|

市场调查报告书

商品编码

1548570

活动管理软体:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Event Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

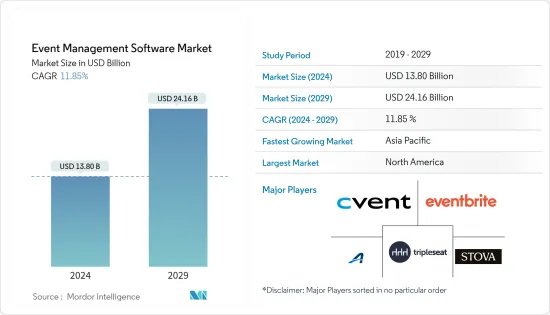

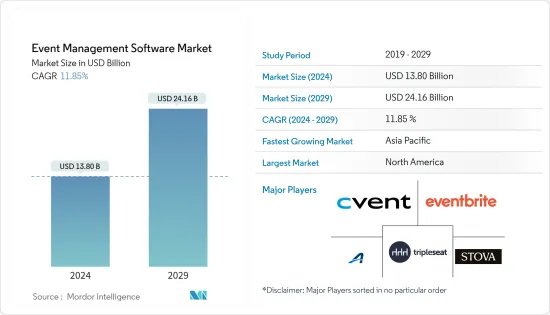

全球活动管理软体市场规模预计在 2024 年达到 138 亿美元,并在 2024-2029 年预测期间以 11.85% 的复合年增长率增长,到 2029 年将达到 241.6 亿美元。

预计该市场将在预测期内成长,这主要是由于活动管理公司对自动化和简化活动营运的需求不断增长所推动。此外,人们越来越注重从事件中提取可行的见解,这进一步推动了市场的成长。活动管理软体发挥着巨大的作用,提供从场地和门票管理到活动分析和潜在客户管理的一系列功能。这种整合方法不仅可以确保活动规划的成功,还可以降低成本并消除部署多个软体的需求。

预计各种变革趋势将推动市场发展。例如,活动管理软体供应商越来越优先考虑可容纳实体和虚拟与会者的平台。这些平台拥有直播、虚拟参展展位和互动网路工具等功能。

例如,Kaltura 2023 年活动状况报告对大约 1,500 多名组织者和参与者进行了调查,发现 40% 的负责人正在计划 2023 年的虚拟活动,18% 的营销人员正在计划混合活动。当谈到业务优先事项时,虚拟活动占据首位,74% 的行销人员声称虚拟活动对其整体策略最重要。负责人预计 2023 年 ROI(投资收益)和预算将全面成长:网路数量将增加 12%,参与度将增加 13%,註册量将增加 14%,出席率和潜在客户开发将增加 15%。这些预测增加了虚拟活动和持续需求成长的适度乐观前景。

此外,活动管理软体比以往任何时候都更常利用人工智慧和机器学习演算法。这些技术分析与会者的资料和偏好,使组织者能够个性化活动的各个方面,从内容推荐到网路提案。例如,2023 年 6 月初,Eventcombo 开始对其最新的活动管理平台进行 Beta 测试。该版本是与亚伯达机器学习研究所合作开发的,旨在利用人工智慧更有效地处理业务事件协调。

活动管理软体市场的主要障碍之一是组织者提供的服务与与会者寻求的服务之间存在显着脱节。组织者通常缺乏对参与者期望的清晰洞察,因此需要帮助准确理解和满足参与者的多样化需求。这种脱节往往会导致活动规划不一致,导致与会者体验不佳,主办单位错失机会。

此外,随着事件变得更加复杂和多样化,传统的软体解决方案越来越难以满足这些多样化的需求。为了有效地弥合这一差距,必须全面了解参与者的人口统计、偏好和行为,并整合创新功能以实现个人化体验和即时回馈。

根据 Convene 在 2022 年底进行的 Covid-19 调查显示,全球会议相关人员将差旅和预算政策限制视为影响 2023 年活动产业的主要因素,而采用混合和虚拟活动的趋势日益明显格式来解决限制

活动管理软体市场趋势

中小企业显着成长

- 小企业主和企业家经常面临与大公司不同的挑战,使他们在商业旅程中感到越来越孤独。会议和社交活动为这些人(包括「个人企业家」)提供了一个与志同道合的专业人士互动并促进合作和思想交流的重要平台。

- 例如,根据印度中小微型企业部的数据,截至 2024 年 3 月,Udyam 入口网站以及 Udyam Assist Platform (UAP)总合40,042,875 家註册中小型微型企业,显示出持续成长。其中,绝大多数是微企业,数量为39,318,355个,占近97.7%。中小企业有608,935家,约占註册中小企业的1.5%;中型企业有55,488家,约占註册中小企业的0.8%。如此庞大的中小企业数量可能会为所研究的市场创造成长机会。

- 举办活动对中小型企业来说有许多好处。这些优势可以激励中小企业推出新的活动,调查市场的需求也随之增加。例如,活动将不同的人群聚集在一起,从潜在客户和合作伙伴到同行。对于小型企业来说,在这些活动中建立联繫很有价值。它开闢了推动成长的所有重要途径,包括合作、伙伴关係和重要的口碑推荐。

- 此外,活动也为市场研究提供了一个很好的平台。小型企业可以分析竞争对手、深入了解消费行为并洞察新兴趋势。这些资讯有助于我们改善产品、改善服务并保持竞争力。

- 据欧盟委员会称,到 2023 年,欧盟 (EU) 估计有 2,440 万家中小企业 (SME)。其中大多数是员工少于九人的微企业。此外,拥有10至49名员工的小型企业有132万家,拥有50至249名员工的中型企业有202,278家。

- 此外,该活动还将提供许多内容创作机会,从直播会议到独家幕后揭秘。活动期间创建的内容具有巨大的重复使用潜力。这些事件的见解和轶事可以在公司的社交媒体平台、部落格报导、时事通讯等上展示,它们的影响在事件结束后可以持续很长时间。

- 此外,用户生成的内容通常是透过举办活动而有机生成的。当与会者在社交平臺上共用他们的活动体验时,他们会为您的品牌创建一个引人注目的叙述,并显着提高您的品牌知名度。透过利用此类用户生成的内容,您可以模仿影响者行销的效果并有可能增加销售额。

- 此外,许多活动支持不同地区小型企业的发展。例如,2024 年亚利桑那州中小企业会议有一个项目,深入探讨采矿计划的进步和创新,包括采矿、地质、冶金、环境问题、新计画和爆破。该活动致力于解决西南沙漠采矿业的挑战和前景,是该地区的基石。该活动以其一流的内容、交流机会以及西南矿业基金会名人堂和中小企业分会高尔夫锦标赛资金筹措等社区支持活动而闻名,是业界同行和朋友们备受期待的年度活动之一。地点。

北美市场占有率最大

- 此外,该活动还提供许多内容创作机会,从直播会议到独家幕后揭秘。活动期间创建的内容具有巨大的重复使用潜力。这些事件的见解和轶事可以在公司的社交媒体平台、部落格报导、时事通讯等上展示,它们的影响在事件结束后可以持续很长时间。

- 此外,用户生成的内容通常是透过举办活动而有机生成的。当与会者在社交平臺上共用他们的活动体验时,他们会为您的品牌创建一个引人注目的叙述,并显着提高您的品牌知名度。透过利用此类用户生成的内容,您可以模仿影响者行销的效果并有可能增加销售额。

- 此外,许多活动支持不同地区小型企业的发展。例如,2024 年亚利桑那州中小企业会议有一个项目,深入探讨采矿计划的进度和创新,包括采矿、地质、冶金、环境问题、新计画和爆破。该活动致力于解决西南沙漠采矿业的挑战和前景,是该地区的基石。该活动以其一流的内容、交流机会和社区支持的活动(例如西南矿业基金会名人堂和中小企业学生分会高尔夫锦标赛筹款活动)而闻名,是行业同行和朋友们梦寐以求的年度聚会点 。

- 由于对高效活动策划、管理和执行解决方案的需求不断增长,北美活动管理软体市场正在经历强劲成长。技术进步以及混合和虚拟活动的日益普及也推动了市场扩张,尤其是在 COVID-19 大流行之后。随着企业和组织适应吸引受众的新方式,对能够处理註册、票务、直播、分析和网路的综合软体的需求正在激增。

- Cvent、Eventbrite 和 Bizzabo 等北美领先的活动管理软体公司是市场上的主要参与者,为活动规划、票务和与会者参与提供全面的工具。这些公司利用人工智慧和资料分析等先进技术来改善用户体验和业务效率,以满足企业和大型活动的需求。

- 此外,成长的关键驱动因素包括高速网路的普及、人工智慧和机器学习的普及以实现个人化的与会者体验,以及即时资料分析和活动行销工具等高级功能的整合。北美重要的IT基础设施和大型高科技公司的存在也为该领域的创新提供了有利的环境。

- 2024 年 2 月,场馆和活动管理 SaaS解决方案供应商Momentus Technologies 发布了 Momentus Prime,这是一款专为中小型企业 (SMB) 市场场馆设计的产品。 Prime 透过提供广泛的功能并让中小企业能够使用传统上属于大型企业的增强技术,彻底改变了场地和活动管理的方法。

- 整体而言,市场上越来越多的中小型企业采用事件管理软体来与大公司进行有效竞争。随着技术的不断进步和数位转型投资的增加,北美活动管理软体市场有望持续成长,满足各行业不断变化的需求。

活动管理软体产业概述

活动管理软体市场高度分散,既有全球参与者,也有中小企业。市场主要参与者包括Cvent Inc.(Blackstone Inc.)、Tripleseat(Vista Equity's)、Active Network LLC(Global Payments Inc.)、STOVA、Eventbrite Inc.等。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

2024 年6 月- Tripleseat 是一家面向餐厅、酒店和独特场馆的销售和活动管理平台,宣布推出Merri,这是一款面向餐厅、酒店、独特场馆和活动策划者的创新3D 平面图和活动设计应用程序,并宣布进行收购。此次策略性收购进一步增强了 Tripleseat 的综合工具集,为场馆提供一体化解决方案,以简化活动规划和管理。

2024 年 1 月 - Cvent 收购了 B2B 1:1 和团体预约安排解决方案 Jifflenow 以及捕获解决方案 iCapture。数百家全球公司依靠 Jifflenow 来安排和管理高品质的 B2B 预约,而 iCapture 为贸易展览和会议提供潜在客户捕获,因为现场活动已成为推动成长的关键管道,满足了企业的需求。透过这些收购,Cvent 进一步扩展了其活动行销和管理平台,并提供增强的解决方案来支援组织。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 影响市场的宏观经济因素评估

第五章市场动态

- 市场驱动因素

- 越来越注重从事件中获取可行的见解

- 活动管理公司越来越多地采用自动化

- 市场挑战

- 高成本、认知度低

- 定价及定价模式分析

第六章 市场细分

- 透过软体

- 活动企划

- 活动行销

- 场地/门票管理

- 分析/报告

- 其他软体类型

- 按组织规模

- 小型企业

- 大公司

- 按安装类型

- 云

- 本地

- 按最终用户产业

- 公司

- 政府

- 教育机构

- 媒体娱乐

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 英国

- 德国

- 北欧的

- 比荷卢经济联盟

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Cvent Inc.(Blackstone Inc.)

- Tripleseat(Vista Equity's)

- Active Network LLC(Global Payments Inc.)

- STOVA

- Eventbrite Inc.

- Momentus Technologies

- Certain Inc.

- SignUpGenius Inc.(Lumaverse Technologies)

- EMS Software LLC(Accruent)

- TryBooking Pty Ltd

- Event Espresso LLC

第八章投资分析

第9章市场的未来

The Event Management Software Market size is estimated at USD 13.80 billion in 2024, and is expected to reach USD 24.16 billion by 2029, growing at a CAGR of 11.85% during the forecast period (2024-2029).

During the forecast period, the market is poised for growth, primarily propelled by event management companies' escalating demand for automation, streamlining event operations. Moreover, a heightened emphasis on extracting actionable insights from events further fuels market expansion. Event management software plays a major role, offering a suite of functions-from venue and ticketing management to event analytics and lead management. This consolidated approach not only aids in successful event planning but also slashes costs, negating the need for multiple software implementations.

Various transformative trends are expected to drive the market. For example, event management software providers increasingly prioritize platforms catering to physical and virtual attendees. These platforms boast features like live streaming, virtual exhibitor booths, and interactive networking tools.

For instance, according to the Kaltura State of Events Report 2023, which surveyed approximately 1,500+ organizers and attendees, 40% of marketers planned virtual events in 2023, and 18% included hybrid events in their plans. Regarding business priority, virtual events take the top spot, with 74% of marketers claiming virtual events are the most important for their overall strategies. In 2023, marketers expected growth across the board, ROI, and budget; networking is expected to grow by 12%, engagement by 13%, registration by 14%, and attendance and lead generation by 15%. These estimations nod toward a moderate but optimistic outlook for the virtual events and continuous growth of demands.

Furthermore, more than ever, event management software harnesses AI and machine learning algorithms. These technologies analyze attendee data and preferences, empowering organizers to personalize every aspect of an event, from content recommendations to networking suggestions. For instance, in early June 2023, Eventcombo initiated beta testing for its updated event-management platform. This version was developed in collaboration with the Alberta Machine Learning Institute, which aimed to leverage artificial intelligence for more efficient handling of business event coordination.

One primary hurdle in the event management software market is the notable divergence between what organizers offer and what attendees seek. Often lacking clear insights into attendee expectations, organizers need help to gauge and cater to their diverse needs accurately. This disconnect frequently results in misaligned event planning, leading to subpar experiences for attendees and missed opportunities for organizers.

Moreover, with events growing in complexity and diversity, traditional software solutions find it increasingly more complex to adapt to these varied demands. To bridge this gap effectively, a comprehensive grasp of attendee demographics, preferences, behaviors and the integration of innovative features for personalized experiences and real-time feedback are imperative.

According to the Convene survey conducted in late 2022, post-COVID-19, meeting professionals globally identified travel and budget policy restrictions as the primary factors impacting the event industry in 2023, leading to an increased adoption of hybrid and virtual event formats to address these constraints.

Event Management Software Market Trends

SMEs to Witness Major Growth

- Small business owners and entrepreneurs often grapple with distinct challenges compared to larger corporations, fostering a sense of isolation as they navigate their business journeys. Conferences and networking events offer a vital platform for these individuals, including 'solopreneurs,' to engage with like-minded professionals, fostering cooperation and the exchange of ideas.

- For instance, according to the Ministry of Micro, Small & Medium Enterprises India, as of March 2024, the Udyam portal, along with the Udyam Assist Platform (UAP), boasted a total of 4,00,42,875 registered MSMEs, showing consistent growth. Of these, micro-enterprises dominate, numbering 3,93,18,355, making up nearly 97.7%. Small enterprises follow, with 6,08,935 entities, accounting for about 1.5%, while medium-sized enterprises stand at 55,488, representing roughly 0.8% of the registered MSMEs. Such a vast number of SMEs may create an opportunity for the growth of the market studied.

- There are various advantages for SMEs when organizing events. Such benefits may propel small and medium enterprises to launch new events, which would proportionately drive the demand for the market studied. For example, events draw a diverse crowd, from potential customers and partners to industry peers. For small businesses, networking at these events is invaluable. It paves the way for collaborations, partnerships, and crucial word-of-mouth referrals, all essential for driving growth.

- Moreover, events provide an excellent platform for market research. Small businesses can analyze competitors, delve into consumer behavior, and glean insights into emerging trends. Such intel is instrumental in product refinement, service enhancement, and maintaining a competitive edge.

- According to the European Commission, in 2023, the European Union was home to an estimated 24.4 million small and medium-sized enterprises (SMEs). The majority of these were micro-sized, employing fewer than nine individuals. Additionally, there were 1.32 million small firms, each with 10 to 49 employees, and 202,278 medium-sized enterprises, employing 50 to 249 workers.

- Furthermore, events offer many content creation opportunities, from live-streamed sessions to exclusive behind-the-scenes peeks. The content produced during events holds immense potential for repurposing. Insights and anecdotes from these occasions find their way onto a company's social media platforms, blog posts, and newsletters, extending the event's impact long after its conclusion.

- Moreover, hosting events often leads to the organic creation of user-generated content. As attendees share their event experiences on social platforms, they craft a compelling narrative around the brand, significantly enhancing its visibility. Leveraging this user-generated content can mimic the effects of influencer marketing, potentially driving up sales.

- Additionally, many events support the growth of SMEs in various regions. For example, at the 2024 SME Arizona conference, the program delves into advancements in mining projects and technical innovations, spanning mining, geology, metallurgy, environmental concerns, new projects, and blasting. This event, exclusive to the challenges and prospects of the mining industry in the desert southwest, is a cornerstone in the region. Renowned for its top-notch content, networking opportunities, and community support events like the Mining Foundation of the Southwest Hall of Fame and the SME Student Chapter Golf Tournament fundraiser, it's one of the much-anticipated annual rendezvous for industry peers and friends.

North America Holds Largest Market Share

- Furthermore, events offer many content creation opportunities, from live-streamed sessions to exclusive behind-the-scenes peeks. The content produced during events holds immense potential for repurposing. Insights and anecdotes from these occasions find their way onto a company's social media platforms, blog posts, and newsletters, extending the event's impact long after its conclusion.

- Moreover, hosting events often leads to the organic creation of user-generated content. As attendees share their event experiences on social platforms, they craft a compelling narrative around the brand, significantly enhancing its visibility. Leveraging this user-generated content can mimic the effects of influencer marketing, potentially driving up sales.

- Additionally, many events support the growth of SMEs in various regions. For example, at the 2024 SME Arizona conference, the program delves into advancements in mining projects and technical innovations, spanning mining, geology, metallurgy, environmental concerns, new projects, and blasting. This event, exclusive to the challenges and prospects of the mining industry in the desert southwest, is a cornerstone in the region. Renowned for its top-notch content, networking opportunities, and community support events like the Mining Foundation of the Southwest Hall of Fame and the SME Student Chapter Golf Tournament fundraiser, it's one of the much-anticipated annual rendezvous for industry peers and friends.

- North America's event management software market has been witnessing robust growth, driven by the growing need for efficient event planning, management, and execution solutions. The market's expansion is also driven by technological advancements and the rising popularity of hybrid and virtual events, especially in the aftermath of the COVID-19 pandemic. As businesses and organizations adapt to new ways of engaging audiences, the demand for comprehensive software that can handle registrations, ticketing, live streaming, analytics, and networking has surged.

- Major event management software companies in North America, such as Cvent, Eventbrite, and Bizzabo, are critical players in the market with comprehensive tools for event planning, ticketing, and attendee engagement. These firms leverage advanced technology, including AI and data analytics, to enhance user experience and operational efficiency, catering to corporate and large-scale event needs.

- Moreover, key factors contributing to the growth include the proliferation of high-speed internet, the increasing adoption of AI and machine learning for personalized attendee experiences, and the integration of advanced features like real-time data analytics and event marketing tools. North America's vital IT infrastructure and the presence of major tech companies also provide a conducive environment for innovation in this sector.

- In February 2024, Momentus Technologies, a venue and event management SaaS solutions provider, introduced Momentus Prime, a product designed for venues in the small to midsize business (SMB) market. Prime brings an extensive range of features, providing SMBs access to enhanced technology that has long been the domain of significant enterprises, revolutionizing their approach to venue and event management.

- Overall, the market is witnessing a rise in small and medium-sized enterprises adopting event management software to compete effectively with larger organizations. With continuous technological advancements and growing investments in digital transformation, the North American event management software market is poised for sustained growth, catering to the evolving needs of various sectors.

Event Management Software Industry Overview

The Event Management Software market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Cvent Inc. (Blackstone Inc.), Tripleseat (Vista Equity's), Active Network LLC (Global Payments Inc.), STOVA, and Eventbrite Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

June 2024 - Tripleseat, a sales and event management platform catering to restaurants, hotels, and unique venues, has confirmed its acquisition of Merri, an innovative 3D floorplan and event design application tailored for restaurants, hotels, unique venues, and event planners. The strategic acquisition is set to bolster Tripleseat's comprehensive toolset, offering venues an all-in-one solution for effortless event planning and management.

January 2024 - Cvent acquired Jifflenow, a B2B 1:1 and group appointments scheduling solution, and iCapture, a capture solution. As in-person events have become a critical channel for driving growth, hundreds of global organizations rely on Jifflenow to schedule and manage high-quality B2B appointments and iCapture for their trade show and conference lead capture needs. With these acquisitions, Cvent further expanded its Event Marketing and Management platform, offering enhanced solutions to help organizations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Gaining Actionable Insights From Events

- 5.1.2 Growing Adoption of Automation by Event Management Companies

- 5.2 Market Challenges

- 5.2.1 High Cost and Lower Awareness

- 5.3 Analysis of Pricing and Pricing model

6 MARKET SEGMENTATION

- 6.1 By Software

- 6.1.1 Event Planning

- 6.1.2 Event Marketing

- 6.1.3 Venue & Ticket Management

- 6.1.4 Analytics and Reporting

- 6.1.5 Other Software Types

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment Type

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By End-user Vertical

- 6.4.1 Corporate

- 6.4.2 Government

- 6.4.3 Education

- 6.4.4 Media and Entertainment

- 6.4.5 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 Nordics

- 6.5.2.4 Benelux

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cvent Inc. (Blackstone Inc.)

- 7.1.2 Tripleseat (Vista Equity's)

- 7.1.3 Active Network LLC (Global Payments Inc.)

- 7.1.4 STOVA

- 7.1.5 Eventbrite Inc.

- 7.1.6 Momentus Technologies

- 7.1.7 Certain Inc.

- 7.1.8 SignUpGenius Inc. (Lumaverse Technologies)

- 7.1.9 EMS Software LLC (Accruent)

- 7.1.10 TryBooking Pty Ltd

- 7.1.11 Event Espresso LLC