|

市场调查报告书

商品编码

1687423

线上赌博 -市场占有率分析、行业趋势与统计、成长预测(2025-2030 年)Online Gambling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

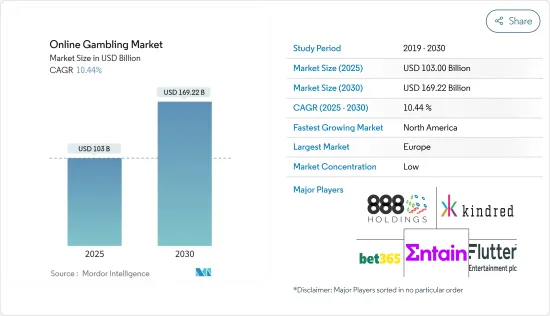

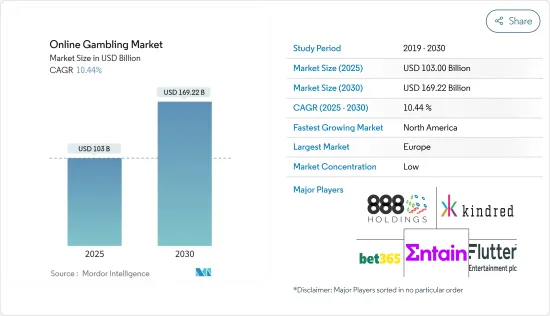

线上赌博市场规模预计在 2025 年达到 1,030 亿美元,预计到 2030 年将达到 1,692.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.44%。

网路普及率的提高对线上赌博业的成长产生了直接影响。根据通讯(ITU) 的数据,到 2022 年,全球网路用户将达到 53 亿。智慧型手机的普及进一步导致多种基于行动应用程式的彩票游戏的兴起,因为它们为最终用户提供了在自己的空间内赌博的便利性和舒适性。赌场赌博因其便利性和最佳的用户体验而成为成长最快的赌博类别之一。为了满足不同玩家的兴趣,线上赌博公司提供各种游戏,如老虎机、扑克、体育博彩等。

体育博彩在亚太地区很受欢迎。此外,线上赌博统计数据显示,抽奖和刮刮乐即时游戏的受欢迎程度正在增加,尤其是在欧洲国家,这对线上赌博业的成长产生了积极影响。根据欧洲游戏和博彩协会的数据,2022 年欧洲线上赌博的总收入为 293 亿欧元。随着虚拟实境和区块链的出现,各种线上赌场公司都专注于推进创新平台,以满足客户的要求和需求,并在市场上获得竞争优势。例如,2023年7月,线上赌博公司Kindred在美国宾州推出了自己的科技平台。该公司在其 Kindred 平台上提供对 Unibet Casino 和 Sportsbook 应用程式的存取权。

线上赌博市场趋势

多样化的赞助和便利的支付方式推动线上赌博产业

线上赌博统计数据显示,行动电话、网路和便利的线上付款闸道的日益普及使得线上赌博服务变得容易获得。此外,线上博彩主要在线上体育类别中成长,尤其是国际足总世界杯和欧洲锦标赛等足球赛事。许多线上赌博公司专注于体育博彩,将赞助各种球队作为其行销策略的一部分,并收购或合併多家公司以实现策略扩张。例如,2022年9月,BC.GAME与阿根廷足球协会签署了赞助合约。

阿根廷队 BC.GAME 为其在卡达举行的 FIFA 世界杯比赛提供了支持。线上赌场营运商还赞助电影、电视节目和串流内容来推广他们的品牌并吸引观众。赌场行业的趋势表明,足球锦标赛和赛马比赛等大型体育赛事是在线赌博运营商推广和吸引体育博彩者的理想平台。例如,2022年12月,全球领先的线上博弈和游戏公司Betway与在南非举行的Twenty20专利权板球锦标赛SA20签署了一份多年冠名赞助协议。

北美是一个快速成长的市场

根据美国现行的网路博彩法律体制,只有在内华达州、宾州和新泽西州获得许可的博彩公司才能合法经营。宾州是第四个也是最大的一个合法化和规范网路赌博的州。新泽西州拥有许多不同类型的线上赌场公司、体育博彩公司和体育博彩应用程式。新泽西州博彩执法部门监督和管理新泽西州的线上博彩网站。

它负责授权网站、征收税收以及测试和核准游戏。新泽西州是美国受监管的最大线上赌博市场。就网路赌博而言,加拿大是一个不受监管的国家。墨西哥打算修改其赌博法并规范线上赌博业,使其与世界其他地区的赌博业保持一致。因此,北美国家及其各自州的网路赌博合法化有望进一步推动线上博彩市场的发展。

线上赌博统计数据显示,扩增实境(AR) 和虚拟实境 (VR) 等技术进步正在融入线上游戏体验,以增加企业的参与度。随着智慧型手机和平板电脑的普及,行动赌博急剧增加,几乎可以随时随地下注。例如,根据墨西哥国家统计和地理研究所的数据,到2022年,墨西哥的行动电话用户将达到9,308万人。

线上赌博行业概述

线上赌博市场高度分散,由区域性和全球性公司组成。 Bet365、Entain PLC、888 Holding PLC、Flutter Entertainment PLC 和 Kindred Group PLC 等线上赌博公司占据市场主导地位。主要参与者正专注于併购、伙伴关係和产品创新以扩大其市场份额。他们也在多种因素上竞争,包括服务产品、赌博内容品质、用户体验、品牌股权、个人化回报和多平台存取权。除此之外,先进的分销网络和製造专业知识使该公司在扩大其产品全球影响力方面处于有利地位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 积极的广告和促销活动

- 安全、加密和串流媒体技术的进步

- 市场限制

- 监管和法律挑战

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 游戏类型

- 体育博彩

- 足球

- 赛马

- 网球

- 其他运动

- 赌场

- 真人娱乐场

- 百家乐

- 二十一点

- 扑克

- 投币口

- 其他赌场游戏

- 抽籤

- 宾果

- 体育博彩

- 最终用户

- 桌面

- 移动的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 瑞典

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太国家

- 大洋洲国家

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司采用的策略

- 市场占有率分析

- 公司简介

- Betsson AB

- 888 Holdings PLC

- Kindred Group PLC

- Entain PLC

- Bet365

- Flutter Entertainment PLC

- 22bet

- Mgm Resorts International

- Draftkings Inc.

- Super Group(sghc Limited)

第七章 市场机会与未来趋势

The Online Gambling Market size is estimated at USD 103.00 billion in 2025, and is expected to reach USD 169.22 billion by 2030, at a CAGR of 10.44% during the forecast period (2025-2030).

Increasing internet penetration has a direct impact on the growth of the online gambling industry. According to the International Telecommunication Union (ITU), the number of internet users globally was 5,300 million in 2022. The increased penetration of smartphones further leads to an increase in several mobile application-based lottery games as they provide end-users the convenience and comfort of gambling within their own space. Casino gambling has been one of the rapidly growing gambling categories, owing to the convenience of usage and optimal user experience. To meet different player interests, online gambling companies provide various games, such as slots, poker, and sports betting.

Sports betting is popular in Asia-Pacific. Moreover, online gambling statistics point towards a rise in the popularity of draw-based and scratch-off instant games, especially across European countries, which positively impacts the growth of the online gambling industry. Online gambling gross win in Europe was EUR 29.3 billion in 2022, according to the European Gaming & Betting Association. With the advent of virtual reality and blockchain, various online casino companies are focusing on advancing innovative platforms to cater to the requirements and needs of customers and achieve a competitive edge in the market. For instance, in July 2023, Kindred, an online gambling company, launched a proprietary tech platform in Pennsylvania, United States. The company offers access to Unibet Casino and Sportsbook apps on the Kindred platform.

Online Gambling Market Trends

Various Sponsorships and Convenient Payment Options are Driving the Online Gambling Industry

Online gambling statistics show an increased penetration of mobile phones, the Internet, and convenient online payment gateways leading to online gambling services easily accessible. Moreover, online betting is predominantly rising in the online sports category, especially in football events like the FIFA World Cup and the European championships. Many online gambling companies are focusing on sports betting and are sponsoring different teams as a part of their marketing strategy and acquiring or merging with several companies for strategic expansions. For instance, in September 2022, BC. GAME signed a sponsorship agreement with the Argentine Football Association.

The Argentine team had BC. GAME's support during the FIFA World Cup matches in Qatar. Operators of online casinos also sponsor films, television programs, or streaming content to promote their brands and attract viewers. The casino industry trends show that major athletic events, such as football championships and horse racing contests, are ideal platforms for online gambling businesses to advertise and attract sports bettors. For instance, in December 2022, a leading global online betting and gaming company Betway signed a multi-year title sponsorship with SA20, a Twenty20 franchise cricket tournament in South Africa.

North America is the Fastest-Growing Market

The current legislative framework for online betting in the United States allows only bookmakers licensed in Nevada, Pennsylvania, and New Jersey to operate legally, as these are the three states where online betting is regulated. Pennsylvania is the fourth and biggest state to legalize and regulate online gambling. New Jersey has various types of online casino companies, sportsbooks, and sports betting apps. New Jersey's Division of Gaming Enforcement oversees and holds New Jersey's online gaming sites.

It handles site licensing, tax revenue collection, and game testing and approval. New Jersey is the largest market for regulated online gambling in the United States. Canada is an unregulated country in terms of online gaming. Mexico is reviewing its gambling laws, intending to regulate the online gambling sector to align with the rest of the region's gambling industry. Therefore, the increasing regularization of online gambling in North American countries and their respective states is expected to drive the online betting market further.

As per online gambling statistics, technological advancements, such as augmented reality (AR) and virtual reality (VR), are incorporated into online gaming experiences to increase player engagement. Mobile gambling has increased dramatically due to the widespread use of smartphones and tablets, which enable bets to be placed at any time and almost anywhere. For instance, the number of mobile phone users in Mexico was 93.08 million in 2022, according to the National Institute of Statistics and Geography.

Online Gambling Industry Overview

The online betting market is highly fragmented and comprises regional and global players. Online gambling companies such as Bet365, Entain PLC, 888 Holding PLC, Flutter Entertainment PLC, and Kindred Group PLC dominate the market. Major players are focusing on mergers and acquisitions, partnerships, and product innovations to expand their presence in the market. They also compete on various factors, including offerings, quality of gambling content, user experience, brand equity, personalized payoffs, and access to multiple platforms. Apart from this, advanced distribution networks and manufacturing expertise give an upper edge to players to expand their range of products globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Aggressive Advertisement And Promotional Activities

- 4.1.2 Advancement In Security, Encryption, And Streaming Technology

- 4.2 Market Restraints

- 4.2.1 Regulatory and Legal Challenges

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Game Type

- 5.1.1 Sports Betting

- 5.1.1.1 Football

- 5.1.1.2 Horse Racing

- 5.1.1.3 Tennis

- 5.1.1.4 Other Sports

- 5.1.2 Casino

- 5.1.2.1 Live Casino

- 5.1.2.2 Baccarat

- 5.1.2.3 Blackjack

- 5.1.2.4 Poker

- 5.1.2.5 Slots

- 5.1.2.6 Others Casino Games

- 5.1.3 Lottery

- 5.1.4 Bingo

- 5.1.1 Sports Betting

- 5.2 End User

- 5.2.1 Desktop

- 5.2.2 Mobile

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Sweden

- 5.3.2.5 Spain

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Oceanic Countries

- 5.3.3.2 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Betsson AB

- 6.3.2 888 Holdings PLC

- 6.3.3 Kindred Group PLC

- 6.3.4 Entain PLC

- 6.3.5 Bet365

- 6.3.6 Flutter Entertainment PLC

- 6.3.7 22bet

- 6.3.8 Mgm Resorts International

- 6.3.9 Draftkings Inc.

- 6.3.10 Super Group (sghc Limited)