|

市场调查报告书

商品编码

1627212

欧洲振动感测器:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

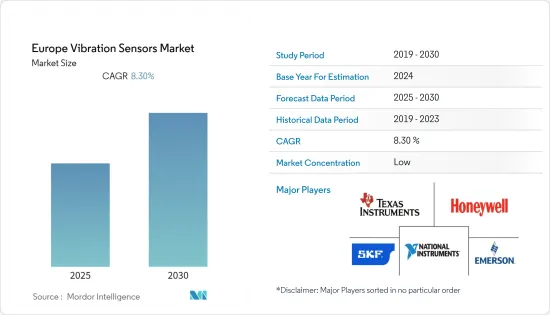

欧洲振动感测器市场预计在预测期内复合年增长率为 8.3%

主要亮点

- 振动感测器在尺寸、负载能力和频率范围方面变得越来越客製化。振动感测器旨在找出引擎问题并快速消除不必要的引擎拆卸。

- 感测器及其应用的感测能力会因最终用户的应用而降低。由于讯号负载较大,无法侦测分析振动时的反应时间。

- 欧洲振动感测器市场在过去十年中经历了重大发展,催生了各种创新且技术先进的产品。

- 在过去的五年里,随着汽车变得越来越复杂,对执行多种功能的各种感测器的需求也随之增加。由于对增强驾驶员资讯、增强安全控制以及更复杂的引擎管理系统以提高燃油效率和减少排放气体的需求不断增长,预计该市场将继续增长。欧洲振动感测器市场主要由全球主要公司组成,很少有小参与企业该市场。

欧洲振动感测器市场趋势

航太及国防终端用户占比较大

- 提高情境察觉以推动营运、具有成本效益的维护以及提高资产利用率是推动飞机健康监测系统需求的一些关键因素。

- 欧洲和英国和德国等其他主要航空市场的客运量和飞机起降量都在成长,预计这将在预测期内推动市场发展。

- 涡轮发动机故障是机械故障的主要原因,这会增加成本。因此,用户越来越多地转向预测健康管理 (PGM) 系统来防止这些损失并降低维护成本。由于振动是航太引擎产业最常见的健康监测参数,PHM系统的发展将直接影响振动感测器的成长。

欧洲扩大工业IoT的采用

- 在过去的十年中,物联网解决方案越来越多地用于优化离散製造产品和环境。离散製造商(汽车、工业机械)与流程製造商一起面临激烈的竞争。这导致对新技术的投资增加,这些新技术利用物联网、云端和巨量资料分析功能来增强创新能力,从而最大限度地提高收益。

- 随着工业 4.0 的到来,工业IoT(IIoT)、智慧製造、智慧工厂、预测製造、工业机器人和感测器等趋势使物联网成为这些离散和流程製造环境的核心支柱,实现远端监控和远端监控,支援工厂车间设备的连续扫描功能、即时分析和预测性维护等新功能。

- 工业4.0支持从遗留系统向智慧组件和机器的过渡,促进向数位工厂甚至连网型工厂和企业生态系统的过渡。

- 随着智慧工厂计画的实施,企业开始专注于预测性维护和製造,这有望降低维护成本并提高产能。据美国能源局称,预测性维护具有成本效益,与预防性维护相比可节省约 8% 至 12%,与纠正性维护相比可节省高达 40%。因此,许多製造商正在将基于状态(预测)的维护方法添加到其维护策略中,以提高製造安全性和效能。

- 此外,据 Vollenhaupt 称,低维护策略可使公司的产能减少多达 20%。机械调节器是识别和预防问题的最有效的维护工具之一。

- 预测性维护的推广正在推动支持它的技术、零件和设备的发展,从而加强振动感测器市场。

欧洲振动感测器产业概况

欧洲振动感测器市场高度分散。由于新参与企业在接触消费者方面面临挑战,拥有知名品牌形象的全球感测器製造商的出现预计将对竞争对手之间的竞争产生重大影响。品牌形像在决定购买行为方面发挥重要作用。因此,知名度较高的公司相对于同一市场的其他公司具有显着的优势。主要公司包括德克萨斯(TI)、Honeywell)和艾默生 (Emerson)。

- 2020 年 6 月 - National Instruments 推出了更新后的品牌标识,包括新标识、视觉标识、增强的数位体验和品牌宣传活动。该公司现在简称为 NI,透过将丰富的软体传统与新的云端和机器学习功能相结合,实现测试和测量行业的现代化。

- 2020 年 4 月 - 艾默生收购主要企业American Governor Company。美国州长公司的加入增强了艾默生在可再生能源和电力行业的技术力和专业知识。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场分析

- 市场概况

- 市场驱动因素

- 对机器监控和维护的需求不断增加

- 振动感测器寿命长,自发电功能,频率范围宽

- 市场限制因素

- 与旧机器的兼容性

- 对环境造成重大且危险的影响

- 产业吸引力—五力分析

- 新进入者的威胁

- 替代品的威胁

- 供应商的议价能力

- 买方议价能力

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章技术概况

- 依技术

- 感应式

- 压电

- 磁的

- 电容式

- 光纤感测器

第六章 市场细分

- 副产品

- 加速计

- 接近探头

- 转速表

- 其他的

- 按行业分类

- 车

- 医疗保健

- 航太/国防

- 家电

- 石油和天然气

- 金属/矿业

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 其他的

第七章 竞争格局

- 公司简介

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.,

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Hansford Sensors Ltd.,

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第八章 投资展望

第九章欧洲振动感测器市场未来性

The Europe Vibration Sensors Market is expected to register a CAGR of 8.3% during the forecast period.

Key Highlights

- The customization in the vibration sensor is growing with respect to its size, load capacity, and frequency range. They are designed to pinpoint engine problems and eliminate unnecessary engine removals quickly.

- The sensing capabilities with respect to sensors and it's usage reduce with its end-user application. The restraints are technical; response time in analyzing the vibration can't be detected due to heavy signal load.

- The European vibration sensor market has experienced important developments over the past decade resulting in a wide variety of innovative and technologically superior products.

- There has been an increase in demand for a variety of sensors to perform a multitude of functions as vehicles have become more complex over the last five years. Continued growth is anticipated for this market, propelled by enhanced demand for greater driver information, tighter safety controls, and more sophisticated engine management systems to improve fuel economy and reduce emissions. The Europe Vibration Sensors market is comprised of mostly large global corporations with few small market participants.

Europe Vibration Sensors Market Trends

Aerospace & Defense End User to Hold Significant Share

- An increase in situational awareness to drive operations, cost-effective maintenance, and increase in asset utilization are some of the key factors driving the demand for aircraft health monitoring systems.

- The passenger traffic in Europe and other major aviation markets, such as the United Kingdom and Germany, have witnessed growth in terms of the number of passengers and aircraft movements, which is expected to drive the market during the forecast period.

- Turbine engine failures are the primary cause of mechanical failures, which is increasing the costs; hence, users are increasingly turning to prognostic health management (PHM) systems to prevent these losses and to reduce maintenance costs. As vibration is the most common health monitoring parameter in the aerospace engine industry, the development of PHM systems is likely to have a direct impact on the growth of vibration sensors.

Growing Adoption of Industrial IOT in Europe Region

- Over the last decade, IoT solutions have been increasingly adopted for optimizing discrete manufacturing products and environments. Discrete manufacturers (in automotive, industrial machinery), along with process manufacturers, face intense competition. Hence, they are increasingly investing in new technologies that leverage the capabilities of IoT, cloud, and Big Data analytics to enhance their ability to innovate maximize return on their assets.

- With the advent of Industry 4.0, trends, like Industrial IoT (IIoT), smart manufacturing, smart factory, predictive manufacturing, industrial robots, sensors, have made IoT the central backbone of these discrete and process manufacturing environments enabling remote monitoring, continuously scanning capabilities from the equipment on the factory floor, real-time analysis, and supporting new capabilities, such as predictive maintenance.

- Industry 4.0 is aiding the industries' transition from having legacy systems to smart components and smart machines, facilitating digital factories, and later, to an ecosystem of connected plants and enterprises.

- With the smart factory concept coming into force, companies focus on predictive maintenance and manufacturing, which is anticipated to reduce maintenance costs and enhance production capacities. According to the US Department of Energy, predictive maintenance is highly cost-effective, saving roughly 8% to 12% over preventive maintenance and up to 40% over reactive maintenance. Therefore, to improve manufacturing safety and performance, many manufacturing organizations have added condition-based (predictive) maintenance approaches to their maintenance strategies.

- Moreover, according to Wollenhaupt, low maintenance strategies can reduce a company's production capacity by as much as 20%. To identify the problems and prevent them, machine conditioning equipment is one of the most effective maintenance tools.

- This drive for predictive maintenance has driven the technologies, components, and equipment supporting it, thereby augmenting the market's vibration sensors.

Europe Vibration Sensors Industry Overview

The European vibration sensor market is highly fragmented. The presence of global sensor manufacturers with established brand identities in the market is expected to have a profound influence on the intensity of competitive rivalry, as new entrants face challenges in reaching out to consumers. Brand identity plays a strong role in determining buyer behavior. Therefore, well-known companies have a considerable advantage over other players in the market. Some of the key players are Texas Instruments, Honeywell, and Emerson.

- June 2020 - National Instruments Corporations unveiled an updated brand identity, including a new logo, visual identity, enhanced digital experiences, and a brand campaign. Now known simply as NI, it is modernizing the test and measurement industry by coupling its rich software heritage with new cloud and machine learning capabilities.

- April 2020 - Emerson acquired the leading hydroelectric turbine controls company, American Governor Company. The addition of American Governor Company builds on Emerson's technology capabilities and expertise in the renewable and power industry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition'

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dyanmics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Machine Monitoring and Maintenance

- 4.2.2 Longer Service Life, Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 4.3 Market Restraints

- 4.3.1 Compatibility With Old Machinery

- 4.3.2 Critical and Hazardous Implication on the Environment

- 4.4 Industry Attractiveness - Porter's 5 Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Threat of Substitute Products or services

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Bargaining Power of Buyers

- 4.4.5 Intensity of competitive rivalry

- 4.5 Industry Value chain analysis

5 Technology Snapshot

- 5.1 Type of Technology

- 5.1.1 Inductive

- 5.1.2 Piezoelectric

- 5.1.3 Magnetic

- 5.1.4 Capacitive

- 5.1.5 Optic Fiber Sensor

6 Europe Vibration sensors market segmentation

- 6.1 By product

- 6.1.1 Accelerometers

- 6.1.2 Proximity Probes

- 6.1.3 Tachometers

- 6.1.4 Others

- 6.2 By Industry

- 6.2.1 Automotive

- 6.2.2 Helathcare

- 6.2.3 Aerospace & Defence

- 6.2.4 Consumer Electronics

- 6.2.5 Oil And Gas

- 6.2.6 Metals and Mining

- 6.2.7 others

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Others

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 SKF AB

- 7.1.2 National Instruments Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Emerson Electric Co

- 7.1.7 Honeywell International Inc.,

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Hansford Sensors Ltd.,

- 7.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)