|

市场调查报告书

商品编码

1641965

自助仓储:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Self Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

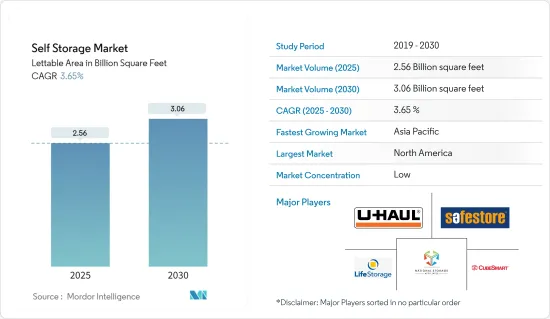

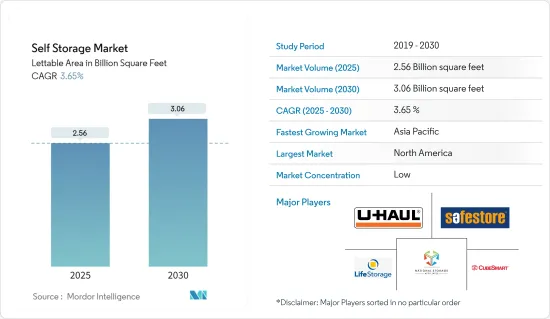

预计自助仓储市场将从 2025 年的 25.6 亿可出租平方英尺成长到 2030 年的 30.6 亿可出租平方英尺,预测期内(2025-2030 年)的复合年增长率为 3.65%。

主要亮点

- 自助仓储产业是商业房地产的一个分支,在都市化和经济改善的推动下,该产业有望实现强劲成长。虽然美国和西欧等成熟市场拥有完善的自助仓储基础设施,但中国和印度等地区仍处于起步阶段。

- 都市化,伴随城市人口的增加,是主要的成长要素。随着城市人口变得越来越稠密,房地产价格上涨,对自助仓储的需求,尤其是租赁住宅的需求正在增长。例如,预计2024年伦敦人口将达到970万,2030年将达到1000万。

- 企业越来越关注储存成本并且越来越多地转向自助仓储解决方案。与传统仓储业不同,自助仓储为企业提供多种空间大小和费率方案。市场在气候控制和数位安全自助仓储设施的开发方面取得了重大进展,为居住者提供远离温度和湿度等环境因素的安全储存设施,尤其是气候控制自助仓储设施。基于功能的自助仓储设施。

- 为了支持这一趋势,2023 年 12 月,专门从事自助仓储的房地产投资公司 VanWest Partners 宣布了在科罗拉多丹佛市计划的计划。该计划将由其子公司 ClearHome Self Storage 管理,将在五层楼、93,000 平方英尺的建筑内配备气候控制的 A 级自助仓储单位。此举是为了满足美国对气候控制储存日益增长的需求。在预测期内,它代表了对商业和住宅客户对气候中性储存解决方案日益增长的需求的策略性回应。

- 然而,该产业面临政府监管的挑战。国防安全保障部警告营运商,他们的设施可能被滥用来储存可能带来安全风险的材料。

自助仓储市场趋势

个人储存领域预计将占据大部分市场占有率

- 在住宅领域,对额外存储空间的需求主要由家庭的成长所推动,家庭财产的增加对自助仓储性能的性能产生了重大影响。此外,随着婴儿潮世代的减少,对储存单元的需求预计也会增加。

- 城市人口的增加导致居住空间越来越小,价格越来越高,尤其是在都市区,导致了更多的流动住宅。联合国预测,2050年全球都市化将达68%。北美是一个高度都市化的地区,超过80%的人口居住在都市区。

- 在都市化威胁着景气衰退且可能因新冠肺炎疫情而加剧的背景下,个人储存产业正在蓬勃发展。面临空间限制的租户在缩小住房规模、搬去与家人同住或采用更变化无常的生活方式时,都会转向储存设施。这项变更为个人储存产业带来了巨大的推动。

- 千禧世代占据了自助仓储用户的大多数,他们的期望也不断改变。千禧世代喜欢透过智慧型手机、应用程式和行动网站进行互动,并要求企业提供技术先进的解决方案。虚拟旅游、线上预订、非接触式付款和自动化存取正在成为行业标准,与该行业的技术进步保持一致。随着传统的实体位置优势逐渐消失,这些数位管道为新兴储存参与者颠覆市场提供了巨大的机会。

北美有望成为最大市场

- 北美,主要是美国和加拿大,可能会主导自助仓储市场。对储存解决方案和工业自动化的不断增长的需求推动了这一增长。北美的主要市场驱动因素包括降低基础设施成本、日益增长的商业洞察力需求以及即时资料可用性需求。自 36 年前诞生以来,自助仓储业一直是成长最快的商业房地产市场之一。根据SpareFoot.com报道,截至2023年1月,自助仓储业的年销售额将达到290亿美元,目前美国运作的自助仓储设施估计有51,206个。

- 此外,由于美国企业和个人客户越来越多地采用自助仓储设施,美国自助仓储领域的投资正在显着成长。该国自助仓储市场较低的租金价格优势可能会推动美国的运转率,从而在预测期内促进市场成长。

- 例如,2023 年 6 月,全球房地产公司 Ivanhoe Cambridge 宣布计划透过与 Safely Store Self Storage 建立策略合作伙伴关係,扩大其在美国的自助仓储组合。该计划旨在增加美国自助仓储设施的可用性并帮助市场成长。

- SecureSpace 也在 2023 年 6 月收购了位于西雅图林伍德社区的 North Lynn Mini Storage。租赁的办公室将采用 SecureSpace 的现代设计和该公司专有的高安全平台进行升级,并由国家安全团队进行管理。

- 稳定的就业机会和不断上涨的工资正在刺激家庭的形成和消费者的支出,从而推动自助仓储的需求。此外,年轻一代和老一代的生活方式节奏越来越快,收集纪念品的爱好也进一步推动了未来对自助仓储空间的需求。

- 此外,2023 年 11 月,专注于国际学生交流和推广、外交事务以及国际和平与安全的国际教育协会将宣布加州、纽约州和德克萨斯州将举办国际学生交流计画。最大贡献者。这可能会推动美国不断增长的移民人口的需求,增加这些美国城市的人口密度,从而支持预测期内对外部储存空间的需求。

自助仓储产业概况

自助仓储市场竞争激烈,主要企业包括 U-Haul International Inc.、Life Storage Inc.、CubeSmart LP、National Storage Affiliates Trust 和 Safestore Holdings PLC。市场的主要企业也参与合作、合併、收购、投资、业务扩张和技术创新,以保持其在市场中的地位。

- 2024年6月,房地产投资公司新加坡政府投资公司(GIC)与澳洲国家仓储房地产投资信託基金(National Storage REIT)合作推出全国仓储创投基金(National Storage Ventures Fund)。该基金旨在在澳洲各地开发自助仓储设施。该伙伴关係将在未来 12 到 18 个月内投资 2.7 亿澳元(1.795 亿美元),以完成 NSR 早期开发组合中的 10 个计划。

- 2024年2月,Talonvest Capital Inc.与Metro Self Storage合作并签订了一项融资协议,向包括美国东南部四处房产在内的投资组合投资2,250万美元。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济因素对市场的影响

- 主要市场基本面分析

- 平均居住面积

- 自助仓储设施运转率

- 办公室租金价格

第五章 市场动态

- 市场驱动因素

- 都市化进程加快,生活空间缩小

- 商业惯例的变化和新冠肺炎疫情下的消费行为

- 市场限制

- 政府对储存的监管阻碍因素了市场成长

第六章 市场细分

- 依使用者类型

- 个人

- 商业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比利时

- 荷兰

- 卢森堡

- 丹麦

- 芬兰

- 挪威

- 瑞典

- 冰岛

- 亚洲

- 中国

- 日本

- 台湾

- 韩国

- 马来西亚

- 香港

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- U-Haul International Inc.

- Life Storage Inc.

- CubeSmart LP

- National Storage Affiliates

- Safestore Holdings PLC

- Simply Self Storage Management LLC

- StorageMart

- Prime Storage Group

- WP Carey Inc.

- Metro Storage LLC

- SmartStop Asset Management LLC

- (Great Value Storage)World Class Capital Group LLC

- All Storage

- Amsdell Cos./Compass Self Storage

- Urban Self Storage Inc.

- Global Self Storage Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Self Storage Market size in terms of lettable area is expected to grow from 2.56 billion square feet in 2025 to 3.06 billion square feet by 2030, at a CAGR of 3.65% during the forecast period (2025-2030).

Key Highlights

- The self-storage sector, a segment within commercial real estate, is set for robust growth driven by urbanization and improving economies. While established markets like the United States and Western Europe boast well-developed self-storage infrastructures, regions such as China and India are witnessing the nascent stages of this concept.

- Urbanization, accompanied by increasing urban populations, is a primary growth factor. As cities grow with denser populations and rising real estate prices, the demand for self-storage, particularly among renters, is rising. For instance, London's population hit 9.7 million in 2024, which is projected to reach the 10 million mark by 2030.

- Businesses are aware of storage costs and are increasingly turning to self-storage solutions. Unlike traditional warehousing, self-storage offers businesses a wider array of space sizes and pricing plans. The market has been registering a significant advancement in the development of climate control and digital security-managed self-storage facilities to provide tenants with safe storage facilities for their belongings against environmental factors, including temperature and humidity, among others, supporting the growth of the market by creating an opportunity for the climate control feature based self-storage facilities.

- Highlighting this trend, in December 2023, VanWest Partners, a real estate investment firm specializing in self-storage, unveiled plans for a project in Denver, Colorado. The project, to be managed by their subsidiary, ClearHome Self Storage, will feature a 5-story, 93,000-square-foot building of Class A, climate-controlled self-storage units. This move addresses the surging demand for climate-controlled storage in the United States. During the forecast period, it signals a strategic response to the growing need for climate-neutral storage solutions catering to business and personal clientele.

- However, the industry faces challenges from government regulations. The Department of Homeland Security has cautioned operators about potential misuse of their facilities for storing materials that could pose security risks.

Self Storage Market Trends

Personal Storage Segment is Expected to Hold Major Market Share

- In the personal sector, the demand for additional storage space is majorly driven by growing families, and their increasing material possessions significantly influence the performance of self-storage properties. Additionally, as baby boomers downsize, the need for storage units is anticipated to rise.

- Rising urban populations are leading to smaller and more expensive living spaces, particularly in cities, with a growing number of mobile renters. The United Nations projects global urbanization to reach 68% by 2050. North America is notably the most urbanized region, with over 80% of its population living in urban areas.

- Amid concerns of a recession, potentially driven by urbanization and exacerbated by the COVID-19 pandemic, the personal storage sector is experiencing a surge. Renters, facing space constraints, are turning to storage facilities as they downsize, move in with family, or adopt a more transient lifestyle. This shift is significantly boosting the personal-storage industry.

- With millennials comprising a significant portion of the self-storage user base, their expectations are evolving. They increasingly seek technologically advanced solutions from operators, preferring interactions through smartphones, apps, and mobile websites. Virtual tours, online bookings, contactless payments, and automated access are becoming industry standards, aligning with the sector's technological advancements. As the traditional advantage of physical location diminishes, these digital channels present a significant opportunity for emerging storage players to disrupt the market.

North America is Expected to be the Largest Market

- North America, led by the United States and Canada, is set to dominate the self-storage market. The increasing demand for storage solutions and industrial automation is driving this growth. Key market drivers in North America include a focus on reducing infrastructure costs, a growing need for business insights, and the necessity for real-time data availability. The self-storage industry has been one of the fastest-growing commercial real estate market segments since its debut 36 years ago. According to SpareFoot.com, the storage industry recorded USD 29 billion in annual revenue as of January 2023, and the United States currently has an estimated 51,206 storage facilities in service.

- Furthermore, investments in the self-storage sector in the US have witnessed significant growth supported by the increasing adoption of self-storage facilities among businesses and individual customers in the country, which would increase the number of self-storage facilities in the US and can decrease rent prices in the market. This advantage of lower renting prices in the country's self-storage market would fuel the occupancy rate in the United States and can drive market growth during the forecast period.

- For instance, in June 2023, Ivanhoe Cambridge, a global real estate company, announced plans to expand its self-storage portfolio in the United States through a strategic partnership with Safely Store Self Storage. This initiative aims to enhance the availability of self-storage facilities in the United States, supporting market growth.

- Also, in June 2023, SecureSpace acquired Northlynn Mini Storage in the Lynnwood area of Seattle. The leasing office will be upgraded with SecureSpace's modern design, and their proprietary high-security platform, managed by a national security team, will be installed.

- The demand for self-storage units is rising due to steady job creation and wage growth, which boost household formation and consumer spending. Additionally, the faster-paced lifestyles and the tendency to collect memorabilia among younger and older generations further strengthen the future need for self-storage space.

- Additionally, in November 2023, the Institute of International Education, which focuses on international student exchange and aid, foreign affairs, and international peace and security, stated that California, New York, and Texas have contributed the highest enrollment of international students, which would fuel the demand for migrant population growth in the country and can increase of population densities in these cities of the US, supporting the demand for external storage spaces during the forecast period.

Self Storage Industry Overview

The self-storage market is highly competitive, with significant players like U-Haul International Inc., Life Storage Inc., CubeSmart LP, National Storage Affiliates Trust, and Safestore Holdings PLC. The key players in the market are also making partnerships, mergers, acquisitions, investments, expansions, and innovations to retain their market position.

- In June 2024, Singapore's GIC, a real estate investor, partnered with Australia's National Storage REIT to launch the National Storage Ventures Fund. This fund aims to develop self-storage facilities across Australia. The partnership will invest AUD 270 million (USD 179.5 million) over the next 12 to 18 months to complete ten projects within NSR's initial development portfolio.

- In February 2024, Talonvest Capital Inc. partnered with Metro Self Storage to invest USD 22.5 million in a financing agreement for a portfolio including four properties across the southeastern United States, which would enhance Metro Self Storage's presence in suburban areas of Nashville, Tampa, Orlando, and Atlanta with a total of 2,382 units and 282,396 net rentable square feet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Macro Economic Factors on the Market

- 4.5 Analysis of Key Base Indicators of the Market

- 4.5.1 Average Living Spaces

- 4.5.2 Occupancy Rates of Self-storage Facilities

- 4.5.3 Office Rental Prices

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Urbanization Coupled with Smaller Living Spaces

- 5.1.2 Changing Business Practices and COVID-19 Consumer Behavior

- 5.2 Market Restraints

- 5.2.1 Government Regulations on Storage are Hindering the Market Growth

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Italy

- 6.2.2.6 Belgium

- 6.2.2.7 Netherlands

- 6.2.2.8 Luxembourg

- 6.2.2.9 Denmark

- 6.2.2.10 Finland

- 6.2.2.11 Norway

- 6.2.2.12 Sweden

- 6.2.2.13 Iceland

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Taiwan

- 6.2.3.4 South Korea

- 6.2.3.5 Malaysia

- 6.2.3.6 Hong Kong

- 6.2.3.7 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 U-Haul International Inc.

- 7.1.2 Life Storage Inc.

- 7.1.3 CubeSmart LP

- 7.1.4 National Storage Affiliates

- 7.1.5 Safestore Holdings PLC

- 7.1.6 Simply Self Storage Management LLC

- 7.1.7 StorageMart

- 7.1.8 Prime Storage Group

- 7.1.9 WP Carey Inc.

- 7.1.10 Metro Storage LLC

- 7.1.11 SmartStop Asset Management LLC

- 7.1.12 (Great Value Storage) World Class Capital Group LLC

- 7.1.13 All Storage

- 7.1.14 Amsdell Cos./Compass Self Storage

- 7.1.15 Urban Self Storage Inc.

- 7.1.16 Global Self Storage Inc.