiber-to-the-home penetration, 5G fixed-wireless access, and dynamic CDN routing now underpin seamless UHD delivery. Western European OTT episode and movie revenue will jump to USD 48 billion by 2029 from USD 31 billion in 2023 digitaltvnews.net . Operators are piloting multicast-assisted unicast delivery that can trim bandwidth use by as much as 90% during live traffic peaks streamtvinsider.com . Viewers benefit through faster start times and reduced buffering across TVs, phones, and in-vehicle screens. Such quality upgrades raise engagement minutes, directly supporting ARPU stability within the Video-on-Demand market.

Escalating Content Licensing Costs Squeezing Platform Margins

Multiyear bidding wars over hit franchises inflate minimum guarantees, squeezing service profitability. Some mid-tier providers have culled libraries, positioning themselves either as buyers of exclusive hits or as sellers monetizing deep back catalogs. The European Commission notes that generative AI tools could eventually ease production costs but the near-term imbalance between spending and returns persists ec.europa.eu. Consequently, operators either push prices up or introduce lower-tier plans with ads, reinforcing the two-track monetization model visible throughout the Video-on-Demand market.

Other drivers and restraints analyzed in the detailed report include:

- Increased Content Investments in Local-Language Originals by Global Streamers

- Bundling of VoD with Telecom & Pay-TV Subscriptions Driving Uptake in South America

- Rising Churn Rates Due to Subscription Fatigue in Matured SVOD Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SVOD controlled 84.63% revenue in 2024, reflecting its early-mover status, but AVOD's 11.12% forecast CAGR signals accelerating demand for low-cost entertainment. The Video-on-Demand market size attributable to AVOD will widen as global advertising outlays migrate to connected screens. Hybrid packages that merge limited ads with modest fees are emerging to curb subscription fatigue while preserving predictable cash receipts. Niche TVOD windows retain relevance for blockbuster premieres, with sports pay-per-view sustaining premium pricing elasticity.

Consumers in emerging economies increasingly treat AVOD as a first-choice service rather than a fallback, prompting platforms to localize ad creative and shorten ad loads. Advertisers, meanwhile, gain addressable targeting that rivals social media precision. For SVOD incumbents, gradual entry into advertising mitigates ARPU erosion. Together, these shifts refine monetization structures without altering the centrality of customer experience within the broader Video-on-Demand market.

OTT streaming garnered 72% of 2024 revenues and is forecast at 11.3% CAGR through 2030. Unlike managed IPTV, OTT scales globally via open internet and adaptive bitrate protocols. MAUD trials that cut peak bandwidth needs by up to 90% further bolster cost efficiency for live events streamtvinsider.com. Thus, the Video-on-Demand market size for OTT channels will outpace legacy cable and satellite, even where Pay-TV VoD persists.

IPTV remains entrenched in regions with bundled DSL and fiber offerings, while HbbTV adoption in Europe and Brazil's upcoming TV 3.0 highlight hybrid models that blend broadcast reach with broadband flexibility advanced-television.com. Looking ahead, the Video-on-Demand industry will integrate edge compute nodes to slash latency for immersive experiences such as volumetric video.

The Video-On-Demand (VoD) Market Report is Segmented by Business Model (Subscription VoD, Advertising VoD, and More), Delivery Technology (OTT Streaming, IPTV VoD, and More), Device Type (Smartphones and Tablets, Smart TVs, and More), Content Genre (Entertainment and Drama, Sports, and More), End-User (Residential, Commercial and Enterprise, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest contributor at 41.65% revenue share in 2024, benefiting from early broadband ubiquity and deep original-content pipelines. Industry bundles launched in 2025 combine multiple flagship services into discounted packages, an antidote to subscription fatigue. Federal infrastructure grants continue to extend rural fiber, reinforcing the Video-on-Demand market's leadership position.

Asia-Pacific is the fastest-growing territory, tracking a 12.2% CAGR to 2030. National initiatives spanning 5G, cloud, and local-language production have spurred USD 24.4 billion in 2023 regional revenue avia.org. India and China top subscriber additions, while Japan and South Korea export cultural hits that travel well internationally. Growth is further supported by robust digital advertising spend, underpinning AVOD viability across emerging economies.

Latin America shows accelerating scale, projected to host 165 million SVOD accounts by 2029 advanced-television.com. Brazil alone may surpass 59 million subs. Telco partnerships ease payments and satisfy bandwidth requirements via ongoing fiber projects such as Entel's USD 618 million 2024 investment entel.cl. Although global majors dominate, local platforms still secure 8% market share, reflecting regional storytelling demand within the Video-on-Demand market.

- Amazon.com Inc. (Prime Video)

- Netflix Inc.

- The Walt Disney Company (Disney+ and Hulu)

- Warner Bros. Discovery Inc. (Max)

- Apple Inc. (Apple TV+)

- Alphabet Inc. (YouTube Premium and YouTube TV)

- Comcast Corporation (Peacock and Xfinity On-Demand)

- Paramount Global (Paramount+)

- Roku Inc.

- Tencent Holdings Ltd. (Tencent Video)

- Alibaba Group (Youku Tudou)

- Baidu Inc. (iQIYI)

- Zee Entertainment Enterprises Ltd. (ZEE5)

- Reliance Industries Ltd. (JioCinema)

- Novi Digital Entertainment Pvt. Ltd. (Disney+ Hotstar)

- KT Corporation (Olleh TV)

- Rakuten Group (Rakuten Viki)

- Sky Group Limited (NOW)

- Telstra Corporation (Telstra TV Box Office)

- PCCW Media (Viu)

- Globoplay (Grupo Globo)

- Shahid (MBC Group)

- Showmax (MultiChoice)

- Canal+ Group (myCanal)

- Vubiquity Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of AVOD platforms in emerging Asia-Pacific markets

- 4.2.2 Expansion of ultra-high-speed broadband rollout in North America and Western Europe

- 4.2.3 Increased content investments in local-language originals by global streamers

- 4.2.4 Bundling of VoD with telecom and pay-TV subscriptions driving uptake in South America

- 4.2.5 Growing adoption of cloud-native CDN and edge compute lowering VoD latency

- 4.3 Market Restraints

- 4.3.1 Escalating content licensing costs squeezing platform margins

- 4.3.2 Intensifying antitrust scrutiny over exclusive content deals in EU

- 4.3.3 Rising churn rates due to subscription fatigue in matured SVOD markets

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Business Model

- 5.1.1 Subscription Video-on-Demand (SVOD)

- 5.1.2 Advertising Video-on-Demand (AVOD)

- 5.1.3 Transactional/Pay-per-view (TVOD)

- 5.1.4 Hybrid and Other Models

- 5.2 By Delivery Technology

- 5.2.1 Over-the-Top (OTT) Streaming

- 5.2.2 Internet Protocol Television (IPTV) VoD

- 5.2.3 Pay-TV VoD

- 5.2.4 Hybrid Broadcast Broadband TV (HbbTV)

- 5.3 By Device Type

- 5.3.1 Smartphones and Tablets

- 5.3.2 Smart TVs

- 5.3.3 PCs and Laptops

- 5.3.4 Connected Streaming Devices

- 5.3.5 Others

- 5.4 By Content Genre

- 5.4.1 Entertainment and Drama

- 5.4.2 Sports

- 5.4.3 Kids and Family

- 5.4.4 Educational and Documentary

- 5.4.5 Others (News, Lifestyle)

- 5.5 By End-user

- 5.5.1 Residential / Individual

- 5.5.2 Commercial and Enterprise (Hotels, Airlines, Hospitals)

- 5.5.3 Educational Institutions

- 5.5.4 Public Sector and Government

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Amazon.com Inc. (Prime Video)

- 6.3.2 Netflix Inc.

- 6.3.3 The Walt Disney Company (Disney+ and Hulu)

- 6.3.4 Warner Bros. Discovery Inc. (Max)

- 6.3.5 Apple Inc. (Apple TV+)

- 6.3.6 Alphabet Inc. (YouTube Premium and YouTube TV)

- 6.3.7 Comcast Corporation (Peacock and Xfinity On-Demand)

- 6.3.8 Paramount Global (Paramount+)

- 6.3.9 Roku Inc.

- 6.3.10 Tencent Holdings Ltd. (Tencent Video)

- 6.3.11 Alibaba Group (Youku Tudou)

- 6.3.12 Baidu Inc. (iQIYI)

- 6.3.13 Zee Entertainment Enterprises Ltd. (ZEE5)

- 6.3.14 Reliance Industries Ltd. (JioCinema)

- 6.3.15 Novi Digital Entertainment Pvt. Ltd. (Disney+ Hotstar)

- 6.3.16 KT Corporation (Olleh TV)

- 6.3.17 Rakuten Group (Rakuten Viki)

- 6.3.18 Sky Group Limited (NOW)

- 6.3.19 Telstra Corporation (Telstra TV Box Office)

- 6.3.20 PCCW Media (Viu)

- 6.3.21 Globoplay (Grupo Globo)

- 6.3.22 Shahid (MBC Group)

- 6.3.23 Showmax (MultiChoice)

- 6.3.24 Canal+ Group (myCanal)

- 6.3.25 Vubiquity Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment