|

市场调查报告书

商品编码

1640540

穿戴式科技:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Wearable Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

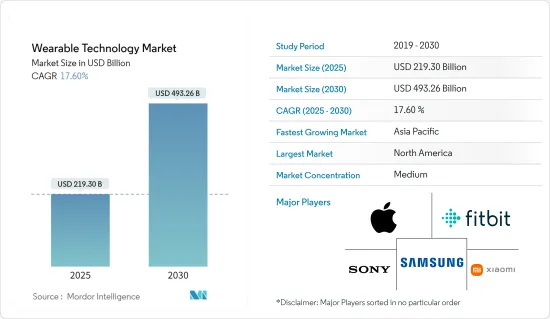

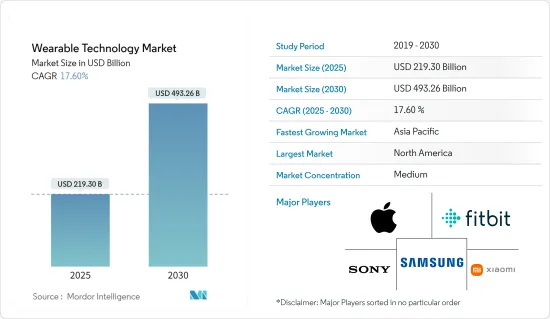

穿戴式科技市场规模预计在 2025 年为 2,193 亿美元,预计到 2030 年将达到 4,932.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 17.6%。

主要亮点

- 穿戴式技术的发展很大程度上受到 MEMS 感测器的兴起的推动。特别是随着严重依赖GPS和IMU(包括加速计、陀螺仪和磁力计)的智慧型手机的广泛使用,穿戴式装置开始整合这些感测器。这种整合显着提高了健身追踪穿戴装置的功能,可以对各种身体活动进行详细监控。

- 消费主义的技术进步导致了穿戴式科技的兴起,这种技术可以监测健康、追踪运动并提供社群媒体通知。智慧型手錶、健身追踪器和 VR/AR 耳机等设备在民众中越来越受欢迎。因此,穿戴式装置的受欢迎程度预计将持续成长,迫使企业寻找创新的方式将其融入日常生活。

- 智慧服饰的需求正在大幅增长,尤其是在穿戴式科技市场,并将改变健康和健身产业。这些服装被称为电子纺织品或智慧布料,采用先进的感测器、硬体和纺织品,提供超越传统服装的个人化见解和监控能力。预计在预测期内,追踪佩戴者的活动、睡眠模式、心率、血压、体温和其他健康指标的能力将推动该市场的显着成长。

- 然而,穿戴式科技的快速普及引发了重大的道德和隐私问题,特别是在个人健康资料的管理和保护方面,这对市场的成长构成了挑战。例如,在最近的一次事件中,一个不安全的资料库包含超过 6,100 万笔与健身追踪器和穿戴式装置相关的记录,在线上洩露了 Apple 和 Fitbit 用户的资料。 WebsitePlanet 和安全研究人员发现了未受密码保护的资料库,其中包含数千万条来自健身追踪、穿戴式装置和应用程式的记录。这个不安全的资料库属于 GetHealth 公司,该公司提供从数百种可穿戴设备、医疗设备和应用程式存取健康和保健资料的整合解决方案。

- 穿戴式科技市场受到了新冠疫情多方面的影响。从积极的一面来看,随着消费者寻求监测自己的生命体征和睡眠模式,对健身追踪器和智慧型手錶等以健康为重点的可穿戴设备的需求增加,反映出人们对个人健康的兴趣日益浓厚。穿戴式装置在患者的远端监控方面也发挥了重要作用,减轻了医院的负担。然而,封锁扰乱了生产和供应链,影响了产品可得性。经济放缓也导致一些消费者优先购买必需品,而不是穿戴式装置。

- 在后疫情时代,由于人们健康意识的增强和远端患者监护的持续成长,市场出现反弹。具有血压监测和跌倒检测等功能的可穿戴设备的进步将巩固可穿戴设备作为预防和主动医疗保健的宝贵工具的地位,从而产生巨大的需求。

穿戴式科技市场趋势

智慧型手錶有望推动市场成长

- 在众多优势的推动下,年轻一代对智慧型手錶的兴趣日益浓厚,这是推动市场成长的关键因素。对保持持续连结性的重视导致智慧型手錶的需求激增。如今的智慧型手錶让用户能够直接在手腕上无缝接收通知、电话和讯息,而无需将智慧型手机从口袋或包包中拿出,一切尽在指尖。

- 例如,根据华为2023年欧洲健康调查显示,45%的西班牙受访者表示自己拥有智慧型手錶,68%的人有兴趣在2023年之前购买一款用于健康目的的新智慧型手錶。同时,在土耳其,近 80% 的受访者有兴趣购买具有健康功能的新智慧型手錶。

- 智慧型手錶製造商正在策略性地进行产品创新,以瞄准运动员、运动爱好者和冒险者等特定的消费者群体。透过专注于这样的利基市场,我们希望增加销售额。这些智慧型手錶不仅提供健身指标,还透过提供对关键健康参数的见解来促进更健康的生活方式。

- 扩增实境(AR)与智慧型手錶的融合预计将成为智慧型手錶需求成长的主要动力。扩增实境将使智慧型手錶更进一步,用户可以透过戴在手腕上的装置将数位资讯迭加到现实世界中。这趋势在导航、游戏甚至教育领域都有潜在的应用,彻底改变使用者与周遭环境的互动方式。

- 此外,在所调查的市场中运营的供应商正在推出整合新技术的智慧型手錶。例如,2024 年 7 月,Realme 发布了 Realme Watch S2,配备了由 ChatGPT 支援的 AI 助理。这款手錶与其他智慧型手錶的不同之处在于,它可以直接在您的手腕上提供智慧答案和帮助,提供无缝、智慧的使用者体验。这些技术创新进一步推动了全球年轻且精通科技的人对智慧型手錶的采用。

北美预计将占据主要市场占有率

- 众所周知,该地区的消费者是新技术的早期采用者。消费者对改善生活方式并带来健康益处的设备和穿戴式产品的浓厚兴趣推动了需求的成长,并进一步促进了穿戴式科技产业的发展。该地区受益于较高的平均可支配收入。这种财务灵活性使得消费者能够在非必需品,尤其是穿戴式产品上花费更多,增加了市场的成长潜力。

- 该地区的人口越来越重视他们的健康和福祉。监测健身指标、睡眠模式和健康生命体的穿戴式装置正在满足这项需求。对预防性医疗保健的关注正在推动创新穿戴式解决方案的强劲市场。特别是根据美国心肺血液研究所(NHLBI)的全国健康资讯趋势调查结果显示,约三分之一的美国成年人使用智慧型手錶来监测自己的健康状况。超过 80% 的穿戴式装置使用者愿意与医生共用装置资料,以加强健康监测。然而,患有心血管疾病或有心血管疾病风险的成年人中,只有不到四分之一的人使用穿戴式装置。

- 许多体育协会加大投资,以消除高薪职业运动员发生可预防伤害的可能性,预计将推动该地区市场的成长。例如,金州勇士队正在与智慧服饰製造商Atos合作,利用这些产品来预防伤害并提高球员的表现。这项投资只是美国体育界参与智慧服装产业的一小部分。

- 除美国外,加拿大对穿戴式装置的需求也在增加。预计该国将为包括服饰在内的军事项目提供足够的支出和资金。 Bell 已在美国和加拿大获得多项专利,这些专利概述了其可穿戴技术如何既可供个人用于监测患病的亲人,也可供机构用于追踪大量人群。

- 此外,2023 年 10 月,高通科技公司 (Qualcomm Technologies Inc.) 与Google建立策略伙伴关係关係,并宣布推出专为Google Wear OS 设计的基于 RISC-V 的可穿戴解决方案。此先进的框架旨在推动生态系统内自订、节能、高性能 CPU 的整合。两家公司致力于加强Snapdragon Wear平台,巩固高通作为Wear OS生态系统领先智慧型手錶硅片供应商的地位。这些战略倡议进一步推动了该地区的市场成长。

穿戴式科技产业概览

穿戴式装置市场竞争适中,几家公司占据主导地位。这些参与者正在进行产品和技术创新,与其他公司合作、合併和收购,以保持市场竞争力。

- 2024 年 7 月:三星在巴黎的产品发表会上推出了搭载 AI 技术的 Galaxy Ring,标誌着其进入智慧环市场。这项策略性倡议不仅扩大了三星的穿戴式技术组合,也巩固了其在健康监测领域的地位。这些新型穿戴装置采用了三星的最尖端科技,为用户提供主动的医疗保健解决方案,巩固了其市场领导地位。

- 2024 年 6 月 专注于开发 AI 驱动的非接触式感应可穿戴设备的科技公司 Wearable Devices Ltd. 将在 2024 年增强世界博览会 (AWE) 上宣布与 Qualcomm Technologies 合作推出扩增实境(XR)。整合的最新功能。此次合作凸显了穿戴式装置创新穿戴式解决方案与高通尖端XR技术之间的协同效应,并有望为消费者和企业带来身临其境型体验。

- 2024年5月,位元组跳动有限公司以约5,000万美元收购中国耳机製造商Oladance。此次收购凸显了位元组跳动向穿戴式科技转变的策略,并可能将其技术足迹扩展到智慧型手机之外。位元组跳动旗下TikTok已派出人员在深圳完成收购并与Oladance展开合作。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 对穿戴式科技市场的影响

第五章 市场动态

- 市场驱动因素

- 消费者越来越偏好健身和医疗保健中使用的小型设备

- 穿戴式装置下一代显示器的成长前景日益看好

- 扩大头戴式显示器的使用范围

- 市场限制

- 电池寿命短

第六章 市场细分

- 依设备类型

- 智慧型手錶

- 头戴式显示器

- 腕带

- 耳戴式装置

- 其他设备类型(智慧服饰)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Samsung Group

- Oculus VR LLC(Facebook)

- Alphabet Inc.

- Sony Corporation

- HTC Corporation

- Fitbit Inc.

- Xiaomi Inc.

- Apple Inc.

- Microsoft Corporation

- DAQRI Company

- AIQ Smart Clothing Inc.

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 54484

The Wearable Technology Market size is estimated at USD 219.30 billion in 2025, and is expected to reach USD 493.26 billion by 2030, at a CAGR of 17.6% during the forecast period (2025-2030).

Key Highlights

- The evolution of wearable technology is largely attributed to the rise of MEMS sensors. Wearable devices now integrate these sensors, particularly in response to the widespread use of smartphones, which heavily rely on GPS and IMU (comprising an accelerometer, gyroscope, and magnetometer). This integration has significantly enhanced the capabilities of fitness-tracking wearables, enabling them to closely monitor various body activities.

- Technological advancements in consumerism have led to the rise of wearable technology that monitors health, tracks movements, and provides social media notifications. Devices such as smartwatches, fitness trackers, and VR/AR headsets are becoming increasingly prevalent among the population. Consequently, the popularity of wearables is expected to continue growing, prompting companies to find innovative ways to integrate them into daily life.

- Smart clothing is experiencing a significant increase in demand, particularly within the wearable technology market, and is set to transform the health and fitness industry. Known as e-textiles or smart fabrics, these garments incorporate advanced sensors, hardware, and textiles, providing personalized insights and monitoring capabilities that surpass traditional clothing. With their ability to track the wearer's activity, sleep patterns, and health indicators such as heart rate, blood pressure, and body temperature, the market is expected to see substantial growth over the forecast period.

- However, the rapid adoption of wearable technology has highlighted significant ethical and privacy concerns, particularly in managing and protecting personal health data, which challenges the market's growth. For example, a recent incident involved an unsecured database containing over 61 million records related to fitness trackers and wearables, exposing data of Apple and Fitbit users online. WebsitePlanet and security researchers discovered this non-password-protected database, which contained tens of millions of records from fitness tracking and wearable devices and apps. The unsecured database belonged to GetHealth, a company that provides a unified solution to access health and wellness data from hundreds of wearables, medical devices, and apps.

- The wearable technology market experienced a mixed impact from the COVID-19 pandemic. On the positive side, demand for health-focused wearables, such as fitness trackers and smartwatches, increased as consumers sought to monitor vital signs and sleep patterns, reflecting a heightened focus on personal well-being. Wearables also played a significant role in remote patient monitoring, reducing the strain on hospitals. However, lockdowns disrupted production and supply chains, affecting product availability. The economic slowdown also led some consumers to prioritize essential purchases over wearables.

- In the post-pandemic era, the market has rebounded due to increased health awareness and the continued growth of remote patient monitoring. Advancements in wearables with features like blood pressure monitoring and fall detection are expected to see high demand, solidifying wearables as valuable tools in preventive and proactive healthcare.

Wearable Technology Market Trends

Smartwatches Expected to Drive Market Growth

- The increasing interest in smartwatches among the younger demographic, driven by their numerous benefits, is a key factor propelling the market's growth. With a growing emphasis on staying connected, the demand for smartwatches has surged. Today's smartwatches enable users to seamlessly receive notifications, calls, and messages on their wrists, eliminating the need to retrieve their smartphones from pockets or bags, providing everything at their fingertips.

- For instance, according to Huawei European Health Survey 2023, 45% of respondents in Spain reported they owned a smartwatch, while 68% expressed interest in buying a new smartwatch for health purposes as of 2023. Meanwhile, almost 80% of respondents in Turkey were interested in purchasing a new smartwatch with health features.

- Smartwatch manufacturers are strategically targeting specific consumer segments, such as athletes, sports enthusiasts, and adventure seekers, through tailored product innovations. By focusing on these niches, they aim to drive sales growth. These smartwatches not only provide fitness metrics but also promote a healthier lifestyle by offering insights into vital health parameters.

- The integration of augmented reality (AR) into smartwatches is poised to be a significant growth driver in the demand for smartwatches. AR is set to elevate smartwatches by enabling users to overlay digital information onto the real world through their wrist-worn devices. This trend could have applications in navigation, gaming, and even education, revolutionizing how users interact with their surroundings.

- Furthermore, the vendors operating in the market studied are introducing smartwatches with new technology integration. For instance, in July 2024, Realme launched its Realme Watch S2, enabled with AI assistant powered by ChatGPT, which distinguishes this watch from other smartwatches by delivering intelligent answers and assistance directly on the wrist, offering a seamless and smart user experience. Such innovations are further driving the adoption of smartwatches among younger and tech-savvy populations globally.

North America Expected to Hold Major Market Share

- Consumers in the region are recognized for their early adoption of new technologies. Their strong interest in gadgets and wearables, which either enhance their lifestyles or provide health benefits, has driven increased demand, thereby fostering further advancements in the wearable tech sector. The region benefits from a higher average disposable income. This financial flexibility enables consumers to spend more on discretionary items, particularly wearables, thereby expanding the market's growth potential.

- The region's population is increasingly prioritizing health and well-being. Wearables, which monitor fitness metrics, sleep patterns, and health vitals, are addressing this demand. This focus on preventive healthcare is driving a strong market for innovative wearable solutions. Notably, findings from the Health Information National Trends Survey, conducted by the National Heart, Lung, and Blood Institute (NHLBI), indicate that nearly a third of American adults use wearables, such as smartwatches, to track their health. Among wearable device users, over 80% of these users are willing to share their device data with their doctors for enhanced health monitoring. However, less than one in four adults with or at risk for cardiovascular disease uses a wearable device.

- Increasing investments by numerous sports associations to eliminate the possibility of any preventable injuries to highly paid professional athletes are expected to fuel the growth of the market in the region. The Golden State Warriors, for instance, are collaborating with smart clothing company Athos to use these products for injury prevention and player performance. This investment represents only a fraction of the involvement of the US athletics sector in the smart clothing industry landscape.

- Apart from the United States, the demand for wearables is also increasing in Canada. The country is expected to provide sufficient expenditures and funding for its military programs (including clothing). Bell has various patents in the United States and Canada that lay out a comprehensive vision for how its wearable technology could be used both by individuals looking to monitor ill loved ones and by institutions wanting to track large populations.

- Moreover, in October 2023, Qualcomm Technologies Inc. and Google established a strategic partnership, introducing a RISC-V-based wearables solution designed for Wear OS by Google. This advanced framework aims to drive the integration of custom, power-efficient, and high-performance CPUs within the ecosystem. Both companies are dedicated to enhancing the Snapdragon Wear platforms, reinforcing Qualcomm's position as the leading provider of smartwatch silicon for the Wear OS ecosystem. Such strategic initiatives are further augmenting the market's growth in the region.

Wearable Technology Industry Overview

The wearable technology market is moderately competitive, with several players holding significant shares and the presence of numerous smaller and niche players operating in the market. These players are witnessing product and technology innovation, partnerships, mergers, and acquisitions to maintain a competitive edge in the market.

- July 2024: At a product launch event in Paris, Samsung introduced its AI-powered Galaxy Ring, marking the company's entry into the smart ring market. This strategic move not only expands Samsung's wearable technology portfolio but also strengthens its position in the health monitoring sector. These new wearables incorporate Samsung's most advanced technologies, providing users with proactive healthcare solutions and reinforcing its market leadership.

- June 2024: Wearable Devices Ltd, a technology company specializing in AI-powered touchless sensing wearables, showcased its latest capabilities in the integration of extended reality (XR) in collaboration with Qualcomm Technologies at the Augmented World Expo (AWE) 2024. This partnership underscores the synergy between Wearable Devices' innovative wearable solutions and Qualcomm's state-of-the-art XR technology, which is poised to transform immersive experiences for both consumers and businesses.

- May 2024: ByteDance Ltd acquired Oladance, a Chinese earphone manufacturer, for approximately USD 50 million. This acquisition highlights ByteDance's strategic shift toward wearable technology, potentially expanding its technological footprint beyond smartphones. TikTok, a subsidiary of ByteDance, has finalized the transaction and deployed its personnel to collaborate with Oladance in Shenzhen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on Wearable Technology Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Customer Preference for Svelte and Small Devices for use in Fitness and Healthcare

- 5.1.2 Rising Growth Prospects for Wearable Devices' Next-Generation Displays

- 5.1.3 Rising use of Head-Mounted Displays

- 5.2 Market Restraints

- 5.2.1 Short Battery Life

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Smart Watches

- 6.1.2 Head-mounted Displays

- 6.1.3 Wristbands

- 6.1.4 Ear-wearables

- 6.1.5 Other Device Types (Smart Clothing)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 India

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Group

- 7.1.2 Oculus VR LLC (Facebook)

- 7.1.3 Alphabet Inc.

- 7.1.4 Sony Corporation

- 7.1.5 HTC Corporation

- 7.1.6 Fitbit Inc.

- 7.1.7 Xiaomi Inc.

- 7.1.8 Apple Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 DAQRI Company

- 7.1.11 AIQ Smart Clothing Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219