|

市场调查报告书

商品编码

1521868

共享出行:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Shared Mobility - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

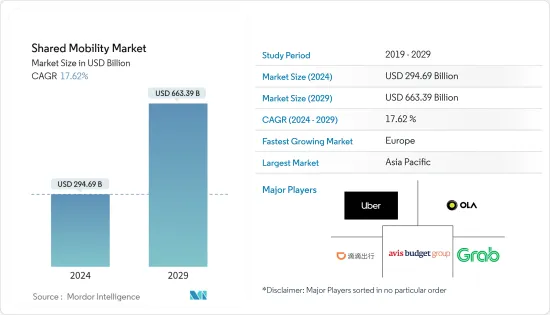

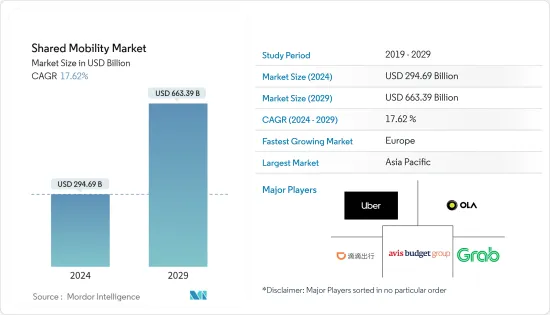

共享旅游市场规模预计到 2024 年为 2,946.9 亿美元,预计到 2029 年将达到 6,633.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 17.62%。

从长远来看,随着消费者对叫车、汽车共享和租赁服务的偏好增加,较低的出行成本可能会推动全球共享旅游市场的发展。由于交通拥堵加剧以及购买新车相关的拥有成本不断上升,消费者越来越多地转向叫车服务进行日常通勤。此外,各种新参与企业与强大竞争对手的整合预计将扰乱市场。例如,叫车平台 inDrive 提供了一个适合司机和消费者的基于竞标的平台。

主要亮点

- 2023年第三季度,北京、长春、重庆成为中国尖峰时段壅塞最严重的大城市。 2023年第三季尖峰时段壅塞指数为北京2.09、长春2.05、重庆1.97。

- 根据TomTom指数,2023年全球交通壅塞最严重的大城市是伦敦、都柏林和多伦多。伦敦行驶10公里的平均时间为37分20秒,是全世界最长的。

由于交通便利以及在交通拥堵时骑行的便利性,对两轮网约车和共享服务的需求不断增加,特别是在亚太地区。亚太地区共用微出行市场突出的国家包括印度、中国和越南,因为与使用叫车服务相比,申请较低。此外,近年来,为了配合政府的脱碳努力,共享旅游产业越来越多地采用电动两轮车,预计这将推动2024年至2029年共享旅游市场的成长。

主要亮点

- 2023 年 8 月,Green and Smart Mobility (GSM) 宣布在越南推出电动自行车叫车服务,以巩固其市场地位,并与 GoJek 和 Grab 等参与企业竞争。此外,该公司还宣布计划在越南五个省份的道路上运营 60,000 辆电动马达。

此外,企业部门投资的增加和世界都市化的提高正在促使消费者迁移到都市区寻找更好的就业机会。随着越来越多的消费者迁移到都市区,这些地区预计将产生大量的就业需求,进而扩大员工交通需求的市场。为了满足员工日益增长的出行需求,各共享出行业者正在製定策略,透过提供随选接驳车服务进入这一领域,从而增加全球共享出行市场的需求,从而产生积极影响。

共享出行市场趋势

预计乘用车领域将成为2024年至2029年的驱动力

乘用车广泛应用于叫车、汽车共享、出租及租赁服务。企业和私人业主部署各种车型,包括掀背车、轿车和运动型多用途车 (SUV),以提高客户的便利性。因此,由于对叫车和租赁服务的大规模需求,都市化的提高和全球游客的涌入是乘用车市场成长的关键决定因素。此外,旨在扩大就业机会和促进经济成长的企业部门投资增加,将导致企业要求提供员工流动租赁服务,这反过来将对乘用车领域的需求产生积极影响。

- 根据世界旅游组织(WTO)的预测,2023年全球国际观光游客总数将达到12.5866亿人次,而2022年为9.6019亿人次,2022年至2023年比与前一年同期比较增长31.0%。

- 根据人口研究所的数据,2023年北美、拉丁美洲和欧洲是全球城市人口最多的主要大陆。 2023年,北美城市人口比例将达83%,其次是拉丁美洲(82%)和欧洲(75%)。

全球的叫车业者和租赁公司越来越倾向于采用电动乘用车,以补充政府为运输业脱碳所做的努力。此外,越来越多的消费者要求电动乘用车作为他们的首选交通途径,这些营运商正在大力投资,将新时代的车辆引入持有,以满足不断增长的需求,这预计将对该市场的成长产生正面影响。

- 2023 年 11 月,越南叫车公司 Green and Smart Mobility (GSM) 宣布在寮国和越南推出电动计程车服务,将自有品牌定位为永续的共用交通途径。该公司计划部署 VinFast VF5 电动车,以扩大可供越南和寮国消费者使用的车队。

预计全球各叫车和租赁公司将持续整合共享旅游市场。随着越来越多的企业融入生态系统,共享出行用乘用车将产生巨大的需求。此外,消费者的偏好正在转向使用成本较低的私人交通,预计这将进一步推动该细分市场的成长。

亚太地区是全球最大的共享旅游市场

由于亚太地区对个人交通便利性的需求不断增长、互联网普及率较高以及游客数量不断增加,消费者对使用个人交通出行的偏好不断增加,这已成为移动市场增长的重要驱动力。此外,由于交通拥堵加剧以及快速城市交通的需求,该地区对两轮叫车服务的需求强劲,这对该细分市场的成长产生了积极影响。

- 根据世界旅游组织预测,2023年亚太地区国际观光人数将达2.3343亿人次,2022年为9,152万人次,2022年至2023年年与前一年同期比较155.0%。

- 根据TomTom指数,印度的班加罗尔和普纳分别被评为全球第6和第7最拥挤城市。在班加罗尔,通勤者行驶 10 公里的平均时间为 28 分 10 秒,而在普纳那则达到 27 分 50 秒。

此外,将电动车纳入共用出行可以显着减少经济中的碳排放。因此,亚太地区各国政府越来越多地制定策略,促进电动车在租赁、叫车和其他共用出行车队中的使用。各种新参与企业正在大力投资,将电动车引入其车队,以满足不断增长的消费者需求。

- 2023 年 9 月,Ola Cabs 宣布在班加罗尔推出电动自行车服务,以加速印度各地叫车的电气化。从2023年9月到2024年1月,该公司完成了超过175万次乘车,标誌着该细分市场成长了40%。该公司计划未来几年在印度各地城市推出这项服务。

此外,中国、韩国和印度等国家的商业投资不断增长,导致企业积极寻求租赁解决方案,预计这将进一步促进该地区共享旅游市场的快速成长。未来几年,亚太地区的公司将花费大量资金来增强其数位平台以吸引消费者,并积极寻求与汽车製造商的合作伙伴关係,以更低的成本购买车辆。

共享旅游行业概况

由于生态系中存在各种国内外参与企业,共享出行市场呈现细分化且竞争激烈。知名参与企业包括Uber Technologies Inc.、ANI Technologies Pvt. Ltd.、Avis Budget Group Inc.、北京滴滴出行科技、Grab Holdings Inc.、Hertz Global Holdings、Lyft Inc.、Drive Now (BMW AG),其中包括Europcar Mobility Group、Cabify、Curb Mobility 和 BlaBlaCar。这些参与企业正在积极寻求扩展到其他地区,以提高品牌知名度,并不断致力于改善消费者体验。

- 2024 年 4 月,Yulu 宣布与 Yuva Mobility 合作,在印度印多尔和中央邦推出基于专利权、合作伙伴主导的共享旅游服务。此次合作将为消费者提供电动车作为共享旅游服务。此外,该公司的目标是扩大基本客群,以满足这些城市的学生、休閒骑士、游客和专业人士对电动车快速增长的需求。

- 2024年4月,Hoop Carpool宣布取得Mango Startup Studio以可转换票据形式的投资。这项投资旨在促进为期六个月的试用期,在此期间,Mango 员工和其他汽车共享乘客将使用 Hoop Carpool 的服务进行日常通勤。

预计市场将见证生态系统中运营的公司之间的各种併购,这将提高盈利前景并有助于满足更广泛的客户群。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行概述

第四章市场动态

- 市场驱动因素

- 消费者对乘车服务的偏好不断上升预计将推动市场成长

- 市场限制因素

- 监管共享出行行业的严格政府法规阻碍了市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 按类型

- 计程车

- 汽车共享

- 共享微型交通(电动自行车、电动Scooter等)

- 出租租赁

- 其他(接驳车服务、巴士服务等)

- 按车型

- 客车

- 轻型商用车(皮卡车等)

- 巴士/远距巴士

- 摩托车

- 按经营模式

- P2P(P2P)

- 企业对企业交易 (B2B)

- 企业对消费者 (B2C)

- 依推进类型

- 内燃机(ICE)

- 电

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Uber Technologies Inc.

- ANI Technologies Pvt. Ltd(Ola Cabs)

- Avis Budget Group Inc.

- Beijing Didi Chuxing Technology Co. Ltd

- Hertz Global Holdings

- Grab Holdings Inc.

- Lyft Inc.

- Drive Now(BMW AG)

- Europcar Mobility Group

- Cabify

- Zoomcar Holdings

- Revv

- Curb Mobility LLC

- BlaBlaCar

- Wingz Inc.

第七章市场机会与未来趋势

- 私家车持有成本高带动市场需求

The Shared Mobility Market size is estimated at USD 294.69 billion in 2024, and is expected to reach USD 663.39 billion by 2029, growing at a CAGR of 17.62% during the forecast period (2024-2029).

In the long term, consumers' increasing preference toward ride-hailing, car-sharing, and rental services owing to the lower cost of transportation will drive the shared mobility market across the world. Due to the increasing traffic congestion and higher ownership cost of purchasing new vehicles, consumers tend to avail ride-hailing as a preferred medium for their daily commutes. Further, the integration of various new entrants with a strong competitive edge is expected to disrupt the market. For instance, inDrive, a ride-hailing platform, offers a bid-based platform suitable for both drivers and consumers, as it helps negotiate a fixed price for short-distance travel and avoids the surge price charged by other competitors.

Key Highlights

- In Q3 2023, Beijing, Changchun, and Chongqing were the leading cities in China with the highest rush hour congestion. The rush hour congestion index in Beijing touched 2.09 in Q3 2023, followed by Changchun with an index of 2.05 and Chongqing with an index of 1.97 during the same period.

- According to the TomTom Index, London, Dublin, and Toronto were the major city centers across the world with the highest traffic congestion in 2023. The average time to travel 10 km in London is 37 minutes and 20 seconds, the highest in the world.

The ease of travel and the convenience of driving through traffic are leading to an increasing demand for two-wheeler hailing and sharing services, especially in Asia-Pacific. Some prominent countries with a significant shared micro-mobility market across Asia-Pacific include India, China, and Vietnam, which are attributed to the lower cost charged compared to availing a car-hailing service. Further, in recent years, there has been a massive penetration of electric two-wheelers in the shared mobility industry to complement the government's decarbonization effort, which is expected to foster the growth of the shared mobility market between 2024 and 2029.

Key Highlights

- In August 2023, Green and Smart Mobility (GSM) announced the commencement of its e-motorcycle-hailing service in Vietnam to solidify its market position and compete with players such as GoJek and Grab. Further, the company stated its plan to operate 60,000 e-motorcycles on Vietnamese roads in five localities across the country.

Moreover, increasing investment in the corporate sector and the worldwide urbanization rate contribute to consumers migrating to urban areas for better employment opportunities. With more consumers migrating to urban areas, there is a massive demand for jobs in these areas, which, in turn, is expected to expand the market for employee transportation needs. To cater to the increasing need for employee transportation, various shared mobility players are strategizing to enter this space by offering on-demand shuttle services, which, in turn, positively impact the demand for the shared mobility market worldwide.

Shared Mobility Market Trends

The Passengers Cars Segment is Expected to Gain Traction Between 2024 and 2029

Passenger cars are extensively utilized in ride-hailing, car-sharing, rental, and leasing services. Operators or individual owners deploy various car makes, such as hatchbacks, sedans, and sports utility vehicles (SUVs), to enhance customers' convenience. Therefore, the growing urbanization rate and the influx of tourists worldwide are significant determinants for the growth of the passenger cars segment, owing to their massive requirement for ride-hailing and rental services. Moreover, the rising investment in the corporate sector to expand job opportunities and expand economic growth leads to businesses demanding leasing services for employee transportation purposes, which, in turn, is positively impacting the demand for passenger cars segment.

- According to the World Tourism Organization, the total number of international tourist arrivals worldwide reached 1,258.66 million in 2023 compared to 960.19 million in 2022, representing a 31.0% Y-o-Y growth between 2022 and 2023.

- According to the Population Reference Bureau, North America, Latin America, and Europe were the leading continents worldwide with the highest urban population in 2023. The share of urban population as a percentage of the overall population in North America touched 83% in 2023, followed by Latin America (82%) and Europe (75%) during the same period.

To complement the government's effort to decarbonize the transport sector, ride-hailing operators and rental providers worldwide increasingly prefer deploying electric passenger cars in their fleets. Further, with more consumers demanding electric passenger cars as their preferred choice of transportation, these players are expected to invest hefty sums in acquiring new-age vehicles in their fleet to meet the surging demand, which, in turn, will positively impact the growth of this market segment.

- In November 2023, Green and Smart Mobility (GSM), a Vietnamese-based ride-hailing company, announced the launch of its electric taxi service in Laos and Vietnam to position its brand as a sustainable mode of shared transportation. The company plans to deploy Vinfast VF5 electric cars to expand its fleet, which will be available to consumers in Vietnam and Laos.

The shared mobility market is anticipated to witness the integration of various ride-hailing and rental companies worldwide, attributed to the lucrative opportunity that the market presents. As more companies integrate into the ecosystem, a massive demand will exist for passenger cars to be utilized for shared mobility. Moreover, consumers are shifting their preferences toward availing of lower-cost private transportation, which is further expected to foster the growth of this segment.

Asia-Pacific is the Largest Shared Mobility Market Across the World

Consumers' increasing preference toward availing private mediums of transportation for traveling purposes owing to the rising need for convenience in personal mobility, high internet penetration rate, and the growing number of tourists in Asia-Pacific serve as significant drivers for the growth of the shared mobility market. Moreover, this region witnesses a substantial demand for two-wheeler hailing services due to the worsening traffic congestion and the need for faster city travel, which, in turn, positively impacts the growth of this segment.

- According to the World Tourism Organization, the number of international tourist arrivals in Asia-Pacific reached 233.43 million in 2023 compared to 91.52 million in 2022, representing a Y-o-Y growth of 155.0% between 2022 and 2023.

- According to the TomTom Index, Bengaluru and Pune in India were the sixth and seventh cities with the highest traffic congestion worldwide, respectively. The average travel time for commuters to travel 10 km in Bengaluru was 28 minutes and 10 seconds, while it reached 27 minutes and 50 seconds in Pune.

Further, integrating electric vehicles in shared mobility fleets can significantly reduce carbon emissions from the economy. Hence, governments across Asia-Pacific are increasingly strategizing to promote the use of electric vehicles in rental, ride-hailing, and other shared mobility fleets. Various new entrants are investing hefty sums in deploying electric cars in their fleets to cater to the increasing consumer demand.

- In September 2023, Ola Cabs announced the launch of its e-bike service in Bengaluru to promote the electrification of ride-hailing fleets across India. Between September 2023 and January 2024, the company witnessed a 40% expansion in this segment by completing more than 1.75 million rides. The company plans to launch this service across cities in India in the coming years.

Moreover, the expanding corporate investment in countries such as China, South Korea, and India is actively leading to companies demanding rental solutions, which, in turn, is further anticipated to contribute to the surging growth of the shared mobility market in the region. In the coming years, Asia-Pacific will witness companies spending hefty sums to enhance their digital platforms to attract consumers and actively seek partnerships with automakers to acquire vehicles in their fleet at a lower cost.

Shared Mobility Industry Overview

The shared mobility market is fragmented and highly competitive due to the presence of various international and domestic players operating in the ecosystem. Some prominent players include Uber Technologies Inc., ANI Technologies Pvt. Ltd, Avis Budget Group Inc., Beijing DiDi Chuxing Technology Co. Ltd, Grab Holdings Inc., Hertz Global Holdings, Lyft Inc., Drive Now (BMW AG), Europcar Mobility Group, Cabify, Curb Mobility, and BlaBlaCar. These players actively seek to expand their business into other geographies to enhance their brand visibility and constantly focus on improving consumer experience.

- In April 2024, Yulu announced its partnership with Yuva Mobility to launch franchise-based partner-led shared mobility services in Indore and Madhya Pradesh, India. The partnership will witness the introduction of electric vehicles offered to consumers as shared mobility services. Further, the company aims to expand its customer base to cater to the surging demand for EVs among students, leisure riders, tourists, and professionals in these cities.

- In April 2024, Hoop Carpool announced that it had raised an investment from Mango Startup Studio in the form of a convertible equity loan. The investment aims to facilitate a six-month trial period during which Mango employees and other car-sharing riders will use Hoop Carpool services for their daily commutes.

The market is anticipated to witness various mergers and acquisitions between firms operating in the ecosystem, which will assist them in enhancing their profitability prospects and help cater to a broader customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Preference of Consumers toward Ride-Hailing Services is Expected to Foster the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 Strict Government Regulations to Govern the Shared Mobility Industry Hampers the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Type

- 5.1.1 Ride-Hailing

- 5.1.2 Car Sharing

- 5.1.3 Shared Micromobility (E-Bikes, E-Scooters, etc.)

- 5.1.4 Rental and Leasing

- 5.1.5 Others (Shuttle Services, Bus Services, etc.)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles (Pickup Vans, etc.)

- 5.2.3 Buses and Coaches

- 5.2.4 Two-Wheelers

- 5.3 By Business Model

- 5.3.1 Peer-to-Peer (P2P)

- 5.3.2 Business-to-Business (B2B)

- 5.3.3 Business-to-Consumer (B2C)

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine (ICE)

- 5.4.2 Electric

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Uber Technologies Inc.

- 6.2.2 ANI Technologies Pvt. Ltd (Ola Cabs)

- 6.2.3 Avis Budget Group Inc.

- 6.2.4 Beijing Didi Chuxing Technology Co. Ltd

- 6.2.5 Hertz Global Holdings

- 6.2.6 Grab Holdings Inc.

- 6.2.7 Lyft Inc.

- 6.2.8 Drive Now (BMW AG)

- 6.2.9 Europcar Mobility Group

- 6.2.10 Cabify

- 6.2.11 Zoomcar Holdings

- 6.2.12 Revv

- 6.2.13 Curb Mobility LLC

- 6.2.14 BlaBlaCar

- 6.2.15 Wingz Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 High Cost of Ownership of Private Vehicles Fuels the Market Demand