|

市场调查报告书

商品编码

1627094

欧洲工厂自动化与工业控制:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

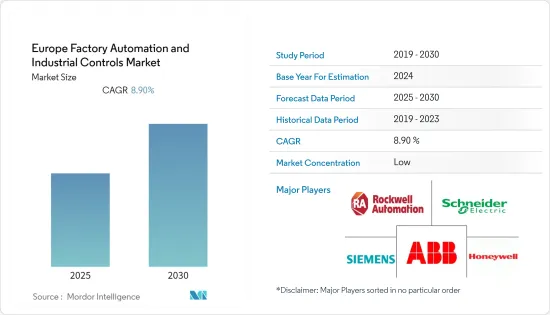

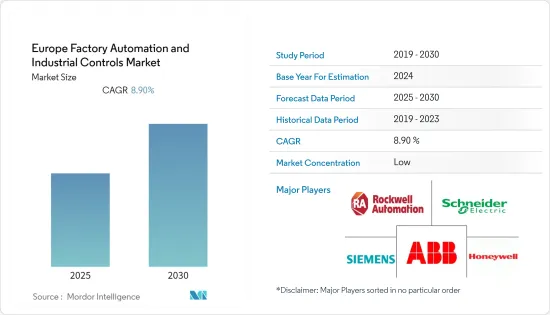

欧洲工厂自动化和工业控制市场预计在预测期内复合年增长率为 8.9%

主要亮点

- 快速加剧的竞争和不断变化的最终用户需求迫使该地区的製造业采用更新的技术创新和数位转型解决方案,以提高业务流程的效率。例如,马达和感测器等现场设备为汽车行业提供了快速响应市场需求、减少製造停机时间、提高供应链效率和扩大生产力的机会。

- 此外,该地区各行业对工业自动化的采用有所增加,各大公司将工业自动化产品推向市场。例如,能源管理和自动化数位转型的参与企业施耐德电机发布了 ClimaSys 智慧通风系统。它是一种智慧解决方案,用于在新建或重建应用中过滤和管理跨多个控制和配电盘的气流。

- 根据经合组织的数据,德国将其GDP的2.88%用于製造业创新,显着高于经合组织2.4%的平均值。近年来,德国汽车工业显着扩大了在汽车生产中的全球地位。此外,製造业的永续性预计将成为所研究市场的主要驱动因素。

- 此外,能源产业正在采取各种措施来增加输电能力,例如智慧电网。因此,在预测期内工业控制系统的使用可能会增加。

- 俄罗斯政府已表示有兴趣替代食品生产的进口。食品进口禁令可能会导致该国食品工业的发展和扩张,需要对现代加工和包装技术进行进一步投资。此外,政府规划了《医药2020战略》,重点发展医药产业。目标是减少俄罗斯经济对进口药品的依赖,预计将鼓励市场投资。

欧洲工厂自动化和工业控制市场趋势

汽车产业推动市场成长

- 汽车工业是重要的产业之一,在全球自动化製造设备中占有很大份额。各种汽车製造商的生产设施都实现了自动化,以保持效率。以电动车取代传统汽车的趋势日益明显,预计将进一步扩大汽车产业的需求。

- 汽车业最关心的是计划工期。因此,快速回报计划与低成本自动化和成本创新相结合,正在帮助製造商透过提高生产力来更好地竞争。製造过程中越来越多地采用自动化、数位化和人工智慧的参与是推动汽车产业对工业机器人需求的关键因素。

- 瑞银预计,到2025年,欧洲电动车销量预计将达到633万辆,其次是中国,销量为484万辆。随着欧洲引领电动车需求,预计该地区将出现越来越多的智慧汽车工厂。

- 机器人和自动化在欧洲汽车行业的不断增长预计将进一步刺激该地区的智慧工厂。此外,德国拥有欧洲最集中的汽车OEM製造商工厂。该国OEM工厂的进一步增加预计将增加对工业控制系统的需求。

德国占有很大的市场占有率

- 德国不仅是欧洲领先的自动化设备消费国,也是欧洲领先的自动化设备製造商。西门子、施耐德电气和库卡等几家主要的自动化和控制设备公司的总部都在德国,这意味着他们在研发活动上投入大量资金。

- 该国对自动化解决方案的需求正在迅速增长。例如,2019 年 8 月,KUKA订单。这些智慧自动驾驶车辆可以向机器人和机器餵料,并完美地控制生产过程。此外,印度与德国在工业4.0方面的合作预计将促进市场成长。

- 根据国际机器人联合会 (IFR) 最近的估计,德国的机器人密度位居世界第三(每 10,000 名工人拥有 338 台机器人),仅次于新加坡和韩国。 IFR预测,随着各产业尤其是汽车产业对机器人的需求不断增加,2018年至2020年德国的年供应量可能会继续以每年至少5%的速度成长。该国工业机器人供应量的增加预计将推动市场研究。

- 国家正在建构完整的5G生态系统,这将进一步加快工业数位化的步伐。这加强了德国在国际竞争中的地位。最近,德国电信业者德国电信为其基于 5G 的智慧工厂生态系统增添了新的合作伙伴。新的合作伙伴是 EK Automation、Konica Minolta和 Endress+Hauser。

欧洲工厂自动化和工业控制产业概况

由于众多参与企业,欧洲工厂自动化和工业控制市场竞争非常激烈。参与企业从事产品开发、伙伴关係、併购和收购等策略活动。

- 2020 年 8 月 - 能源管理和自动化数位转型的领导者Schneider Electric透过收购 ProLeiT AG 扩大了其产品组合,加强了其对整体和软体支援的自动化的承诺。 ProLeiT AG 提供具有整合製造执行系统 (MES) 功能的製程控制系统 (PCS),针对消费品市场进行了最佳化,包括食品和饮料、化学品和生命科学领域。

- 2020 年 3 月 - 自主机器人拣选解决方案供应商 RightHand Robotics (RHR) 在德国法兰克福设立了销售和业务开发办事处,继续其全球扩张。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 人们对能源效率和降低成本的兴趣日益浓厚

- 市场限制因素

- 贸易摩擦与实施挑战

第六章 行业标准和法规

第七章 市场区隔

- 副产品

- 工业控制系统

- 集散控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控/资料采集(SCADA)

- 产品生命週期管理 (PLM)

- 人机介面 (HMI)

- 製造执行系统(MES)

- 企业资源规划(ERP)

- 其他工业控制系统

- 现场设备

- 机器视觉系统

- 机器人(工业)

- 感测器和发射器

- 马达与驱动器

- 其他现场设备

- 工业控制系统

- 按最终用户产业

- 车

- 化学/石化

- 公共产业

- 製药

- 饮食

- 石油和天然气

- 其他的

- 国家名称

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

第八章 竞争格局

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

第九章投资分析

第十章 投资分析市场的未来展望

简介目录

Product Code: 48814

The Europe Factory Automation and Industrial Controls Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- With a rapid increase in competition and evolving end-user requirements, manufacturing units in the region are being forced to adopt newer technological innovations and digital transformation solutions to make their business process as efficient as possible. For instance, field devices, like motors and sensors, among others, offer opportunities to the auto industry to react faster to market requirements, reduce manufacturing downtimes, and enhance the efficiency of supply chains, and expand productivity.

- The region is also adopting industrial automation in various industries, with major firms launching industrial automation products in the market. For instance, Schneider Electric, a player in the digital transformation of energy management and automation, announced the ClimaSys smart ventilation system, which is an intelligent solution for filtering and managing the airflow for multiple control panels or electrical distribution cabinets in new or renovated applications.

- According to OECD, Germany spends 2.88% of its GDP into manufacturing innovation, well ahead of the OECD average of 2.4%. The German automotive industry has extended its worldwide position in automotive production, significantly, over the past few years. Moreover, sustainability in the manufacturing sector is expected to be a major driver for the market studied.

- Furthermore, various measures are being taken to boost power transmission capacity, such as smart grid, in the energy landscape The measures by the four national grid operators, to boost power transmission capacity, add up to a cost of EUR 50 billion. This is likely to escalate the usage of industrial control systems during the forecast period.

- The Russian government is showing interest in import substitution of food production. The ban on imports of food could lead to the development and expansion of the country's food industry, further demanding investment in modern technology for processing and packaging. Also, the government is focused on creating its pharmaceutical industry by planning 'Pharma 2020 Strategy'. Its goal is to reduce the reliance on the Russian economy on imported pharmaceuticals, which is expected to drive investments in the market.

Europe Factory Automation & Industrial Controls Market Trends

Automotive Industry to Drive the Market Growth

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand further.

- The primary concern of the automotive industry is the length of a project. Hence, quick return-on-investment projects, combined with low-cost automation and cost innovation, are helping the manufacturers improve competitiveness through productivity improvement. The growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots' demand in the automotive sector.

- According to UBS, the projected electric vehicle sales in Europe are expected to reach 6.33 million units by 2025, followed by China, with 4.84 million units. As Europe is leading the electric vehicles' demand, the region is anticipated to see an increase in smart automotive factories' implementation.

- The growing presence of robots and automation in the European automotive industries is further expected to fuel the region's smart factory. Additionally, Germany also possesses the largest concentration of automotive OEM plants in Europe. A further increase in OEM sites in the country is expected to increase industrial control systems' demand.

Germany Holds Significant Market Share

- Germany is not only a major consumer of automation equipment, but it is also a major manufacturer of automation equipment in Europe. Several major players of automation and control equipment, such as Siemens, Schneider Electric, KUKA, etc., are based out of Germany, thus driving a high investment flow toward R & D activities.

- The country has been witnessing rapid growth in the demand for automation solutions. For instance, in August 2019, KUKA received an order for 22 KMP 1500s from an automotive customer. These intelligent, autonomous vehicles can supply materials to robots and machines, perfectly timing the production process. Additionally, a collaboration between India and Germany in Industry 4.0 is expected to augment the market growth.

- According to the recent estimates from the International Federation of Robotics (IFR), Germany has the third most robot density in the world (338 units per 10,000 workers), after Singapore and South Korea. IFR estimates that the annual supply in Germany may continue to grow by at least 5% on average per year, between 2018 and 2020, due to the increasing demand for robots in various industries, with a focus on the automotive industry. This increasing supply of industrial robots in the country is expected to drive the market studied.

- There is the development of a complete 5G ecosystem in the country, which will further accelerate the pace of digitization in the industry. This will strengthen Germany's position in global competition. Recently, Deutsche Telekom, a German telecommunications company, added new partners for its 5G-based smart factory ecosystem. The new partners are EK Automation, Konica Minolta, and Endress+Hauser.

Europe Factory Automation & Industrial Controls Industry Overview

The European factory automation and industrial controls market is competitive due to several players in the market. Players are involved in product development and strategic activities such as partnerships, mergers, and acquisitions.

- August 2020 - Schneider Electric, the digital transformation leader of energy management and automation, is expanding its portfolio and reinforcing its commitment to holistic and software-supported automation through the acquisition of ProLeiT AG. ProLeiT AG provides Process Control Systems (PCS) with an integrated Manufacturing Execution System (MES) functions optimized for the Consumer Packed Goods marketplace, including the Food and Beverage, Chemicals, and Life Sciences segments

- March 2020 - RightHand Robotics (RHR), a provider of autonomous robotic picking solutions, continues for its global expansion by establishing a sales and business development office in Frankfurt, Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Energy Efficiency and Cost Reduction

- 5.2 Market Restraints

- 5.2.1 Trade Tensions and Implementation Challenges

6 INDUSTRY STANDARDS AND REGULATIONS

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Industrial Control Systems

- 7.1.1.1 Distributed Control System (DCS)

- 7.1.1.2 Programmable Logic Controller (PLC )

- 7.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 7.1.1.4 Product Lifecycle Management (PLM)

- 7.1.1.5 Human Machine Interface (HMI)

- 7.1.1.6 Manufacturing Execution System (MES)

- 7.1.1.7 Enterprise Resource Planning (ERP)

- 7.1.1.8 Other Industrial Control Systems

- 7.1.2 Field Devices

- 7.1.2.1 Machine Vision Systems

- 7.1.2.2 Robotics (Industrial)

- 7.1.2.3 Sensors and Transmitters

- 7.1.2.4 Motors and Drives

- 7.1.2.5 Other Field Devices

- 7.1.1 Industrial Control Systems

- 7.2 By End-user Industry

- 7.2.1 Automotive

- 7.2.2 Chemical and Petrochemical

- 7.2.3 Utility

- 7.2.4 Pharmaceutical

- 7.2.5 Food and Beverage

- 7.2.6 Oil and Gas

- 7.2.7 Other End-user Industries

- 7.3 Country

- 7.3.1 United Kingdom

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Schneider Electric SE

- 8.1.2 Rockwell Automation Inc.

- 8.1.3 Honeywell International Inc.

- 8.1.4 Emerson Electric Company

- 8.1.5 ABB Ltd

- 8.1.6 Mitsubishi Electric Corporation

- 8.1.7 Siemens AG

- 8.1.8 Omron Corporation

- 8.1.9 Robert Bosch GmbH

- 8.1.10 Yokogawa Electric Corporation

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219