|

市场调查报告书

商品编码

1849853

北美位置分析:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

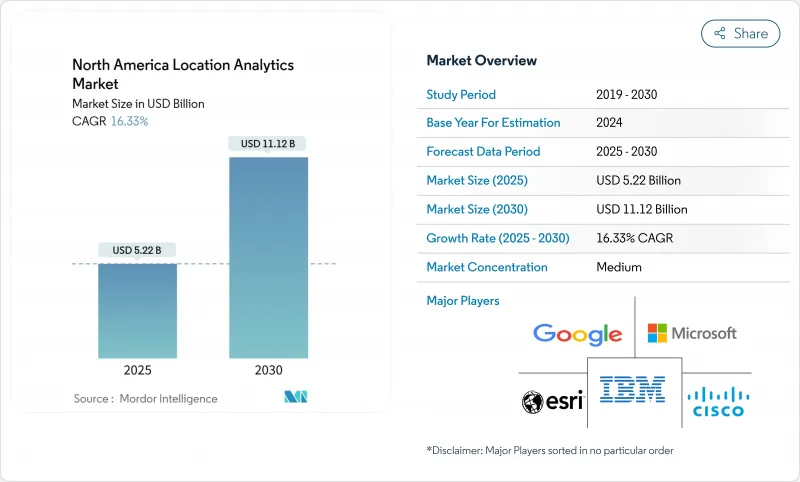

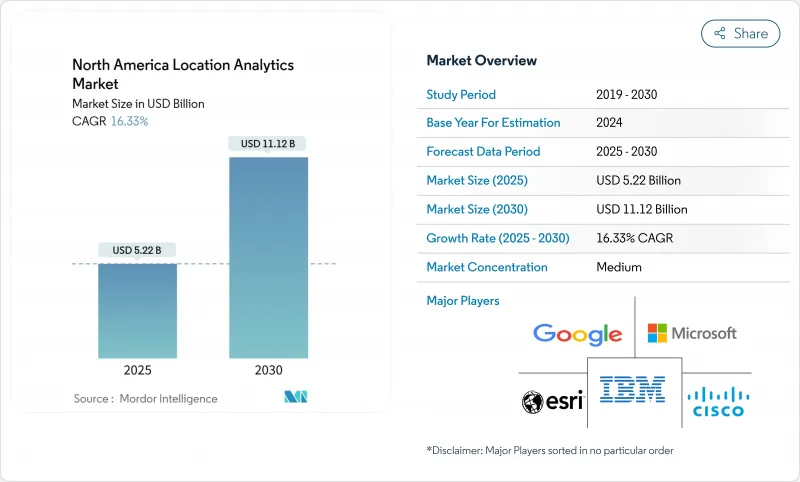

预计到 2025 年北美位置分析市场将成长至 52.2 亿美元,到 2030 年将成长至 111.2 亿美元,复合年增长率为 16.33%。

强大的推动力包括:全通路零售商寻求精准的地理行销;物联网感测器的普及,即时传输空间资料;以及向缩短部署週期的云端原生地理空间平台的广泛迁移。企业正在从基本的经纬度追踪转向丰富的空间分析,以优化商品行销、路线规划和设施吞吐量。民用5G和CBRS网路正在缩小室内定位精度差距,政府对紧急应变地理技术的投资也正在增加机构需求。虽然日益严格的隐私法规是一个主要限制因素,但合规的资料探勘架构已经出现,以保持北美位置分析市场的强劲发展势头。

北美位置分析市场趋势与洞察

全通路零售地理宣传活动激增

零售商正在将地理围栏工具与其 CRM 套件相结合,以推出即时促销活动并提高门市层面的转换率。展示室优化研究表明,策略性的店内产品布局和扩大的地理覆盖范围可以提升销售和消费者信任。随着实体店与点击的连结日益紧密,差异化的位置内容将成为纯粹电商无法比拟的忠诚度槓桿。

加强隐私和消费者选择退出法规

加州的《加州消费者隐私法案》(CCPA)强调了地理位置资料的个人属性,并强制要求明确选择退出并强化同意流程。企业现在需要将隐私工程融入其整个分析堆迭中,有时甚至需要降低资料粒度以保持合规性。

細項分析

随着GPS/GNSS为运输和物流赋能,户外定位服务将在2024年占据北美位置分析市场55%的份额。然而,受CBRS私有5G和超宽频部署带来的亚米级精度推动,室内定位将以18.4%的复合年增长率成长。製造商正在采用这项技术来实现资产级可视性,医院也正在利用它来追踪高价值设备。

日益增长的混合需求迫使供应商将室内和室外层整合到单一真实来源仪表板中。工业 4.0 蓝图要求工人安全地理区域和自动导引车需要连续的座标流。因此,北美位置分析市场正在转向能够适应室外 GPS 漂移和室内多路径校正的多模态引擎。

到2024年,本地系统仍将占北美位置分析市场规模的60%,反映出在这个高度监管的产业中,资料主权的重要性日益凸显。云端选项正以20.1%的复合年增长率扩张,按计量收费处理和本地协作模式吸引了资本支出有限的公司。结合边缘推理和云端建模的混合架构也正在兴起,从而支援低延迟用例。

私有 CBRS 网路提供了一种结合云端协作和自主资料路径的现场替代方案,为工厂提供了避免公共云端锁定的途径。 GeoParquet 等格式化创新技术可最大限度地降低 ETL 开销,从而解锁先前需要专门 GIS 脚本编写的敏捷工作流程。

北美位置分析市场按位置(室内、室外)、部署模式(本地、云端、其他)、组件(解决方案、其他)、技术(GPS/GNSS、Wi-Fi、其他)、终端用户垂直领域(零售、银行、製造、政府、其他)、应用(风险管理、其他)和国家细分。市场预测以美元计算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全通路零售地理宣传活动激增

- 物联网感测器和连接设备的激增

- 加速采用云端原生地理空间分析平台

- 企业对混合工作场所占用资讯的需求

- CBRS Private 5G 提升室内定位精度

- 市场限制

- 加强隐私和消费者选择退出法规

- 即时室内定位系统的总拥有成本高

- 地理空间资料科学人才短缺

- 价值/供应链分析

- 监管格局

- 技术展望

- 五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按位置类型

- 室内的

- 户外

- 按部署模型

- 本地部署

- 云

- 杂交种

- 边缘(在设备上)

- 按组件

- 解决方案

- 服务

- 依技术

- GPS/GNSS

- Wi-Fi

- 低功耗蓝牙 (BLE)

- 超宽频(UWB)

- 蜂窝网路(包括 4G/5G 和 CBRS)

- RFID 和 NFC

- 磁性及其他

- 按最终用户

- 零售与电子商务

- 银行、金融服务和保险(BFSI)

- 製造业

- 医疗保健和生命科学

- 政府和国防

- 能源与公共产业

- 运输/物流

- 通讯/IT

- 房地产和智慧建筑

- 其他行业

- 按用途

- 风险管理

- 供应炼和库存优化

- 销售和行销优化

- 设施和资产管理

- 人力资源与现场管理

- 远端监控和预测性维护

- 紧急和灾难应变管理

- 客户体验与参与

- 诈欺与合规分析

- 其他的

- 按国家

- 美国

- 加拿大

- 墨西哥

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- SAP SE

- Esri Inc.

- Aruba Networks(HPE Development LP)

- IBM Corporation

- SAS Institute Inc.

- Pitney Bowes Inc.

- HERE Global BV

- TIBCO Software Inc.

- Ericsson Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Alteryx Inc.

- Mapbox Inc.

- CARTO

- Trimble Inc.

- Zebra Technologies Corp.

- Inpixon

- Foursquare Labs Inc.

- Precisely

- TomTom NV

- Mapsted Corp.

第七章 市场机会与未来展望

The North America location analytics market size is valued at USD 5.22 billion in 2025 and is projected to advance to USD 11.12 billion by 2030, expanding at a 16.33% CAGR.

Strong tailwinds come from omni-channel retail organizations demanding precise geo-marketing, the surge of IoT sensors streaming real-time spatial data, and widespread migration to cloud-native geospatial platforms that compress deployment cycles. Enterprises are moving beyond basic latitude-and-longitude tracking toward rich spatial analytics that optimize merchandising, routing, and facility throughput. Private-5G and CBRS networks shorten indoor accuracy gaps, while government investment in emergency-response geotechnology adds an institutional layer of demand. Rising privacy regulation represents the main tempering factor, yet compliant data-mining architectures are already emerging to keep momentum intact for the North America location analytics market.

North America Location Analytics Market Trends and Insights

Surge in Omni-Channel Retail Geo-Marketing Campaigns

Retailers pair geofencing tools with CRM suites to trigger real-time promotions, driving higher conversion at store level. Showroom optimization research indicates that strategic in-store product placement and geographic reach expansion lift sales and consumer confidence. As brick-and-click convergence deepens, differentiated location content becomes a loyalty lever that pure-play e-commerce cannot replicate.

Heightened Privacy and Consumer Opt-Out Regulations

California's CCPA enforcement sweep spotlights the personal nature of geolocation data, requiring explicit opt-outs and stronger consent flows. Enterprises must now embed privacy engineering into every analytics stack, sometimes trimming data granularity to stay compliant.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of IoT Sensors & Connected Devices

- Accelerated Adoption of Cloud-Native Geospatial Analytics Platforms

- Corporate Demand for Hybrid Workplace Occupancy Intelligence

- High Total Cost of Ownership for Real-Time Indoor Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor services retained 55% North America location analytics market share in 2024 as GPS/GNSS underpins transportation and logistics. Indoor positioning, however, compounds at 18.4% CAGR, powered by sub-meter accuracy from CBRS-enabled private 5G and ultra-wideband deployments. Manufacturers embed the technology for asset-level visibility, while hospitals apply it to track high-value equipment.

Growing hybrid demand obliges vendors to fuse indoor and outdoor layers into single source-of-truth dashboards. Industry 4.0 blueprints call for worker safety geozones and automated guided vehicles requiring continuous coordinate streams. The North America location analytics market therefore pivots to multi-modal engines that reconcile GPS drift outdoors with multipath corrections indoors.

On-premise systems still accounted for 60% of the North America location analytics market size in 2024, reflecting data-sovereignty priorities among heavily regulated sectors. Cloud options are scaling at a 20.1% CAGR as pay-as-you-go processing and native collaboration entice enterprises with limited capex. Hybrid architectures are also rising, combining edge inference with cloud modeling for low-latency use cases.

Private CBRS networks offer an on-site alternative that marries cloud orchestration with sovereign data paths, giving factories a route around public-cloud lock-in. Format innovations such as GeoParquet minimize ETL overhead, unlocking agile workflows that previously demanded specialist GIS scripting.

The North America Location Analytics Market Segmented by Location (Indoor, Outdoor), Deployment Model (On-Premises, Cloud and More), Component (Solutions and More), Technology (GPS / GNSS, Wi-Fi and More), End-User Vertical (Retail, Banking, Manufacturing, Government, and More), Application (Risk Management and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- SAP SE

- Esri Inc.

- Aruba Networks (HPE Development LP)

- IBM Corporation

- SAS Institute Inc.

- Pitney Bowes Inc.

- HERE Global BV

- TIBCO Software Inc.

- Ericsson Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Alteryx Inc.

- Mapbox Inc.

- CARTO

- Trimble Inc.

- Zebra Technologies Corp.

- Inpixon

- Foursquare Labs Inc.

- Precisely

- TomTom N.V.

- Mapsted Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in omni-channel retail geo-marketing campaigns

- 4.2.2 Proliferation of IoT sensors & connected devices

- 4.2.3 Accelerated adoption of cloud-native geospatial analytics platforms

- 4.2.4 Corporate demand for hybrid workplace occupancy intelligence

- 4.2.5 Availability of CBRS private-5G improving indoor location accuracy

- 4.3 Market Restraints

- 4.3.1 Heightened privacy and consumer opt-out regulations

- 4.3.2 High total cost of ownership for real-time indoor location systems

- 4.3.3 Shortage of geospatial data-science talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Location Type

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.2.4 Edge (on-device)

- 5.3 By Component

- 5.3.1 Solutions

- 5.3.2 Services

- 5.4 By Technology

- 5.4.1 GPS / GNSS

- 5.4.2 Wi-Fi

- 5.4.3 Bluetooth Low-Energy (BLE)

- 5.4.4 Ultra-Wideband (UWB)

- 5.4.5 Cellular (4G/5G incl. CBRS)

- 5.4.6 RFID & NFC

- 5.4.7 Magnetic & Other

- 5.5 By End-User Vertical

- 5.5.1 Retail & E-Commerce

- 5.5.2 Banking, Financial Services & Insurance (BFSI)

- 5.5.3 Manufacturing

- 5.5.4 Healthcare & Life Sciences

- 5.5.5 Government & Defense

- 5.5.6 Energy & Utilities

- 5.5.7 Transportation & Logistics

- 5.5.8 Telecom & IT

- 5.5.9 Real Estate & Smart Buildings

- 5.5.10 Other Verticals

- 5.6 By Application

- 5.6.1 Risk Management

- 5.6.2 Supply Chain & Inventory Optimization

- 5.6.3 Sales & Marketing Optimization

- 5.6.4 Facility & Asset Management

- 5.6.5 Workforce & Field-Force Management

- 5.6.6 Remote Monitoring & Predictive Maintenance

- 5.6.7 Emergency & Disaster Response Management

- 5.6.8 Customer Experience & Engagement

- 5.6.9 Fraud & Compliance Analytics

- 5.6.10 Others

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 SAP SE

- 6.4.3 Esri Inc.

- 6.4.4 Aruba Networks (HPE Development LP)

- 6.4.5 IBM Corporation

- 6.4.6 SAS Institute Inc.

- 6.4.7 Pitney Bowes Inc.

- 6.4.8 HERE Global BV

- 6.4.9 TIBCO Software Inc.

- 6.4.10 Ericsson Inc.

- 6.4.11 Microsoft Corporation

- 6.4.12 Google LLC

- 6.4.13 Oracle Corporation

- 6.4.14 Alteryx Inc.

- 6.4.15 Mapbox Inc.

- 6.4.16 CARTO

- 6.4.17 Trimble Inc.

- 6.4.18 Zebra Technologies Corp.

- 6.4.19 Inpixon

- 6.4.20 Foursquare Labs Inc.

- 6.4.21 Precisely

- 6.4.22 TomTom N.V.

- 6.4.23 Mapsted Corp.

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment