|

市场调查报告书

商品编码

1686299

无线感测器:市场占有率分析、行业趋势和成长预测(2025-2030)Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

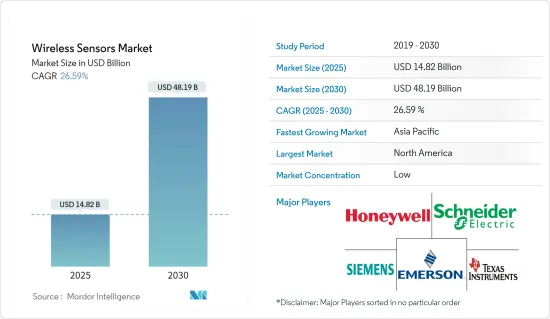

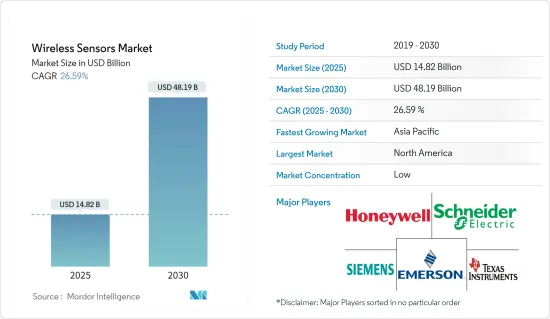

无线感测器市场规模预计在 2025 年为 148.2 亿美元,预计到 2030 年将达到 481.9 亿美元,在市场估计和预测期(2025-2030 年)内的复合年增长率为 26.59%。

无线感测器在RFID和蓝牙等各种创新技术的帮助下,具有准确性和可靠性等多种优势,并且可以更轻鬆地整合到电子设备中。因此,它在过去几年里获得了许多支持。这些感测器主要用于工厂监控生产流资料。其他应用包括汽车、国防、建筑自动化以及物料输送、食品和饮料等其他产业。对新能源来源的不断探索、政府法规、可再生能源开发以及快速的技术进步正在推动无线感测器市场的发展。

主要亮点

- 无线感测器被视为智慧电网中用于远端监控电力线和变压器的重要组成部分。无线感测器用于监测电力线上的温度和天气。工业自动化以及对小型消费性设备(如穿戴式装置和物联网连接设备)的需求是推动无线感测器市场发展的关键因素。

- 由于政府对使用感测器来增强安全性的监管日益严格,对无线感测器的需求也日益增长。例如,在石油钻井平台、锅炉等环境条件恶劣的区域,则有高压、高温等。无线感测器让您可以轻鬆地从安全距离控制和监控您的设施。

- 工业 4.0 革命使机器变得更加智慧、更加直观,从而推动了无线感测器工业应用的需求。新设备的设计更有效率、安全、灵活,并能够自主监控其性能、使用情况和故障。因此,这些应用正在推动对高灵敏度感测器的需求。

- 物联网的普及也是推动市场成长的一个主要因素。物联网连接设备的增加预计将推动对无线感测器的需求。此外,智慧家庭、智慧建筑、智慧城市和智慧工厂的发展需要无线感测器,因为它们外形规格小、精度高、功耗低,并且能够控制周围参数。

- 这些感测器降低了安装成本,并最大限度地减少了对人员和室内装饰的干扰,因为安装无线感测器系统不需要对建筑物进行布线或结构变更。许多企业正在投资无线技术,因为它具有成本效益、安全且方便。

- 例如,Monnit 公司最近宣布推出 ALTA 土壤湿度感测器,以满足农业科技市场的需求。这种创新的土壤湿度感测器可帮助农民、商业种植者和温室管理者轻鬆地将他们的精准灌溉作业连接到物联网 (IoT)。国防部门正在采用无线感测器技术。这些感测器可以监控场所、识别可疑活动并追踪有价值的资产。

- 然而,对高性能、高性价比和高可靠性感测器的需求不断增长,推动市场供应商增加对研发活动的支出。预计奈米技术和微技术的进步将在预测期内推动无线感测器市场的成长。

无线感测器市场趋势

能源和电力占据较大的市场占有率

- 节能对于企业减少电力消耗和相关成本以及最大限度地减少对环境的影响(包括生态足迹)变得越来越重要。为了提高节能效果,可携式和固定式气象站、风力发电係统、柴油卡车排放测试仪器、新建筑设计空气动力学的风动态、高空气象研究气球、海洋调查、水污染仪器、空气品质调查、烟囱汞采样等都需要精确的无线感测器测量。

- 零功率无线感测器需要能量处理低功耗管理电路来监控换能器输出功率、储存能量并为无线感测器的其余部分供电。能源采集有助于为工业应用中的无线感测网路供电。低功耗、可靠的无线通讯、感测器和能源采集技术的进步使得这种通讯方式比有线基础设施更加实用和高效。

- 随着电动车和自动驾驶汽车等未来技术创新,汽车领域对这些无线压力感测器的需求预计将会增加。动力传动系统应用占业务的 50% 以上,其次是安全应用,其中轮胎压力管理系统 (TPMS) 是最重要的单一汽车应用。在二氧化碳排放和自动化的推动下,无线压力感测器在未来将得到更广泛的采用和使用。

- 基于能源采集的自主无线感测器节点是一种方便且经济高效的解决方案。能源采集的使用消除了限制无线节点广泛采用的关键限制。电源的稀缺性具有必要的特性,可以为感测器节点提供多年的能量和电力,而无需更换电池。与硬布线解决方案相比,部署零无线感测器可实现显着的经济优势。据英国石油公司称,印度的初级能源消费量最近达到约35.4艾焦耳,推动了能源和电力产业对无线感测器的需求。

亚太地区快速成长

- 亚太地区是电气和电子设备製造市场最大的地区之一。该地区也是无线感测器技术的重要供应商,尤其是中国和日本。中国是全球最大的汽车市场,也是全球最大的汽车生产基地,包括电动车生产基地,具有巨大的成长潜力。根据中国工业协会统计,近期中国商用车销量约31.7万辆。中国销量约占全球汽车销量的32.56%。

- 这些行业占据了无线感测器市场的很大一部分,因此该地区将在预测期内提供机会。联网汽车概念和汽车安全法规的兴起也有望推动该地区无线感测器的采用。

- 在汽车中,液压煞车是保障乘客安全的重要部件。您使用煞车控制车辆的能力归功于包括压力感测器在内的复杂组件的组合。据 Auto Punditz 称,两轮车是 2022 财年印度销售的主要电动车类型,销量达到约 231,000 辆,推动了汽车行业对无线压力感测器的需求。

- 无线感测器日益普及的另一个原因是该地区积极部署无线感测器,以加强不断增长的 IT 医疗保健市场并创新新的医疗保健设备和器械。

- 横河电机株式会社近日宣布在日本推出其OpreX品牌无线解决方案Sushi Sensor。该感测器是一种整合感测和通讯功能的紧凑型无线设备,用于监测工厂设备的振动和表面温度。

无线感测器产业概况

无线压力感测器市场竞争非常激烈。高昂的研发成本、伙伴关係、联盟和收购是区域公司为在激烈的竞争中保持竞争力而采取的主要成长策略。市场的主要企业包括Honeywell国际、Schneider Electric、艾默生电气、德克萨斯、西门子、ABB、罗克韦尔自动化和 Pasco Scientific。

- 2022 年 10 月 - 西门子与 Volta Trucks 合作,加速商用车电气化进程。压力是电动车液体冷却系统的关键参数。压力感测器对于提供反馈以调整和优化冷却系统以及检测可能表明洩漏的压力损失至关重要。

- 2022 年 6 月 - 无线压力感测器也用于压裂、酸洗和固井应用中,用于类似的压力监测和控制目的。无线压力感测器能够测量管道中气体或液体的表压。 ABB 与城市燃气发行公司 Think Gas 合作,实现其燃气网路的自动化运作。无线压力感测器支援直接安装到管道上,有助于在生产车间轻鬆安装,并且湿润材料具有很强的耐腐蚀性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19对无线感测器市场的影响

第五章市场动态

- 市场驱动因素

- 无线技术的采用率不断提高,尤其是在恶劣环境中

- 智慧工厂概念(工业自动化)的出现

- 市场挑战

- 感测器产品具有较高的安全需求和成本

- 物联网领域的网路安全问题与最新趋势

第六章市场区隔

- 按类型

- 压力感测器

- 温度感测器

- 化学和气体感测器

- 位置和接近感测器

- 其他感测器

- 按最终用户产业

- 车

- 卫生保健

- 航太与国防

- 能源与电力

- 食品和饮料

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

第七章竞争格局

- 公司简介

- Honeywell International Inc.

- Schneider Electric SE

- Emerson Electric Co.

- Texas Instruments Incorporated

- Siemens AG

- ABB Ltd.

- Rockwell Automation, Inc.

- Pasco Scientific

- Monnit Corporation

- Phoenix Sensors LLC

第八章投资分析

第九章:市场的未来

The Wireless Sensors Market size is estimated at USD 14.82 billion in 2025, and is expected to reach USD 48.19 billion by 2030, at a CAGR of 26.59% during the forecast period (2025-2030).

Wireless sensors offer several advantages, such as accuracy and reliability, with the help of various innovative technologies, such as RFID and Bluetooth, and the potential to make electronic devices easy to integrate. As a result, they gained significant traction in the past few years. These sensors are primarily used in factory settings for data monitoring production flow. These also find applications in Automotive, defense, building automation, and other industries, like materials handling and food and beverage. Due to the increasing quest for new energy sources, government regulations, renewable energy development, and rapid technological advancements, the wireless sensors market is propelling.

Key Highlights

- Wireless sensors are considered a vital component in smart grids for remote monitoring of power lines and transformers. They are present in service to monitor line temperature and weather conditions. Industrial automation and demand for miniaturized consumer devices across regions, such as wearables and IoT - connected devices, are among the significant factors driving the wireless sensors market.

- Due to the increased government regulation for the increased use of the sensor for safety, the demand for wireless sensors is growing. For instance, the areas with challenging environmental conditions, such as Oil rigs, Boilers, etc., present high pressure, high temperature, etc. Wireless sensors make it easy to control and monitor the facility from a safe distance.

- The industry 4.0 revolution, in which machines are becoming brighter and more intuitive, is increasing the need for wireless sensors' industrial applications. The new devices are designed to be more efficient, safe, and flexible, with the ability to monitor their performance, usage, and failure autonomously. These applications, therefore, spur the demand for highly- sensitive sensors.

- The rising adoption of IoT is another major factor driving the market's growth. This growth in IoT-connected devices is projected to fuel the demand for wireless sensors. Further, transforming the development of smart homes and buildings, smart cities, and intelligent factories demands wireless sensors, owing to the small form factor, high precision, low power consumption, and ability to control ambient parameters.

- These sensors have reduced installation costs and minimal disruption to the workforce and interiors; therefore, installing wireless sensor systems requires no wiring or structural building changes. Many companies are investing in wireless technologies, which are cost-effective, safe as well as convenient.

- For instance, Monnit Corporation recently announced its ALTA Soil Moisture Sensor's availability to meet the AgriTech market's demands. The innovative Soil Moisture Sensor assists farmers, commercial growers, and greenhouse managers in easily connecting their precision irrigation operations to the Internet of Things (IoT). The defense sector is embracing wireless sensor technology, as these sensors can monitor their premises, identify suspicious activity, and track valuable assets.

- However, the demand for high-performance, cost-efficient, and reliable sensors has increased, leading to higher spending in R&D activities by market vendors. These technological advancements in nanotechnology and micro-technology are expected to propel the market growth of wireless sensors over the forecast period.

Wireless Sensors Market Trends

Energy and Power to Hold Significant Market Share

- Energy conservation is increasingly essential to reduce any enterprise's power consumption and associated costs and minimize the environmental impact, including a business's ecological footprint. For improved energy conservation, accurate wireless sensor measurements are required in portable and stationary weather stations, wind energy systems, testing devices for diesel truck emissions, wind engineering concerning new building design aerodynamics, high-altitude weather research balloons, ocean research, water pollution devices, atmospheric studies, and smokestack mercury sampling.

- Zero-power wireless sensors require energy processing low power management circuitry to monitor the transducer output power, store energy, and deliver power to the rest of the wireless sensor. Energy harvesting helps in powering wireless sensor networks in industrial apps. Advancements in low-power and reliable wireless communications and sensor and energy harvesting technologies make this type of communication more practical and efficient than a wired infrastructure.

- With futuristic innovations, like electric cars and self-driving cars, the demand for these wireless pressure sensors is assumed to increase in the automotive sector. Powertrain applications represent more than 50% of the business, followed by safety, with tire pressure management systems (TPMS) being the most significant single automotive application. Driven by carbon dioxide emission reduction and automation, wireless pressure sensors will increasingly be adopted and used in the future.

- Energy harvesting-based autonomous wireless sensor nodes are a convenient and cost-effective solution. Using energy harvesting removes one of the critical factors limiting the proliferation of wireless nodes. The scarcity of power sources has the characteristics necessary to deliver the energy and power to the sensor node for years without battery replacement. Significant economic advantages are realized when zero wireless power sensors are deployed vs. hard-wired solutions. According to BP, primary energy consumption in India recently amounted to some 35.4 exajoules, thus driving the demand for wireless sensors in the energy and power industry.

Asia Pacific to Witness Significant Growth

- The Asia Pacific is one of the largest regions in the electrical and electronics manufacturing market. The region is also a significant vendor of wireless sensor technologies, especially in China and Japan. China is also the world's largest car market and the world's largest production site for cars, including electric cars, with much growth potential. According to the China Association of Automobile Manufacturers (CAAM), recently, approximately 317,000 commercial vehicles were sold in China. Sales in China accounted for about 32.56% of global motor vehicle sales.

- As these industries account for a significant portion of the wireless sensor market, the region offers an opportunity over the forecast period. The growing concept of connected cars and regulations regarding automotive safety is also expected to drive the adoption of wireless sensors in the region.

- In automobiles, hydraulic brakes are a crucial component in passenger safety. The ability to control a vehicle using brakes is down to a complex blend of components, including pressure sensors. According to Auto Punditz, In the financial year 2022, the leading type of electric vehicle sold in India was two-wheelers, reaching around 231 thousand units, thus driving the demand for wireless pressure sensors in the automotive industry.

- Another reason for increasing the adoption of wireless sensors is the region's high activity level in deploying them to enhance its growing IT healthcare market and innovate new healthcare equipment and devices.

- Recently, Yokogawa Electric Corporation announced the release of the Sushi Sensor, an OpreX brand wireless solution, in Japan. The sensor is a compact wireless device with integrated sensing and communication functions that are intended to monitor plant equipment vibration and surface temperature.

Wireless Sensors Industry Overview

The Wireless Pressure Sensors Market is highly competitive. The high expense on research and development, partnerships, collaborations, and acquisitions are the prime growth strategies adopted by the regional companies to sustain the intense competition. Key players in the market are Honeywell International Inc., Schneider Electric SE, Emerson Electric Co., Texas Instruments Incorporated, Siemens AG, ABB Ltd., Rockwell Automation Inc, Pasco Scientific, and many more.

- October 2022 - Siemens partnered with Volta Trucks to accelerate commercial fleet electrification. Pressure is a crucial parameter in an electric vehicle's liquid cooling system. Pressure sensors are vital for feedback for cooling system regulation and optimization and to detect pressure loss that could suggest a leak.

- June 2022 - Wireless pressure sensors are also used during fracturing, acidizing, and cementing applications for similar pressure monitoring and control purposes. The wireless pressure sensor has the function of measuring the gauge pressure of gases and liquids in piping. ABB Partnered with Think Gas, a city gas distribution company, to automate operations across Think Gas' gas network. The wireless pressure sensors help easy installation for a production site to support direct installation into piping, and wetted material is highly resistant to corrosion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Wireless Sensors Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies (Especially in Harsh Environments)

- 5.1.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Cost associated with the Sensor Products

- 5.2.2 Concerns pertaining to cybersecurity in the IoT space and recent developments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensors

- 6.1.2 Temperature Sensors

- 6.1.3 Chemical and Gas Sensors

- 6.1.4 Position and Proximity Sensors

- 6.1.5 Other Types of Sensors

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy and Power

- 6.2.5 Food and Beverage

- 6.2.6 Other End-user Industries

- 6.3 ***By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Schneider Electric SE

- 7.1.3 Emerson Electric Co.

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 Siemens AG

- 7.1.6 ABB Ltd.

- 7.1.7 Rockwell Automation, Inc.

- 7.1.8 Pasco Scientific

- 7.1.9 Monnit Corporation

- 7.1.10 Phoenix Sensors LLC