|

市场调查报告书

商品编码

1628802

义大利纸包装:市场占有率分析、产业趋势、成长预测(2025-2030)Italy Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

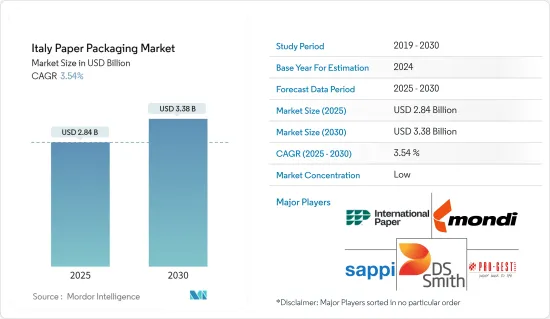

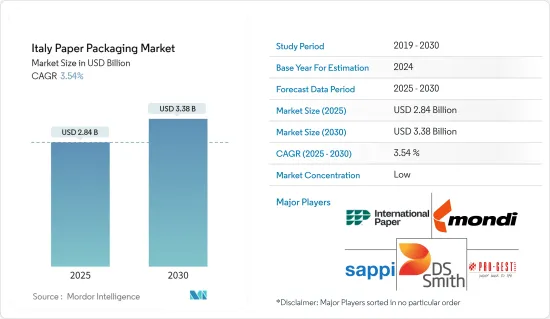

义大利纸包装市场规模预估至2025年为28.4亿美元,预估至2030年将达33.8亿美元,预测期间(2025-2030年)复合年增长率为3.54%。

主要亮点

- 近年来,由于对永续性和环境的日益关注,义大利对纸包装的需求稳步增长。义大利已采用欧盟法规来减少塑胶废弃物,鼓励企业转向纸张替代品。由于纸质包装解决方案的可回收性和永续性,欧洲的一次性塑胶指令鼓励各行业的公司采用纸质包装解决方案。

- 义大利消费者高度的环保意识对纸质包装的采用产生了重大影响。食品和饮料、化妆品和奢侈品行业的公司正在从塑胶包装转向纸包装。这项转变旨在满足环境标准并展示对永续性的承诺。

- 食品和饮料行业接受纸质产品,包括各种食品的纸盒、袋子和包装纸。消费者对永续性的兴趣以及有机和健康食品的兴起正在推动对纸包装的需求。随着餐饮业外带和外送服务的扩展,纸质包装已成为首选。

- 电子商务的扩张增加了对耐用和永续包装解决方案的需求。随着义大利网路购物的成长,公司开始采用纸质包装进行运输和交付。电商公司普遍使用瓦楞纸箱和纸包装,它们具有成本效益、重量轻且可回收,同时满足了具有环保意识的消费者的需求。

- 公司正在透过开发新的解决方案和技术来创新纸包装市场。例如,2024年6月,Saika集团与亿滋共同开发了一种用于多包装糖果零食、饼干和巧克力产品的可回收纸质包装解决方案。该包装设计为透过标准纸张回收流程进行处理。这种包装材料与热封包装工艺相容,有涂层和无涂层两种版本。这项发展符合欧洲造纸工业联合会 (CEPI) 制定的永续性标准。

- 由于原料成本上升和外包趋势,义大利纸包装市场的成长面临限制。主要原料纸浆价格上涨,增加了製造商的生产成本。这些成本增加转嫁给消费者时,可能会减少需求,特别是对价格敏感的中小型企业造成影响。义大利公司将生产外包到低成本地区的趋势正在影响当地供应链,延长交货时间并降低品管能力。儘管外包具有成本优势,但它可能会阻碍创新和永续实践,因为公司将降低成本置于环保措施之上。儘管对环保包装解决方案的需求不断增加,但这些综合因素正在限制市场成长。

义大利纸包装市场趋势

瓦楞纸箱占较大市场占有率

- 在电子商务、物流和製造业的推动下,义大利对瓦楞纸箱的需求持续成长。网路购物的扩张增加了对直接面向消费者运输的可靠且经济高效的包装解决方案的需求。电子商务公司需要可客製化的包装选项,而瓦楞纸箱因其保护品质、成本效益和品牌潜力而极具吸引力。

- 义大利作为全球重要出口国的地位影响瓦楞包装的需求。时尚、食品和汽车等行业依靠纸板来安全地进行产品的国际运输。该国以出口为导向的经济需要符合国际运输标准的包装。瓦楞纸箱提供远距运输所需的耐用性和保护,并确保产品在运输过程中的完整性。

- 2023年义大利出口额将达6,769.6亿美元,增加瓦楞纸箱的需求。义大利是机械、汽车、食品和时尚的主要出口国,需要可靠的国际运输包装解决方案。瓦楞纸箱在运输过程中为货物提供必要的保护,同时符合环境永续标准。义大利出口活动的不断扩大正在支持瓦楞包装市场的成长。

- 永续性已成为包装产业的重要因素,义大利公司正在优先考虑环保选择。由可回收废纸生产的瓦楞纸板符合这些环保要求。欧盟 (EU) 实施严格的回收和废弃物法规,增加了对包括纸板在内的可回收材料的需求。

- 义大利食品和饮料行业需要广泛的瓦楞包装解决方案。出口到世界各地的义大利食品需要安全和保护性的运输包装。纸板对于包装葡萄酒、橄榄油、义式麵食和其他食品至关重要。该行业需要能够在国内和国际运输过程中保持产品新鲜度和安全性的包装解决方案。

- 在电子商务扩张、永续性要求和该国出口活动的支持下,义大利瓦楞纸箱市场预计将保持成长轨迹。包装设计的发展,包括更轻的重量和更高的强度,预计将增加瓦楞包装在整个行业的采用。出口对耐用、高品质包装的需求可能继续成为市场的基本驱动力。

饮料领域预计将占据很大的市场份额

- 在义大利,由于对永续性的担忧日益增加,饮料包装对纸张的需求持续增加。作为葡萄酒、烈酒和软性饮料等饮料的主要生产国和出口国,义大利需要既能提供保护又具有环境效益的包装解决方案。纸包装已成为饮料製造商的首选,因为它具有高度生物分解性和可回收性,满足生态学要求和消费者偏好。

- 在义大利葡萄酒产业,纸包装(主要是纸箱和盒子)被广泛用于出口过程中的安全运输。受消费者偏好和环境合规要求的影响,随着生产商转向永续包装解决方案,葡萄酒出口的纸包装需求预计将增加。

- 预计到2024年,义大利非碳酸饮料市场销售额将达到6.7446亿美元,销售量将达到4.95亿公升,推动纸包装需求不断成长。果汁、瓶装水和茶的消费量不断增加,需要有效且永续的包装解决方案。纸包装因其生物分解性和可回收的特性而成为这些饮料的首选,解决了消费者和生产商的环境问题。

- 由于非碳酸饮料在义大利饮料行业占据主导地位,製造商已转向纸盒和瓶子。这项转变符合欧盟减少塑胶使用和促进永续包装的法规。纸盒和多层纸包装越来越多地用于果汁、茶和水产品,以满足消费者对环保解决方案的偏好和监管要求。非碳酸饮料领域的稳健表现继续巩固了纸张作为义大利饮料行业主要包装材料的地位。

- 欧盟 (EU) 法规对义大利饮料业的纸包装需求产生重大影响。欧盟严格的包装废弃物指南要求公司使用可回收和可重复使用的材料。这个法律规范促使义大利饮料製造商引入纸质包装解决方案,以满足永续性要求并减少塑胶废弃物。

- 纸包装技术的创新正在增强义大利的需求。最近的趋势,包括纸质瓶子和多层纸盒,正在增加饮料保护,同时保持永续性标准。这些技术改进增加了纸包装对生产商和消费者的吸引力,并使义大利饮料产业处于永续包装趋势之中。

义大利纸包装产业概况

义大利纸包装市场较为分散。这是一个有多家公司参与的竞争市场。 DS Smith Plc、International Paper Company、Sappi Limited、Mondi Group 和 Pro-Gest SpA 等在该国运营的公司不断创新、投资并建立战略伙伴关係,以保持市场占有率。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 消费者对纸包装的认知不断增强

- 电子商务销售成长

- 餐饮业需求增加

- 封闭式回收工作有助于将纸质包装材料推向市场

- 市场限制因素

- 对纸包装引起的森林砍伐的担忧

- 原料成本上升与外包

第六章 市场细分

- 依产品类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他产品类型(挠性纸、液体包装等)

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 个人护理

- 电气/电子产品

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- DS Smith Plc

- International Paper Company

- Sappi Limited

- Smurfit Westrock

- Mondi Group

- Seda International Packaging Group

- Tetra Pak International SA

- Pro-Gest SpA

第八章投资分析

第九章 市场未来展望

The Italy Paper Packaging Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 3.38 billion by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

Key Highlights

- The demand for paper packaging in Italy has experienced a steady rise in recent years, driven by the growing emphasis on sustainability and environmental concerns. Italy has adopted European Union regulations to reduce plastic waste, prompting businesses to shift towards paper alternatives. The EU's Single-Use Plastics Directive has encouraged companies across sectors to adopt paper-based packaging solutions due to their recyclability and sustainability.

- Italian consumers' eco-conscious attitudes have significantly influenced the adoption of paper packaging. Companies in the food and beverages, cosmetics, and luxury goods industries are transitioning from plastic to paper packaging. This shift serves to meet environmental standards and demonstrate their commitment to sustainability.

- The food and beverage industry has embraced paper-based products, including cartons, bags, and wraps for various food items. Consumer focus on sustainability and the growth of organic and health-conscious food products has increased paper packaging demand. The food service industry's expansion in takeout and delivery services has established paper packaging as the preferred choice.

- E-commerce expansion has increased the need for durable and sustainable packaging solutions. As online shopping grows in Italy, businesses adopt paper packaging for shipping and delivery. E-commerce companies commonly use corrugated cardboard boxes and paper wraps, which are cost-effective, lightweight, and recyclable while meeting environmentally conscious consumer demands.

- Companies are innovating in the paper packaging market by developing new solutions and technologies. For instance, in June 2024, Saica Group and Mondelez collaborated to create a recyclable paper-based packaging solution for multipack confectionery, biscuits, and chocolate products. The packaging is designed to be processed through standard paper recycling streams. The packaging material is compatible with heat-sealable packing processes and is available in coated and uncoated variants. The development aligns with the sustainability standards established by the Confederation of European Paper Industries (CEPI).

- The paper packaging market in Italy faces growth limitations due to increasing raw material costs and outsourcing trends. The rising prices of paper pulp, a primary raw material, have increased production costs for manufacturers. These cost increases can reduce demand when transferred to consumers, particularly affecting price-sensitive small and medium-sized businesses. The trend of Italian companies outsourcing production to lower-cost regions impacts the local supply chain, extends delivery times, and reduces quality control capabilities. While outsourcing offers cost advantages, it can hinder innovation and sustainable practices implementation as companies focus on cost reduction rather than environmental initiatives. These combined factors create market growth constraints despite the growing demand for environmentally friendly packaging solutions.

Italy Paper Packaging Market Trends

Corrugated Boxes to Hold Significant Market Share

- The demand for corrugated boxes in Italy continues to grow, driven by e-commerce, logistics, and manufacturing sectors. The expansion of online shopping has increased the need for reliable and cost-effective packaging solutions for direct-to-consumer shipping. E-commerce companies require customizable packaging options, making corrugated boxes attractive for their protective qualities, cost efficiency, and branding potential.

- Italy's position as a significant global exporter influences the demand for corrugated packaging. Industries, including fashion, food, and automotive, depend on corrugated boxes for safe international product transportation. The country's export-focused economy necessitates packaging that meets international shipping standards. Corrugated boxes provide the durability and protection needed for long-distance transportation, ensuring product integrity during transit.

- Italy's export value reached USD 676.96 billion in 2023, increasing demand for corrugated boxes. The country's significant machinery, vehicles, food, and fashion exports require reliable packaging solutions for international shipping. Corrugated boxes provide the necessary protection for goods during transport while meeting environmental sustainability standards. The continuous expansion of Italy's export activities sustains the growth of the corrugated packaging market.

- Sustainability has become a significant factor in the packaging industry, with Italian businesses prioritizing eco-friendly options. Corrugated boxes, produced from recyclable and recycled paper, meet these environmental requirements. Implementing strict European Union recycling and waste regulations has increased demand for recyclable materials, including corrugated cardboard.

- The Italian food and beverage industry requires extensive corrugated packaging solutions. Italian food products, exported globally, need secure and protective packaging for transportation. Corrugated boxes are essential for packaging wine, olive oil, pasta, and other food items. The sector requires packaging solutions that maintain product freshness and safety during domestic and international shipping.

- The Italian corrugated box market is expected to maintain its growth trajectory, supported by e-commerce expansion, sustainability requirements, and the country's export activities. Packaging design developments, including weight reduction and strength improvements, are expected to increase the adoption of corrugated packaging across industries. The requirement for durable, high-quality packaging in exports will remain a fundamental market driver.

Beverages Segment Expected to Hold Significant Share in the Market

- The demand for paper in beverage packaging in Italy continues to rise, driven by increased focus on sustainability. As a major producer and exporter of beverages, including wine, spirits, and soft drinks, Italy requires packaging solutions that offer both protection and environmental benefits. Paper packaging has emerged as a preferred choice among beverage producers due to its biodegradable and recyclable properties, meeting both ecological requirements and consumer preferences.

- The Italian wine industry extensively uses paper packaging, mainly cartons and boxes, for safe bottle transportation during export. The demand for paper packaging in wine exports is projected to increase as producers transition to sustainable packaging solutions, influenced by consumer preferences and environmental compliance requirements.

- The non-carbonated beverage market in Italy is projected to reach 674.46 million USD in sales value and 495 million liters in volume by 2024, driving increased demand for paper packaging. The growth in consumption of juices, bottled water, and tea necessitates effective and sustainable packaging solutions. Paper packaging has emerged as a preferred choice for these beverages due to its biodegradable and recyclable properties, addressing the environmental concerns of both consumers and producers.

- The substantial market share of non-carbonated beverages in Italy's beverage industry has prompted manufacturers to adopt paper-based cartons and bottles. This transition aligns with European Union regulations to reduce plastic usage and promote sustainable packaging practices. Paper cartons and multi-layer paper packaging are increasingly utilized for juices, teas, and water products, meeting consumer preferences for eco-friendly solutions and regulatory requirements. The robust performance of the non-carbonated beverage segment continues to strengthen the position of paper as a primary packaging material in Italy's beverage industry.

- European Union regulations significantly influence paper-based packaging demand in Italy's beverage sector. The EU's stringent packaging waste guidelines require companies to use recyclable and reusable materials. This regulatory framework has prompted Italian beverage companies to implement paper packaging solutions to meet sustainability requirements and reduce plastic waste.

- Innovations in paper packaging technology have strengthened demand in Italy. Recent developments, including paper-based bottles and multi-layer paper cartons, enhance beverage protection while maintaining sustainability standards. These technological improvements increase the appeal of paper packaging for producers and consumers, positioning Italy's beverage industry within sustainable packaging trends.

Italy Paper Packaging Industry Overview

The Italy Paper Packaging Market is fragmented. It is a highly competitive market with several players. Companies operating in the country, such as DS Smith Plc, International Paper Company, Sappi Limited, Mondi Group, and Pro-Gest S.p.A., keep innovating, investing, and entering into strategic partnerships to retain their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumer Awareness on Paper Packaging

- 5.1.2 Growth in E-commerce Sales

- 5.1.3 Rising Demand from the Foodservice Sector

- 5.1.4 Recycling Initiatives Involving Closed-loop Systems to Aid Market Adoption of Paper Packaging-based Materials

- 5.2 Market Restraints

- 5.2.1 Deforestation Concerns Due to Paper Packaging

- 5.2.2 Increasing Raw Material Costs and Outsourcing

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types (Flexible Paper, Liquid Cartons, Etc.)

- 6.2 By End-User Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal and Household Care

- 6.2.5 Electrical and Electronics Products

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DS Smith Plc

- 7.1.2 International Paper Company

- 7.1.3 Sappi Limited

- 7.1.4 Smurfit Westrock

- 7.1.5 Mondi Group

- 7.1.6 Seda International Packaging Group

- 7.1.7 Tetra Pak International S.A.

- 7.1.8 Pro-Gest S.p.A.