|

市场调查报告书

商品编码

1624584

亚太地区位置分析:市场占有率分析、产业趋势/统计、成长预测(2025-2030)APAC Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

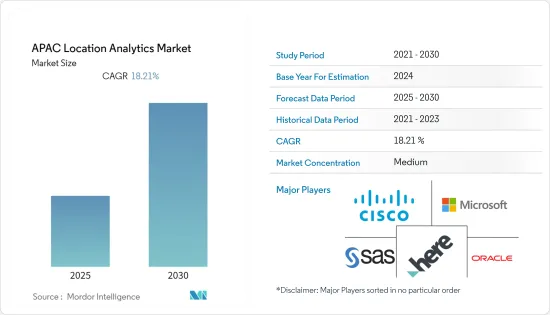

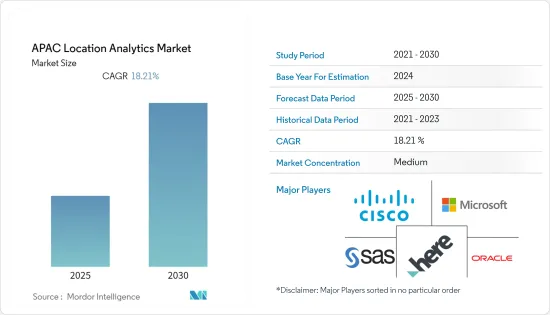

亚太地区位置分析市场预计在预测期内复合年增长率为 18.21%

主要亮点

- 零售商之间的激烈竞争试图比竞争对手赚取更多的钱。智慧型手机席捲了世界。亚太市场正在蓬勃发展,对于任何智慧型手机公司来说都是一个巨大的市场。预算型和高阶智慧型手机领域都有很大的需求。这两种成长的结合正在支持该地区基于位置的分析市场。

- 市场区隔正在成为市场研究领域的关键部分之一。由于许多零售商店每天都在营业,每次消费者或顾客进入商店并在购买后停留直至离开时都会创建大量用户资料。

- 目前正在使用各种分析解决方案对这些资料进行分析。基于位置的分析将基于位置的资料置于上下文中,以得出有意义的见解并为战略业务决策提供资讯。位置分析供应商利用具有 Wi-Fi 网路的智慧型手机,以最低的成本运行位置分析解决方案。

- Wi-Fi 基于位置的分析 (LBS) 系统已在所有面向客户的行业中引入。该系统允许顾客透过现场Wi-Fi进行连接,使零售中心和其他机构能够更好地了解他们的消费者,并相应地提供适合他们需求的产品。

- 当今市场上流行各种分析解决方案,例如网路分析。基于位置的分析将成为设计和衡量客户体验的时代需求。位置分析解决方案将很快在市场上变得司空见惯。

这场大流行对世界各地的各种企业产生了重大影响,印度和中国等国家受到病毒爆发的负面影响。因此,全球智慧型手机以及基于位置的分析解决方案的使用量显着增加。印度政府支持当局对接触过新冠病毒阳性患者的人进行有效的接触者追踪,并从其使用中受益匪浅。

亚太区位分析市场趋势

车载连接推动汽车产业的成长

- 内建导航的新车正在成为标准配置,车载导航供应商预计将会成长。此外,车辆的外部和内部连接正在推动连网式导航服务和即时位置内容的成长。

- 对于汽车製造商来说,嵌入式和连网型的位置服务,如路线规划(TBT)导航、交通资讯和兴趣点(POI)搜寻(包括停车场和加油站)将成为车载服务的主要部分未来五年,它将继续成为资讯娱乐系统(IVI)的组成部分。尤其是导航系统在入门级汽车中变得越来越普遍。据预测,导航安装率将从2020年占新车销售的38%增至2026年的近70%,为供应商提供显着的成长机会。

- 儘管未来五年受到疫情的负面影响,但导航车辆的年销量预计将增长近一倍,从 2020年终的超过 3450 万辆增至 2025 年的超过 6800 万辆。这总合不包括安全引导自动驾驶车辆所需的高清地图。儘管如此,联网汽车仍然包括在内。联网汽车可以为使用者提供基于地图的即时服务,作为连网型车载资讯娱乐 (IVI) 体验的一部分。

- 随着汽车行业致力于提高道路安全性并减少或消除交通事故,更多新车将配备 ADAS(高级驾驶辅助系统)。

分析师预测,到 2025 年,全球距离警告的普及率将达到轻型车辆的 76%,其中依赖 Masu 地图的比例不断增加(可能是四分之一到三分之一)。其他 ADAS 功能包括预测动力传动系统距离警告、智慧速度援助和车道偏离警报。

透过位置洞察提供竞争考察继续推动企业需求

整个企业的许多层面都感受到了数位化的好处,包括销售和行销、营运、策略、IT 管理以及研发。收集和分析资料以获得见解,以改善决策、课责、效率和业务绩效。

智慧定位将地图和地理空间服务与企业和组织资料结合。智慧定位是商业智慧的子集,可在地图上视觉化业务产生的资料(性能资料、定价、成本资料等)(或应用位置服务),战术性和策略目的。

智慧定位的使用案例包括地理行销、定位广告、站点位置规划(例如零售店、餐厅、加油站和行动无线电接取网路等基础设施)以及远端设备效能监控。资产追踪、车队管理、随选行动服务和其他业务功能也可以透过位置服务增强。

BCG 去年 2 月对 520 家公司进行的全球企业位置情报调查发现,位置资料对于跨行业的业务绩效非常重要,其中 95% 的企业涉及房地产、物流和配送、零售、电子商务等、地图和地理空间资料对于今天实现预期的业务成果至关重要,91% 的人表示,它们在三到五年内将变得更加重要。

亚太地区位置分析产业概览

在亚太地区位置分析市场营运的公司集中度适中,注重伙伴关係和创新。市场上的主要供应商包括思科系统公司、微软公司、HERE、SAS Institute Inc.、甲骨文公司、SAP SE、ESRI(环境系统研究所)、Tibco Software Inc.、Pitney Bowes 和 Gaige。

2022 年 7 月,Citycity 将与 HERE 合作,在其解决方案和产品中使用定位服务和应用程式介面 (API)。这将简化城市交通运营,提供可行的分析来推动交通脱碳,减少交通拥堵、车辆管理、智慧城市停车和物流,并促进印度的智慧和永续生活。

2022 年 7 月,Google 地图宣布与 Genesis International 和 Tech Mahindra 合作,在印度推出街景服务。这些伙伴关係关係的目的是创建有用的地图,使导航和探索更容易、更准确,并与当地社区共用重要且有用的基于位置的资讯并为当地社区提供支援。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法与方法论

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 零售市场成长

- 更多采用分析商业智慧和地理资讯系统技术

- 物联网的使用不断增加

- 市场限制因素

- 安全和隐私问题

- 由于业务资讯不完整、资讯过时、位置资料库限制等原因,系统容易发生错误。

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 业内竞争对手之间的对抗关係

第五章技术概述

- 技术简介

- 持续发展

第六章 市场细分

- 按地点

- 室内的

- 户外

- 按部署模型

- 本地

- 一经请求

- 按行业分类

- 零售

- 银行

- 製造业

- 运输

- 卫生保健

- 政府机构

- 能源/电力

- 其他行业

- 按国家/地区

- 中国

- 印度

- 日本

- 澳洲

- 其他国家

第七章 竞争格局

- 公司简介

- Cisco Systems

- Microsoft Corporation

- HERE

- SAS Institute, Inc.

- Oracle Corporation

- SAP SE

- ESRI(Environmental Systems Research Institute)

- Tibco Software Inc.

- Pitney Bowes

- Galigeo

第八章投资分析

第九章亚太地区位置分析市场的未来性

The APAC Location Analytics Market is expected to register a CAGR of 18.21% during the forecast period.

Key Highlights

- There is cutthroat competition between the retailers to earn more than their rivals. Smartphones have taken the world by storm. The boom in Asia-Pacific markets has been enormous and is a huge market for every smartphone company. There is a huge demand in both the low-cost and high-end smartphone segments. The combination of growth in both has helped the location analytics market in this region.

- Location analytics is emerging as one of the major segments in the field of market research. As more retail stores open every day, a lot of user data is created every time a consumer or customer walks into a store and stays there until he or she leaves after making a purchase.

- These data points are now being analyzed with different analytical solutions. Location-based analytics aids in contextualizing location-centric data in order to derive meaningful insights and inform strategic business decisions.This data could enhance the customer experience and give us a competitive edge over other market players. By leveraging smartphones with wi-fi networks, location analytics vendors have enabled location analytics solutions to run at a minimal cost.

- The rise in all customer-facing industries has resulted in the introduction of the wi-fi location analytics (LBS) system, which allows customers to connect through on-site wi-fi, opening a direct channel of communication that enables retail centers and similar others to better understand their consumers and accordingly deliver products that meet their needs.This method helps maximize retail output and services by understanding the consumer's needs.

- Different analytics solutions, like web analytics, are popular in the market currently. Location-based analytics will become the need of the hour for designing and measuring the experiences of customers. Shortly, location analytics solutions will become commonplace in the marketplace.

The pandemic significantly impacted various businesses worldwide, with countries such as India and China being adversely affected by the outbreak of the virus. As a result, smartphone usage increased significantly globally, and location analysis solutions increased. The Government of India has greatly benefited from using it, as it has assisted authorities in conducting effective contact tracing for people who met COVID-positive patients.

APAC Location Analytics Market Trends

In-vehicle connectivity is driving growth in the Automotive sector

- New vehicles with built-in navigation are becoming standard, which will allow in-vehicle navigation suppliers to grow. Also, the growth of connected navigation services and live location content is being driven by both external and internal connectivity in vehicles.

- For carmakers, embedded and connected location services, such as turn-by-turn (TBT) navigation, traffic information, and point-of-interest (POI) search (including parking and gas stations), will remain an essential component of in-vehicle infotainment systems (IVI) over the next five years. Specifically, navigation systems are becoming common in entry-tier vehicles. According to predictions, the attach rate for navigation will increase from 38% of new cars sold in 2020 to almost 70% by 2026, providing suppliers with a sizable opportunity for growth.

- Despite the negative impact of the pandemic over the next five years, it is estimated that annual sales of navigation-enabled cars will almost double from over 34.5 million at the end of 2020 to exceed 68 million by 2025. This total excludes HD maps required to guide autonomous cars safely. Still, it includes connected cars, which can deliver live map-based services to users as part of the connected in-vehicle infotainment (IVI) experience.

- As the auto industry works to make roads safer and cut down on or get rid of car accidents, more new cars will have advanced driver assistance systems (ADAS).

Analysts expect the global penetration of the distance warning feature to reach 76% of light-duty vehicles in 2025, with a growing share (likely between a quarter and a third) of these relying on an ADAS map. Other ADAS features include distance warning with predictive powertrain, intelligent speed assistance, and lane departure alerts.

Achieving competitive advantage through location insights continues to drive demand for Enterprises

The benefits of digitalization are felt at various levels across enterprises, e.g., sales and marketing, operations, strategy, IT management, and R&D. Data is collected and analyzed to gain insights that improve decision-making, accountability, efficiency, and business performance.

Location intelligence combines mapping and geospatial services with a company's or organization's data. Location intelligence is a subset of business intelligence whereby a business visualizes the data it generates, e.g., performance data, pricing, cost data, etc., on a map (or applies location services) for improved tactical and strategic decision-making.

Use cases for location intelligence include geo-marketing, location-targeted advertising, site location planning (e.g., retail stores, restaurants, fueling stations, and other infrastructure like mobile radio access networks), and remote equipment performance monitoring. Asset tracking, fleet management, on-demand mobility services, and other business functions can also be enhanced with location services.

A BCG global survey on location intelligence for enterprises conducted across 520 companies in February last year shows the high importance of location data to business performance across different sectors, where 95% said that mapping and geospatial data are essential in achieving desired business results today and 91% said that they would be even more essential in three to five years, including in real estate, logistics and delivery, retail, and e-commerce.

APAC Location Analytics Industry Overview

Companies operating in the Asia-Pacific Location Analytics Market focus on partnerships and innovations and are moderately concentrated. Some of the key vendors in the market include Cisco Systems, Microsoft Corporation, HERE, SAS Institute Inc., Oracle Corporation, SAP SE, ESRI (Environmental Systems Research Institute), Tibco Software Inc., Pitney Bowes, and Gaige.

In July 2022, Citility will work with HERE to use location services and application programming interfaces (APIs) in its solutions and products. This will provide actionable analytics that streamline city mobility operations and encourage the decarbonization of transportation and reduce traffic congestion, fleet management, smart city parking, and logistics to promote smart, sustainable living in India.

In July 2022, Google Maps announced partnerships with Genesys International and Tech Mahindra to launch Street View in India. The goal of these partnerships is to make helpful maps that make navigation and exploration easier and more accurate and to share important and useful location-based information with communities to help them.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH APPROACH AND METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Retail Market

- 4.2.2 Increasing adoption of analytical business intelligence and geographic information systems technology

- 4.2.3 Increasing Usage of Internet of Things

- 4.3 Market Restraints

- 4.3.1 Concerns about security and privacy

- 4.3.2 Systems are error prone In cases like incomplete business information, out-of-date information and limitation of place databases

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat from new entrants

- 4.5.4 Threat from substitute Product Types

- 4.5.5 Competitive rivalry within the industry

5 TECHNOLOGY OVERVIEW

- 5.1 Technology Snapshot

- 5.2 Ongoing developments

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Deployment Model

- 6.2.1 On-premise

- 6.2.2 On-demand

- 6.3 By Verticals

- 6.3.1 Retail

- 6.3.2 Banking

- 6.3.3 Manufacturing

- 6.3.4 Transportation

- 6.3.5 Healthcare

- 6.3.6 Government

- 6.3.7 Energy and Power

- 6.3.8 Other Verticals

- 6.4 By Countries

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems

- 7.1.2 Microsoft Corporation

- 7.1.3 HERE

- 7.1.4 SAS Institute, Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 ESRI (Environmental Systems Research Institute)

- 7.1.8 Tibco Software Inc.

- 7.1.9 Pitney Bowes

- 7.1.10 Galigeo