|

市场调查报告书

商品编码

1687350

离散半导体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

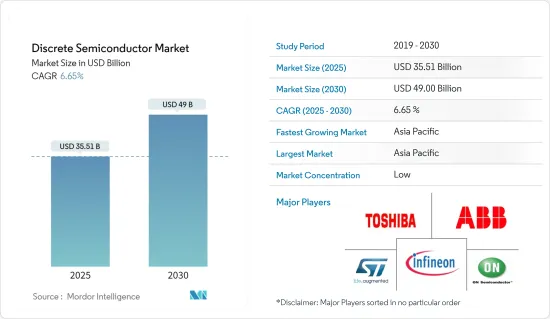

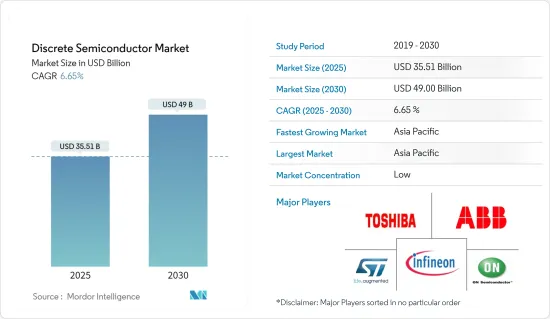

预计2025年离散半导体市场规模为355.1亿美元,预计2030年将达到490亿美元,预测期内(2025-2030年)的复合年增长率为6.65%。

从出货量来看,预计将从 2025 年的 4,272.1 亿台成长到 2030 年的 5,449.9 亿台,预测期内(2025-2030 年)的复合年增长率为 4.99%。

主要亮点

- 随着新应用的出现和现有技术的发展,对更先进、更有效率的半导体的需求日益增长。小型化、功率效率和性能的提高为将半导体整合到各种设备和系统中开闢了新的可能性。物联网 (IoT)、人工智慧 (AI) 和自动驾驶汽车等领域的创新正在推动对离散半导体的需求。

- 此外,汽车和电子产业对节能、省电设备的需求不断增长,以及对绿色能源发电的需求不断增加,也正在推动市场的发展。

- 此外,受可支配收入增加、生活方式改变和技术进步等因素的推动,全球消费性电子产品市场持续快速成长。智慧型手机、平板电脑、穿戴式装置和家用电器等消费性电子产品严重依赖离散半导体。这些设备的需求不断增加,导致对离散半导体的需求也增加,进而推动了市场成长。

- 然而,市场面临着影响其成长和发展的几个限制因素。积体电路(IC)竞争日益激烈,对市场的成长构成了重大挑战。 IC 提供了紧凑且经济高效的解决方案,减少了对离散半导体的需求。这些市场偏好的转变对离散半导体产业提出了重大挑战。

- 持续的俄乌衝突和中国的「零容忍政策」导致全球通货膨胀大幅上升,影响到包括电子元件产业在内的多个产业,导致逻辑、线性、分立、先进模拟和被动元件价格上涨,从而对研究市场的成长产生不利影响。

离散半导体市场趋势

汽车产业可望大幅成长

- 这些系统利用二极体和电晶体等离散半导体来管理电流并有效地减少能量损失。因此,汽车产业对离散半导体的需求受到对汽车电气化日益关注的推动。

- 自动驾驶和 ADAS 技术正在彻底改变汽车产业,需要先进的电子和离散半导体来实现即时资料处理、感测器融合和车辆控制。这些系统严重依赖节能、省电的设备来确保准确可靠的运作。

- 离散半导体对于实现主动式车距维持定速系统、车道维持辅助和防撞等自动驾驶功能至关重要。自动驾驶和 ADAS 技术的需求激增,导致汽车产业对节能、省电设备的需求增加。

- 此外,随着向电动车的转变,过去几年中製造基于 SiC 的逆变器原型的汽车公司数量迅速增长。在这一领域,SiC 功率 MOSFET、二极体和模组的主要应用是车载电动车 (EV) 充电器、DC/DC 转换器和动力传动系统逆变器。插电式混合动力电动车或纯电动车使用家中或公共充电站的车用充电器为车用电池充电。

- 此外,正如国际能源总署所强调的那样,全球汽车产业正在经历重大变革时期期,其影响也可能对能源产业产生影响。预测表明,到 2030 年,电气化将减少每天 500 万桶石油的需求。

中国可望引领市场

- 由于中国工业数量不断增加,并且与自动化相结合以提高投资收益,中国的离散半导体市场正在经历显着增长。中国拥有全球最大的製造业,对市场需求贡献巨大。中国製造商优先采用4.0解决方案来优化和改进业务,从而促进市场扩张。

- 政府不断采取措施加强该国的半导体生态系统,以及该国成为全球汽车和家用电子电器生产国,这些都可能支持市场的成长。

- 在该国,由于汽车製造对离散半导体装置的需求不断增加,预计市场成长将受到汽车产业的巨大影响。例如,2024年1月,中国工业协会宣布,中国汽车产业年产销售量突破3,000万辆,并取得了显着的里程碑。这清楚地表明了汽车市场巨大的成长潜力。

- 中国汽车产业取得了长足的发展,巩固了在全球汽车市场主要企业的地位。中国政府认为汽车工业及其零件产业是国民经济的重要支柱。

- 电动车在世界各地越来越受欢迎。中国是全球采用电动车的领先国家。中国的「十三五」规划提倡发展混合动力汽车汽车和电动车等环保型交通解决方案,以促进国家交通运输业的发展。

- 政府计划在 2060 年实现碳中和,预计将推动对离散半导体的需求,并促进包括电动车市场在内的各个领域的成长。根据中国新能源汽车产业发展计画(2021-2035),到2025年电动车将占25%的市场占有率。

- 因此,中国正在实施更积极的政策来鼓励电动车的普及,这反过来又加速了电动车中广泛使用的离散半导体的采用。 2023 年 8 月,中国汽车工业协会报告称,中国已生产了 589,000 辆纯电动车 (BEV)。此外,同月中国生产了25.4万辆插电式混合动力汽车(PHEV),其中25.3万辆为搭乘用PHEV,1000辆为商用PHEV。

离散半导体产业概况

离散半导体市场较为分散,主要企业包括 ABB 有限公司、安森美半导体公司、英飞凌科技股份公司、意法半导体公司、东芝电子设备及储存公司和恩智浦半导体公司(将被高通收购)。市场上的公司正在努力创新先进、全面的产品,以满足消费者复杂且不断变化的需求。

- 2024 年 3 月:英飞凌推出其全新先进 MOSFET 技术 OptiMOS 7 80 V 的首批产品。 IAUCN08S7N013 显着提高了功率密度,并采用多功能、坚固、高电流 SSO8 5 x 6 mm2 SMD 封装。 OptiMOS 780 V 非常适合即将推出的 48 V 板网应用。这些产品专为满足电动车车载 DC-DC 转换器、48 V马达控制等严苛的汽车应用所需的高性能、高品质和稳健性而设计。电动方向盘(EPS)、48 V 电池开关以及电动二轮车和三轮车。

- 2024 年 2 月:安森美半导体推出 1200V SPM31 智慧功率模组 (IPM),采用尖端的场截止 7 (FS7)绝缘栅双极电晶体(IGBT) 技术。这些 IPM 以其卓越的效率和紧凑的设计而闻名,具有更高的功率密度,最终意味着与竞争对手相比更低的整体系统成本。透过利用这些优化的 IGBT,SPM31 IPM 找到了它的最佳应用点,尤其是在热泵、商务用HVAC 系统、伺服马达以及各种工业泵浦和风扇的三相逆变器驱动器等应用中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链/供应链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章 市场动态

- 市场驱动因素

- 汽车和电子领域对高节能设备的需求不断增加

- 绿色能源发电需求不断成长推动市场

- 市场限制

- 积体电路需求不断成长

第六章 市场细分

- 依设备类型

- 二极体

- 小讯号电晶体

- 功率电晶体

- MOSFET 功率晶体管

- IGBT 功率电晶体

- 其他功率电晶体

- 整流器

- 闸流体

- 按行业

- 车

- 消费性电子产品

- 通讯设备

- 产业

- 其他行业

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

第七章 竞争格局

- 公司简介

- ABB Ltd

- On Semiconductor Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- Toshiba Electronic Devices and Storage Corporation

- NXP Semiconductors NV

- Diodes Incorporated

- Nexperia BV

- Semikron Danfoss Holding A/S(Danfoss A/S)

- Eaton Corporation PLC

- Hitachi Energy Ltd(Hitachi Ltd)

- Mitsubishi Electric Corporation

- Fuji Electric Co Ltd

- Analog Devices Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- Rohm Co. Ltd

- Microchip Technology

- Qorvo Inc.

- Wolfspeed Inc.

- Texas Instrument Inc.

- Littelfuse Inc

- WeEn Semiconductors

第八章投资分析

第九章 市场机会与未来趋势

The Discrete Semiconductor Market size is estimated at USD 35.51 billion in 2025, and is expected to reach USD 49.00 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 427.21 billion units in 2025 to 544.99 billion units by 2030, at a CAGR of 4.99% during the forecast period (2025-2030).

Key Highlights

- As new applications emerge and existing technologies evolve, the demand for more advanced and efficient semiconductors increases. Advancements such as miniaturization, increased power efficiency, and improved performance open new possibilities for integrating semiconductors into various devices and systems. Innovations in areas like the Internet of Things (IoT), artificial intelligence (AI), and autonomous vehicles drive the demand for discrete semiconductors.

- Additionally, the rising demand for high-energy and power-efficient devices in the automotive and electronics segment and the increasing demand for green energy power generation drive the market.

- Furthermore, the global consumer electronics market continues to experience rapid growth, fueled by factors such as rising disposable incomes, changing lifestyles, and technological advancements. Consumer electronics, including smartphones, tablets, wearables, and home appliances, heavily rely on discrete semiconductors. The increasing demand for these devices translates into a higher demand for discrete semiconductors, driving the market's growth.

- However, the market faces several restraints that impact its growth and development. The increasing competition from integrated circuits (ICs) is a significant challenge for the market's growth. ICs offer a compact and cost-effective solution, which led to a decline in the demand for discrete semiconductors. This shift in the market preference poses a significant challenge for the discrete semiconductors industry.

- Continuous Russia-Ukraine conflict, as well as China's "Zero Tolerance Policy," has led to a significant increase in global inflation, impacting multiple sectors, including the electronic components industry, leading to climbing prices of logic, linear, discrete, advanced analog, and passive component, thus negatively impacting the growth of the market studied.

Discrete Semiconductor Market Trends

Automotive Segment Is Expected to Witness Major Growth

- Discrete semiconductors, such as diodes and transistors, are utilized in these systems to manage power flow and minimize energy losses efficiently. The demand for discrete semiconductors in the automotive industry is thus driven by the growing emphasis on vehicle electrification.

- Autonomous driving and ADAS technologies are revolutionizing the automotive industry, requiring sophisticated electronics and discrete semiconductors to enable real-time data processing, sensor fusion, and vehicle control. These systems heavily rely on high energy and power-efficient devices to ensure precise and reliable operation.

- Discrete semiconductors are crucial in enabling autonomous driving functions like adaptive cruise control, lane-keeping assist, and collision avoidance. The surge in demand for autonomous driving and ADAS technologies has consequently driven the need for high-energy and power-efficient devices in the automotive industry.

- Furthermore, with the transition to EVs, the number of car companies building SiC-based inverter prototypes has rapidly increased in the past few years. In the sector, the primary applications for SiC power MOSFETs, diodes, and modules are onboard electric vehicle (EV) chargers, DC/DC converters, and drivetrain inverters. Plug-in hybrid EVs and BEVs use onboard chargers to refuel the vehicle battery either at home or at a public charging station.

- Moreover, the global automotive industry is undergoing a significant transformation, as highlighted by the IEA, with potentially far-reaching implications for the energy sector. According to projections, the rise of electrification is anticipated to result in a daily elimination of the need for 5 million barrels of oil by 2030.

China is Expected to Lead the Market

- The discrete semiconductor market in China is experiencing substantial growth due to the increasing number of industries in the country and their integration with automation to enhance return on investment. China has the largest manufacturing industry globally, contributing significantly to market demand. Manufacturing companies in China prioritize adopting 4.0 solutions to optimize and elevate their operations, thereby propelling market expansion.

- The growth of governmental initiatives in strengthening the country's semiconductor ecosystem and the country's emergence as a global producer of automotive and consumer electronic sectors would support the market's growth.

- The market's growth in the country is expected to be greatly influenced by the automotive segment, as there is a rising demand for discrete semiconductor devices in automotive manufacturing. For instance, in January 2024, the China Association of Automobile Manufacturers announced that China's automobile industry achieved a remarkable milestone, with production and sales surpassing 30 million units annually. This clearly indicates the immense growth potential of the automobile market.

- China's automotive sector experienced significant growth, solidifying the country's position as a key player in the worldwide automotive market. The Chinese government considers the automotive industry, along with its auto parts segment, to be crucial pillars of the nation's economy.

- The popularity of EVs is rising globally. China is a dominant adopter of electric vehicles worldwide. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric vehicles, to advance the country's transportation sector.

- The government's efforts to attain carbon neutrality objectives by 2060 are projected to enhance the need for discrete semiconductors by leveraging the growth of various sectors, including the electric vehicle market. According to China's Development Plan for the New Energy Automobile Industry (2021-2035), electric vehicles could capture a 25% market share by 2025.

- Consequently, China is implementing more assertive measures to incentivize the adoption of electric vehicles, thereby expediting the adoption of discrete semiconductors for their extensive utilization in EVs. In August 2023, CAAM reported that China manufactured 589,000 battery electric vehicles (BEVs), comprising 551,000 passenger BEVs and 38,000 commercial BEVs. Additionally, 254,000 plug-in hybrid electric vehicles (PHEVs) were produced in China during the same month, with 253,000 being passenger PHEVs and 1,000 being commercial PHEVs.

Discrete Semiconductor Industry Overview

The discrete semiconductor market is fragmented, with several prominent players, such as ABB Ltd, ON Semiconductor Corporation, Infineon Technologies AG, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, and NXP Semiconductors NV (to be acquired by Qualcomm). The market players strive to innovate advanced and comprehensive products to cater to consumers' complex and evolving requirements.

- March 2024: Infineon introduced the first product in its new advanced MOSFET technology OptiMOS 7 80 V. The IAUCN08S7N013 features a significantly increased power density and is available in the versatile, robust, and high-current SSO8 5 x 6 mm2 SMD package. The OptiMOS 780 V offering perfectly matches the upcoming 48 V board net applications. It is designed specifically for the high performance, high quality, and robustness needed for demanding automotive applications like automotive DC-DC converters in EVs, 48 V motor control, for instance, electric power steering (EPS), 48 V battery switches, and electric two- and three-wheelers.

- February 2024: Onsemi unveiled its 1200 V SPM31 Intelligent Power Modules (IPMs), showcasing the cutting-edge Field Stop 7 (FS7) Insulated Gate Bipolar Transistor (IGBT) technology. These IPMs, known for their superior efficiency and compact design, boast a higher power density, ultimately translating to a reduced overall system cost compared to their industry counterparts. Leveraging these optimized IGBTs, the SPM31 IPMs find their sweet spot in applications like three-phase inverter drives, notably in heat pumps, commercial HVAC systems, servo motors, and various industrial pumps and fans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 5.1.2 Increasing Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistor

- 6.1.3 Power Transistor

- 6.1.3.1 MOSFET Power Transistor

- 6.1.3.2 IGBT Power Transistor

- 6.1.3.3 Other Power Transistor

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 South Korea

- 6.3.6 Taiwan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices and Storage Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Diodes Incorporated

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd (Hitachi Ltd)

- 7.1.12 Mitsubishi Electric Corporation

- 7.1.13 Fuji Electric Co Ltd

- 7.1.14 Analog Devices Inc.

- 7.1.15 Vishay Intertechnology Inc.

- 7.1.16 Renesas Electronics Corporation

- 7.1.17 Rohm Co. Ltd

- 7.1.18 Microchip Technology

- 7.1.19 Qorvo Inc.

- 7.1.20 Wolfspeed Inc.

- 7.1.21 Texas Instrument Inc.

- 7.1.22 Littelfuse Inc

- 7.1.23 WeEn Semiconductors